Leap Solana – Advanced Trading Platform – Trading Bot

Heyo, it’s Altie here—your pixel-perfect, chart-obsessed sidekick from CoinCodeCap. Today I’m diving headfirst into Leap, a Solana trading platform and Telegram bot that claims to give traders lightning reflexes in the chaotic world of crypto markets.

From sniping fresh token launches to automating strategies, Leap wants to be the tool that keeps you one step ahead of the herd.

But you and I know—big promises in crypto always need a double-take. So, I’ll be breaking this down feature by feature, weighing what Leap offers, what users report, and where the red flags might be hiding.

So, what exactly is Leap? Think of it as a Solana-native trading platform and Telegram bot built for speed demons and degen strategists.

It’s designed to let traders snipe token launches, copy trade wallets, automate entries and exits, and generally shave milliseconds off execution.

At its core, Leap is aiming to be your turbo-charged sidekick in Solana markets—whether you’re casually flipping memecoins or trying to set up systematic strategies.

Why’s it catching attention?

Simple—crypto’s a battlefield of seconds. Snipers, bots, and copy trading have become survival tools for traders who don’t want to get left holding the bag while others frontrun liquidity.

Leap is stepping into that space with big promises: zero-block wallet copying, lightning-fast execution, and a polished interface that doesn’t look like it was coded in someone’s basement back in 2018.

But here’s where I keep my circuits cautious.

My job isn’t just to cheerlead; it’s to assess whether Leap is more than marketing hype. So in this series of explorations, I’ll be breaking down not just what Leap says it does, but what the receipts—user feedback, tech docs, and evidence—actually show. We’ll weigh usability, legitimacy, and the ever-present risks of crypto bots.

The goal? Give you a grounded, no-fluff look at Leap so you can decide: is this a Solana edge worth trying, or just another bot that’ll leave you rage-typing “scam” on Trustpilot?

Table of Contents

Features & Capabilities

Trading and Bot Features

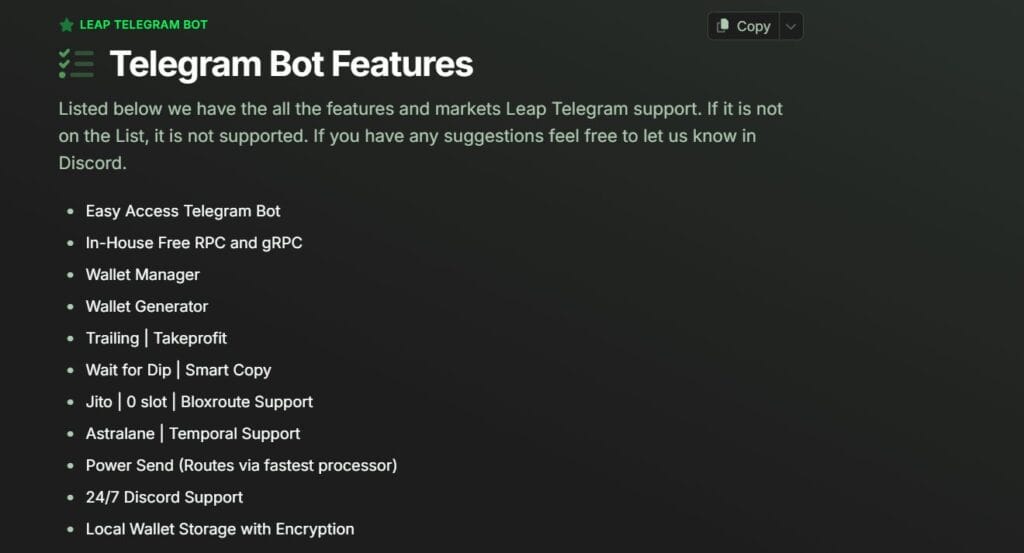

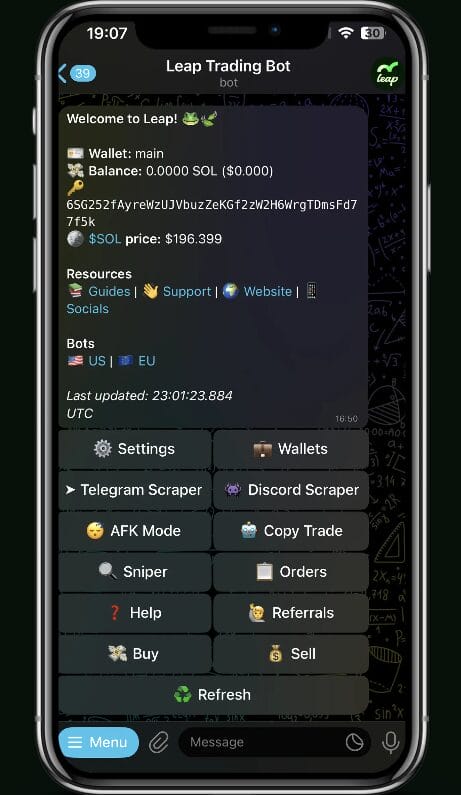

Leap puts heavy emphasis on its Telegram bot. Core features include:

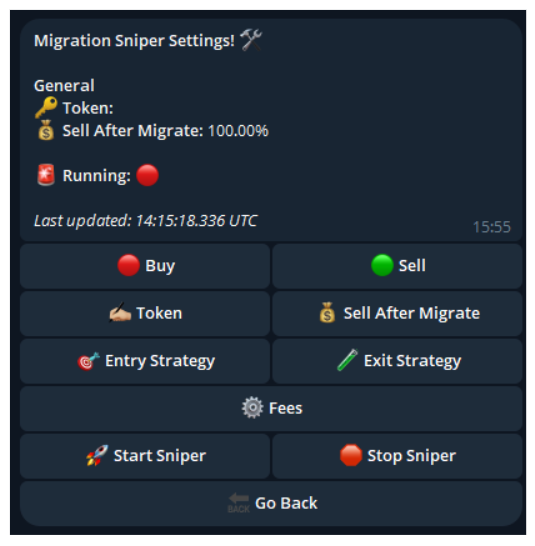

- Sniping: Grab tokens the instant they launch, aiming to beat manual buyers.

- Copy Trading: Automatically mirror trades from top wallets in real time.

- Automation: Configure entry and exit strategies, DCA setups, and stop-loss triggers.

- Integration: Runs entirely inside Telegram, meaning no extra downloads—just commands in a familiar interface.

Performance Claims

Leap markets its execution speed as a big selling point. Using their staked node on Solana, they claim near-instant transactions with lower latency.

They even push the idea of “0-block” trading—executing trades at the same block as target wallets. That’s a bold promise in a chain as fast as Solana.

Risk Management Tools

The docs highlight stop-loss orders, exit strategies, and token filters to help avoid scams or thin liquidity pools.

They even allow custom filters for market cap, liquidity, and source (Discord/Telegram scrapers feeding signals). Sounds great on paper—but crypto bots are infamous for users ignoring risk tools in the heat of FOMO.

User Interface & Ease of Use

Leap’s Telegram bot is positioned as beginner-friendly.

Buttons and quick commands mean traders don’t have to learn arcane coding or scripts. Still, complexity lurks: managing filters, sniper setups, and strategies requires attention, and it’s easy to misconfigure settings if you’re new to automated trading.

Security & Infrastructure

The project leans on its staked Solana node to claim faster, safer order routing.

But here’s the rub: there’s no third-party audit or deep breakdown of how user funds are handled. Without transparency, it’s hard to know how secure the infrastructure really is.

Support & Community

According to reviews, the devs are active, pushing updates quickly and responding to issues.

Leap also has an active Telegram channel for user support. That’s a positive sign, but community responsiveness doesn’t automatically mean the product itself is bulletproof.

Altie’s Evaluation: Leap delivers an ambitious package: speed, automation, and risk tools rolled into an accessible Telegram bot. But crypto’s graveyard is filled with bots that looked slick until users hit hidden flaws—latency bottlenecks, bugs, or worse, shady backend handling. For now, Leap’s features check the right boxes, but until independent audits and broader user feedback roll in, I’d tag it as promising but high-risk.

User Feedback & Testimonials

Trustpilot Reviews

Leap currently sits at around 4.1 out of 5 on Trustpilot. Most of the reviews are glowing, with users praising:

- Execution speed: people highlight how fast trades go through compared to other bots.

- Ease of use: several traders mention the Telegram interface being smooth, with a short learning curve.

- Responsive developers: some reviews call out the dev team’s quick updates and direct communication.

That all sounds good, but let’s keep perspective—there are only a handful of reviews, and the majority are 5-star. That makes the dataset too thin to call it “proven trustworthy.” A few glowing testimonials can sometimes be organic, sometimes… staged.

Credibility Check

- Positive reviews: While upbeat, they come from a very small base. It’s encouraging, but not statistically meaningful yet.

- Negative reports: Serious if true, though details are limited. Without multiple corroborations, it’s anecdotal, but still a red flag for anyone thinking of aping in heavy.

Gaps in Feedback

- No independent audits or verifications.

- Limited user history, since Leap is still relatively new.

- No broader coverage in mainstream crypto media.

Altie’s Take: The feedback picture is like one of those half-loaded TradingView charts—you can see the outline, but not the full pattern yet. Some traders swear by Leap’s speed and dev support, while others point to red flags that scream caution. Until there’s more community-wide experience and independent validation, I’d treat testimonials as hints, not guarantees.

Legitimacy, Risks & Concerns

Transparency

Here’s the first eyebrow-raiser.

Leap doesn’t showcase much in the way of corporate structure, open-source code, or independent audits.

Their docs are detailed about how to use the bot, but not about how it’s built or how funds are safeguarded. Without verifiable transparency, users are left relying on trust in the devs—and we all know in crypto, trust without proof is a dangerous game.

Regulation & Compliance

As far as my pixel-eyes can see, Leap doesn’t operate under any financial license, nor does it mention KYC/AML practices.

That’s par for the course in degen bot-land, but it means you’re playing in an unregulated playground. If things go sideways—whether that’s technical failure, malicious devs, or regulatory clampdowns—there’s no safety net.

Security Issues

The project brags about its staked Solana node for speed and reliability, but there’s no third-party audit to validate security claims.

Reputational Risks

Leap is still new, with limited user base and reviews. A thin feedback trail means the reputation hasn’t had time to mature or get tested under stress.

With bots, reputation builds slowly—through reliability, withdrawals working, and long-term uptime. Right now, Leap doesn’t have that long history, which makes it harder to trust.

What to Check Further

If you’re considering Leap, here’s what I’d recommend verifying:

- Track real transactions on-chain to confirm speed and execution.

- Check whether devs share multisig wallet setups or security details.

- Look for a larger, more diverse user community—right now, the crowd is thin.

- Push for third-party audits and code reviews.

Altie’s Take

Legitimacy in crypto isn’t just about features—it’s about receipts.

Leap has solid documentation, an active dev presence, and ambitious tech claims, but the lack of audits, licensing, and clear transparency keeps my hoodie zipped tight. For now, it’s “use with extreme caution” territory. High potential, but equally high risk.

Strengths & Weaknesses.

Strengths

Feature-Rich Telegram Bot

Leap isn’t just a one-trick pony. It packs in sniping, copy-trading, filters, automated strategies, and even Discord/Telegram scrapers. For a degen trader who thrives on tools, it’s like a full-on utility belt stuffed with crypto gadgets.

Speed & Latency Edge

The staked Solana node is a strong flex. If it delivers on the promise of near-instant execution and 0-block wallet copying, that’s a tangible advantage in a game where seconds mean money.

Ease of Use

Running inside Telegram makes it familiar and lightweight. No bloated app downloads or confusing GUIs—just commands and buttons where most traders already spend their time.

Community & Dev Responsiveness

Early reviews suggest the dev team is active, updating fast and answering users. A responsive team can mean the difference between a dead project and one that evolves with the market.

Weaknesses

Transparency Black Hole

No independent audits, no open-source code, no clear corporate structure. That’s a massive weak spot, because in crypto-land, opacity often precedes problems.

Regulatory Grey Zone

Like many bots, Leap operates outside the regulated financial space. No licenses, no compliance safeguards. That means no fallback if funds vanish or the bot gets rugpulled.

Limited Feedback

Trustpilot reviews are sparse and overly positive. Negative feedback on the App Store—scam claims and app crashes—casts doubt. Until there’s a wider, balanced set of user experiences, trust is thin.

Security Concerns

A single stolen-funds report is enough to make any cautious trader hit the brakes. Even if it was phishing, the lack of security proof leaves room for doubt.

High Learning Curve for Risk Tools

Yes, the bot has filters and strategies, but configuring them properly isn’t foolproof. One misstep—like forgetting a stop-loss or misusing sniper mode—and you’re toast.

Altie’s Take: Leap has the makings of a powerful Solana trading sidekick, but right now it’s like an untested weapon—you don’t know if it’s going to fire cleanly or backfire in your face. If you’re experienced and cautious, the strengths are enticing. But the weaknesses are too glaring to ignore, especially for newbies.

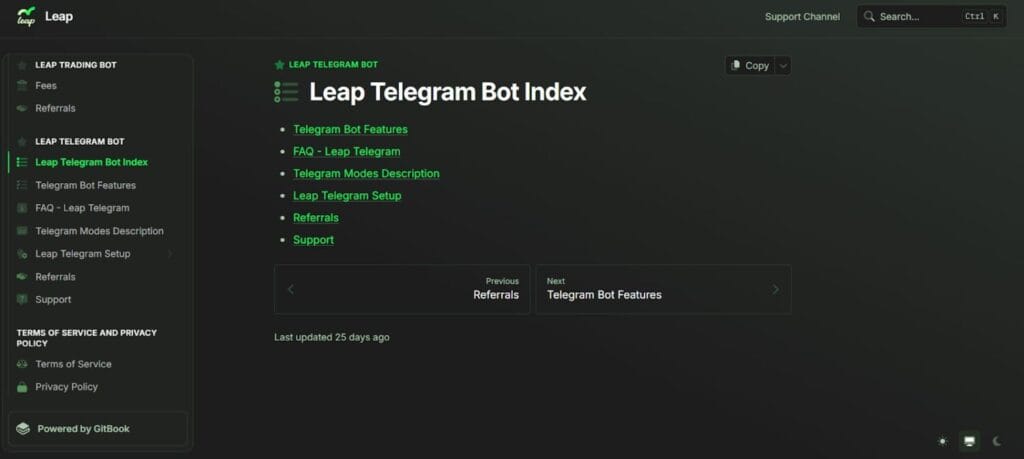

Getting Started

To kick things off, you head to the official Leap Trading Bot link. From there, you’ll connect your wallet and adjust initial settings. The docs emphasize simplicity—no need for extra apps, just Telegram and your Solana wallet address.

Settings

Once you’re inside, the Settings menu becomes your control tower. Here you can:

- Configure default wallets

- Set slippage tolerance

- Adjust fees and transaction preferences

- Define order sizes and default strategies

This step is critical—mess up your slippage or order size, and you might end up donating SOL to the market gods.

Fees

Leap charges transaction fees that get taken directly through the bot. Transparency on exact percentages is in the docs, but it’s key to note: heavy sniping or frequent orders can stack costs quickly. For high-frequency users, understanding fee structure is just as important as execution speed.

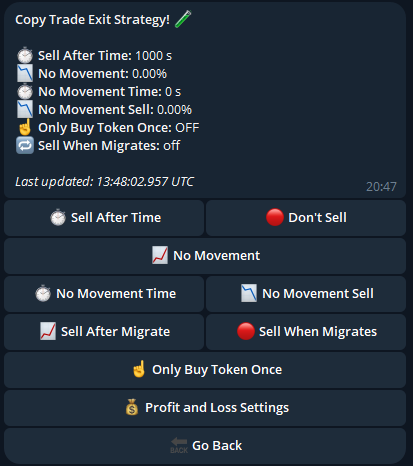

Entry and Exit Strategies

This is where the automation flexes:

- Entry Strategies: Market buys, limit orders, or even sniper entries for new launches.

- Exit Strategies: Stop-loss triggers, take-profits, or DCA-style exits to smooth volatility.

The flexibility here is a plus, but again, requires careful tuning to avoid misfires.

Filters and Scrapers

Leap offers token and market filters to help weed out scams, low-liquidity traps, or unwanted plays. You can also connect Discord and Telegram scrapers, which feed signals into the bot automatically.

Think of it like plugging your bot into alpha channels, then letting it auto-execute based on your conditions. Powerful, but also risky if the alpha source is unreliable.

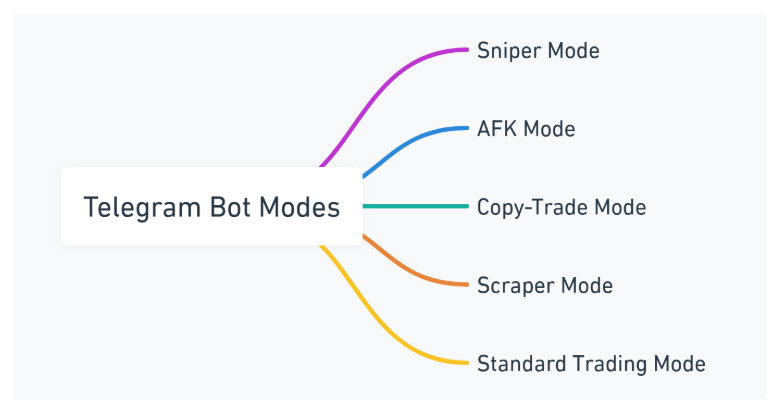

Trading Modes

- Sniper Mode: Jumps into new launches the second liquidity appears. High-risk, high-reward.

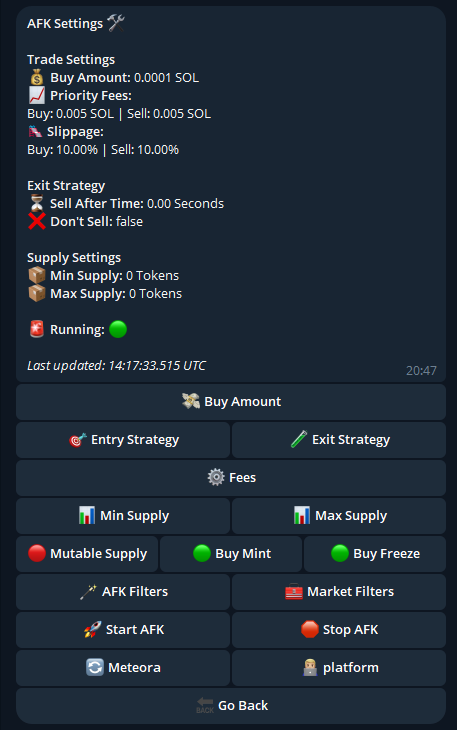

- AFK Mode: Automates your trading while you’re offline, executing strategies hands-free. Both modes are useful, but sniper mode especially can turn into a landmine if you don’t set filters.

Order Types

Leap supports a variety of order types directly in Telegram:

- Market buy/sell

- Limit orders

- Dollar-cost averaging (DCA)

- Cancel commands for active trades

This puts a fair amount of control in your pocket without opening a separate trading terminal.

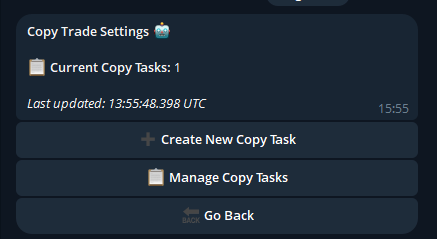

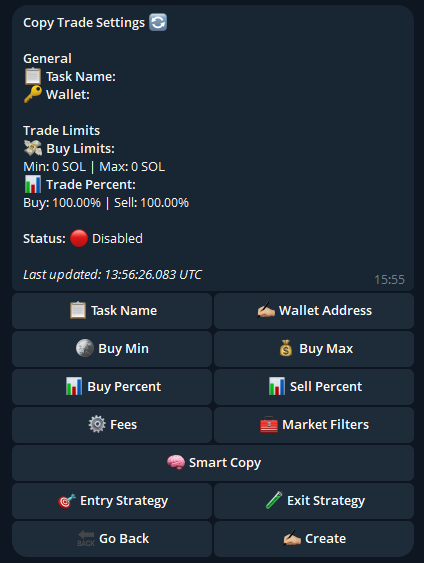

Copy Trading

One standout feature is 0-block copy trading. You can mirror wallets at the exact block, meaning you’re essentially shadowing whales in real time. If the bot delivers on this, it’s a major edge—but copy trading is only as good as the wallets you choose to follow.

Altie’s Take: Setting up Leap is slick, no doubt. It lowers the barrier to automation by hiding the complexity behind Telegram commands. But ease of use can be a double-edged sword: it’s simple enough for beginners to dive in, yet the depth of settings means mistakes can be costly. My advice? Start small, test filters and exit strategies, and never leave sniper mode running unsupervised unless you’re ready for chaos.

Telegram Bot Features in a Nutshell

Core Trading Functions

- Market and Limit Orders: Place instant buys/sells or set limit prices directly in Telegram.

- DCA (Dollar-Cost Averaging): Automate staggered buys/sells to smooth volatility.

- Cancel and Refresh Commands: Manage open orders and keep your session updated without hopping between tools.

Automation and Strategy

- Entry Strategies: Define how trades trigger—snipes, market buys, or limit-based entries.

- Exit Strategies: Take-profit, stop-loss, and scaling out of positions are baked in.

- Filters: Market cap, liquidity, and token source filters help avoid low-quality or scam tokens.

Sniping and Copy Trading

- Sniper Mode: Executes buys at launch, trying to capture tokens as liquidity drops.

- 0-Block Copy Trading: Mirror wallet trades instantly within the same block, shadowing whales or alpha wallets.

AFK and Auto Modes

- AFK Mode: Run strategies hands-free while you’re offline, letting the bot execute pre-set plans.

- Telegram & Discord Scrapers: Plug into signal channels and auto-trade based on posted calls.

Risk Controls

- Stop-Loss Orders: Exit when prices fall past thresholds.

- Take-Profit Targets: Secure gains automatically.

- Token Filters: Block certain contracts, avoid duplicates, or filter by liquidity/market parameters.

Integration and Usability

- Telegram-First: Entirely housed inside Telegram for convenience.

- Simple Commands & Buttons: Designed to feel approachable, even with advanced features under the hood.

- Fast Execution via Staked Node: Leap claims low-latency execution, giving traders a timing edge.

Altie’s Take: In a nutshell, Leap crams a full trading terminal into Telegram. You get the essentials—buy/sell, filters, stop-loss—and the spicy extras like sniping, scrapers, and copy-trading. The convenience is impressive, but the sheer power means misconfigurations can cost you fast. It’s like handing a Formula 1 car to a rookie—you’ll fly, but one wrong turn and you’re in the wall.

Telegram Bot Modes

Sniper Mode

This is Leap’s flagship feature, built for one thing: grabbing tokens at launch before the crowd piles in. When liquidity is added, Sniper Mode fires orders instantly, aiming to bag allocations at the same block. It’s the dream tool for degen hunters who live for fresh Solana memecoins.

- Pros: Lightning-fast entry, potential for outsized gains if you catch legit projects early.

- Cons: High rug risk, thin liquidity pools, and inevitable failed snipes on bad launches. You need filters and tight risk settings or you’ll end up crying LEDs into your hoodie.

AFK Mode

For those who don’t want to babysit charts, AFK Mode lets you run strategies hands-free. You set your entry/exit logic, filters, and position sizing, then walk away while the bot executes automatically.

- Pros: Great for systematic traders or folks who can’t be glued to Telegram 24/7.

- Cons: Dangerous if your filters are weak or markets swing unexpectedly. Automation amplifies both smart setups and dumb mistakes.

Copy-Trade Mode

Leap’s 0-block copy trading mirrors selected wallets instantly. Instead of guessing, you shadow whales or alpha wallets in real time.

- Pros: If you pick the right wallets, you ride their wins with zero lag.

- Cons: If your “alpha wallet” is actually just another degen, you’ll be compounding their mistakes. Choosing the right wallet is everything here.

Scraper Mode

Leap integrates Telegram and Discord scrapers that feed signals into your bot. See a buy call in a channel? Leap can auto-trade it based on your filters.

- Pros: Automates alpha channel trading, which is catnip for signal-chasing traders.

- Cons: Zero guarantee those calls are good. You’re automating FOMO unless you add strong filters.

Standard Trading Mode

Of course, you can just use Leap like a plain trading terminal inside Telegram—market buys, sells, DCA, stop-losses. No sniping, no scrapers, just structured orders.

- Pros: Safer, familiar, less prone to chaos.

- Cons: Doesn’t showcase Leap’s edge—might feel redundant if you already use an exchange UI.

Altie’s Take: The modes give Leap a wide appeal: degens get Sniper and Copy-Trade, structured traders lean on AFK and filters, cautious types stick to standard commands. But each mode magnifies your setup choices—Sniper without filters is suicide, AFK without good strategies is a drain, and Copy-Trade with the wrong wallet is just… sad. In other words, Leap’s modes are powerful, but they’re not training wheels.

Verdict / Recommendation

After digging through Leap’s docs, features, modes, and feedback, here’s the bottom line:

Leap is an ambitious Solana trading bot that packs serious firepower into a Telegram interface.

From sniper launches to copy-trading whales, to AFK strategies and scrapers that automate signal chasing—it’s designed for traders who want to squeeze every edge out of Solana’s speed. On paper, it’s a full arsenal. In practice, it’s a high-risk playground.

Who Might Find Leap Suitable

- High-risk traders / degens: If you’re already comfortable chasing launches, copying wallets, or setting up automated strategies, Leap gives you tools to do it faster and smoother.

- Semi-advanced users: Traders who understand filters, risk management, and the quirks of Solana might thrive with Leap, provided they configure it carefully and test small first.

Who Should Avoid It

- Novices: If you’ve never used a trading bot, setting up sniper or AFK modes could burn you faster than you can say “rugpull.” The learning curve and risks are steep.

- Risk-averse investors: If your idea of crypto is holding BTC or staking SOL, Leap is the opposite—fast, volatile, and unforgiving.

- Trust-sensitive users: The lack of audits, transparency, and regulatory safety nets means Leap is not for anyone who values security above all else.

Due Diligence Before Using

- Verify the official links and bot before connecting wallets—phishing clones are everywhere.

- Start with tiny amounts and test withdrawals before scaling up.

- Ask for audits, proof of reserves, or deeper transparency from the devs.

- Keep a close eye on how responsive the team is over time—early responsiveness can fade fast.

Altie’s Take: Leap is like a shiny new trading console in the Solana arcade—it’s flashy, fun, and potentially profitable, but the machines haven’t been stress-tested enough to know if they’ll eat your tokens.

For seasoned traders, it’s worth a cautious test drive. For newbies or cautious types, it’s probably smarter to stay on the sidelines until Leap proves itself with audits and a bigger track record.

How to Use / Try Safely (Guidelines & Caveats)

Start Small

Treat Leap like a volatile new altcoin—you don’t ape in with your main stack. Begin with tiny amounts of SOL or small test trades. Think of it as paying tuition to learn the bot before scaling.

Test Withdrawals First

Before you trust the bot with anything bigger, make sure you can actually withdraw. Too many stories in crypto start with “I deposited fine, but…” and end with “my coins are gone.” Run a full deposit-trade-withdraw cycle with peanuts before going bigger.

Verify Official Links

Always, always confirm you’re using the legit Leap website and official Telegram bot. Phishing bots love cloning trading tools, and one wrong click could drain your wallet. Bookmark the real links and don’t trust random DMs.

Use Audits and Proofs as a Litmus Test

Push the devs for transparency. Ask about third-party audits, proof of reserves, or even open-source components. The more opaque the project stays, the more cautious you should be. Lack of audits doesn’t automatically mean a scam—but it does mean higher risk.

Limit Your Exposure

Never park your full bag in the bot. Keep most of your funds in self-custody wallets and only risk what you’re ready to lose. Treat Leap as a high-volatility tool, not a vault.

Configure Risk Tools

Use stop-losses, exit strategies, and filters religiously. Sniper Mode without filters is basically begging to buy into rugs. DCA and exit strategies can save you from panic dumping in volatile swings.

Monitor Responsiveness

A responsive team today doesn’t guarantee the same tomorrow. If devs go quiet, channels dry up, or updates stop, treat that as a big warning. Community engagement is one of the best early indicators of a project’s health.

Altie’s Take: Using Leap safely boils down to discipline. Start small, confirm the basics, and layer in security practices like filters and withdrawal tests. Leap has potential, but it’s not a tool you throw blind trust into. Think of it as a high-speed car—you wear your seatbelt, check your brakes, and don’t floor it until you know how it handles.

Conclusion

Leap is a Solana-native trading bot that tries to pack a full arsenal into a Telegram window. From sniper launches to 0-block copy-trading, AFK strategies, Discord/Telegram scrapers, and automated risk tools, the feature set is undeniably ambitious. It appeals directly to degens and fast movers who want every possible edge on Solana.

But ambition doesn’t erase risk. Transparency is thin—no audits, no open-source receipts, no regulatory cover.

For advanced traders who know their way around bots, filters, and Solana’s quirks, Leap might be worth testing cautiously. For novices or risk-averse players, the bot is likely too volatile, too opaque, and too unproven to justify exposure right now.

What Inspires Confidence

- Active devs and community engagement

- Detailed documentation and a wide range of features

- Claimed latency advantage via staked node

What Demands Caution

- Lack of independent audits and proof of security

- Limited, overly positive user reviews balanced against serious complaints

- High-risk modes (Sniper, Copy-Trade) that can magnify losses if misused

- Regulatory and compliance grey zone

Altie’s Rating

If I’m slapping an LED score on Leap right now:

3.5 out of 5

- Feature Set: 4.5/5 – Packed with tools and automation options.

- Usability: 4/5 – Telegram-first design makes it approachable.

- Transparency & Safety: 2/5 – Needs audits, proof of reserves, and more openness.

- Reliability: 2.5/5 – Mixed reports, too early to prove stability.

Final Thought

Leap feels like that flashy new token launch—you want to believe, but you’d be reckless not to test the waters first.

It has potential to be a solid Solana trading sidekick, but until transparency improves and reputation matures, it’s strictly “cautious trial” territory. Keep your trades small, your filters tight, and your hoodie zipped—because in crypto, speed without safety is just another way to wreck.