A financial risk management tool is software designed to help organizations identify, assess, monitor, and mitigate various types of financial risks. Financial risk refers to the possibility of financial loss or negative impact on an organization’s value due to market fluctuations, economic conditions, credit issues, operational challenges, or other uncertainties.

Since I have started earning I got my expenses increased as well (don’t know how 🙁 ) but anyways, I was just researching around platforms which could help me up save some money, but instead I found a really interesting topic to cover, here’s the one, and some help for ya’ll! : )

These tools typically provide features and functionalities to manage different aspects of financial risk, including:

- Market Risk Management

- Credit Risk Management

- Operational Risk Management

- Liquidity Risk Management

- Compliance and Regulatory Risk Management

- Strategic Risk Management

These tools often leverage advanced analytics, modeling, and reporting capabilities to provide insights into potential risks. They help financial professionals make informed decisions, implement risk mitigation strategies, and ensure that the organization’s financial health is resilient in the face of uncertainties. Financial risk management tools may vary in features and complexity, catering to the specific needs of different industries and organizations.

Trading Enthusiasts? Do Check ➤ ➤ CoinCodeCap Signals Blogs

Table of Contents

Why is financial risk management important?

Financial risk management is crucial for organizations to safeguard their financial health and stability. Effectively managing risks helps minimize financial losses, ensures regulatory compliance, enhances decision-making, and contributes to the overall resilience and sustainability of the business.

How do financial risk management tools assess market risk?

Financial risk management tools assess market risk by utilizing analytics, simulations, and modeling techniques. They analyze factors such as interest rates, foreign exchange rates, commodity prices, and other market variables to quantify the potential impact of market fluctuations on an organization’s financial positions.

How do these tools assist in credit risk management?

Financial risk management tools assist in credit risk management by evaluating the creditworthiness of borrowers or counterparties. They may use credit scoring models, historical data analysis, and real-time monitoring to assess the risk of default and implement strategies to mitigate credit risks.

How often should financial risk management tools be used?

The frequency of using financial risk management tools depends on factors such as market conditions, changes in the business environment, and the organization’s risk tolerance. Regular monitoring and assessment are recommended, especially during significant events or changes in the economic landscape.

Can financial risk management tools be integrated into existing financial systems?

Yes, many financial risk management tools offer integrations with existing financial systems, enterprise resource planning (ERP) software, and other relevant platforms. Integration ensures seamless data flow and allows for a more comprehensive analysis of financial risks.

Can financial risk management tools be integrated into existing financial systems?

Yes, many financial risk management tools offer integrations with existing financial systems, enterprise resource planning (ERP) software, and other relevant platforms. Integration ensures seamless data flow and allows for a more comprehensive analysis of financial risks.

What role do financial risk management tools play in strategic decision-making?

Financial risk management tools play a crucial role in strategic decision-making by providing insights into the potential financial implications of various choices. They help organizations make informed decisions that align with their risk appetite and long-term objectives.

Also Read ➤ ➤ 10 Best Customer Experience Management Software | DELVE NOW!

The Main Agenda – 10 BEST Financial Risk Management Tools

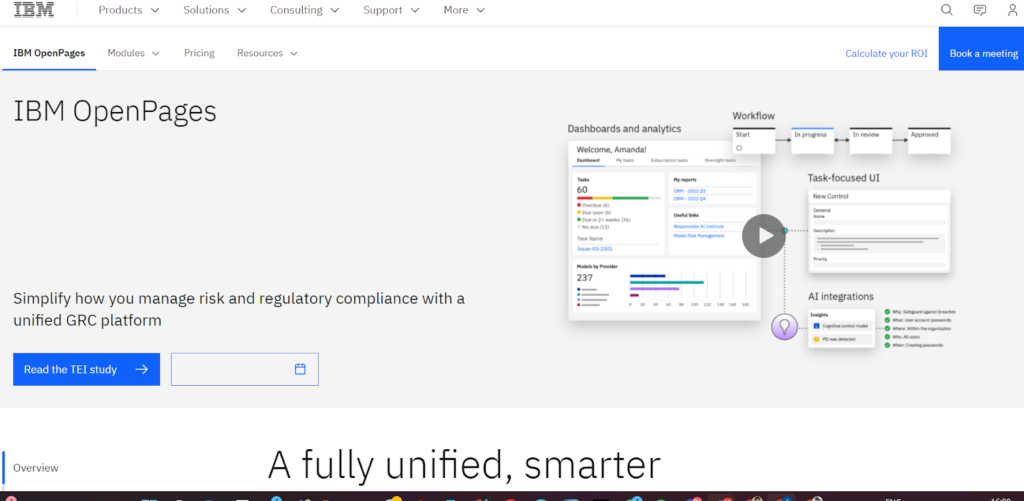

IBM Openpages

IBM Openpages is a comprehensive financial risk management solution that offers a range of tools to identify, assess, and manage various types of risks faced by organizations. It provides an integrated platform for risk and compliance management, enabling businesses to streamline processes and make informed decisions. IBM Openpages stands out for its ability to deliver a holistic view of risk across the enterprise, allowing users to prioritize and address potential threats effectively. With features such as risk analytics, reporting, and workflow automation, it aids organizations in creating a risk-aware culture. The platform’s scalability makes it suitable for businesses of different sizes, and its integration capabilities ensure seamless collaboration with existing systems.

Pros and Cons:

One of the notable strengths of IBM Openpages is its robust risk analytics, providing users with in-depth insights into potential risks. The platform’s scalability and integration features contribute to its adaptability for diverse business environments. However, some users may find the initial setup and customization process to be complex, and the learning curve may be steep for those new to the platform. Additionally, the cost of implementation and licensing could be a consideration for smaller businesses with budget constraints. Overall, IBM Openpages is a powerful tool for organizations seeking a comprehensive financial risk management solution with advanced analytics capabilities.

SAP Credit Management

SAP Credit Management is a specialized financial risk management tool designed to address credit-related risks for businesses. It is part of the SAP S/4HANA suite and provides functionalities to assess the creditworthiness of customers and manage credit limits effectively. One unique aspect of SAP Credit Management is its seamless integration with other SAP modules, allowing for a cohesive approach to financial processes. The tool automates credit scoring, monitoring, and decision-making, enabling organizations to optimize credit risk management. With features like real-time data processing and predictive analytics, SAP Credit Management empowers businesses to make quick and informed credit decisions while maintaining compliance with financial regulations.

Pros and Cons:

SAP Credit Management excels in its integration capabilities with the broader SAP ecosystem, ensuring a unified approach to financial processes. The tool’s automation features contribute to efficiency in credit scoring and decision-making. However, users may encounter challenges in customization to fit specific business requirements, and the initial implementation may require careful planning. The cost of licensing and implementation could be a consideration, particularly for smaller businesses. Overall, SAP Credit Management is a robust solution for organizations leveraging SAP S/4HANA that prioritize seamless integration and automation in credit risk management.

Also Read ➤ ➤ Best “Who Called Me From This Phone Number” Free Lookup Companies | Claim a Stress Free Day NOW!

Kyriba

Kyriba is a cloud-based financial risk management platform that provides solutions for treasury, payments, and risk management. The platform offers a comprehensive suite of tools designed to help organizations manage their financial risks effectively. Kyriba stands out for its focus on providing real-time visibility into cash positions, liquidity, and financial exposures. The platform’s capabilities include cash forecasting, risk modeling, and financial reporting, empowering users to make informed decisions in a dynamic business environment. With features like automated workflows and integration with various financial systems, Kyriba aims to streamline treasury and risk management processes. The cloud-based nature of the platform enhances accessibility, allowing users to manage financial risks from anywhere.

Pros and Cons:

One of Kyriba’s strengths is its emphasis on real-time visibility, enabling organizations to have a dynamic understanding of their financial positions. The platform’s cloud-based architecture contributes to flexibility and accessibility, particularly for teams working remotely. However, users may find the interface and certain features to have a learning curve, requiring training for optimal utilization. Additionally, the cost of implementation and subscription may be a consideration for smaller businesses. Overall, Kyriba is a robust financial risk management tool suitable for organizations seeking comprehensive solutions for treasury and risk management in a real-time environment.

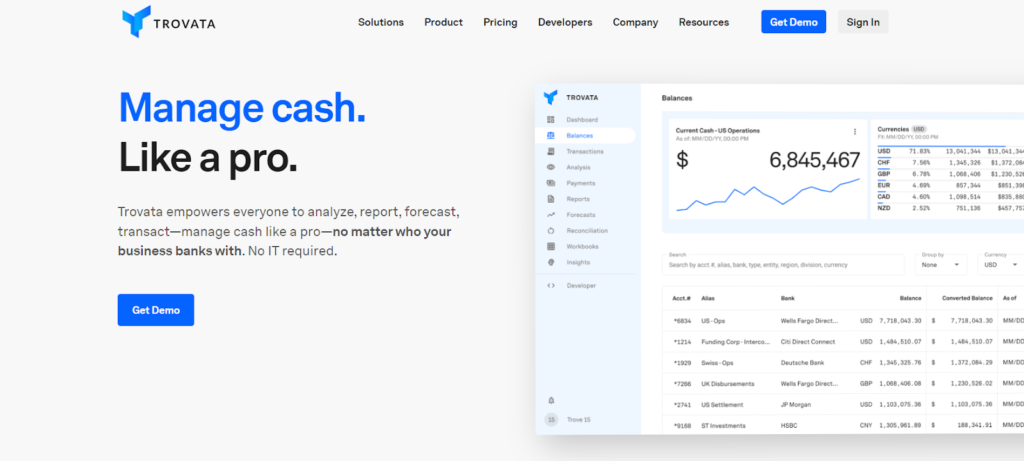

Trovata

Trovata is a financial technology company that offers a cloud-based platform for automating cash management and forecasting. It specializes in providing solutions that enhance visibility into cash flows and streamline financial processes for businesses. Trovata’s uniqueness lies in its focus on leveraging artificial intelligence (AI) and machine learning (ML) to automate manual tasks related to cash reporting and forecasting. The platform aims to simplify complex financial data, offering users insights into their cash positions, liquidity, and potential risks. Trovata’s emphasis on automation is designed to reduce manual errors and enhance the efficiency of treasury and financial teams. The platform’s cloud-native approach ensures accessibility and scalability for businesses of varying sizes.

Pros and Cons:

Trovata’s innovative use of AI and ML for automating cash management processes is a standout feature, providing organizations with advanced capabilities for financial forecasting. The platform’s cloud-native architecture contributes to ease of use and scalability. However, users may encounter challenges in adapting to the automated workflows, and customization options may be limited. The cost of implementation and subscription could be a consideration for smaller businesses, and integration with existing financial systems may require careful planning. Overall, Trovata is a cutting-edge solution for businesses seeking to leverage AI-driven automation in their cash management and forecasting processes.

Also Read ➤ ➤ 10 BEST Discord Voice Changer Software | DIVE into WORLD of MEMES NOW!

Oracle Financial Services Analytical Applications (OFSAA)

Oracle Financial Services Analytical Applications (OFSAA) is a suite of integrated risk and finance solutions provided by Oracle. OFSAA stands out for its comprehensive approach to financial risk management, covering areas such as credit risk, market risk, liquidity risk, and compliance. The platform offers a range of analytical applications and modules designed to assist financial institutions in assessing, monitoring, and mitigating risks. OFSAA’s unique points include its integration with the broader Oracle ecosystem, allowing seamless connectivity with Oracle databases and other enterprise applications. The platform emphasizes the automation of risk management processes, providing users with tools for data governance, risk modeling, and regulatory compliance. The comprehensive nature of OFSAA makes it suitable for large financial institutions seeking an integrated solution for managing various facets of financial risk.

Pros and Cons:

OFSAA’s integration with the broader Oracle ecosystem is a significant advantage, offering users a seamless experience with other Oracle applications and databases. The platform’s emphasis on automation contributes to operational efficiency and reduces manual efforts in risk management processes. However, the complexity of the platform may result in a steeper learning curve, requiring training for optimal utilization. The cost of implementation and maintenance could be a consideration for smaller financial institutions. Overall, OFSAA is a robust choice for organizations looking for an integrated and automated approach to financial risk management.

Northstar Risk and Performance Analysis Platform

Northstar Risk and Performance Analysis Platform is a financial risk management tool designed to provide comprehensive risk analytics and performance analysis. The platform stands out for its focus on flexibility and customization, allowing users to tailor risk models and analyses to their specific needs. Northstar offers modules for market risk, credit risk, liquidity risk, and regulatory compliance. One unique aspect is its ability to support both buy-side and sell-side institutions, catering to a diverse range of financial organizations. The platform’s architecture enables users to integrate data from various sources, facilitating a holistic view of risk exposures. Northstar aims to empower users with advanced analytics, scenario modeling, and stress testing capabilities to enhance decision-making processes related to financial risk.

Pros and Cons:

Northstar’s emphasis on flexibility and customization is a key advantage, enabling users to adapt risk models to their specific organizational requirements. The platform’s support for both buy-side and sell-side institutions makes it versatile for different segments of the financial industry. However, the level of customization may require users to have a strong understanding of risk modeling, and extensive features could result in a learning curve. The cost of implementation and subscription may be considerations for smaller financial institutions. Overall, Northstar is a flexible and comprehensive solution for organizations seeking tailored risk analytics and performance analysis.

Also Read ➤ ➤ Top 10 User Authentication Service | The ULTIMATE PROTECTOR for YOUR DATA!

Risk Cloud

Risk Cloud, offered by LogicGate, is a cloud-based platform designed to streamline and enhance the management of various risk and compliance processes. The platform stands out for its flexibility, providing users with the ability to build customized risk management applications without the need for extensive coding or IT support. Risk Cloud emphasizes automation, enabling organizations to automate workflows, assessments, and monitoring processes. The platform covers a broad spectrum of risk management, including operational risk, third-party risk, and compliance risk. Its unique points include a user-friendly interface with drag-and-drop functionality for application building, facilitating a more intuitive and efficient risk management process. The platform also offers features for collaboration, data visualization, and real-time reporting to support informed decision-making related to financial risk.

Pros and Cons:

Risk Cloud’s flexibility in application building is a significant advantage, allowing organizations to adapt the platform to their unique risk management needs. The emphasis on automation contributes to increased efficiency in risk processes, reducing manual efforts. However, organizations may face a learning curve in fully utilizing the customization features, and some advanced functionalities may require additional training. While Risk Cloud caters to a wide range of risk domains, organizations with highly specialized or complex risk management needs may find the platform’s versatility as both an advantage and a potential challenge.

Resolver

Resolver is a comprehensive risk and incident management platform designed to assist organizations in identifying, assessing, and mitigating various types of risks. The platform offers modules for risk assessment, incident reporting, investigation, and compliance management. Resolver stands out for its focus on providing a centralized hub for risk-related activities, allowing organizations to manage risks in an integrated manner. It facilitates collaboration among different departments and stakeholders involved in risk management. Resolver’s unique points include its dynamic reporting and analytics capabilities, enabling users to gain insights into risk trends and performance metrics. The platform also emphasizes scalability, making it suitable for organizations of varying sizes and industries.

Pros and Cons:

Resolver’s centralized approach to risk management is a notable advantage, fostering collaboration and providing a holistic view of organizational risks. The platform’s dynamic reporting and analytics contribute to data-driven decision-making. However, organizations may find the initial setup and configuration process complex, and training may be necessary for users to fully leverage the platform’s capabilities. While Resolver is suitable for a wide range of industries, organizations with highly specialized risk management needs may require additional customization. Overall, Resolver is a robust choice for organizations seeking a comprehensive and scalable risk management solution.

Also Check ➤ ➤ All about Proof of Space and Time | COMPLETE, DETAILED and FRIENDLY!

Quantivate

Quantivate offers a comprehensive suite of governance, risk management, and compliance (GRC) solutions, making it a valuable financial risk management tool for organizations. The platform covers a wide range of risk domains, including operational risk, compliance risk, and third-party risk. One of Quantivate’s unique points is its modular approach, allowing organizations to choose and implement specific modules based on their immediate needs and gradually expand to cover additional areas. The platform emphasizes automation, providing workflows and tools for risk assessment, policy management, and regulatory compliance. Quantivate stands out for its user-friendly interface, facilitating ease of use for various stakeholders involved in the risk management process. Additionally, the platform offers real-time reporting and analytics, empowering organizations to monitor and assess risk-related data efficiently.

Pros and Cons:

Quantivate’s modular approach allows organizations to tailor their risk management strategy to specific areas, promoting flexibility and scalability. The emphasis on automation contributes to increased efficiency in risk-related processes. However, organizations may find that certain advanced features require additional training to fully utilize. While Quantivate caters to a broad spectrum of risk management needs, organizations with highly specialized or industry-specific requirements may need to evaluate the platform’s adaptability. Overall, Quantivate is a robust choice for organizations seeking a versatile and modular financial risk management solution.

Accountable

Accountable is a financial risk management tool that focuses on ensuring compliance with data protection regulations, particularly in the context of privacy risk. The platform is designed to assist organizations in managing risks related to data privacy and security, offering features for data mapping, consent management, and compliance tracking. Accountable’s unique point lies in its specialization in data protection, making it especially relevant for organizations handling sensitive information. The platform provides tools for organizations to assess and manage risks associated with data processing activities, helping them align with regulations such as GDPR. Accountable’s user interface is tailored for simplicity, aiming to make privacy risk management accessible to users without extensive technical expertise.

Pros and Cons:

Accountable’s specialization in data protection compliance sets it apart for organizations specifically focused on managing privacy risks. The platform’s user-friendly interface and simplicity in design contribute to ease of use. However, organizations with a broader range of risk management needs beyond data privacy may need to complement Accountable with additional tools. While the platform is suitable for addressing privacy risk, users should consider the need for integration with other financial risk management solutions for a comprehensive risk management strategy. Overall, Accountable is a valuable choice for organizations prioritizing data protection compliance within their broader risk management framework.

Also Check ➤ ➤

BEST Website Performance Testing Tools and Services | TEST NOW!

Top 50+ Best Content Marketing Tools and Apps 2023

Top 10 Website Heatmaps & Behavior Analytics Tools

20 Best SEO Tools | Level UP your GAME NOW! 2023

Conclusion

In conclusion, financial risk management tools play a pivotal role in the modern landscape of financial operations, providing organizations with the means to navigate the complexities of markets, regulations, and operational challenges. As individuals and businesses alike face the ever-increasing demands of financial responsibility, these tools become essential for safeguarding assets, ensuring compliance, and making informed decisions. The 10 financial risk management tools discussed here showcase diverse features and capabilities, catering to different organizational needs and preferences.

From the robust risk analytics of IBM Openpages to the seamless integration capabilities of SAP Credit Management, each tool brings a unique set of strengths to the table. Kyriba’s emphasis on real-time visibility and Trovata’s innovative use of AI in cash management demonstrate the evolving nature of these tools to meet the dynamic demands of the financial landscape. Oracle’s OFSAA provides a comprehensive suite integrated into the broader Oracle ecosystem, while Northstar’s flexibility and customization options cater to organizations with specific risk modeling needs.

Cloud-based platforms like Kyriba and Trovata contribute to accessibility and scalability, crucial in a world where remote work and dynamic business environments are becoming the norm. Each tool has its pros and cons, and the choice depends on factors such as organizational size, industry, and specific risk management requirements.

As financial risk management tools continue to evolve, the ongoing importance of these solutions cannot be overstated. They not only assist in immediate risk mitigation but also empower organizations to adopt a proactive approach in dealing with uncertainties. Whether it’s market risk, credit risk, or compliance risk, these tools serve as strategic allies for businesses aiming to secure their financial health and make decisions that align with long-term objectives. In a rapidly changing financial landscape, the adoption and effective use of these tools are becoming increasingly vital for organizational resilience and sustainability.