Choosing the best crypto exchange platform can be a little hectic sometimes. Therefore, in this eToro vs Robinhood article, we compared features, fees, funding method, financial markets, and whatnot so that we can inform you to make the correct decision.

Table of Contents

eToro vs Robinhood: What is eToro?

eToro exchange is a leading social trading and multi-asset brokerage company that focuses on providing financial and copy trading services. It was established in 2007 and has been in business for 14 years. Moreover, it also offers both investing in stocks and cryptocurrencies and trading CFD with different underlying assets. Read our eToro Review to get more insight on this platform.

eToro vs Robinhood: What is Robinhood?

Robinhood Markets, Inc. is a pioneer of commission-free trades of stocks and exchange-traded funds. It was established in 2013 and has been in business for eight years. In addition, it offers secure trading to self-directed customers by its financial team.

eToro vs Robinhood: Features

Although both platforms are similar to each other, they have some distinctive features. They are listed below:

Features of eToro

- eToro has an option for users to set Price alerts.

- It also allow access to traders and investors to more than 2,000 different financial assets, including stocks, cryptocurrencies, ETFs, indices, currencies, commodities, and limit orders.

- Moreover, you can also copy from trades of experienced traders by using the Copy Trader function.

- One-click trading

- In addition, it let traders and investors to interact, share ideas, insights, and trading strategies, and even make new friends.

- Different account types in eToro are Demo account, VIP account, Standard account, Islamic account.

- Futhermore, the funding method through eToro is a Credit card, Bank transfer, PayPal, Neteller, and Skrill.

- The platform is multilingual, which includes, English, German, Spanish, French, and Italian.

Features of Robinhood

- Robinhood gives an option to set Price alerts.

- The users can do Hedge trading.

- It is also one-click trading.

- Moreover, it allow access to traders to trade up to 5,000 financial assets, including Stocks, and Commodities.

- Instant access to funds up to $1,000 to trade cryptocurrency.

- This exchange platform has two different type of accounts: demo account and Robinhood Gold.

- Furthermore, it uses Bank transfer as a funding method

- The platform’s supports different languages, including English, Deutsch, Nederlands, Espanol, Francais, Italiano, Polski, Srpski, Norsk, Svenska, Cesky, Russian, Romana, Turkce, Arabic, and Chinese.

eToro vs Robinhood: Financial Markets

The financial markets of eToro are Forex (Currency), Majors, Indices, FTSE, Dad, Nikkei, ETFs, Bitcoin, Metals, Agricultures, Energies.

However, Robinhood financial markets are Indices, Penny stocks, Dow Jones, FTSE, Dax, Nikkei, ETFs, Bitcoin.

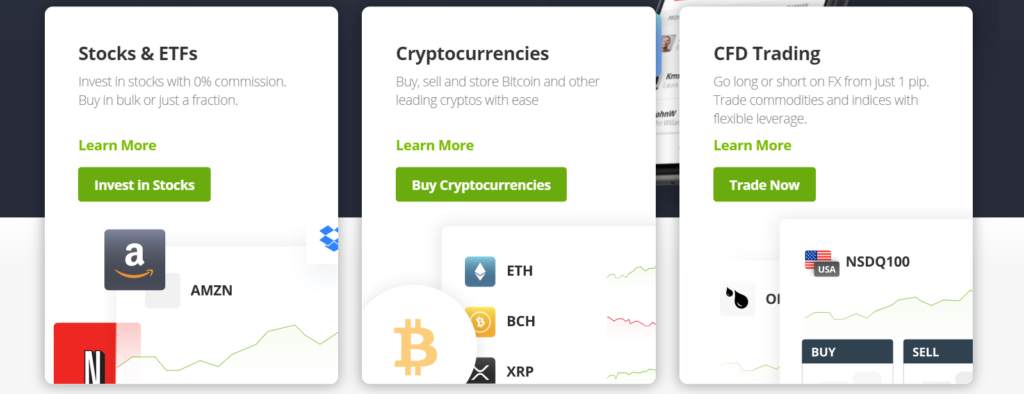

eToro vs Robinhood: Products

The products eToro offers are CFD trading with currencies, indices, stocks, commodities, and cryptocurrencies.

Robinhood offers a series of products such as stocks and funds, options, gold, cash management, and crypto.

Supported Cryptocurrency

eToro

The customers of eToro are provided with the ability to store cryptocurrency as well as wallet to transfers. eToro wallet allows the client to transfer the crypto positions from the platform to the wallet. Furthermore, it enables converting one crypto to another.

eToro has a margin trading feature that allows you to take a loan from them against your funds, allowing you to have greater exposure to trading capabilities. The available cryptos are Bitcoin, Bitcoin Cash, Litecoin XRP, etc.

Robinhood

Robinhood allows a commission-free buy and sells of cryptocurrency. You do not need to buy or sell a whole coin for Robinhood crypto, except for dogecoin, which has a minimum of 1 DOGE. The available cryptocurrencies in Robinhood crypto are bitcoin, bitcoin cash, dogecoin, etc.

eToro vs Robinhood: Education program

eToro offers free courses, podcasts, tutorials, and more to help beginners and experienced traders. In addition, the platform offers social trading, which allows you to connect with other traders to learn and share your ideas.

Robinhood offers essential learning of trade, investment, and cryptocurrency. Moreover, it has a small segment called Investment Basics, where beginners can learn about investment, stock, stock market, and many more. The platform also has a virtual library to learn things from with the help of articles available.

Robinhood vs eToro: Fees

eToro fees

- The platform demands a commission, withdrawal fee, an inactivity fee.

- Furthermore, eToro withdrawal fee is $5 for every request.

- The rollover (weekend/overnight) fees change from time to time based on global market conditions.

- Overnight fees are charged every night between Monday and Friday at 17:00 EST for open CFD positions.

- Moreover, the minimum deposit amount is $200 with a minimum trade of $25.

- However, this platform doesn’t charge any deposit fee.

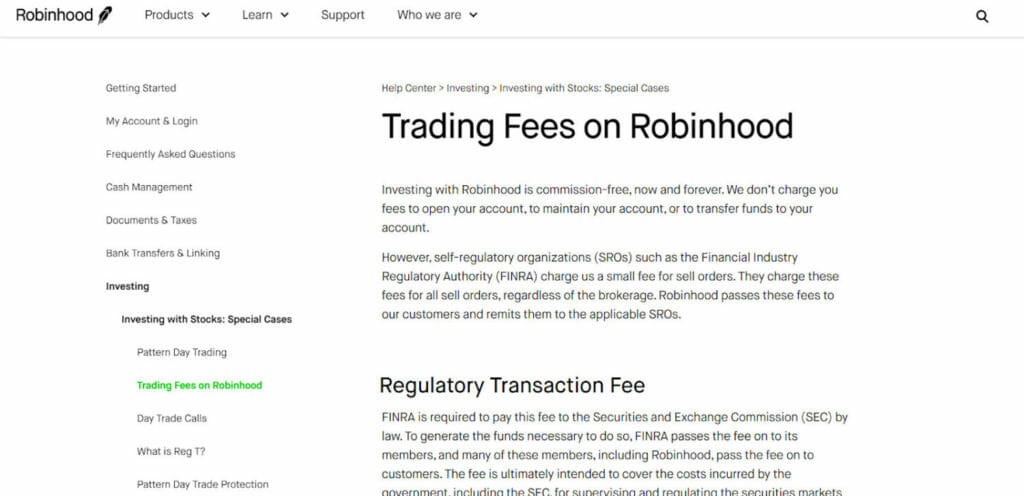

Robinhood fees

- Robinhood does not charge any commission, deposit fee, or inactivity fee.

- However, there’s a $75 fee to transfer your assets out of Robinhood, whether as a partial or complete transfer.

- In addition, the Trading Activity Fee is $0.000119 per share (equity sells) and $0.002 per contract (options sells).

- The SEC fee is $5.10 per $1,000,000 of principal (sells only)

Robinhood vs eToro: Mobile App

eToro App

eToro app is available for both iOS and Android devices. Users can use it on the web platform, tablet, and mobile devices. Moreover, traders outside the USA can also use it as a social media trading platform, especially for traders trading in cryptocurrency. In addition, it also has an option of demo account for new users

Robinhood App

Robinhood app is also available for both iOS and Android devices. Users can use it on the web platform, tablet, and mobile devices. However, crypto offerings are limited in the app. It allows users to create a demo account on the app too for new users. In addition, the app also sends push notifications when there are changes in stock price.

eToro vs Robinhood: Security

Is eToro Safe?

eToro is a safe, regulated, and zero-commission stockbroker. Moreover, it is regulated by FCA, CySEC, MiFID, and ASIC. Since it has been active for the last 14 years, shows the user’s trust in this exchange. Besides, to keep frauds away from this platform, it requires email confirmations and has a strict verification process. However, every client’s personal information is guarded under SSL encryption, and funds are kept in tier 1 banks.

Is Robinhood Safe?

Robinhood is safe and is a member of the SIPC. It is regulated by the Securities and Exchange Commission (SEC), FCA, and FSC. Moreover, it has been active for eight years now and has proven its trust. Besides that, for security purposes, it requires email confirmation, and clients have to go through a strict verification process.

However, there are many controversies around Robinhood, including in 2020, where traders were infuriated for being unable to use the app during high-volume trades and the busiest day of the year.

Customer Support

eToro customer support includes live chat options for customers. Hence, users can get their queries solves immediately.

Moreover, both eToro and Robinhood have a valuable and well-organized help center. Additionally, they also have a resource hub with email and phone support.

Robinhood vs eToro: Referral Program

eToro Referral Program

You can invite your friends to join eToro. For each new user who enters via your link and makes a trade of a minimum of $100, both the referrer and referred friend receives a reward of $50 from eToro. However, the person should sign up through your link and complete the registration within 30 days. Moreover, you can claim the Refer-a-Friend reward up to 10 times. Therefore, the approximate time of the bonus to be credited will be 7 to 10 days.

Robinhood Referral Program

Every time you invite someone to join, you’ll both earn a reward as soon as your friend signs up and links their bank account. In addition, you can receive up to $500 in reward stocks each calendar year. Approximately 98% of the participants will receive a reward store value from $2.50 to $10.

Robinhood vs eToro: Pros and Cons

| eToro | Robinhood | |

|---|---|---|

| Pros | – Simple and easy to use. – supports different payment methods, including Credit card, Bank transfer, and Skrill. – The app uses English, German, Spanish, French, and Italian. – Live chat option | – Simple and easy to use. – Is available in English, Deutsch, Nederlands, and 13 other languages. – $0 minimum deposit |

| Cons | -Requires inactive and withdrawal fee – Minimum deposit of $200 – It doesn’t accept funding from American Express or Bitcoin. – It is excluded from many countries, including India, Pakistan, Turkey, Algeria, Belgium, among many others. | – The app does not have a live chat option – Only uses Bank transfer as a funding method – Excluded from countries like Cuba, Iran, North Korea, Syria, and the Crimea region of Ukraine. |

eToro vs Robinhood: Conclusion

While both Robinhood and eToro have pros and cons, Robinhood is much safer for beginners, and we do not recommend eToro for first-time users as it is a CFD broker.

If you’re a professional, eToro can be volatile. However, it is a good platform and better than Robinhood in customer services.

On the other hand, if you don’t know what you’re doing, do not use either. In 2020, controversy surrounded Robinhood, where a trader committed suicide by seeing the negative balance in his account. So, if you do not have any idea about trading and cryptocurrency, research first and then move ahead with your plan.

Frequently Asked Questions

How to get started with eToro?

Get a thorough knowledge about trading, cryptocurrency and investment; only then go to the play store or app store to download the app, register, and start trading.

Is there any brokerage fee while buying shares in eToro?

No, there is no brokerage fee during the buy position. Hidden charges or management fees are also not there.

Does Robinhood charge fees?

Robinhood does not charge commission or trading fees for stocks, crypto, options, and ETFs trades. However, you need to pay a transfer fee of $75 if you’re transferring from one brokerage to another.

What are the criteria for verification in Robinhood?

▪ Be 18 years or older;

▪ Have a valid Social Security Number (not a Taxpayer Identification Number);

▪ Furthermore, you must be a U.S. citizen or have a valid U.S. visa.

- Coinbase vs Robinhood | Which one is Best for You? [2021]

- Top 5 Coinbase Alternatives in 2021 [Latest]

- 3Commas vs Mudrex vs eToro [2021]

- eToro vs Shrimpy – Best Profitable Social Trading Platform

Disclaimer

Please remove the content on a CTA and add a disclaimer:

Don’t invest unless you’re prepared to lose all the money you invest.

This is a high-risk investment and you should not expect to be protected

if something goes wrong.

![17 Best Cryptocurrency Bots on Telegram [Get Now] 27 Cryptocurrency Bots on Telegram](https://coincodecap.com/wp-content/uploads/2021/11/Desktop-60-768x432.png)

![Best Exchanges to Trade Leveraged Tokens [Don't Miss] 29 Best Leveraged Token Exchanges](https://coincodecap.com/wp-content/uploads/2021/11/Desktop-59-768x432.png)