Polymarket has become one of the most active decentralised prediction market platforms, attracting traders who rely on speed, information, and execution precision. As markets react instantly to news, polls, and liquidity shifts, copy trading has emerged as a practical way to follow experienced traders. By tracking profitable wallets and mirroring their trades, users can reduce research time and react faster. This article explores the top tools that enable copy trading on Polymarket and explains how each fits different trading styles.

Table of Contents

What Is Copy Trading on Polymarket?

Copy trading on Polymarket involves replicating trades made by other wallets, either automatically or manually. When a tracked trader buys or sells shares, copy-trading tools either execute the same trade on your behalf or alert you so you can act. While this approach can improve efficiency, traders must consider slippage, liquidity, and risk management. Choosing reliable wallets and diversifying across strategies is critical.

Comparison Table

| Tool | Copy-Trading Method | Execution | Platform | Best For |

|---|---|---|---|---|

| Polymarket Insider Bot | Wallet alerts | Manual | Telegram | Wallet discovery |

| PolyBot Trading | Alerts + execution | Market & limit | Telegram | Fast execution |

| OkBet Bot | Alerts + execution | Market & limit | Telegram & Web | Cross-market traders |

| PolyX Gold Bot | High-signal alerts | Manual | Telegram | Premium signals |

| Predictify Bot | Alerts + orders | Advanced orders | Telegram | Risk-managed copying |

| Polycule Trade Bot | Automated copying | Fully automatic | Web & Telegram | Full automation |

| Polyscalping | Arbitrage alerts | Manual | Web & Telegram | Scalpers |

| PolyData Explore | Wallet tracking | Manual | Telegram | Wallet analysis |

| PolyAlertHub | Analytics-driven alerts | Manual | Web | Data-focused traders |

| Polyburg | Smart-wallet tracking | Manual | Web & Telegram | Smart-money followers |

Top 10 Tools to Copy Trade Polymarket Traders

Polymarket Insider Bot

Polymarket Insider Bot is a Telegram-based tool that helps users track profitable Polymarket wallets and receive instant alerts when those wallets trade. It focuses on wallet transparency and trade discovery, allowing users to manually replicate trades from high-performing participants.

Key Features

- Real-time alerts when tracked wallets place trades

- Whale trade detection for large-size positions

- Wallet performance metrics, including win rate and PnL

- Custom watchlists for monitoring multiple wallets

- Fully Telegram-native interface

Pricing

Freemium model. Basic wallet alerts are free; advanced analytics and filters require a paid subscription. No additional trading fees.

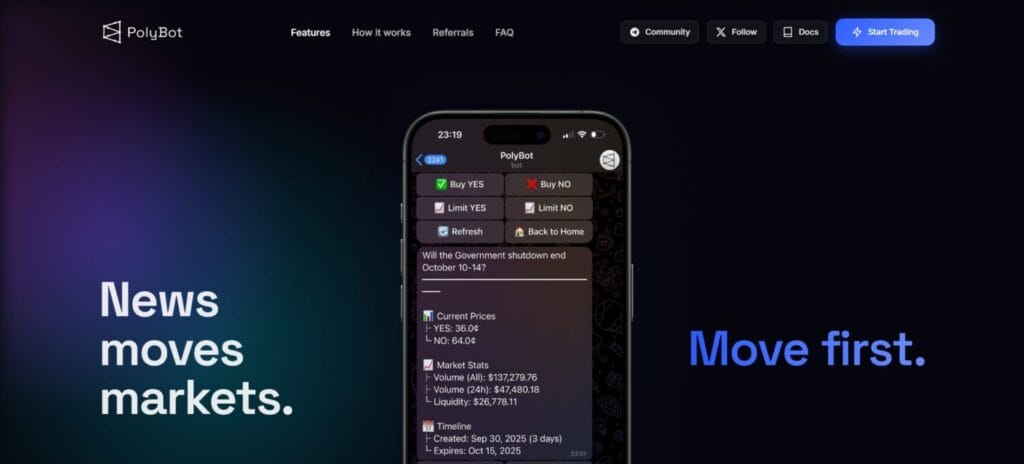

PolyBot Trading

PolyBot Trading is a full Polymarket trading terminal inside Telegram. It allows users to place market and limit orders directly in chat and supports fast copy trading through instant execution. Each user operates via a self-custodial Safe wallet.

Key Features

- Market and limit order execution directly in Telegram

- Self-custodial Safe wallet architecture

- Automatic USDC and USDC.e handling on Polygon

- Sponsored gas fees (no MATIC required)

- Built-in referral rewards program

Pricing

1% flat fee per executed trade. No subscription fees; gas costs are covered.

OkBet Bot

OkBet is a multi-market trading and alert platform supporting Polymarket and Kalshi. Available via Telegram and web, it combines trade execution, alerts, and natural-language order placement, making it suitable for cross-market copy trading.

Key Features

- Cross-market alerts for Polymarket and Kalshi

- Market and limit order execution

- Natural-language “agent” trade commands

- Cross-chain USDC deposits and bridging

- Unified dashboard for positions and orders

Pricing

1% fee on buys and sells. No mandatory subscription.

PolyX Gold Bot

PolyX Gold Bot is a premium Telegram alert bot focused on high-signal events such as whale trades, new market launches, and sharp price movements. It is designed for traders who want selective, high-confidence copy-trading signals

Key Features

- Whale trade alerts

- New Polymarket market notifications

- Large price movement detection

- Wallet-specific trade tracking

- Customizable alert thresholds

Pricing

Free tier available; premium subscription required for advanced alerts.

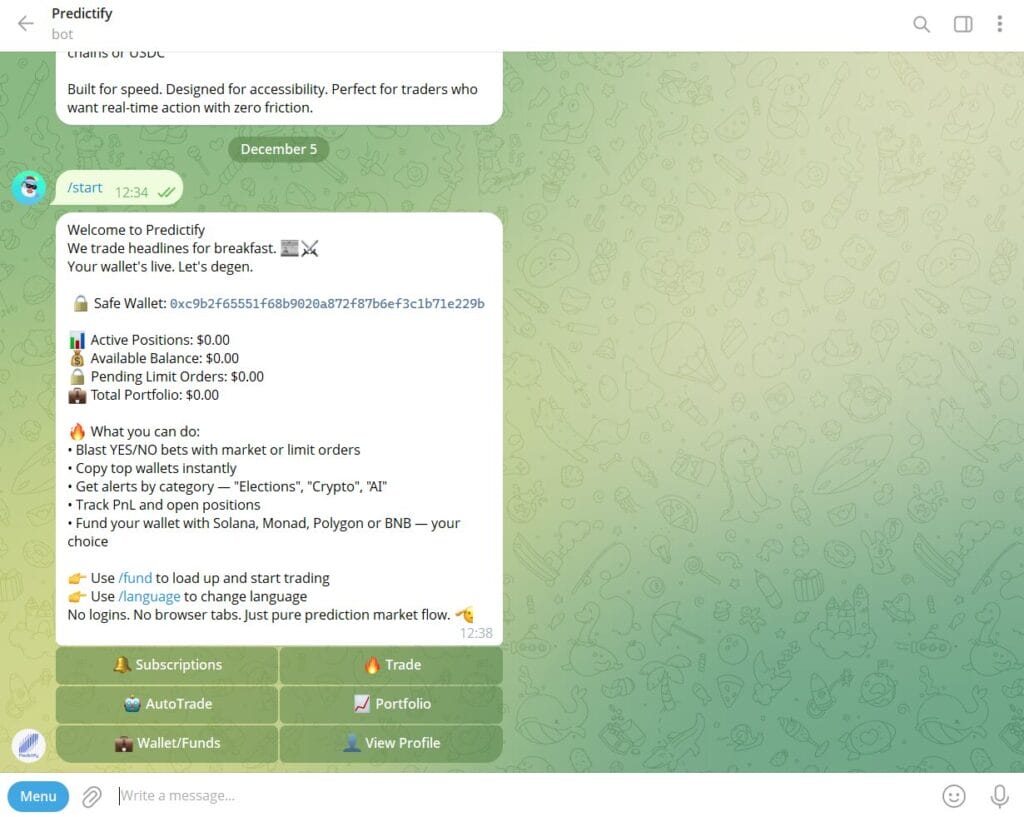

Predictify Bot

Predictify Bot is a Telegram-based trading assistant that supports alerts, copy trading signals, and advanced order management. It is designed for traders who want more control over copied positions, including risk management tools.

Key Features

- Market and price alerts

- Copy-trade signal notifications

- Advanced orders (limit, take-profit, stop-loss)

- Multi-language Telegram support

- Real-time PnL and position tracking

Pricing

Free to use. Standard trading fees apply when executing trades.

Polycule Trade Bot

Polycule is an automated copy-trading platform available via web and Telegram. It allows users to fully mirror selected traders’ actions with configurable trade sizing and execution rules, making it one of the most advanced automation tools on Polymarket

Key Features

- Automatic trade execution

- Flexible sizing (fixed, percentage, or ranges)

- Advanced filters for liquidity and odds

- Copy-or-counter trading logic

- Custom sell and exit rules

Pricing

Free to use; standard trading fees apply. Optional native token provides fee discounts.

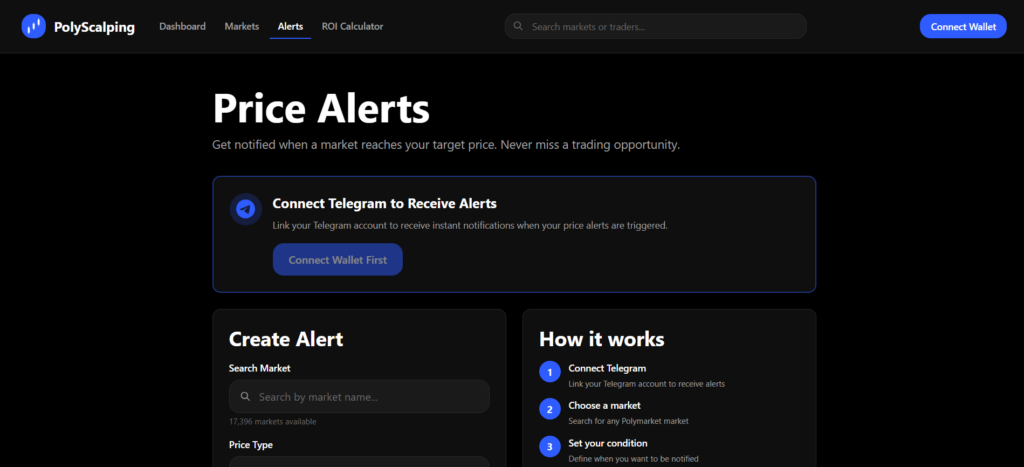

Polyscalping

Polyscalping is an analytics and alert platform built for short-term traders and arbitrageurs. It continuously scans Polymarket markets to identify price inefficiencies and alerts users so they can copy or replicate profitable trades quickly.

Key Features

- Automatic market scans every minute

- Instant alerts for scalping opportunities

- Advanced filters for spread, volume, and liquidity

- Market-wide dashboard with key metrics

- ROI estimation tools

Pricing

Free access available; premium tiers may be introduced later.

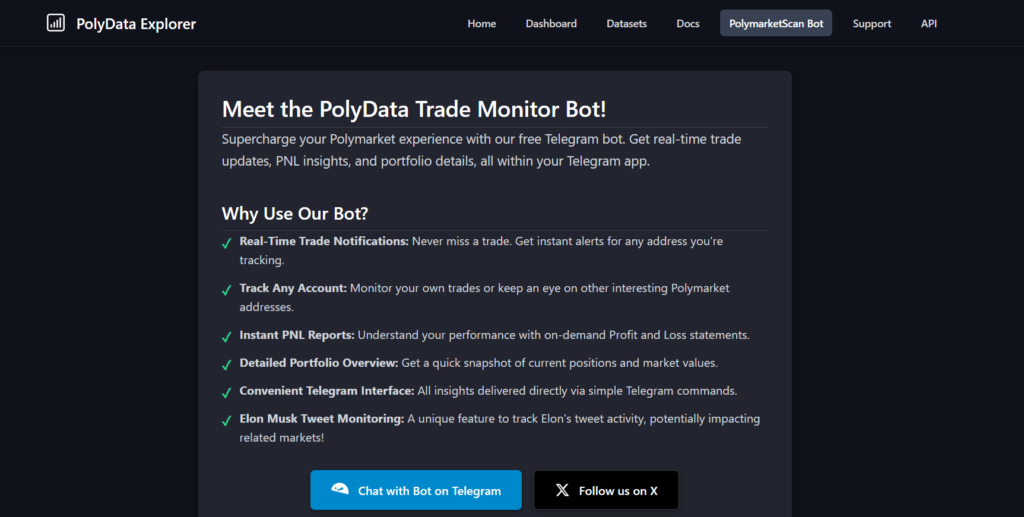

PolyData Explore

PolyData Explore is a Telegram bot focused on wallet tracking and trade monitoring. It enables users to observe specific wallets, receive trade alerts, and analyse performance, making it useful for manual copy trading.

Key Features

- Real-time trade notifications for tracked wallets

- Wallet-level PnL and performance reports

- Multi-wallet monitoring

- Telegram-first delivery

- Optional social sentiment integration

Pricing

Free to use; advanced analytics may require a subscription.

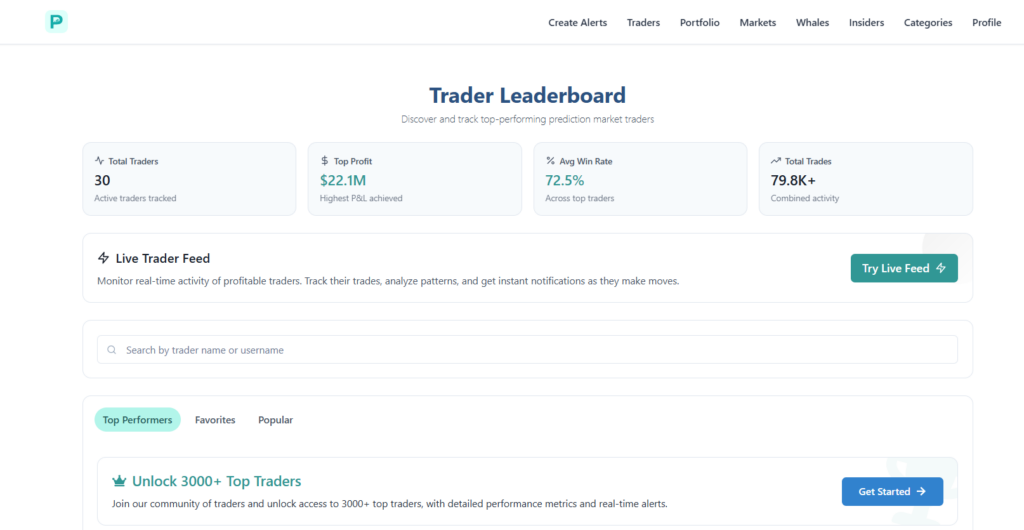

PolyAlertHub

PolyAlertHub is an analytics-driven alert platform offering deep insights into Polymarket activity. It supports trader alerts, whale alerts, insider detection, and portfolio analytics, helping users identify copy-trading opportunities with context.

Key Features

- Trader-specific alerts

- Whale trade alerts

- Smart price and event alerts

- Insider activity detection

- Market, trader, and portfolio analytics

Pricing

Free tier available; advanced analytics require a paid plan.

Polyburg

Polyburg is a smart-wallet intelligence platform that tracks and ranks profitable Polymarket wallets. It focuses on performance benchmarking and wallet analytics, helping users decide which traders to copy

Key Features

- Smart-wallet trade alerts

- Wallet ranking by win rate and volume

- Market-wide activity monitoring

- Terminal-style analytics interface

- Performance benchmarking tools

Pricing

Free basic access; advanced features available via subscription.

Best Tools to Copy Trade Polymarket Traders – Conclusion

Copy trading tools play a crucial role in helping traders navigate fast-moving Polymarket markets. Whether through full automation, wallet alerts, or deep analytics, these platforms reduce reaction time and improve access to smart-money behaviour. As Polymarket continues to grow, copy-trading infrastructure will remain essential for traders seeking efficiency, insight, and a competitive edge.

Frequently Asked Questions (FAQs)

Is copy trading allowed on Polymarket?

Yes. Polymarket is fully on-chain and permissionless. Copy trading tools simply observe public wallet activity or automate order placement on behalf of users. There are no restrictions against copying other traders’ positions.

Can copy trading be fully automated?

Yes. Some tools, such as automated copy-trading bots, can replicate trades instantly without manual input. Other tools provide alerts only, allowing users to review and execute trades themselves. The level of automation depends on the tool you choose.

Do these tools custody funds?

Most copy trading tools are non-custodial. Alert-based tools never touch user funds, while execution tools typically use self-custodial wallet setups where users retain full control. Always verify wallet permissions before using automated execution.

How do I choose which traders or wallets to copy?

Traders are commonly evaluated based on win rate, consistency, trade volume, and market specialisation. Smart-wallet tracking platforms rank wallets by performance metrics, helping users identify traders with proven track records rather than short-term luck.

What are the main risks of copy trading on Polymarket?

Key risks include slippage (price movement between the original trade and your execution), low liquidity in certain markets, overexposure to a single trader, and changing trader behaviour. Copy trading does not eliminate market risk and should be paired with proper position sizing.