In this article, we will review Coinrule, a smart assistant for cryptocurrency trading that was founded in 2018. The trading platform was developed in the UK and works according to the UK’s financial and commercial laws.

You are allowed to take full control of your trading while fighting back hedge funds and automated bots. You can build your own rules or choose from 150+ rules. They analyze the market and automates your trading strategies.

Key Takeaways

- A beginner-friendly interface

- Best-in-class user experience

- Flexible strategies based on the If-This-Then-That logic

- Offers more than 130 trading strategies templates

- Do not support Backtesting (Will release this feature in 2020)

- Excellent real-time Customer Service and extensive guides to get started

- Free plan available and multiple premium plans according to different needs

Table of contents

- Key Takeaways

- Coinrule review: Order Types

- Coinrule review: How to create rules?

- Coinrule review: Conditions/Triggers

- Operators

- Coinrule review: Technical Indicators

- Coinrule Demo Exchange

- Coinrule Trading Templates

- Strategies

- Coinrule review: Security

- Supported Exchanges

- User Experience

- Coinrule review: Backtesting

- Pricing

- Coinrule review: Pros and Cons

- Customer Support

- Coinrule review: Conclusion

- Frequently Asked Questions

Coinrule review: Order Types

Market Order

These orders are filled immediately as soon as they reach the order book of the exchange. They also depend on the liquidity of the market and the size of the order. They don’t guarantee a specific price.

Limit Order

These orders allow you to set a minimum and maximum price for buying and selling. Therefore you have to wait for the order to get executed. They are not filled immediately. A margin can be set to increase or reduce the possibility of trade execution.

How Coin

Coinrule review: How to create rules?

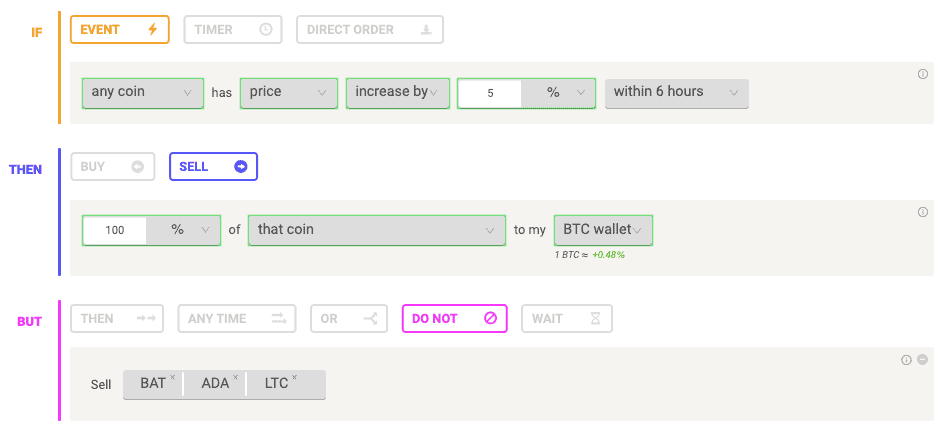

The rules follow the “if-this-then-that” approach.

Total Time: 5 minutes

Choose an exchange

Choose an exchange you would like to trade with.

Select Template

If you don’t want to make a trading strategy from scratch, you can choose from the templates. The parameters in the templates are customizable.

Select a condition and execute orders

Select a condition to execute your orders. It can be set at a specific time interval or after certain events occur.

Select actions

Select actions that you want to be triggered as soon as your order gets executed.

Launch rule

An advanced rule can be created by adding operators. Now you just have to launch your rule. You should have full control over your rule to prevent any undesirable circumstances such as over-trading.

Coinrule review: Conditions/Triggers

While creating your trading bot, you have to set conditions/triggers to execute an action. They are broadly divided into three categories –

- The recurring orders are sent at a specific interval of time.

- Check for a specific condition, and only if the condition is met, the order will be sent. Additional conditions can be added using “Add Condition.”

- Direct orders are sent using the “Launch” button.

Operators

Operators represent a logical connection between different blocks of the same rule. There are four different types of operators.

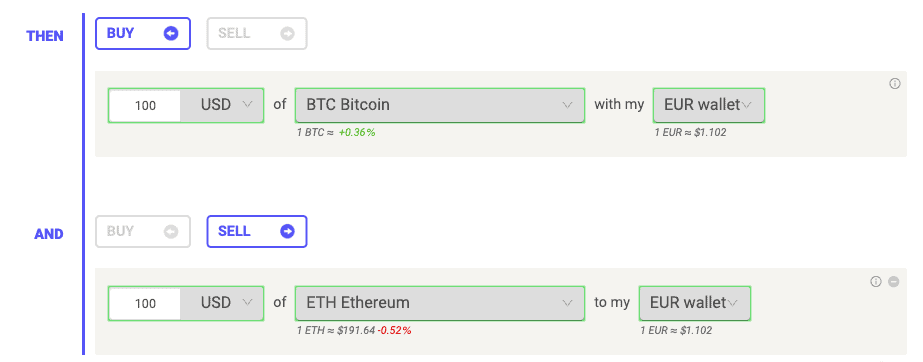

1. THEN Operator

It allows you to set up a condition that activates the strategy and define at least one action to be executed when the rule executes. You can set up a multi-trading-strategy involving an initial condition, action, sequential condition, and action. It runs as BUY-SELL-BUY-SELL and so on. You can customize the parameters when setting up these rules.

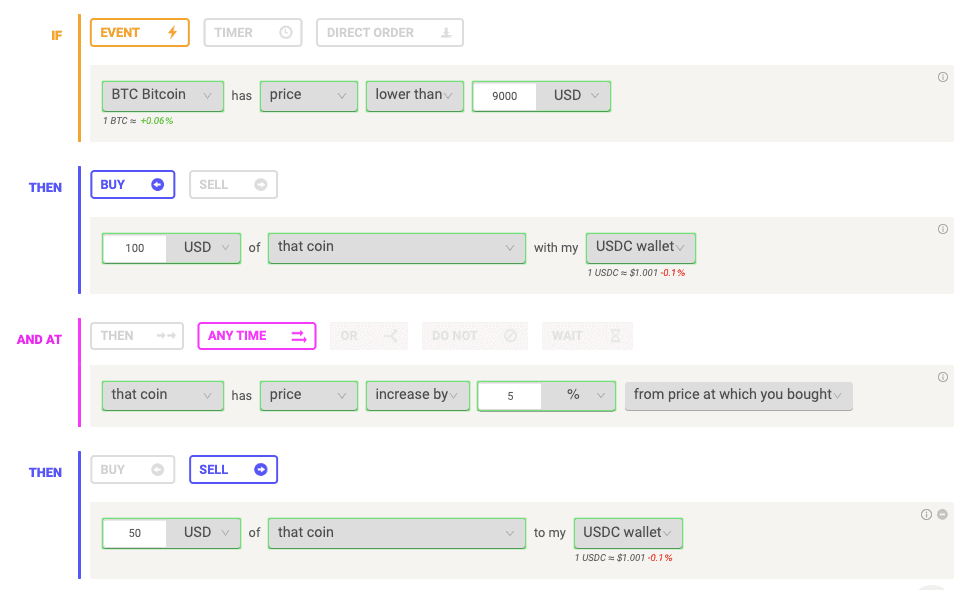

2. ANY TIME Operator

Any time operator allows you to create multiple strategies within the same rule. It is useful when setting up an accumulation strategy. You can accumulate and then set up a stop loss to cut your time exposure.

The first and second parts of the rule are executed simultaneously. As soon as the first action is completed, the second condition is checked, the first condition doesn’t wait for the second action to run again.

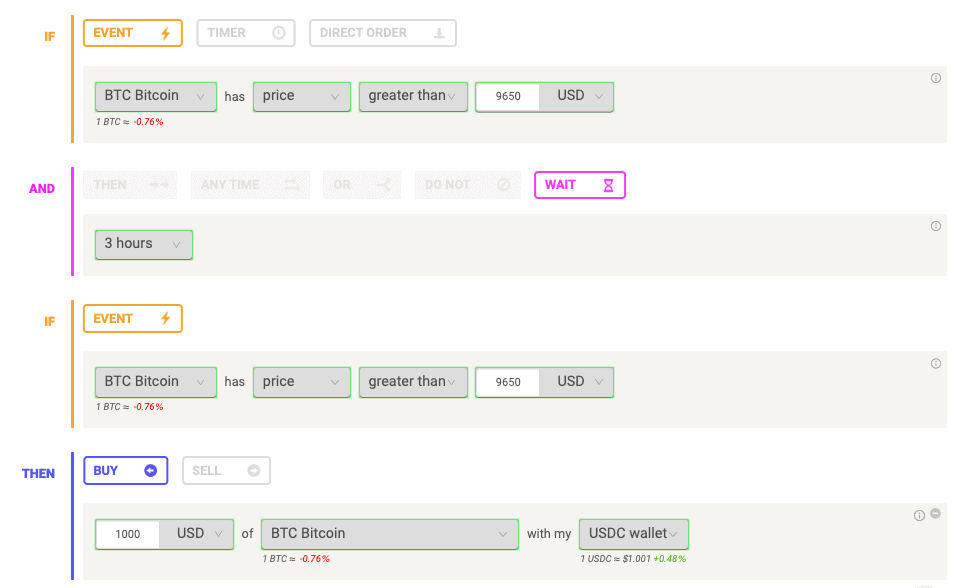

3. WAIT Operator

The WAIT Operator is used to avoid false breakouts. Cryptocurrency trading is highly volatile. To buy or sell, you might be waiting for the breakout time and might end up in a loss if the trend reverses. To avoid that, you can set a price condition to activate the rule and then wait to confirm that move. This helps you check how the market conditions are evolving and prevent losses.

4. DO NOT Operator

Coins used for long-term assessments are separated from the remaining assets and the bots’ trading activity. Coinrule comes to the rescue by offering a DO NOT operator to the coins you don’t want to trade. You can select up to three coins under this operator.

Additionally, you can use the DO NOT operator to avoid the coins you don’t want to buy under any circumstances. This adds a higher degree of control to your automated trading strategy.

Coinrule review: Technical Indicators

Technical indicators are mathematical formulas that provide you information about the applied asset’s market trend or condition. They are used for assessing the likelihood of a certain scenario. You can also adjust the parameters to provide effective outcomes. For example, Indicators can be used to calculate an asset’s closing price in a certain period.

One of the popular technical indicators is the Relative Strength Index (RSI). It measures the strength of the price trend over a defined period. The mathematical formula takes into account the percentage of price moves up compared to those down. The more the up moves overweight, the price drops, the more the price of the asset is in a solid uptrend.

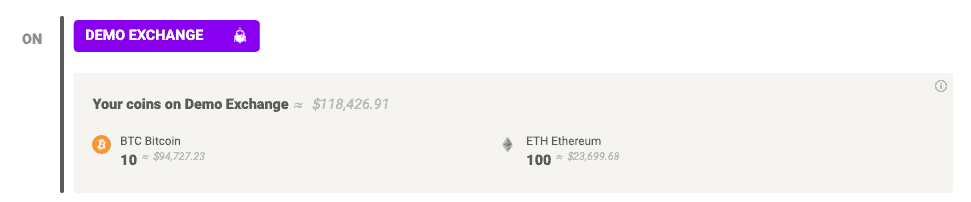

Coinrule Demo Exchange

Coinrule offers a demo platform that allows its users to experiment with their trading strategies before implementing them in the live exchange. This is a real crypto trading simulator. It provides you the opportunity to make changes in your rules to make better profits.

All the rules you set on the demo platform will run in paper trading on Binance. Therefore all the coins available on Binance can be used for strategy testing.

All users are virtually allocated 10 BTC and 100 ETH.

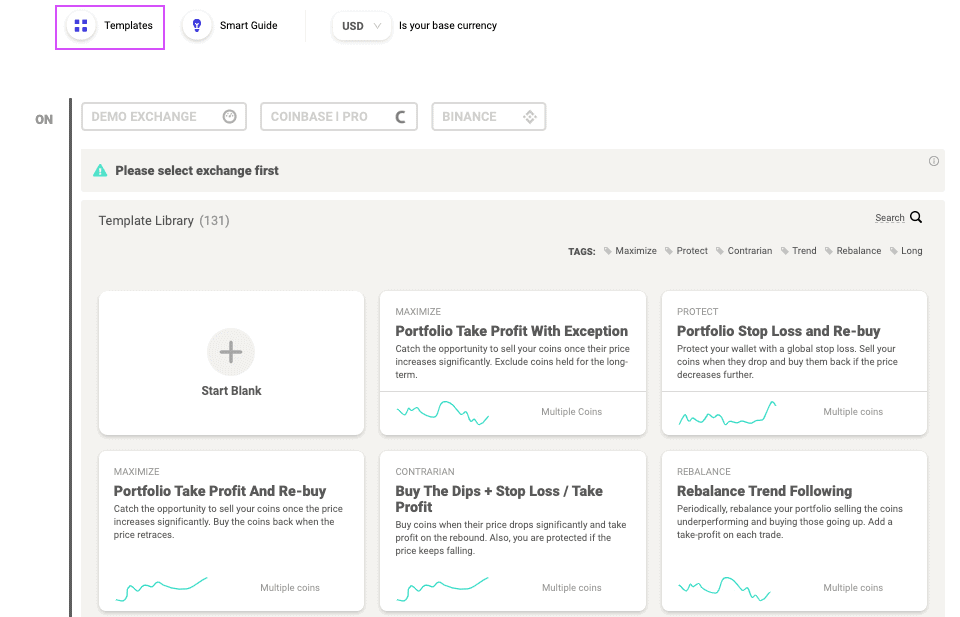

Coinrule Trading Templates

Coinrule provides pre-built trading strategy templates that you can unlock depending on your selected plan. The templates have built-in parameters for each strategy.

The templates include portfolio take profit and re-buy, buy the dips with stop loss and take profit, trend following, accumulate with a take profit, range trading, Golden Cross Trading, and RSI-based strategies.No coding is required to set these strategies. The templates don’t have elaborate explanations.

Strategies

There are unlimited options in terms of trading strategies that users can create with Coinrule. From Dollar-Cost Averaging to Trend-following and Contrarian rules, the only limit is the trader’s creativity.

The trader can connect different blocks within each strategy to protect every order with a stop loss or selling in profit when the set conditions are met.

Another interesting option is to run the rules across multiple coins at the same time. For example, the trader can include in one rule for all the coins traded on the market or only those that he holds in his wallet. Thanks to this option, it’s possible to create strategies like a Global Portfolio Stop Loss or a Global Buy-the-Dip. It significantly increases the market opportunities that the bot can catch at any time.

Coinrule review: Security

Coinrule uses the following security measure to protect its platform and users –

- Coinrule uses TLS 1.2 or higher to encrypt all the communication between the app, database, cache nodes, and backend.

- The API keys are encrypted using advanced security protocol.

- Each user has a dedicated private key. All the private keys are stored in detached data storage. Additionally, they are encrypted with AES-256.

- To protect against DDoS and other cyber attacks, they have been associated with Cloudflare.

- You can connect to the exchange wallet through your Coinrule account only using API keys that don’t have any withdrawal permissions.

- They don’t store passwords in their database and use Ukey1 as a secure authentication gateway partner. Ukey1 encrypts all personal information and passwords using advanced algorithms.

- All your purchases are processed using Stripe and marked as Merchant-Initiated Transaction (MIT) by Stripe. All your payments data are confidential and can be accessed by neither Coinrule nor Stripe.

Supported Exchanges

- Binance

- Coinbase Pro

- Okex

- HitBTC

- Bitstamp

- Bitpanda pro

- Kraken

- Bitfinex

- Liquid

- Bitmex

User Experience

Coinrule offers a simple and easy to use interface. They don’t use complicated jargon, making it easy for beginners to start trading. The dashboard shows all your balanced on the connected exchanges.

It lists all your rules. To pause a live rule you have to click on the green button. To restart it click on it again. The performance of all your rules will be displayed along with the aggregate return of your portfolio.

Coinrule review: Backtesting

Backtesting uses historical data to test a trading strategy. It helps you verify how these strategies perform in certain market conditions. Though it is not necessary, they will recur the same way as they did in the past. The actual result depends on the execution prices that can never be forecasted.

Pricing

| Category | Price in USD (Annually) | Price in USD (Monthly) | Features |

|---|---|---|---|

| Starter | Free | Free | Live Rules – 2Demo Rules-2Template Strategies – 7 Connected Exchange – 1Monthly Trade Volume – up to $3k |

| Hobbyist | 29.99 | 39.99 | Live Rules – 7Demo Rules-7Template Strategies – 40Connected Exchange – 2Monthly Trade Volume – up to $50k Leverage StrategiesLive Telegram + Text NotificationsAdvanced Indicators Advanced OperatorsFree Access to Trader Community |

| Trader | 59.99 | 79.99 | Live Rules – 15Demo Rules- 15Template Strategies – UnlimitedConnected Exchange – 3Monthly Trade Volume – up to $300k Leverage StrategiesLive Telegram + Text NotificationsAdvanced Indicators Advanced OperatorsFree Access to Trader CommunityOne-to-one Training Sessions |

| Pro | 449.99 | 499.99 | Live Rules – 50Demo Rules- 50Template Strategies – UnlimitedConnected Exchange – UnlimitedMonthly Trade Volume – up to $3m Leverage StrategiesLive Telegram + Text NotificationsAdvanced Indicators Advanced OperatorsFree Access to Trader CommunityOne-to-one Training SessionsDedicated serverUltra-fast execution |

Coinrule review: Pros and Cons

Pros

- Daily emails with trading strategies free of cost.

- They offer professional-level trading to new users.

- User-friendly interface.

- Military-grade security and encryption.

- Fast order execution. They take around 500 ms to reach the market. The frequency of the conditions checks is 40 seconds.

Cons

- They provide limited fundamental and technical indicators.

- It is a relatively new platform.

Customer Support

The help center contains guides and tutorials on how to use the platform. The platform also provides live chat functionality. You can write to them at [email protected].

They also run a Youtube channel, which contains a lot of useful resources. You can also connect to them via Twitter.

Coinrule review: Conclusion

Coinrule allows you to automate trading strategies by setting or choosing from rules. They follow “If-this-then-that” trading strategies. They offer a demo platform to try out your trading strategies before implementing them in live exchange. They also provide a free account for starting and getting used to the platform. The trading templates help beginners to use crypto bots.

Frequently Asked Questions

Is Coinrule safe?

Coinrule uses TLS 1.2 or higher to encrypt all the communication. The API keys are encrypted using advanced security protocol. To protect against DDoS and other cyber attacks, they have been associated with Cloudflare. They don’t store passwords in their database and use Ukey1 as a secure authentication gateway partner.

Why should I use CoinRule?

CoinRule offers built-in trading templates to automate and your trading strategies. You can customize the templates without any coding. They follow “If-this-then-that” principle. They provide a Demo exchange to test your coding strategies before implementing them in live exchange. Backtesting uses historical data to test a trading strategy. Additionally, the platform is highly secure.

Also Read:

![3Commas Review | An Excellent Crypto Trading Bot [Updated] 8 3Commas Review](https://coincodecap.com/wp-content/uploads/2020/11/3Commas-Review-768x432.png)