This week in Markets

All the crypto assets had a fallback after bitcoin plunged below $40K by the start of Q2. The first quarter of the year had been in red throughout. Moreover, after the double top on the monthly time frame we had back in November, this was the first time Bitcoin was able to cross the $47K mark.

Even though it was not at new all-time highs, we might not see those for months. But some tokens (like FXS) did better (both fundamentally and on charts) than others.

The crypto market cap began reprising its levels and reached 2.127 T USD. Even with over 0.3 T USD pullback, we’re making a higher low, and the MACD is not far from hitting its bottom.

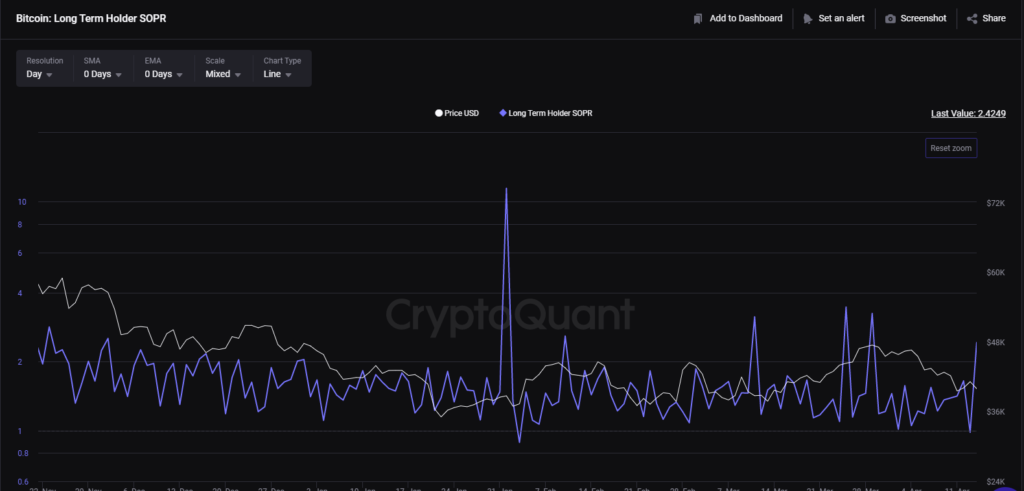

Long-term hodlers are getting stronger and have started surging again.

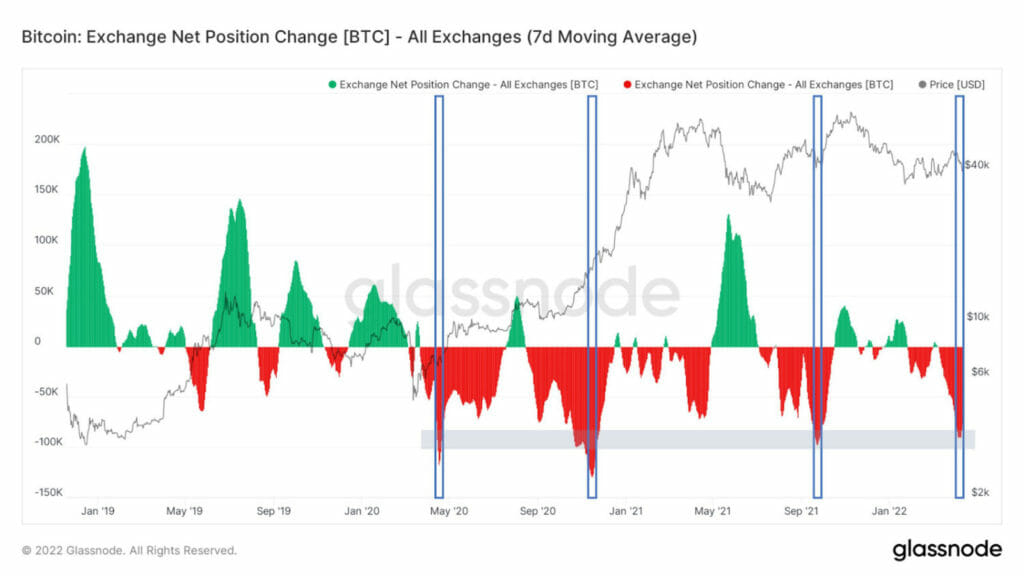

The net outflow from exchanges is hitting new levels, and this has only been seen thrice last year. Moreover, out of these three, all of them were the beginning of a new rally.

The Ethereum Merge

The Ethereum community has been excited about the Merge for a while now, and it is finally happening. Even though we don’t have a fixed day with us yet, FOMO will be huge when it starts happening.

The pressure on the price would also act as a factor since there’ll be a reduction of up to 90% in the issuance of new ETH; creating a supply shock, and removing the need for miners or validators to sell the ETH they own as they no longer would have to pay for their mining expenses. On top of that, the locked ETH will stay locked at least for a couple of quarters after the merge.

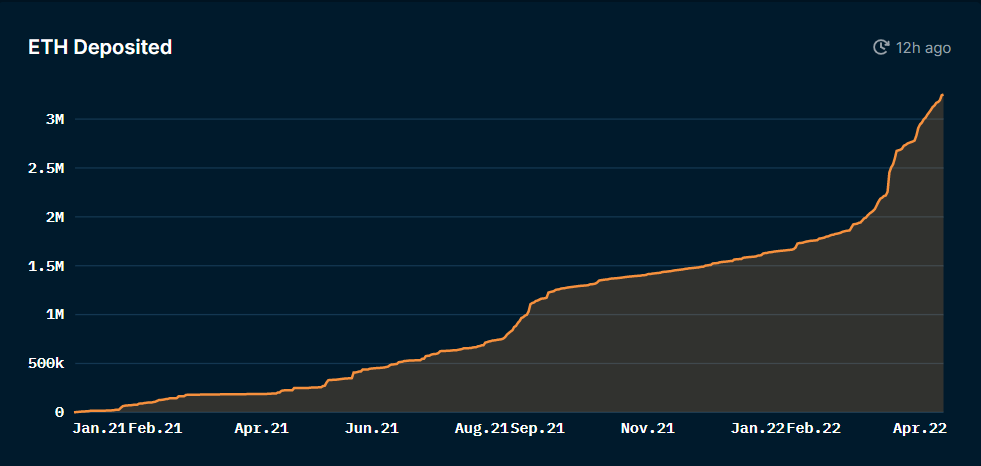

The ETH deposited on Lido has constantly been rising and has now crossed the 3.2M ETH mark.

Even the nearest and best competitor to Lido, RocketPool has a very small market share, accounting for only over 5% of the total ETH staked. Even though RocketPool presents better and more decentralized staking, Lido has the benefit of starting early.

The Happenings

- While the community is meeting up, partying, networking, and introducing new products in Bitcoin 2022; the Bitcoin market crashed to $39K. Even though El Salvador was the first country to adopt bitcoin as legal tender; Nayib Bukele was unable to attend the Miami Summit. [Link]

- There’s been a booming industry for crypto payments as it works as the best alternative to traditional wire transfers. Taking this further, the cash app allowed users to accept paychecks in bitcoin; however, CBN fired four banks for violating crypto policy.

- The US Federal Reserve has an inflated $9 trillion balance sheet. Moreover, regular investors are finding themselves laden by an 8% inflation rate, which is draining away their life’s savings. [what’s the inflation hedge again?]

- KYC loop has been haunting traders as a person trying to swap ~$20,000 through Changelly got his money stuck in the platform. [Link]

- What if someone scams an entire company after pumping a dog coin? Well, Elon did. First, he bought the 9% stake in Twitter and refused to join the board at Twitter, then he offered to buy Twitter for $41 Billion. [Link]

- Insider Trading has always been there in centralized exchanges, and the same is the case with crypto. Coming into the limelight is Coinbase when someone bought over 400 Million tokens worth $10,000 24 hours before a blog post by Coinbase announcing its listing. [Link]

- After El Salvador, Brazil is also on its way to adopting crypto and passing a law to regulate cryptocurrencies. Mexico is not far behind as a senator is drafting a bill for CBDC.

The Charts and Dips

- On-chain Research On GenieSwap, An NFT MarketPlace Aggregator [Link]

- DeFi Staking Tokens To Look Out For In 2022 [Link]

- Top 5 Meme Tokens To Keep An Eye On This Week [Link]

- Crypto To Look Out For This Week [Link]

- Top 5 Metaverse Tokens To Buy In April 2022 [Link]

Stolen/ Rugged/ Scammed/ Hacked

- Crypto-mining Malware Has Been Discovered On AWS Lambda.

- $SAFUU Protocol is a scam. Here’s why?

- There’s a new NFT discord scam using QR codes. Not just this, Club 721 Discord was hacked, members lost their NFTs

- Elephant Money or Reserve finance was exploited, and more than $11 Million were lost.

- US Treasury connects North Korean hackers to a $622M Axie Infinity exploit.

The information above does not constitute investment advice, and the author does not ask you to either buy or sell any of the assets mentioned in the article.