Key Takeaways:

- Voyager gets permission to return $ 270 million in customer cash held with Metropolitan Commercial Bank (MCB).

- Voyager is estimated to have over 100,000 creditors and between $1 billion and $10 billion in assets.

The New York Bankruptcy Court has given the bankrupt crypto lender Voyager Digital permission to return $ 270 million in customer cash held with Metropolitan Commercial Bank (MCB).

According to Judge Michael Wiles, who is overseeing Voyager’s bankruptcy, the crypto firm provided a “sufficient basis” for its contention that customers should be granted access to the custodial account held at MCB.

Confirming the reports, an MCB representative said, “We believe it is clear that the debtors [Voyager] do not hold any legal or equitable interest in the cash and the MCB FBO accounts and that such cash was held in trust for customers”.

The latest development follows Voyager Digital CEO Stephen Ehrlich stating in July that he intended to return customer funds from MCB as soon as a “reconciliation and fraud prevention process” was completed.

Last week, the crypto lender was ordered by the Federal Reserve and the Federal Deposit Insurance Corp (FDIC) to cease making “false and misleading” claims that the government protected its customers’ funds. The regulators said that the company just had a deposit account at MCB, and customers investing via its platform had no FDIC insurance.

According to the court document, around $100 to $200 million was held in these accounts for the benefit of customers and not stored in Voyager’s bankruptcy estate. Despite the latest court announcement, the answer to whether crypto assets on Voyager’s platform belong to customers or the company in bankruptcy remains unanswered.

Voyager has recently rejected Alameda/FTX’s proposal to buy all of its assets, citing that the deal is not “value maximizing.” In the Thursday court hearing, Voyager stated that it had received word from 88 interested parties keen to bailout the firm, adding it is in “active discussions” with over 20 potentially interested parties.

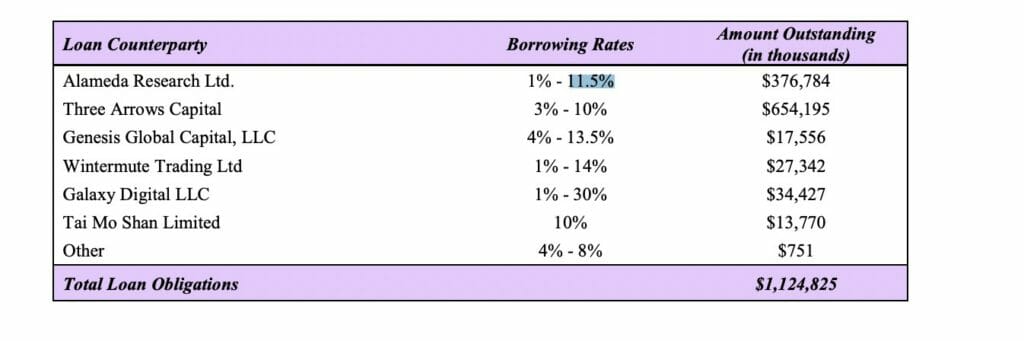

On July 5, Voyager Digital filed for Chapter 11 bankruptcy showing that it held custody of $1.3 billion in customer crypto assets spread across 3.5 million active users. Crypto hedge fund 3AC’s loan default following Terra/LUNA exposure pushed Voyager into bankruptcy. In its bankruptcy filing, Voyager estimated that it had over 100,000 creditors, between $1 billion and $10 billion in assets and liabilities of the same value.

The market crash fueled by the downfall of Terra/Luna in May had hurt crypto lenders and hedge funds alike. Apart from Voyager 3AC, Celsius and Zipmex were also beaten by market conditions and filed for bankruptcy.