In the relentless churn of global markets, where every tick can spell opportunity or peril, traders crave tools that cut through the noise. Enter Frontbroker, a CFD trading platform that’s rapidly gaining traction as a versatile powerhouse for retail and seasoned speculators alike. Launched in 2023, it fuses seamless integrations with MetaTrader 4 (MT4), MetaTrader 5 (MT5), and TradingView alongside innovative features like the Frontbroker Market Screener and Frontbroker Heatmap. These tools transform raw data into visual symphonies of insight, empowering users to navigate forex pairs, cryptocurrencies, indices, and beyond with precision. This Frontbroker Review dissects its strengths from multi-asset breadth to social trading dynamics to reveal if it’s truly among the best CFD brokers for the year ahead.

Table of Contents

What Is Frontbroker?

Frontbroker is a multi-asset CFD broker designed to simplify professional-grade trading for a global audience. Offering thousands of instruments, it merges cutting-edge analytics with an intuitive interface to help users speculate, hedge, or diversify portfolios.

Founded in 2023, it focuses on speed, data transparency, and trader empowerment, giving users access to both automated and manual strategies through cross-platform integrations.

Account Types and Onboarding

Frontbroker streamlines entry with two tailored account structures, each calibrated to trader maturity and ambition:

- Standard Account: Ideal for newcomers, it features a modest minimum deposit (starting at $250), competitive spreads from 0.5 pips, and bundled educational perks like webinars and demo simulations. Leverage caps at 1:200, balancing accessibility with risk controls.

- Professional Account: Geared toward high-volume operators, this tier unlocks tighter spreads (as low as 0.1 pips), elevated leverage up to 1:500, and exclusive access to premium analytics, including advanced Frontbroker Heatmap customisations.

Both account types support demo environments and secure deposits through multi-currency options. Onboarding is KYC-verified for compliance and safety.

Trading Platforms and Technology

Frontbroker’s tech stack is a trifecta of proven heavyweights, delivering flexibility without the bloat:

- Frontbroker Web App: A sleek, browser-native interface for on-the-go execution, complete with customizable dashboards and one-click order placement—perfect for scalpers who can’t afford delays.

- TradingView Integration: Harness the world’s most popular charting suite for Pine Script indicators, social idea sharing, and multi-timeframe analysis, all synced seamlessly to your Frontbroker account.

- MetaTrader 4 & 5: The gold standard for automation, these platforms support expert advisors (EAs), backtesting, and mobile apps, enabling algorithmic strategies that run 24/7.

Low-latency servers in Tier-1 data centres minimise slippage, while API bridges ensure cross-platform harmony. For MT4 and MT5 brokers enthusiasts, this setup rivals the elites, blending legacy reliability with forward-thinking enhancements.

Market Coverage

Diversity is Frontbroker’s hallmark, offering a veritable buffet of CFDs to fuel any strategy:

- Forex: Frontbrokers offers forex trading in 60+ majors, minors, and exotics, with tight spreads on high-liquidity pairs like GBP/JPY.

- Cryptocurrencies: Direct exposure to BTC/USD, ETH/USD, and emerging altcoins, capturing 24/7 volatility without wallet hassles, all this to make the crypto trading journey easy.

- Indices: Track global heavyweights—S&P 500, FTSE 100, Nikkei—mirroring broader economic pulses.

- Stocks & ETFs: CFDs on blue-chips like Apple and Tesla, plus sector ETFs for thematic plays.

- Commodities: Investors concerned about inflation can use hedging tools across multiple commodities, including Brent crude oil and soybeans, to protect their portfolios.

This expansive roster—spanning over 2,000 instruments—positions Frontbroker as a multi-asset trading hub, ideal for diversified, correlation-aware approaches in today’s interconnected markets.

Market Screener

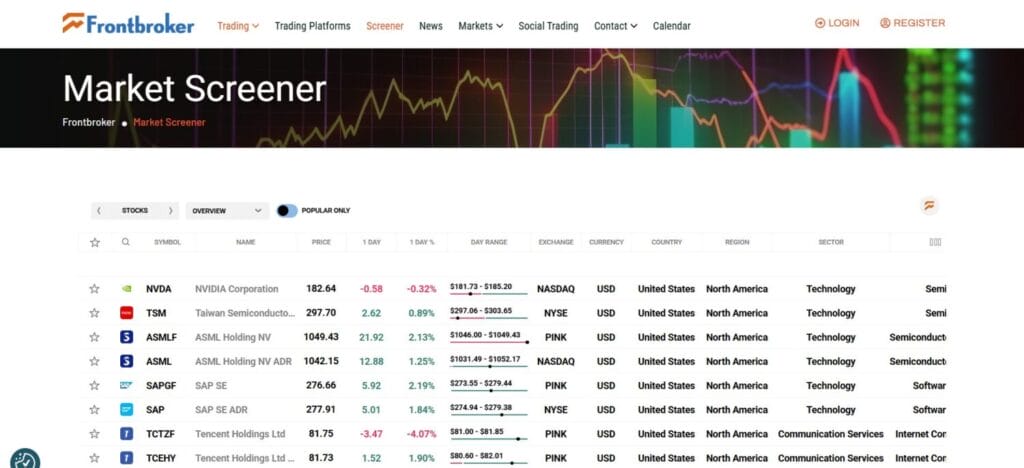

In the quest for alpha, sifting through market noise is a trader’s eternal battle. Frontbroker’s Market Screener emerges as a beacon, a dynamic tool that scans and ranks assets in real time to spotlight opportunities before they crest.

At its heart, the screener deploys intuitive filters for volume surges, performance metrics, or volatility thresholds, allowing users to zero in on forex crosses bubbling with momentum or crypto tokens showing unusual liquidity spikes.

Key capabilities include:

- Custom Rankings: Sort by daily/weekly gainers, losers, or relative strength to uncover hidden gems.

- Sector and Timeframe Segmentation: Drill into equities by industry or forex by session (Asian, London, New York) for context-specific insights.

- Liquidity Gauges: Real-time spread and depth analysis to avoid illiquid traps, crucial for high-frequency setups.

Whether you’re a day trader hunting breakouts or a swing operator building positions, the Frontbroker Market Screener distills complexity into clarity, turning data overload into decisive edges. Integrated alerts keep you proactive, ensuring no signal slips through the cracks.

Heatmap

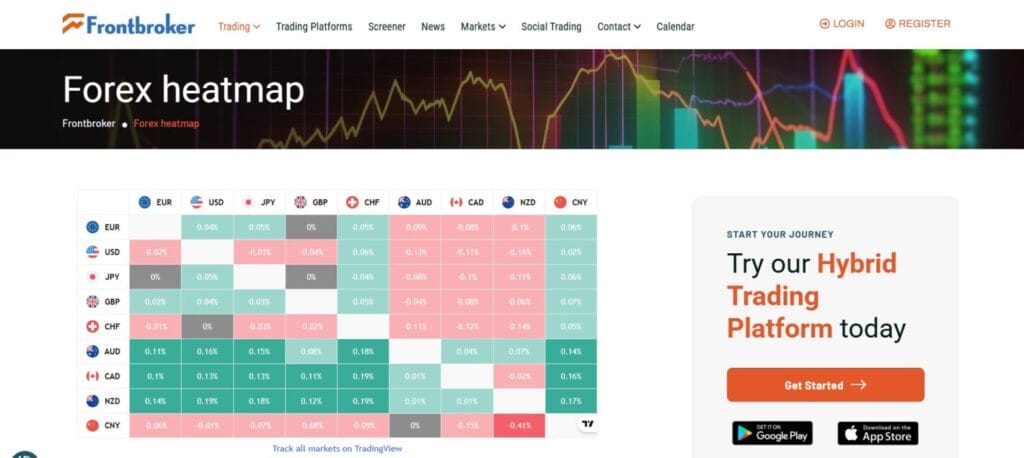

If the Market Screener is your compass, the Frontbroker Heatmap is the radar— a vivid, at-a-glance mosaic of market pulses that decodes sentiment across asset classes with effortless elegance.

Rendered in intuitive colour gradients (vibrant greens for bullish surges, stark reds for bearish retreats), the heatmap updates instantaneously, reflecting price deltas, volatility indices like VIX analogues, and cross-asset correlations. Standout elements include:

- Cluster Detection: Pinpoint overbought clusters in tech stocks or oversold pockets in commodities, revealing herd behaviors early.

- Sentiment Mapping: Overlay risk-on/risk-off themes to gauge macro shifts, such as safe-haven flows during geopolitical flares.

- Interactive Zoom: Dive from global overviews to granular pair views, with tooltips unpacking underlying drivers.

Paired with the Market Screener, this duo forms a synergistic analytics engine, empowering traders to visualise the invisible currents shaping markets. For the best CFD brokers aficionados, the Frontbroker Heatmap isn’t just a feature—it’s a revelation, compressing hours of chart-watching into seconds of strategic insight.

Social and Copy Trading

Frontbroker elevates solitary trading into a collaborative arena with its robust social and copy trading module, where emulation meets innovation.

Transparent leaderboards showcase verified performers—filtered by risk-adjusted returns, drawdown history, and asset focus—allowing users to allocate funds dynamically. Features like one-click copying, customizable lot sizing, and automatic stop-copy safeguards put control in your hands. Novices absorb strategies from pros, while signal providers earn performance fees, fostering a vibrant ecosystem.

This peer-to-peer dynamic not only accelerates learning but also amplifies diversification, making social trading a cornerstone for community-driven success on Frontbroker.

Education and Market Intelligence

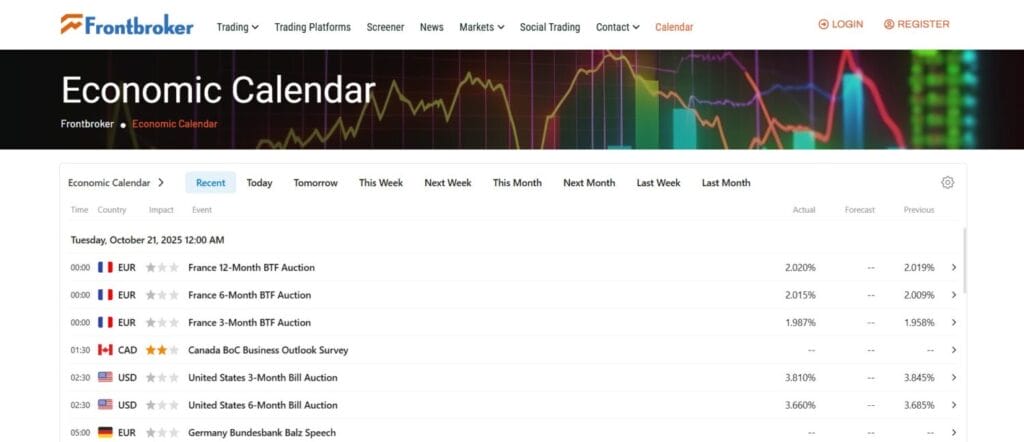

Knowledge isn’t optional in trading—it’s ammunition. Frontbroker arms users with a dedicated academy featuring bite-sized video tutorials on CFD mechanics, leverage pitfalls, and technical setups. A searchable glossary demystifies jargon, while live webinars dissect real-world scenarios.

Beyond basics, the intelligence suite streams Bloomberg-level feeds, earnings calendars, and economic calendars synced to your timezone. Customizable news aggregators filter alpha from noise, ensuring you’re briefed on FOMC whispers or OPEC decisions without the scroll fatigue. This holistic approach cements Frontbroker as a lifelong trading ally, not just a transactional pit stop.

Security, Regulation, and Customer Support

Trust is the bedrock of any broker, and Frontbroker fortifies it with end-to-end encryption (SSL/TLS), segregated client funds at top-tier banks, and rigorous KYC/AML protocols. Negative balance protection shields against wipeouts, while two-factor authentication (2FA) and biometric logins add layers of defence.

Support shines with 24/7 multilingual live chat—response times averaging under 90 seconds—bolstered by email ticketing and a comprehensive FAQ. While full regulatory disclosures (e.g., CySEC or FCA affiliations) are evolving, Frontbroker’s adherence to EU standards signals a maturing compliance posture, instilling confidence for global users.

Pros and Cons

Pros of Frontbroker

- Expansive Multi-Asset Coverage: Access to over 2,000 CFD instruments across forex, crypto, indices, stocks, and commodities, enabling robust diversification and hedging strategies.

- Advanced Analytics Tools: Built-in Market Screener and Heatmap provide real-time insights into volatility, sentiment, and performance, giving traders a data-driven edge without third-party add-ons.

- Seamless Platform Integrations: Full support for MT4, MT5, and TradingView, allowing flexible execution from automated EAs to community-driven charting.

- Engaging Social Trading: Transparent leaderboards and one-click copy trading foster community learning and passive strategy adoption for beginners and pros alike.

- Comprehensive Education Hub: Free resources like tutorials, economic calendars, and Bloomberg-style feeds empower self-directed growth, reducing the steep learning curve.

Cons of Frontbroker

- Evolving Regulatory Landscape: Limited disclosures on full CySEC/FCA affiliations may concern risk-averse traders seeking ironclad compliance.

- Tiered Access to Premium Features: Advanced Heatmap customisations and tighter spreads are locked behind the Professional account, potentially frustrating Standard users.

- Relatively New Platform: Launched in 2023, it lacks the long-term track record of established CFD brokers, which could impact trust during market stress.

- Geographic and Access Restrictions: Availability varies by region, with potential limitations in certain countries due to ongoing KYC/AML expansions.

- No Native Mobile App: Reliance on web and third-party mobile integrations (e.g., MT5 app) may feel less polished for on-the-go traders compared to dedicated apps.

Conclusion

Frontbroker isn’t chasing trends—it’s defining them. In this Frontbroker Review, its fusion of powerhouse platforms (MT4, MT5, TradingView), razor-sharp analytics via the Frontbroker Market Screener and Frontbroker Heatmap, and a vibrant social trading ecosystem emerges as a game-changer for multi-asset warriors. From forex frontiers to crypto crescendos, it equips traders with the tools to thrive amid uncertainty, all wrapped in a secure, intuitive shell. Sure, fuller regulatory sails would steady the ship, but for agile operators seeking an edge in a data-drenched world, Frontbroker sails ahead as one of the best CFD brokers.

Frequently Asked Questions(FAQs)

What makes Frontbroker stand out among the best CFD brokers?

Frontbroker shines with MT4, MT5, and TradingView integrations for versatile execution on 2,000+ CFDs. Its Market Screener and Heatmap deliver real-time volatility and sentiment insights, complemented by social trading and education. Multi-asset access—from forex to crypto—suits all levels, though regulations are maturing.

How does the Frontbroker Market Screener help traders identify opportunities?

The Frontbroker Market Screener ranks assets by volume, gains/losses, and volatility, with filters for sectors and timeframes. It highlights liquidity spreads and sends alerts for breakouts, aiding day traders in spotting entries across forex, crypto, and equities efficiently.

What role does the Frontbroker Heatmap play in market analysis?

The Frontbroker Heatmap uses color gradients to map bullish/bearish trends and correlations in real-time across assets. It flags overbought zones and risk shifts, integrating with the Screener for quick macro overviews that streamline decisions without endless charting.

Is Frontbroker suitable for beginners interested in social trading?

Yes, Frontbroker’s social trading offers leaderboards for copying verified pros with easy allocations and safeguards. Paired with demos and CFD tutorials, it builds skills fast, making it beginner-friendly for emulating strategies in forex or crypto.

What are the key security and support features at Frontbroker?

Frontbroker ensures safety via SSL encryption, segregated funds, 2FA, and negative balance protection with KYC compliance. 24/7 live chat responds in under 90 seconds, plus email/FAQ support, fostering trust despite ongoing regulatory enhancements.