Key Takeaways:

- Bitfarms, a publicly traded Bitcoin mining company, reported a $142 million net loss for the second quarter.

- Bitfarms reported last quarter’s net losses and a 5% increase in revenue.

- Some of the company’s miners will now be delivered early next year.

The second quarter’s net loss for bitcoin miner Bitfarms was $142 million, compared to the first quarter’s net income of $5 million.

The company started production at one spot and finished the second phase of development at another in Canada during the quarter, increasing its hash rate by 33% to 3.6 hexa hashes per second (EH/s).

During the quarter, Mike Novogratz’s Galaxy Digital loan was partially repaid when Quebec-based Bitfarms sold 3,357 Bitcoin for $69.3 million. According to the company’s filing with the U.S. Securities and Exchange Commission, as of June, it held 3,144 BTC, valued at roughly $62 million.

Geoff Morphy, chief operating officer, and president, stated that moving forward, “we are targeting 4.2 EH/s and 6.0 EH/s by the end of the third quarter and year-end 2022, respectively, by bringing online our first warehouse in Argentina and phase 3 of The Bunker buildout.”

The company’s two 50 megawatt warehouses in Rio Cuarto, Argentina, are still being built.

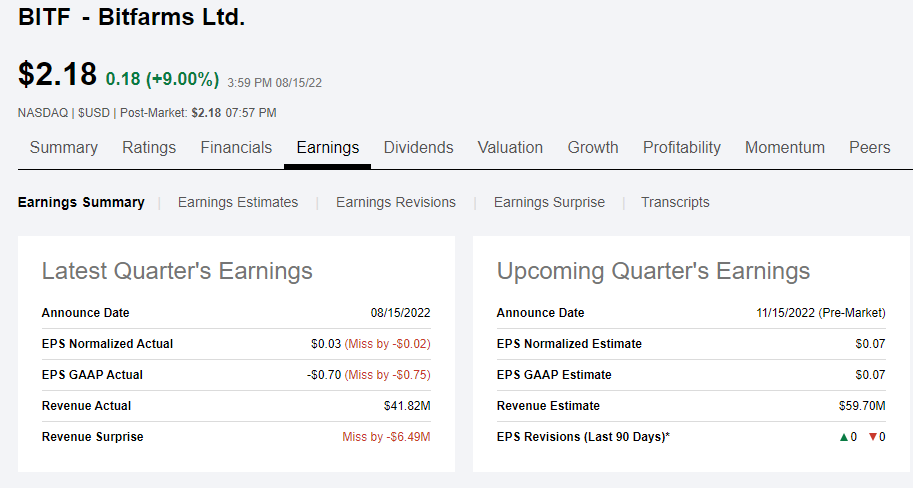

The Q2 EPS of -$0.70, which decreased from -$0.02 at June 30, 2021, might not be directly analogous to the consensus estimate of $0.05.

According to a press release from Morphy, “delivering strong operational growth, we increased our corporate hashrate by 33% from the start of the quarter and by 157% from a year ago to 3.6 exahash per second (EH/s) at June 30, 2022.” We further increased our market share, which is now approaching 2% of the BTC network, a Bitfarms’ record, after bringing phase 2 of The Bunker buildout online.

To better coincide with its regimen for completing the necessary infrastructure, Bitfarms delayed the delivery and payment of some of its mining equipment until 2023. The company is still on track to achieve 6.0 EH/s by the end of the year. As Bitfarms announced it was reducing its expansion plans, that number was changed from 7.2 EH/s in the previous quarter.

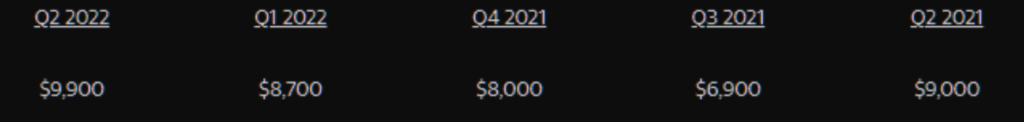

Direct Production Cost Per BTC on Average**

An increase in BTC network difficulty of 12% and an accrual for potential Canadian tax legislation were reflected in Bitfarms’ average direct cost of production** in Q2 2022, which was $9,900, among the lowest documented in the sector. A rise in operational efficiency partly offsets these factors.

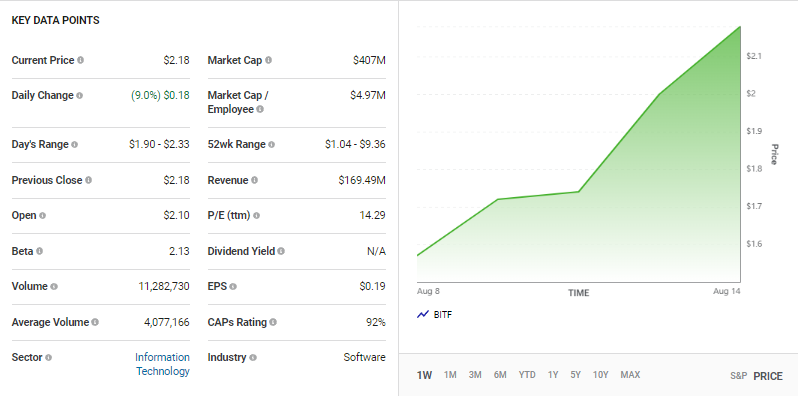

Why Bitfarms’ Stock Spanned by 16.5%

During Monday’s trading session, Bitfarms Ltd. (NASDAQ: BITF) shares are up 13.8% to $2.28 after the company revealed that second-quarter sales were up yearly.

On close to $48.3 million in revenue, analysts projected a net profit of $0.05 per share. Instead, Bitfarm reported $41.8 million in sales and $0.70 per diluted share in a net loss. Bitfarm’s business model was compromised in 2022 by the declining prices of Bitcoin (BTC -3.42%).

Many experts also believe that any crypto mining company, Core Scientific, usually has the highest operating cash flows.

Analysts explain that cash outflows are equally important because they determine the mining company’s fate. In 2022, many crypto companies still owe hundreds of millions of dollars in machine payments. There is also the possibility that the debts will deplete their liquidity.