After a rough financial shakedown due to COVID-19, Cryptocurrency markets are making a slow and steady recovery. Bitcoin consolidated back over the $7000 level during Thursday’s busy trading day. According to the Bitcoin Block Reward Halving Countdown, The bitcoin halving is expected to be completed around May 12, 2019. The event is speculated to already be priced in; however, basing the future on the past performance of cryptocurrency markets never paints a clear picture. So, what does the Bitcoin Halving mean in 2020?

What is a block halving event?

As part of Bitcoin’s coin issuance setup, miners are rewarded a certain amount of bitcoins whenever a block is produced (approximately every 10 minutes). When Bitcoin first started, 50 Bitcoins per block were given as a reward to miners. After every 210,000 blocks are mined (approximately every 4 years), the block reward halves and will keep on halving until the block reward per block becomes 0 (approximately by the year 2140). As of now, the block reward is 12.5 coins per block and will decrease to 6.25 coins per block post halving. read more about Bitcoin mining here.

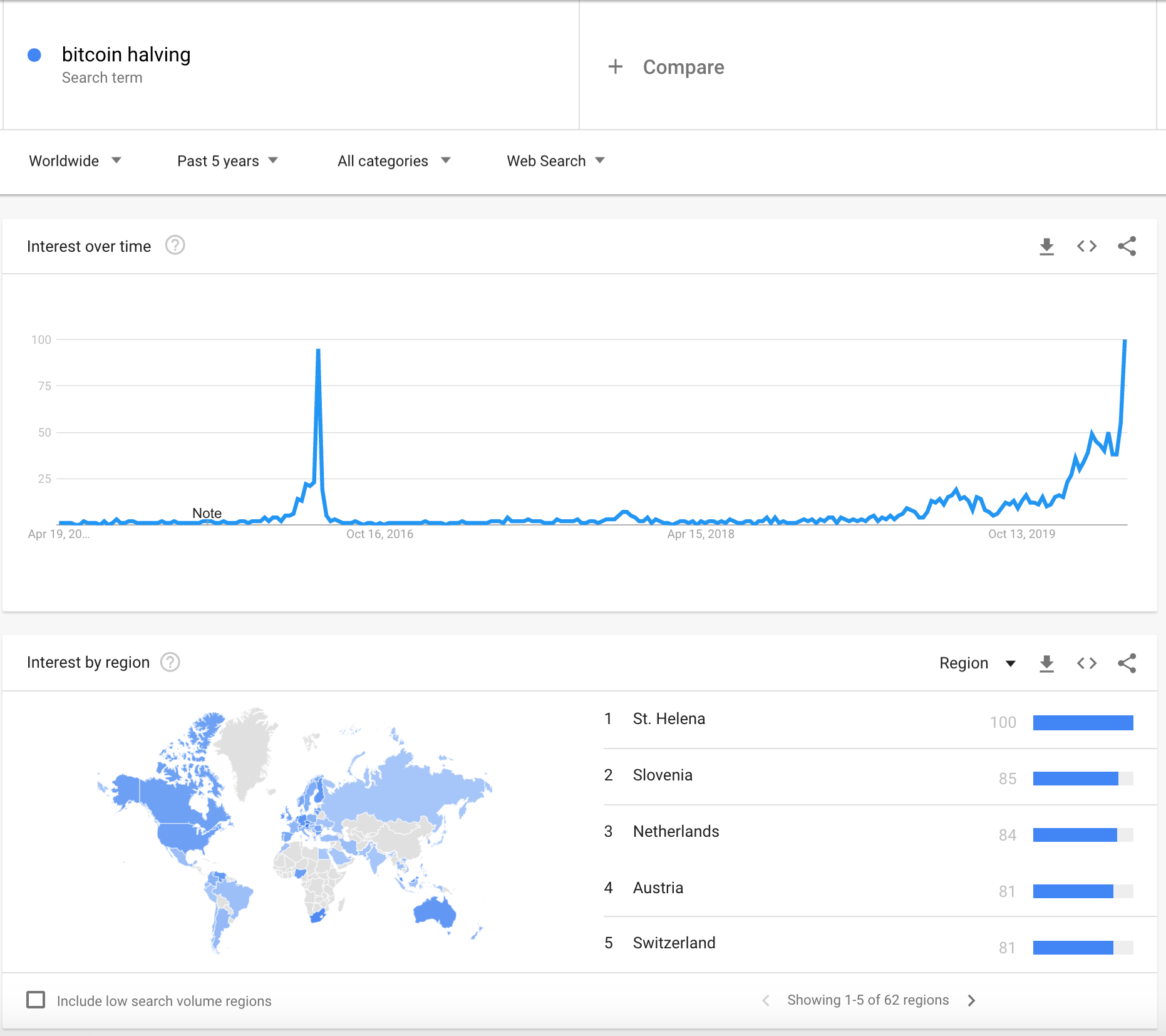

Google Trends reports search volume has topped the previous Bitcoin Halving of 2016.

Twitter’s cryptocurrency community has been bursting with interest surrounding the Bitcoin halving. Facing an onslaught of price speculation as discussion debates whether less supply of Bitcoin released into the market means a higher demand for coins. LunarFeed on Twitter detailed how the Bitcoin Halving has effected price throughout the years.

2012 halving reduced the new supply by $302,400 per week or $43,200 per day. 2016 halving reduced the new supply by $8,190,000 per week or $1,170,000 per day. 2020 halving will reduce the new supply by $63,000,000 per week or $9,000,000 per day. What does social media sentiment say about Bitcoin Halving effecting the price of Bitcoin?

Table of Contents

Bitcoin Price vs. Bitcoin Social Volume

According to LunarCRUSH — Social Listening For Crypto, Bitcoin Social Volume has been steady for the past year, until recently we see an increase in Bitcoin’s Social Volume. It is apparent that Bitcoin Social Volume increased enormously on March 19, 2020.

Bitcoin Price vs. Bullish Sentiment

With an increase of social media discussion around Bitcoin, it’s important to determine whether the majority of the Bitcoin mentions are Bullish or Bearish. Bitcoin’s bullish sentiment graph on LunarCRUSH displays a similar spike as the Social Volume spike. What about Bearish sentiment, do we see an increase in Bearish posts?

Bitcoin Price vs. Bearish Sentiment

Bearish sentiment surrounding Bitcoin appears to be sporadic, with less major spikes as Bitcoin’s Bullish sentiment. Social Volume is a great indicator in community strength and it’s important to focus on the development of these communities along with the technology surrounding Bitcoin and Blockchain technology.

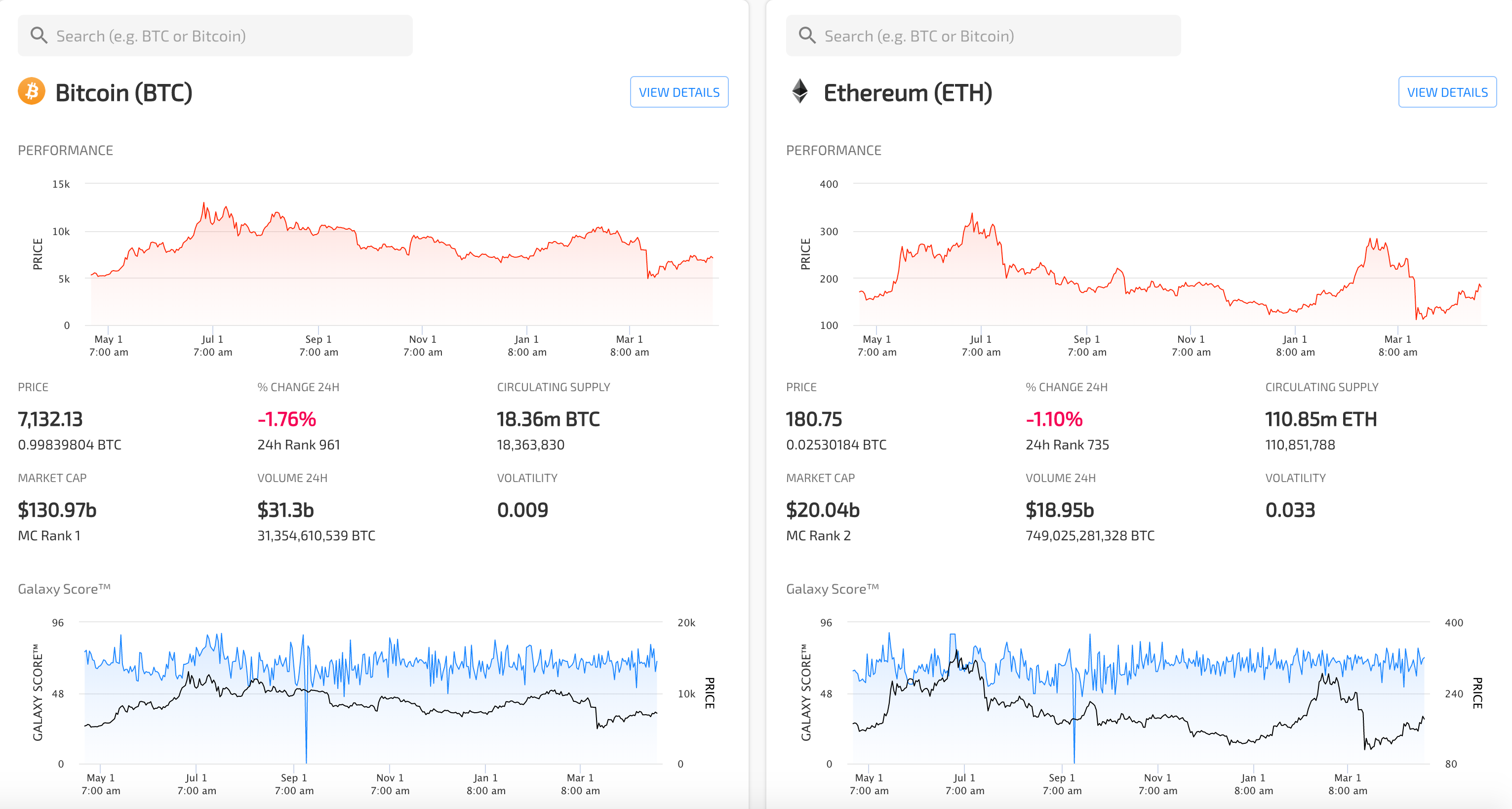

Comparing Bitcoin vs. Ethereum

In the last 24 hours, the Bitcoin price increased by around 10%, maintaining April 3rd levels. Bitcoin has seen a slight recovery from the financial meltdown of “Black Thursday”. Bitcoin (BTC) has been trending between $6,600 and $7,300 and hasn’t shown clear signs of which direction it will move.

Ethereum is trading at $182 at the time of writing after losing 2.79% of its value on the day. On the other hand, $176 happens to be the first support and where the previous week high. Ethereum hit $190 with 100% of the “Black Thursday” crash recovered.

Cryptocurrency Short-term Impact

If the Bitcoin price breaks the maintains resistance it failed to test in early April, $7,400 then a potential rally to the $7,900 to $8,000 range. As long as the Bitcoin price remains below $7,000, uncertainty about post Bitcoin Halving will continue to fill social media discussion.

Knowledge is Power! The decentralized nature of cryptocurrency makes for more free and democratic ways of accessing networks. Share your knowledge, open source your projects , participate in a community (any community!), and maybe just maybe publish a blog post about it.

None of this should be treated as investment advice. Whichever investments you pursue are purely at your own discretion.

About the author

The above article is contributed by Nicholas Resendez, he can be reached on Instagram @nirholas, on Medium, and Twitter @Bothersome for updates on new articles.

The views and opinions expressed here are solely those of the author and do not necessarily reflect the views of the publication. Every investment and trading move involves risk, you should conduct your own research when making a decision.

You might also be interested in: