“Risk comes from not knowing what you’re doing,” said Warren Buffett, one of the world’s most successful investors. This quote emphasises the importance of knowledge and strategy when it comes to investing, especially in the world of cryptocurrencies.

As the market constantly fluctuates, it is crucial for investors to understand the significance of crypto portfolio rebalancing and diversification.

Rebalancing involves periodically adjusting the allocation of assets in a portfolio to maintain a desired level of risk and return.

Meanwhile, diversification refers to the practice of spreading investments across different asset classes and cryptocurrencies to reduce the risk of significant losses. That’s why you need crypto portfolio rebalancing tools that help you to simplify this process and ensure that investors are making an informed decision.

Benefits of Using a Crypto Rebalancing Tool

Before we get into all the platforms offering crypto rebalncing tools let’s look at some of it’s benefits:

- They help you optimize your asset allocation and reduce your risk exposure.

- Further, it allows you to take advantage of market fluctuations and capture opportunities across different coins and tokens.

- They automate the process of buying and selling crypto based on your predefined rules and preferences.

- The platform saves you time and effort by eliminating the need for manual calculations and transactions.

- It provides you with insights and analytics on your portfolio performance and market trends.

Best Crypto Rebalancing Tools

There are different tools that can help investors with crypto portfolio rebalancing and diversification. Some of these tools are :

3Commas: 1st Best Crypto Portfolio Rebalancing Tools

3Commas is a popular trading platform that offers automated portfolio rebalancing features. Users can connect their crypto exchange accounts to 3Commas and create custom rebalancing strategies based on their preferences.

Some of the benefits of using 3Commas are:

- It supports multiple exchanges, such as Binance, Coinbase, Bybit, and more.

- The platform allows users to create and manage trading bots, which can execute trades automatically based on predefined strategies and settings.

- It provides advanced analytics and reports, such as portfolio performance, trade history, and risk management.

- Further, it has a user-friendly interface and a mobile app (PlayStore & iOs), which make it easy to access and use the platform from anywhere.

Drawbacks of 3Commas

- It is not a free service, and users have to pay a monthly or annual subscription fee to access all the features and tools.

- The platform does not offer direct access to the crypto markets, and users have to connect their exchange accounts via API keys, which may pose some security risks.

In conclusion, 3Commas is a powerful and versatile trading platform that can help traders improve their skills and results.

However, it also has some limitations and challenges that users should consider before using it. As with any trading platform, users should do their own research and due diligence before investing their money and time in 3Commas.

Quadency: 2nd Best Crypto Portfolio Rebalancing Tools

Quadency is an automated cryptocurrency asset management tool. It serves as a unified window/interface for trading and maintaining a cryptocurrency portfolio across many exchanges.

Launched in 2018, the site offers advanced crypto solutions to all traders, whether novice, intermediate, or expert, using automated bots.

Quadency, which also has a three-point mission, intends to make Crypto accessible to anyone, simplify complex trading tools, and standardize the Crypto trading experience.

Some of the pros of using Quadency are:

- Quadency has professional-grade tools for crypto trading and portfolio management.

- It holds several effective trading strategies in the form of libraries.

- The intuitive UI makes this platform the best option for new traders.

Some of the cons of using Quadency are:

- Margin trading strategies are not available on Quadency.

- Quadency platform does not have a mobile app.

Holderlab: 3rd Best Crypto Portfolio Rebalancing Tools

Holderlab is a crypto trading tool that allows users to create and manage their own crypto portfolios. It provides features such as portfolio rebalancing, backtesting, and analytics. Here are some pros and cons of using Holderlab:

Some of the pros of using Holderlab are:

- Holderlab supports various exchanges, such as Binance, Coinbase Pro, Kraken, etc.

- It helps users optimize their portfolio performance by automatically rebalancing their assets according to their preferences and market conditions.

- Further, it allows users to test different strategies and scenarios using historical data and simulated trading.

- The platform provides users with insights and recommendations based on their portfolio performance, risk profile, and market trends.

Some of the cons of using Holderlab are:

- The platform charges a monthly subscription fee that varies depending on the number of portfolios and exchanges connected.

- Holderlab does not support some popular exchanges, such as Bittrex, Bitfinex, and Huobi.

- It does not offer advanced trading features, such as stop-loss orders, margin trading, or leverage.

In Conclusion, Holderlab is a useful tool for crypto traders who want to simplify and automate their portfolio management. It can help users improve their portfolio performance, diversify their risk, and gain insights into the crypto market. However, it also has some limitations and drawbacks that users should be aware of before subscribing.

CoinStats: 4th Best Crypto Portfolio Rebalancing Tools

CoinStats is a crypto trading tool that allows users to track and manage their crypto portfolio across various platforms and exchanges. Some of the pros and cons of using CoinStats are:

Some of the pros of using CoinStats:

- Coinstats supports over 8000 coins and tokens and integrates with more than 300 exchanges and wallets, giving users a comprehensive view of their crypto assets.

- The platform offers various features to help users make informed trading decisions, such as price alerts, news updates, market analysis, portfolio performance, and trading signals.

- Further, it allows users to trade directly from the app using the CoinStats Swap feature, which supports over 500 trading pairs and offers low fees and fast transactions.

- Coinstats supports many people’s favorite exchanges and wallets like Binance, Metamask, Ethereum, etc.

Some of the cons of using ConinStats:

- Coinstats may not be compatible with some wallets or exchanges that have specific security or API requirements, which may limit the accuracy and functionality of the app.

- The platform may experience occasional glitches or delays in updating the prices or balances of some coins or tokens, especially during periods of high volatility or network congestion.

- Further, it may not be suitable for users who prefer more advanced or sophisticated trading tools or strategies, such as margin trading, futures trading, or arbitrage trading.

In conclusion, CoinStats is a useful and convenient crypto trading tool that can help users track and manage their crypto portfolio across various platforms and exchanges.

Therefore, users should weigh the pros and cons of using CoinStats before deciding whether it meets their needs and expectations.

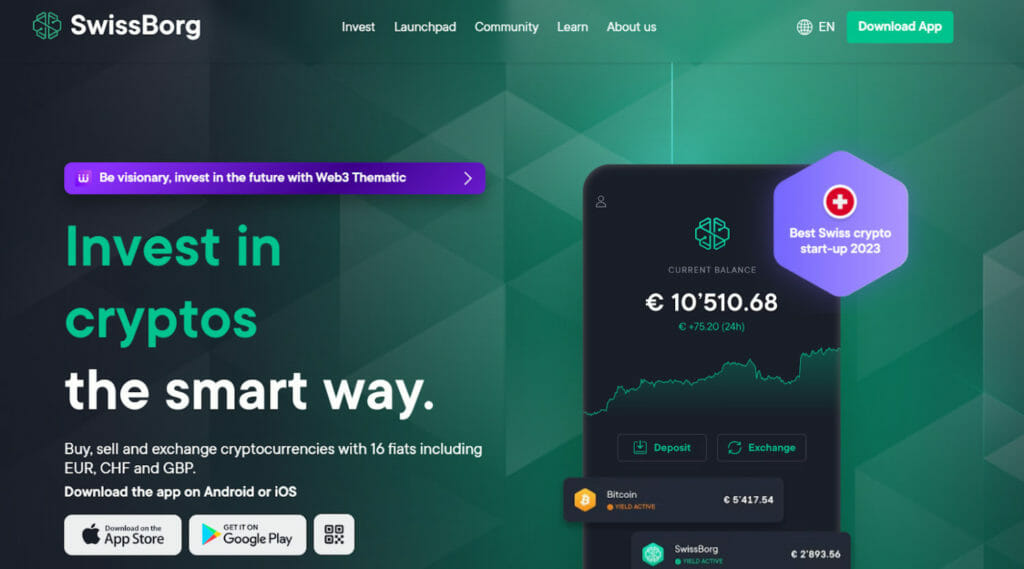

SwissBorg: 5th Best Crypto Portfolio Rebalancing Tools

SwissBorg is a popular cryptocurrency trading platform that enables users to buy, sell, and exchange digital assets using 16 fiat currencies such as EUR, CHF, and GBP.

This platform offers unique features, including Portfolio Analytics, Hourly Asset Analysis, Thematics, Smart Yield, and CHSB Yield, to help users manage, understand, and grow their crypto wealth.

Some of the pros of using SwissBorg:

- SwissBorg has a simple and user-friendly app that is ideal for beginners and experienced traders alike. The app is intuitive, easy to navigate, and offers a seamless trading experience.

- Its Smart Engine is designed to connect with leading exchanges such as Binance, Kraken, LMAX, etc. This feature ensures that users get the best price for their trades in milliseconds.

- The platform offers access to 2,581 unique crypto to fiat trading pairs, even if they do not exist on any exchange. The platform automatically converts the currency, enabling users to trade any digital asset they want.

- SwissBorg charges a small and transparent fee for each exchange, and it reinvests this fee back into the ecosystem. Unlike other platforms, It does not hide fees in the spread or exchange rate.

Some of the cons of using SwissBorg:

- The platform is not available in some countries due to regulatory restrictions or lack of fiat support. This limitation can be frustrating for users who want to trade on this platform.

- It does not support some popular cryptocurrencies such as Cardano, Polkadot, or Solana at the moment. This drawback can limit the trading options for users who want to invest in these assets.

- SwissBorg relies on third-party exchanges and protocols for its Smart Engine and Smart Yield features. This dependency can pose risks or limitations, such as potential downtime or low liquidity.

In conclusion, SwissBorg is a comprehensive trading platform that offers unique features and tools for managing and growing your crypto wealth. It has advantages such as best price execution, unique trading pairs, transparent fees, and rewards for CHSB holders. Before using SwissBorg services, users should research and weigh the pros and cons to determine if it is the right platform for their trading needs.

Best Crypto Portfolio Rebalancing Tools: Conclusion

Thank you for joining us on a journey to streamline your crypto investment game with the top 5 rebalancing and diversification tools in the market. With these tools at your disposal, you can now effortlessly manage your crypto portfolios with ease and accuracy.

Whether you are a seasoned trader or just starting, these tools offer a perfect balance of simplicity and functionality to help you make informed investment decisions.

Remember, the key to success in the crypto world is to stay diversified and disciplined. So go ahead and give these tools a try, and watch your portfolio flourish like never before!

Also, read