In a constantly evolving world of cryptocurrency trading, copy trading has become a popular and convenient way for novice and experienced traders to participate. This article provided you with the features of Copy Trading Comparison – Fairdesk Vs. Bybit Vs. BingX Vs. Binance.

Table of Contents

What is copy trading?

With copy trading, novice traders may automatically copy the transactions of more seasoned traders. By copying the trading decisions and methods of more experienced traders, it enables less experienced traders to gain from their knowledge. Users of copy trading platforms usually have access to a list of lead traders, or copy traders, whose trading activity may be automatically replicated by followers. Those who are new to trading or lack the time or experience to make their own trading judgments may find this type of trading to be especially helpful.

Summary

- Fairdesk is an easy-to-use copy trading platform that offers sophisticated features and comprehensive performance data to help traders make wise decisions. It enables duplicate trading tactics to be tailored according to the risk choices of the user.

- A well-known cryptocurrency exchange that provides derivatives, futures, and spot trading is Bybit. In order to establish a successful trading environment for Master Traders and Followers, it gives access to a variety of cryptocurrencies and trading pairs.

- A cryptocurrency exchange called BingX places a strong emphasis on social trading tools and encourages a thriving trading community. gives followers clear access to traders’ data and instructional materials so they may control replicate trading settings.

- One of the biggest cryptocurrency exchanges in the world, Binance, provides copy, futures, and spot trading. Users can replicate deals by accessing a variety of cryptocurrencies and trading pairings.

What is Fairdesk?

Fairdesk is an easy-to-use platform for copy trading that provides users with a variety of cryptocurrencies and cutting-edge trading features. It gives customers access to comprehensive performance data about traders, enabling them to choose traders to follow with knowledge. Users of Fairdesk may also tailor their copy trading techniques according to their preferred level of risk.

Followers

- In order to accommodate different user needs, Fairdesk launched the Copy Trading initiative, which allows followers to mimic the trading strategies of traders they follow.

- Users with a net asset exceeding $100 and completed KYC verification can apply as copy traders. Please transfer funds to your copy trading account if your balance needs to be increased.

- Presently, Fairdesk facilitates trading for BTC-USDT, ETH-USDT, BNB-USDT, ADA-USDT, and XRP-USDT pairs, with plans to incorporate additional trading pairs.

- Fairdesk provides new users with an exclusive 10% cashback, capped at $1,000 USDT, for those who join Fairdesk and experience the copy trading feature.

- TP/SL prices are determined by whichever is reached first, as set by both the trader and follower. For instance, if the market hits the follower’s TP/SL price before the trader’s, the follower’s order will be executed first.

- If a trader’s position is liquidated, followers’ positions may not be liquidated due to customizable leverage and margin, leading to potential differences in liquidation prices.

- When a trader’s position is liquidated, the system will automatically close the follower’s position, either through liquidation or stop on loss.

Trader

- Traders set their private copy code, typically displayed on the copy trade settings page if requested by the copy trader. Fairdesk cannot alter or provide access to a trader’s copy code.

- A protective range for slippage is automatically established when initiating a position to guarantee the highest profit for followers.

- By allowing users to choose long or short positions individually and with different leverage for a given currency, Fairdesk’s Separate Position Execution reduces market risk and safeguards user funds.

What is Bybit?

A well-known cryptocurrency exchange, Bybit provides a range of trading services, including as futures, spot, and other derivatives trading. It is well-known for its sophisticated trading tools, strong security measures, and easy-to-use interface. Bybit gives customers access to a wide range of cryptocurrencies and trading pairs, enabling them to participate in highly liquid leveraged trading. Additionally, the platform provides customers with sophisticated risk management features to help them manage their holdings profitably, such take-profit and stop-loss orders.

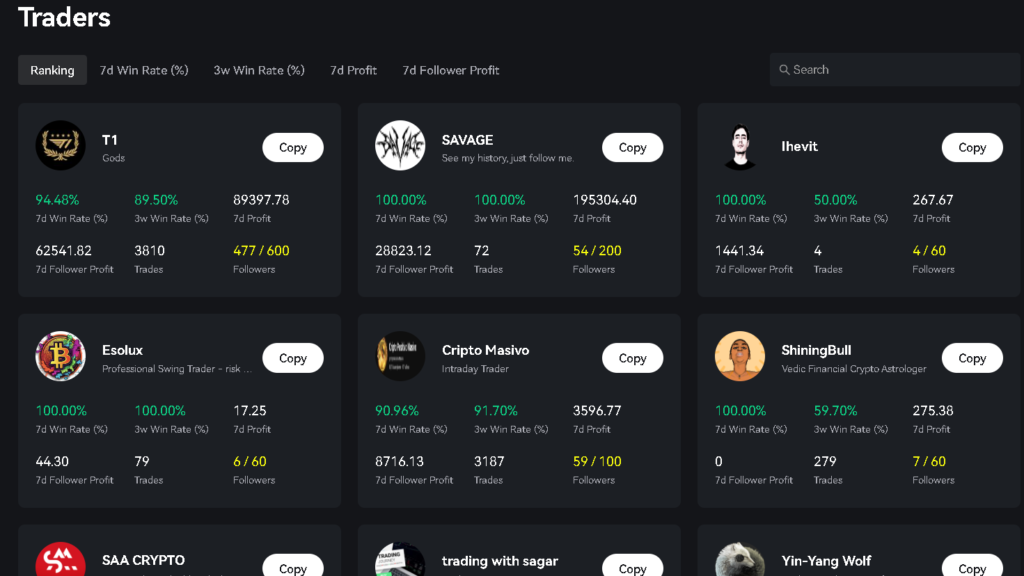

Bybit currently offers copy trading for derivatives and spots. The goal of Bybit’s Copy Trading platform is to give Master Traders and Followers access to profitable trading environments.

Followers

- Both Followers and Master traders can use Bybit’s copy trading feature, where Followers provide 10% of their net gains to the traders they copy.

- By encouraging friends to join Bybit’s copy trading, users can earn up to 500 USDT in bonuses and a 30% commission through the platform’s referral program.

- Bybit’s automated copy trading feature makes it user-friendly and offers dependable solutions for novice traders to have a positive copy trading experience.In order to help customers make educated judgments, Bybit’s copy trading platform is transparent and shows all relevant information, including transactions, gains, and losses.

- Bybit distinguishes itself from other platforms by carefully vetting Master Traders, giving a wealth of performance data, and giving Followers and Master Traders alike access to smart trading tools.

- Think about things like return on investment, trading program, follower profit over time, and 7-day profit/loss percentage when selecting a master trader.

Master Traders

To become a Master Trader on Bybit, traders must meet the following requirements:

- Take the assets out of the Copy Trading Account and close any open copy deals.

- Maintain a minimum of 100 USDT in the Copy Trading Account and only create one Master Trader account.

- Finish the New Trader Missions, which involve joining the official Bybit Telegram group for copy trading, reading Trading Penalties for Bybit Copy Trading, and earning 50 USDT while trading derivatives.

What is BingX?

The cryptocurrency exchange BingX provides a range of trading options, such as copy, futures, and spot trading. It is renowned for emphasizing social trading features that let users communicate with one another, exchange ideas, and talk about trading tactics. To help users develop their trading abilities, BingX offers a lively social trading community and educational materials. The platform wants to foster a cooperative atmosphere where merchants may learn from one another and gain from each other’s experiences and knowledge.

Followers

- In addition to requesting a monthly salary of up to $1,000 USDT and an annual management compensation of 2%, traders have the opportunity to earn a profit share of up to 20%.

- There is a daily cap of 10 orders per trader in BingX copy trading; if this cap is exceeded, followers will not copy their orders. The margin limit for the follower is 40 times that of the copy trader.

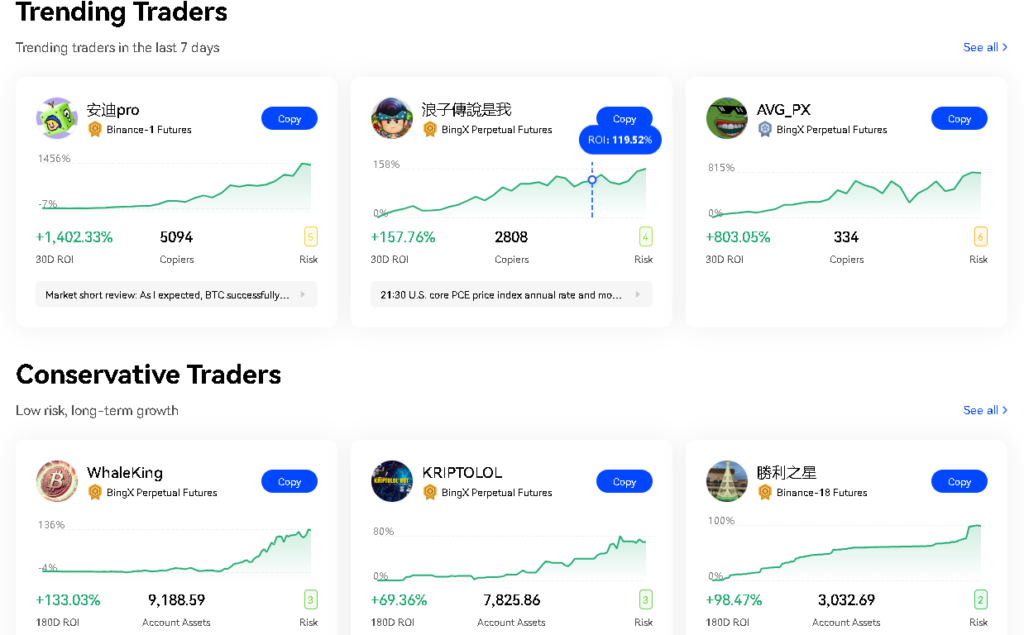

- A large range of traders are available for copy trading on Bingx, where followers can examine traders’ position histories, most recent trades, trading pairs, and profitability.

- By giving followers the ability to change copy trade settings or stop following a trader at any time, and by giving traders’ trading data access, the platform guarantees transparency.

- Prospective copiers have access to a wealth of information about each lead trader, including risk assessment, preferred trading assets, and weekly profit or loss, to assess their performance.

- To help copy traders locate the perfect lead trader, BingX offers a number of criteria, including cumulative PnL, account assets in USDT, number of copiers, 30D ROI, risk level, win ratio, and P&L ratio.

Traders

- Traders can be paid up to 8% of the daily net profit obtained by their followers through copy trading.

- Publishing trading data can help traders gain recognition and be listed on the community ranking.

- The KOL express channel is for traders with a significant fan base, requiring social media followers and a minimum of 1,000 USDT in copy trading assets to apply.

- Traders can only apply for the express channel once a month and cannot apply through the normal channel while their “KOL Express Channel” application is being reviewed.

What is Binance?

One of the biggest cryptocurrency exchanges in the world, Binance, provides a range of trading options, including as copy, futures, and spot trading. Users may choose from a wide variety of cryptocurrencies and trading pairs on Binance. Through its copy trading platform, users may profit from the experience of lead traders, or more seasoned traders, by copying their transactions.

Followers

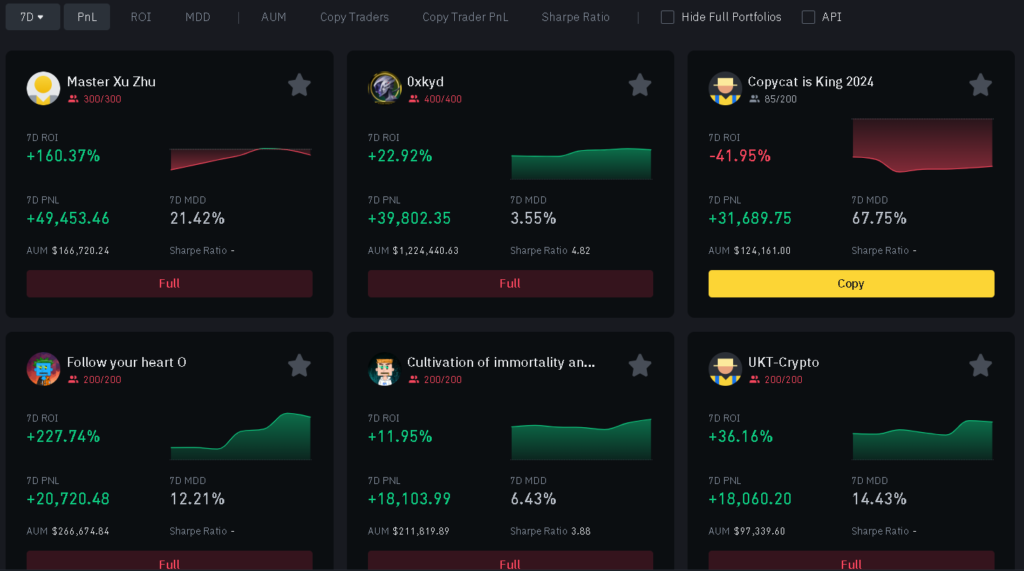

- Binance Futures Copy Trading operates as an automated trading system. Users can act as lead traders, allowing others to copy their portfolios, or as copy traders, replicating the portfolios of lead traders.

- Each user can simultaneously have one lead trading portfolio and up to ten copy trading portfolios.

- Copy Trading facilitates over 100 USDⓈ-M Futures contracts, with the list subject to occasional adjustments based on market conditions.

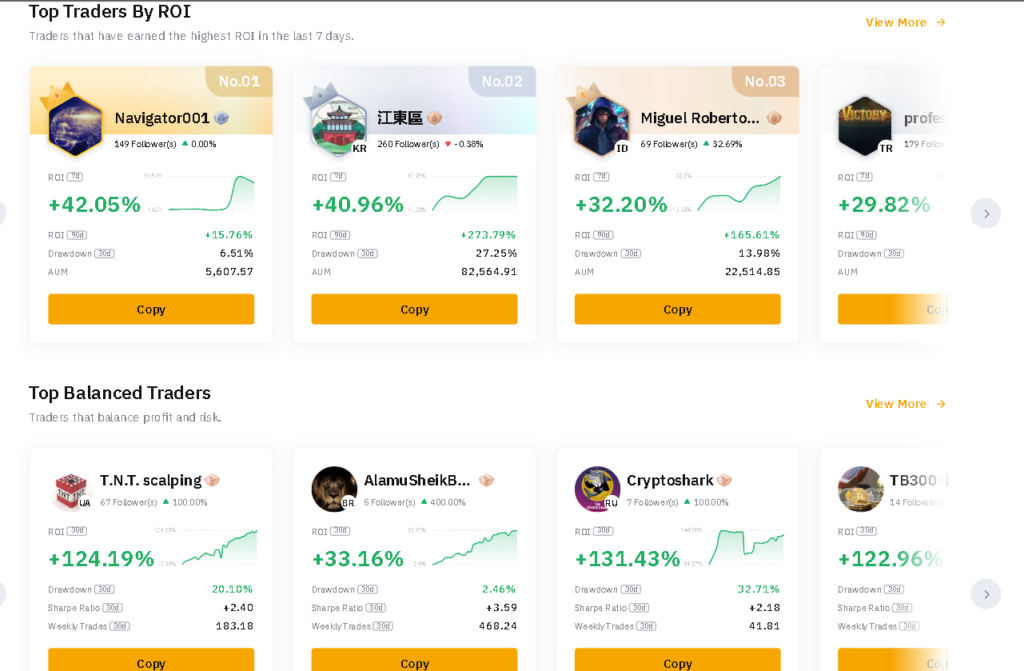

- Runtime, PNL, ROI, MDD, Win Rate, Win Positions and Total Positions, Assets Under Management (AUM), and Leading Margin Balance are all included in the indicator.

- The Elite Trader Program has been made available to lead traders by Binance Futures Copy Trading. Lead traders who meet the requirements can start using a number of cutting-edge features and exclusive benefits.

- After completing your first copy exchange, you will be rewarded with thirty thousand USDT.

- Additionally, you get access to the Binance Copy Trading Bot, which provides Telegram groups with copy trading users with real-time portfolio updates, customized notifications, and information about subscribing portfolios.

Lead Trader

- Lead traders in Binance Futures’ copy trading program can earn a 10% profit share from their copy traders and a 10% commission from their copy traders’ trading fees.

- Weekly profit settlements occur from 00:00:00 UTC on Mondays to 23:59:59 UTC on Sundays, and profits are automatically distributed to the lead trader’s Spot Wallet on Mondays after settlement.

- On Mondays, lead traders will get a 10% weekly commission from their active copy portfolios. The weekly 10% trading fee commission has a ceiling that is determined by the margin balance of the copy portfolio.

- When a copy trader stops replicating their portfolio, when the lead trader shuts their portfolio, or when a copy trader takes winnings out of the copy portfolio, lead traders will also profit.

Conclusion

The purpose of this article is to present a thorough comparison of Fairdesk, Bybit, BingX, and Binance—four well-known copy trading platforms. Every platform has different features, resources, and advantages for traders who want to practice copy trading. Through an analysis of the advantages and disadvantages of every platform, readers will acquire significant knowledge regarding the variety of choices accessible for copy trading inside the bitcoin industry. Regardless of your level of experience or familiarity with cryptocurrencies, this comparison will assist you in selecting the platform that most closely matches your trading objectives and tastes.

What are the drawbacks of copy trading?

There are restrictions on copy trading that traders need to be aware of. It has dangers even if it has the ability to duplicate the profits of seasoned traders. If the lead trader’s approach doesn’t go as planned, followers can lose money. Furthermore, slippage and market volatility may have an effect on how replicated deals are executed. Additionally, followers may be exposed to concentrated risk and little diversification if they depend only on the decisions of a single lead trader. Before adopting lead traders’ methods, followers should carefully consider and evaluate them because previous performance does not guarantee future trading outcomes.

How can I use Bybit to cancel my copy trading order?

On Bybit, you may cancel a copy trading order by going to the copy trading area of your account, finding the particular order you wish to cancel, and choosing the cancel option. Since Bybit’s platform is user-friendly, you should be able to navigate the copy trading interface and discover the choices you need. If you run into problems, check out Bybit’s official support material or get in touch with their customer service representatives.

Does copy trading work?

Copy trading, also known as social trading, has the potential to be profitable when used through reliable, regulated brokers and platforms. However, it’s crucial to remember that using copy trading does not guarantee success. Although it has potential, it has to be aware of the hazards involved.