Crypto Trading bots are the talk of the town. They automate the crypto trading experience with relative ease. However, have you guys thought about creating your very own crypto trading bot?

A trading bot cannot be created from scratch as quickly as most people believe. The DIY (Do It Yourself) method is challenging and complex. If you’re starting out, the process takes a long time and is almost always expensive. Therefore we have simplified the process through this article.

Also Read: 4 Best Free Open Source Trading Bots

Table of Contents

How to build your crypto trading bot?

Download an existing open-source Bitcoin trading bot

- The number of crypto trading bots is increasing daily along with the cryptocurrency market. Most modern, highly developed crypto-trading bots are expensive to purchase or only available via subscription.

- However, there is currently a more organic way to buy a trading bot. Anyone can choose from various open-source platforms that offer free trading bot software.

- A few platforms that offer trading bots include 3commas, Pionex, Coinrule, Cryptohopper, etc.

Setting up the API for each exchange.

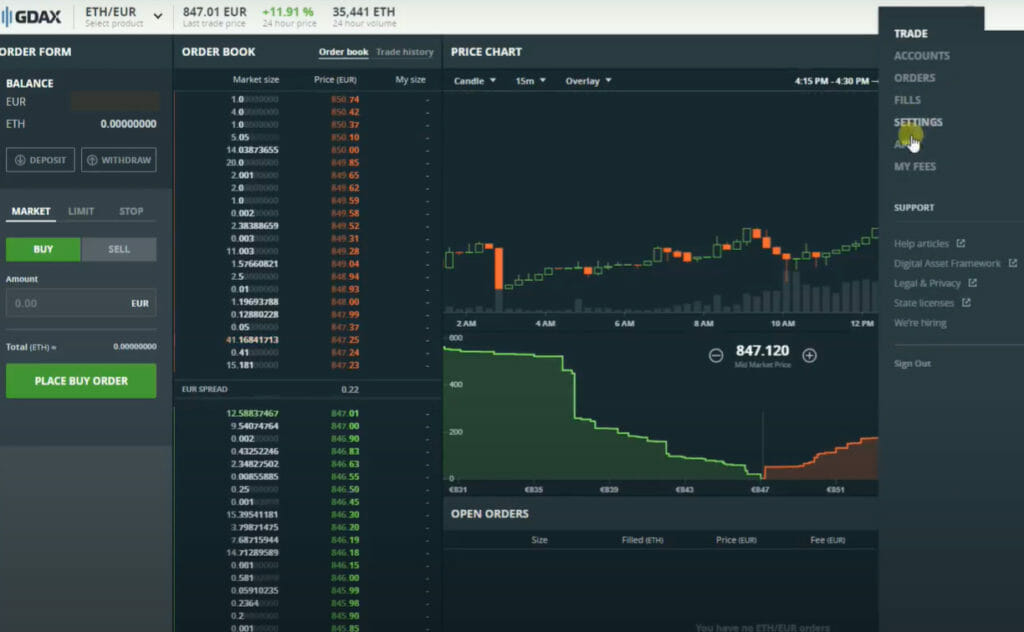

- Most users must know they are using an API, as they have become crucial components of the modern Bitcoin trading ecosystem.

- A trading bot’s interface, an API (Application Programming Interface), enables the bot to send and receive data from an exchange.

- You can utilize the bot’s API interface on almost all big cryptocurrency exchanges.

- However, these systems often rely on a few permission levels secured by secret and individual keys.

- It would help if you first created an API key on the exchange you wish to use to accomplish this. To access the API afterward, you must enter your key and secret into the trading bot.

- You are advised to never reveal your API secret keys to anyone and use extra caution when selecting the platform into which you insert your key.

- Once the keys have been stolen or compromised, someone else can access your crypto trading bot to trade or withdraw money without your knowledge.

- You should disable the withdrawal option if it is enabled for the API. By turning it off, you can make withdrawals manually and stop the bot from taking money out of your account.

- Links to popular currency exchange APIs Bitstamp, Kraken, Bittrex, BitMEX, Poloniex, Binance, Gate.io.

Also read: 5 Best BitMEX Crypto Signals

Make a crypto trading bot checklist

- You can create your crypto trading bot instead of paying a subscription fee or buying one.

- Select the programming language you wish to employ.

- Take control of your APIs and ensure you obtain all the APIs for cryptocurrency exchanges your trading bot will need to communicate with.

- Register for accounts on the exchanges you plan to utilize.

- To make a good crypto trading bot with minimal difficulty, decide on the programming language that you want to use and get hold of your APIs

- Select a trading strategy using a bot: market making, market following, or arbitrage.

- Make sure to specify exactly what kind of data you want your trading bot to analyze.

- The most time-consuming step in creating the trading bot is creation. Make sure to follow the correct procedures.

- Verify the proper operation of your trading bot. If not, now is the ideal moment to make adjustments.

- Deploy and use the crypto trading bot after you have resolved any issues with it

How to Make a Trading Bot with Python?

- Download and install Pycharm

An IDE (Integrated Development Environment) for Python programming and software development is PyCharm. Beginners should use it since it makes learning easier. In addition, it can be modified and has all the features and tools a programmer needs to be effective during development.

- Download and Install all Libraries and Dependencies

Downloading and installing all the libraries and dependencies should be your next step. You can perform various tasks using this group of methods and functions without necessarily writing any code. Most of the libraries you require may be purchased from PyPI and installed using pip, which frequently includes your Python installation. Trying to install all the requirements from PyPI manually could take some time, so you might need to write a script to accelerate the process.

- Install the Python Exchange Library on Github by downloading it.

Either manually download and install the source code or download and install a copy from the PyPI repository. The Python exchange library will be installed using either approach. Alternatively, you could copy directly from the source. Either approach will be effective.

- Index/ Portfolio Tracker

This section’s primary objective is to give Binance’s automated trading bot portfolio capability. For example, a template from “Tracking a Portfolio with Python” will offer the following features:

- Create a cryptocurrency portfolio with the buy, sell, and buy/sell transactions denominated in Satoshis with daily, weekly, and monthly profit and loss statistics.

- Ability to do complex portfolio operations, such as indexing a crypto profile, to generate “play money” portfolios.

- Save all data in.csv format, which Microsoft Excel can easily edit.

- Incorporates Matplotlib and Pandas’s data structures for data analysis and visualization.

- Obtaining and Examining Old Data from Binance and Coinbase

Next, You will have to discover how to gather and use historical data from Binance and Coinbase and learn how to gather and save data in formats for later use. Additionally, you will use this information to communicate your trading strategy to the trading bot. For example, the best coins, when to buy and sell, etc.

- Comparing to an “Index” while tracking profit and loss

All code posted on GitHub under the name “Portfolio Tracker” will be used by you and forked and updated to track your cryptocurrency portfolio on Binance. Using publicly available code, you can use a great program called “Cryptrack by Herschee” to track a cryptocurrency portfolio. You will use it to pull hourly, daily, and weekly profits and losses. Before adding the “Portfolio Tracker” capability, this actual code will be incorporated into the algorithmic trading project.

- Developing new strategies based on historical data

The Crypto trading bot can benefit significantly from historical data. You can use it to predict future performance, decide good or unfavorable periods to buy or sell, and determine future trade positions. The bot analyses all data to look for short- or long-term patterns, which eventually help it decide which trading technique to use.

What are Cryptocurrency trading strategies?

A bitcoin trading strategy enables users to increase profits while spending less capital. However, trading bots can’t respond to essential market factors like official cryptocurrency choices, rumors, or exchange hacks. Therefore, to modify a trading bot to fit any given situation, it is crucial to keep these strategies in mind as you create it.

Trend-following strategy

According to this method, a cryptocurrency trading bot can be designed to spot trends in a specific cryptocurrency and execute buy and sell orders in accordance with these trends. Trend trading can benefit from trading bots. The trend-following strategy looks for profit by assessing an asset’s trend in a particular direction. With this approach, traders will take long positions when a cryptocurrency is trending upwards and short positions when it is trending downwards.

Arbitrage

With this strategy, a trader will profit from a price difference between two cryptocurrency exchanges. The trader purchases digital assets on one market, then resell them for a profit on another.

When cryptocurrency exchanges were decentralized and largely unregulated, there were wide price differences, which allowed traders to earn significantly through arbitrage. However, the spread between exchanges has gotten closer these days.

A crypto arbitrage bot can assist a trader in maximizing the value of these price differences.

Market Making

Trading bots are effective at implementing market-making. This strategy calls for constant buying and selling on a range of spot cryptocurrencies and digital derivatives contracts to capture the difference between the buy and sell prices.

A trader will place limited orders on both sides of the book to implement this approach (buy and sell). The trading robot will then repeatedly place limit orders to take advantage of the spread. However, this method may need to be more profitable in intense rivalry or insufficient liquidity.

The benefit of utilizing a custom trading bot is the opportunity to retain control over your private keys. Additionally, you can add whatever features you want to the trading bot.

Conclusion

Cryptocurrency trading bots are in high demand due to their ability to trade continuously, execute strategies, and issue orders quickly.

They are commonly found on popular exchanges, and traders use them to conserve and grow their investment capital while minimizing manual involvement, especially given the market’s volatility.

Q. What is the best crypto trading bot?

Best Crypto Trading bots include pionex – crypto trading bot, 3Commas, Binance, etc.

Q. What are the Risks While Writing a Personal Crypto-Trading Bot?

Creating a bot requires extensive programming, technical, and analytical skills, as unknown defects or system flaws could be buried deep within its source code, rendering it useless. Investing a significant sum of money could result in losses if the bot doesn’t work.

Q. What are the risks of using a Crypto trading bot?

A trading bot can be costly, insecure, unregulated, or uncompetitive.

Q. How to choose a Crypto trading bot?

You should consider the functionality, performance, security, and compatibility of the trading bot.

For on-demand analysis of any cryptocurrency, join our Telegram channel.