Transaction monitoring software is essential in the ever-changing world of cryptocurrencies for identifying and stopping illegal activity. This article examines the top options in this field and evaluates their benefits and characteristics. These tools are essential to maintaining compliance and security standards in the rapidly developing cryptocurrency space, including anything from real-time analytics to blockchain inspection. Let us first take a look at what exactly this software is all about.

Table of Contents

What is Crypto Transaction Monitoring Software?

The purpose of cryptocurrency transaction monitoring software is to track, examine, and evaluate cryptocurrency transactions. It uses a variety of methods, including risk assessment, blockchain analysis, and pattern recognition, to identify suspicious activity. This helps to ensure regulatory compliance and reduces the dangers related to financial crime in the cryptocurrency sector.

Top 9 Crypto Transaction Monitoring Software

1. Chainalysis

Chainalysis is a tool used by governments, banks, and businesses to safeguard customers, promote innovation, and make important decisions. They have the most data because they were the first to market. Their graphs are excellent, and their clustering is distinct from that of their rivals. It delivers effective risk management solutions for regulatory compliance and operational safety.

Pricing information for the platform is not available.

Also, you may read Secure Crypto Transactions with the Top VPN Services

2. Elliptic

Elliptic comprises the world’s largest blockchain identity dataset, trusted by the world’s leading organizations. It is the first chain-agnostic screening solution that scales risk assessment programmatically and displays value transfers across chains and assets on a single graph with just one click. For a completely comprehensive understanding of risk, follow each transaction through the whole cryptocurrency ecosystem.

A free trial of the platform is available. Other pricing plans are currently unavailable.

3. AnChain.AI

The AI and machine learning-powered risk algorithms evaluate cryptocurrency transactions rapidly and highlight high-risk activity. It is trusted to protect the smart contract ecosystem by the top regulators worldwide. Users may examine internal exchanges and events that smart contracts cause. It allows you to utilize the first Web3 SOC platform in the world to integrate security audits, transaction monitoring, AML/CFT compliance, threat modeling, and incident response plans. AnChain.AI is trusted by the top law enforcement agencies and regulators in the world for their crypto criminal forensics and anti-money laundering needs.

Pricing information for the platform is not available.

4. Bitquery

Bitquery is a platform providing blockchain API and crypto data products. The money tracking technology of the platform uses cutting-edge machine learning with cross-chain tracing capabilities to reveal money flow.

On numerous blockchains, it has millions of tagged addresses, and this number keeps increasing. It offers real-time transaction monitoring, wherein you can utilise the streaming technology to keep an eye on addresses and entities. It enables users to make use of incredible metadata addresses to create risk algorithms.

The pricing plan for the platform starts at $249 per month.

Also, you may read 8 Best Investment Monitoring Platforms

5. Merkle Science

Merkle Science is a risk and intelligence platform that helps users mitigate risks and monitor transactions. It offers automated investigation that helps prevent cross-chain attacks. It also uses risk scores for smart contracts and liquidity pools as a measure of risk prevention.

The web3 fraud prevention and behavior-based transaction monitoring result in improved reporting of entities. It automates compliance and AML processes to quickly obtain a license, screen transactions, accept cryptocurrency payments, and adhere to national and international standards.

The pricing plan for the platform starts at $1500 per person.

6. Crystalintelligence

Crystalintelligence is a simplified platform for AML compliance and blockchain investigations. It works with both the public and private sectors to collect information about real-world fraud. A variety of reports for audits, KYC, compliance, and cyber security incidents are also prepared by the platform.

It assists organisations in retrieving and locating misplaced or pilfered cryptocurrency. Their blockchain forensics specialists are capable of deciphering intricate transactions, locating dubious addresses, and offering useful information to support asset recovery initiatives.

Pricing information about the platform is not available.

7. TRM Labs

TRM Labs is an incredible blockchain investigation and risk management platform that helps you investigate, monitor, and detect crypto-related financial crimes. To create their own risk score system, users can select from a wide range of risk indicators, such as the FATF’s money laundering predicate violations.

Users can access the biggest and fastest-growing criminal activity database, created using cutting-edge data science and unique threat intelligence.

Individual pricing for the platform starts at $1400, while group pricing starts at $1200.

Also, you may read 4 Best Free Crypto Tax Software

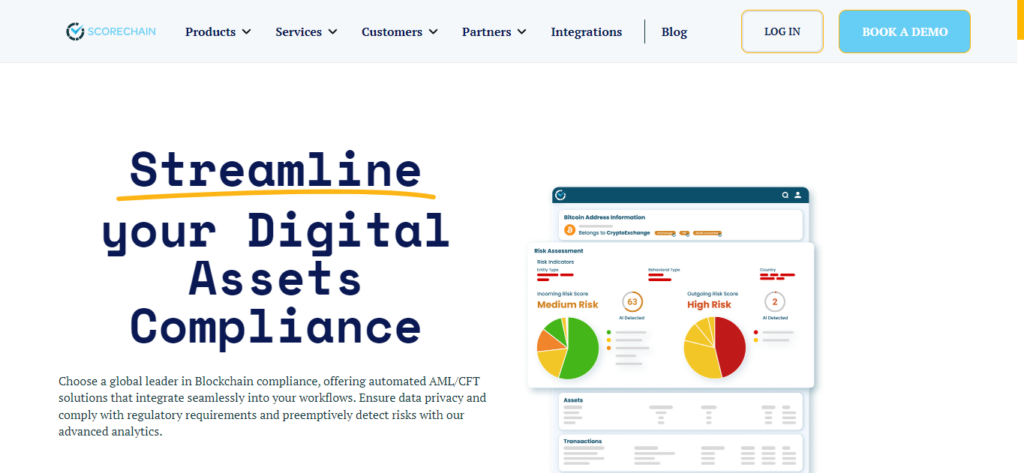

8. Scorechain

Scorechain is a supplier of risk-AML software for digital assets and cryptocurrency. In addition to using a risk-based approach with counterparties, customers can scan transactions for high-risk activity or red flags, confirm the origin and destination of funds, and report fraudulent trends to authorities.

Their application effectively compares digital activity to blacklists, dark web marketplaces, frauds, and breaches, offering crucial information for risk management and continuous surveillance.

The pricing plan for the platform starts at €500 per month.

9. Coinfirm (acquired by Lukka)

Lukka uses strong analytics over the largest blockchain database to lead the market in blockchain compliance and analytics for digital assets. It provides excellent analytics tools for strategic risk management.

It examines the on-chain data of your company to help analyse blockchain data and assess risk for AML risk monitoring. It offers very effective transaction screening. The multiple tracking methodologies of the platform allow users to track their funds easily.

The pricing information for the platform is not available.

Top Crypto Transaction Monitoring Software : Conclusion

Crypto transaction monitoring software is a vital deterrent against financial crime in the cryptocurrency field in a time of rapid digital development. With their powerful analytics and real-time monitoring capabilities, these platforms serve a critical role in fostering transparency, security, and regulatory compliance in the ever-evolving world of digital assets.

Frequently Asked Questions

What is crypto verification?

Blockchain networks and cryptocurrency exchanges use crypto verification, also known as crypto identity verification, to guarantee the legitimacy of transactions. It entails evaluating the cryptographic signatures connected to a transaction in order to verify its legitimacy. Fraud, double-spending, and other nefarious activity happen in the absence of these checks. Additionally, it is a crucial part of the crypto onboarding process for new users because personal information may be checked for compliance with regulations.

What is the KYC platform for crypto?

Any tool that helps blockchain enterprises, cryptocurrency exchanges, or other connected entities verify users is known as a KYC platform for cryptocurrency. These systems offer crypto AML/KYC solutions to guarantee adherence to national and global laws. They reduce the possibility of fraud and money laundering and allow these businesses to authenticate the identities of their users. Platform selection is frequently influenced by factors including processing speed, solution correctness, and customizability.

What are the core features of the top crypto transaction monitoring software?

Among the many features of the top crypto monitoring software, you may look for the following: user verification, business verification, transaction monitoring, fraud prevention, business data and UBO discovery, AML screening, onboarding flow risk scoring, monitoring, reporting, and audit trail.