AscendEx, previously known as Bitmax, is the global crypto exchange platform, which supports over 100 cryptocurrencies, including BTC, ETH, LTC, DOGE, etc. This article will focus on staking services — AscendEx Staking (Bitmax Staking), Defi Yield Farming, and other features like Curve (Polygon) Yield Farming.

Table of contents

- Summary (TL;DR)

- AscendEx Staking

- Steps to begin with AscendEx Staking

- Moving ahead with Delegation

- Steps to un-stake in AscendEx

- What is Yield Farming?

- DeFi Yield Farming projects on AscendEx

- AscendEx Staking: Curve (Polygon) Yield Farming

- AscendEx Staking: Staking vs. Yield Farming

- AscendEx Staking: Conclusion

- Frequently Asked Questions

Summary (TL;DR)

- Staking is a way to earn digital asset mining rewards without investing in expensive hardware having high processing power.

- AscendEx Staking supports instant unbounding, which allows users to un-stake assets to place orders or withdraw immediately.

- AscendEx offers around 50 staking projects like DOT (Polkadot), ASD (AscendEx Native Token), ATOM (Cosmos), CUDOS (Cudos), BOND (Bonded Finance), SWINGBY (Swingby), etc.

- For each staking project, there will be a minimum delegation amount value. Therefore, your staked amount should be greater than or equal to the minimum delegation amount.

- DOT-S indicates staked DOT tokens.

- AscendEx staking supports two kinds of undelegation: Regular undelegation and instant unbounding.

- DeFi Yield Farming allows users to earn either fixed or variable interest by investing digital assets in a DeFi protocol.

- Staking aims to help blockchain networks stay secure and yield farming’s focus to gain the highest possible yield.

- In DeFi yield farming, stable coins like USDT, USDC, Dai, and Tether are preferred.

- Curve (Polygon) Yield Farming is newly launched by AscendEx this week (2nd week of July 2020).

AscendEx Staking

Staking is a way to earn digital asset mining rewards without investing in expensive hardware with high processing power. This is a very convenient way to earn passive income by holding digital assets on the AscendEx exchange.

When you stake eligible tokens, you lock your tokens into your chosen Proof of Stake (PoS) blockchain. Staked tokens are used to achieve consensus, which is mandatory to keep the network secure while validating every new transaction on the blockchain.

As rewards, users will receive new tokens from the network. These rewards will be proportional to the number of tokens staked; the higher the number of tokens staked, the greater the validation power.

If we talk about a traditional staking mechanism, you lock your staked assets for a specific period of time when you opt for staking. During the unbounding period, neither do you have access to your staked assets nor you eligible to receive staking rewards. Because of this, you can’t place orders to sell staked assets. Also, you can’t even withdraw or transfer your assets to another exchange or wallet.

While AscendEx Staking has a concept of instant unbounding, users can un-stake assets to place orders or withdraw immediately. Furthermore, AscendEX allows staked assets to be used as margin collateral. This only applies to the assets which are supported by the platform for margin trading.

Also, read Staking Crypto – An Ultimate Guide on Crypto Staking [2021]

Steps to begin with AscendEx Staking

Using Desktop

Before you proceed to participate in AscendEx Staking, first log in to your AscendEx account. If you don’t have an account, please create an account on AscendEx and then log in.

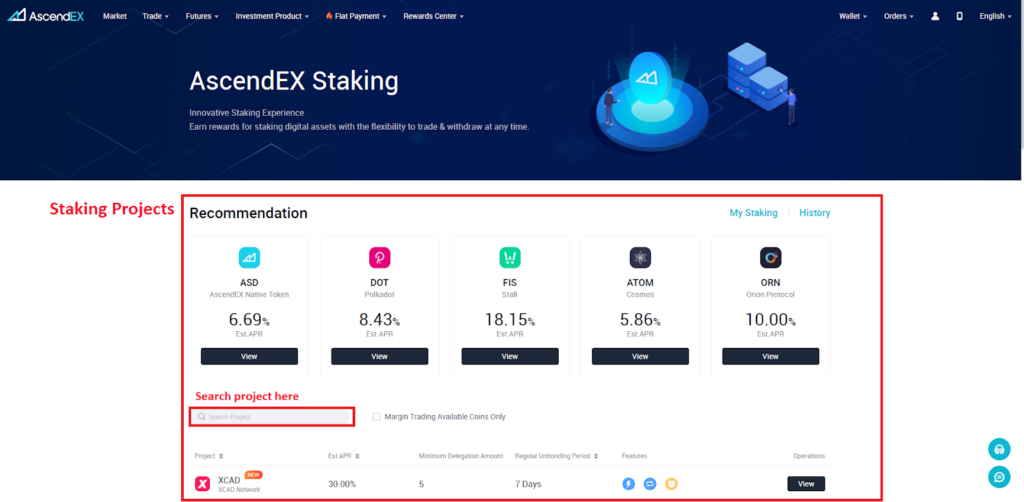

- Head over to AscendEx Staking page.

- AscendEx offers around 50 staking projects like DOT (Polkadot), ASD (AscendEx Native Token), BOND (Bonded Finance), etc.

- Open any project. For example, here, I’m opening the DOT staking project by clicking on it.

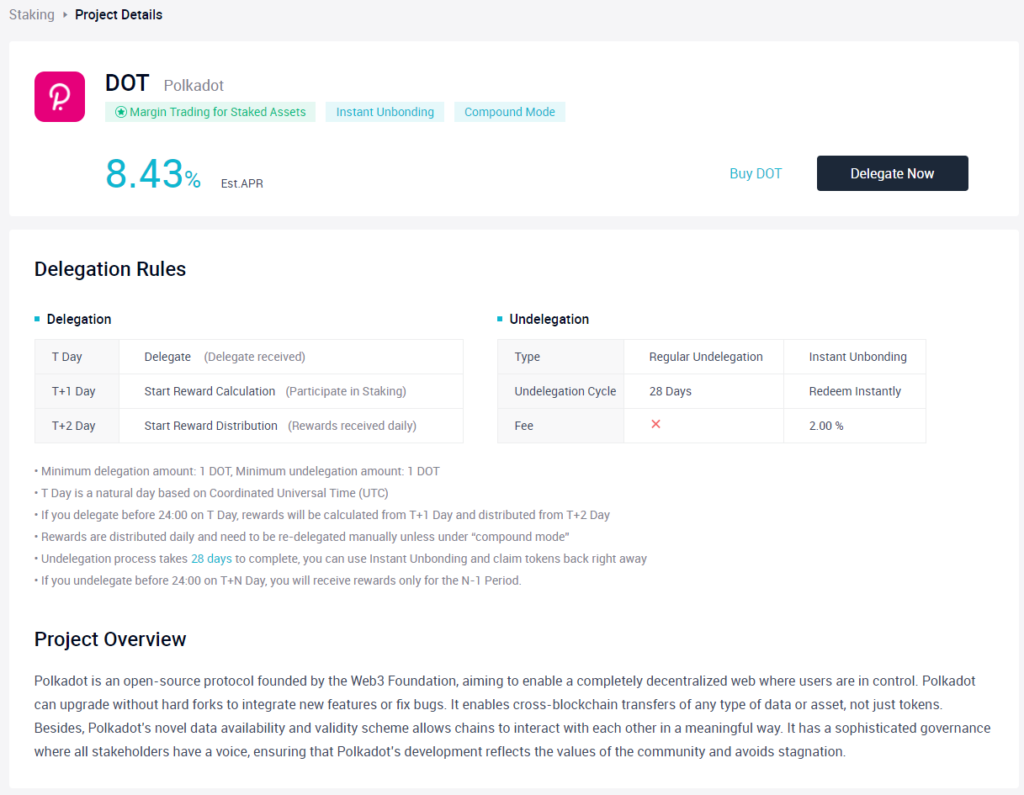

- On the DOT staking page, you will find project overview and delegation rules for selected staking project. There will be two buttons to proceed further, Buy DOT and Delegate Now. Click on the “Delegate Now” button to stake DOT tokens. If you don’t have DOT tokens in your wallet, go for the “Buy DOT” option.

- It will take you to the DOT/ USDT trading page, where you can buy DOT tokens by placing an order.

- Once you have sufficient funds, click on Delegate Now.

- This will open a pop-up window to set up DOT Delegation.

Using Mobile App

- Open AscendEx App.

- If you don’t have AscendEx App, please download for Andriod from here and iOS from here. (Use this referral code B7N5N8TRJ, to get a discount on the fees)

- Click on “Staking”.

- On the “All Staking” page, you will find the list of staking projects offered by AscendEx. Search for any project and select one of your choices.

- It will take you to the selected project’s staking page. If you don’t have enough selected assets to delegate, go to the DOT/ USDT pair to buy some, and then follow steps 1, 2, and 3 again.

![A Guide To Ascendex Staking 3 Ascendex Staking [Mobile App]](https://coincodecap.com/wp-content/uploads/2021/07/image-126-1024x428.jpg)

Moving ahead with Delegation

- Enable “Compound Mode” to enable auto-redelegation of staking rewards and compound your return.

- Enter “Delegation Amount”. For each project, there will be a minimum delegation amount value. Make sure you enter a delegation amount greater than or equal to the minimum required value. If you don’t have enough assets to delegate, you can click on the buy option, which we have already discussed.

- Read AscendEx Staking Agreement and check the box(I’ve read and agreed to AscendEx Staking Agreement).

- Click on “Delegate Now”.

- You can find staking details under “My Staking”.

Steps to un-stake in AscendEx

AscendEx Staking: un-stake using Desktop

- Open My Staking page on AscendEx.

- You will find a list of projects in which you have staked assets. Click on Undelegate to un-stake your assets from a specific project.

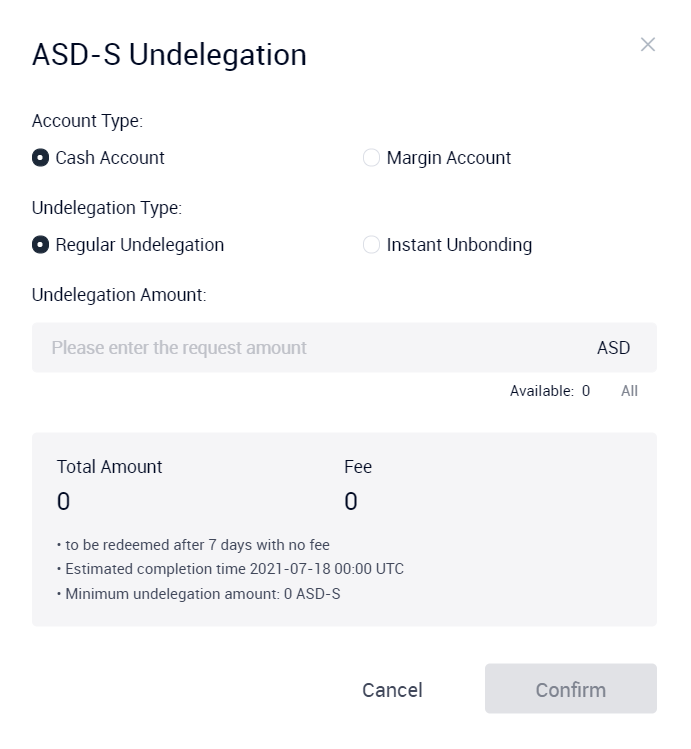

- It will open one pop-up window.

- Select Account Type: Cash account or Margin account

- Select Undelegation Type: Regular undelegation or Instant Unbounding.

- In regular delegation, assets will be redeemed after seven days with no fee.

- In instant unbounding, assets will be redeemed instantly with 2.5% of the fee.

AscendEx Staking: un-stake using Mobile App

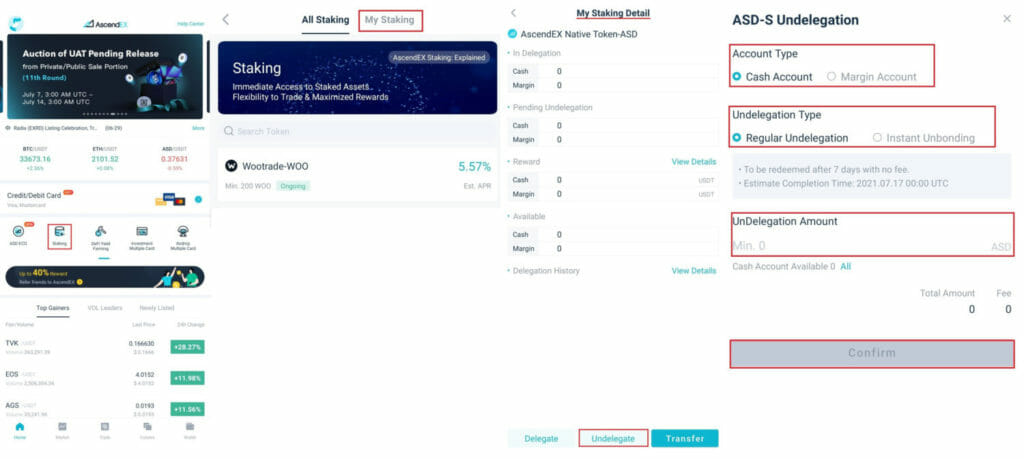

- Open AscendEx App.

- Click on “Staking”.

- Click on “My Staking”.

- Select a project from which you want to undelegate your tokens.

- Click on the “Undelegate” button.

- It will open one pop-up called “Project_Name – S Undelegation”.

- Click on Confirm.

What is Yield Farming?

Yield Farming allows users to temporarily lock up their holdings and earn rewards. It will enable users to earn either fixed or variable interest by investing digital assets in a DeFi protocol.

Yield Farming is similar to Staking as, in both cases, you can earn passive income. However, Field Farming lends the locked-up digital assets to DeFi protocols instead of contributing to a proof of stake network. It locked up funds in a liquidity pool. The liquidity pools power the marketplace where traders can exchange, borrow, or lend tokens. Once you’ve added your funds to a pool, you officially become a liquidity provider. DeFi lending protocols allow lenders to gain interest on their assets while giving borrowers access to more capital for trading. In DeFi yield farming, stable coins like USDT, USDC, Dai, and Tether are preferred.

Also, read DeFi Yield Farming and Liquidity Mining

AscendEx Staking: Benefits of Yield Farming

- “One-click” farming functionality,

- No Gas fees, and

- Ability to rotate between different protocols to maximize yields.

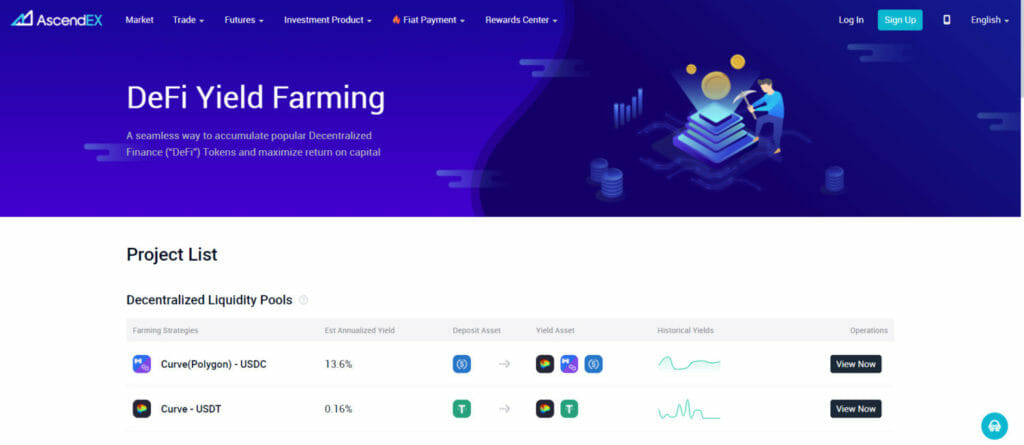

DeFi Yield Farming projects on AscendEx

As of now, AscendEX offers Yield Farming products like lending protocols and liquidity pooling. In liquidity pooling, you’ll act as a liquidity provider by contributing assets to pools and earn transaction fees in return. In lending protocols, you require lending assets to pools in exchange for lending interest plus additional token incentive issued.

There are 2 Decentralized Liquidity Pools –

- Curve (Polygon) – USDC

- Curve – USDT

Also 1 Lending & Borrowing Project – HARC – USDX

Curve (Polygon) Yield Farming launched this week (2nd week of July 2020) on AscendEx. Hence, we’ll discuss this project in depth.

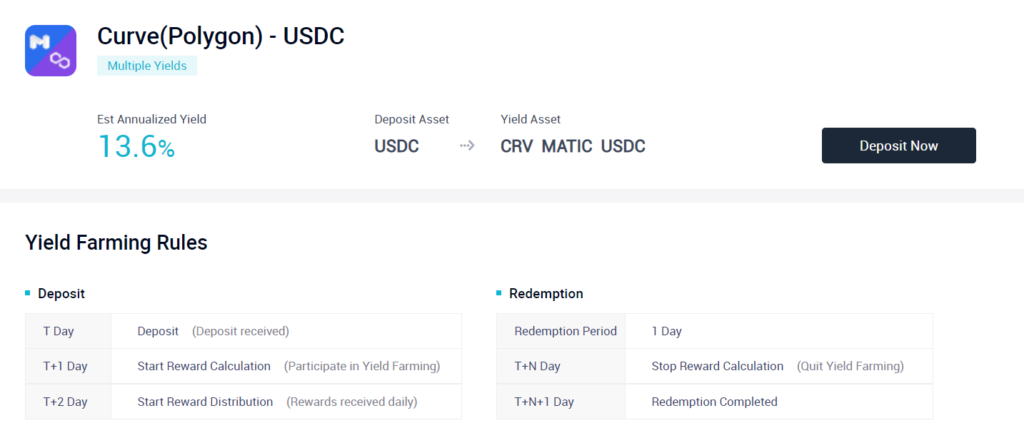

AscendEx Staking: Curve (Polygon) Yield Farming

Polygon is providing MATIC rewards to users for being liquidity providers. In addition, Polygon is the first well-structured, easy-to-use platform for ethereum scaling and infrastructure development.

- Deposit asset: USDC (Minimum — 500 USDC, Maximum — 250,000 USDC)

- Yield asset: USDC + MATIC + CRV

- Minimum redemption amount: 500 USDC

- T Day is a natural day based on Coordinated Universal Time (UTC). Therefore, if you deposit before 24:00 on T Day, rewards will be calculated from T+1 Day and distributed from T+2 Day.

- The redemption process takes one day to complete; Instant Redemption Function is currently unavailable.

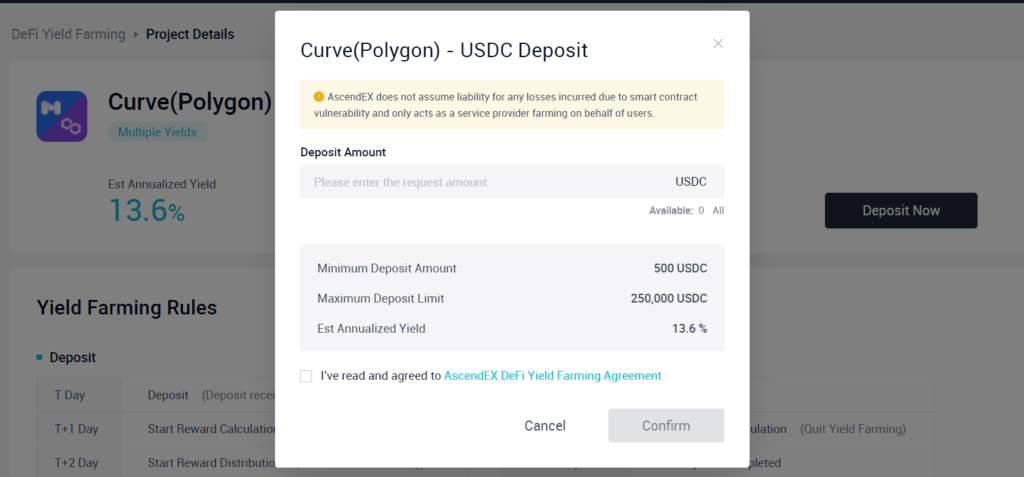

How to deposit in Curve (Polygon) Yield Farming?

AscendEx Staking: Using Desktop

- Open AscendEx’s DeFi Yield Farming page.

- Click on “View now” for Curve(Polygon) — USDC.

- This will open the Polygon Yield Farming page.

- You will find project introduction and yield farming rules. Then, to invest in this project, click on the “Deposit Now” button.

- Thereafter, enter “Deposit Amount”. It should be greater than or equal to 500 USDC. As you can see in the pop-up window, the estimated annual yield is 13.6%.

- Read AscendEx DeFi Yield Farming Agreement and check the box.

- Finally, click on the “Confirm” button.

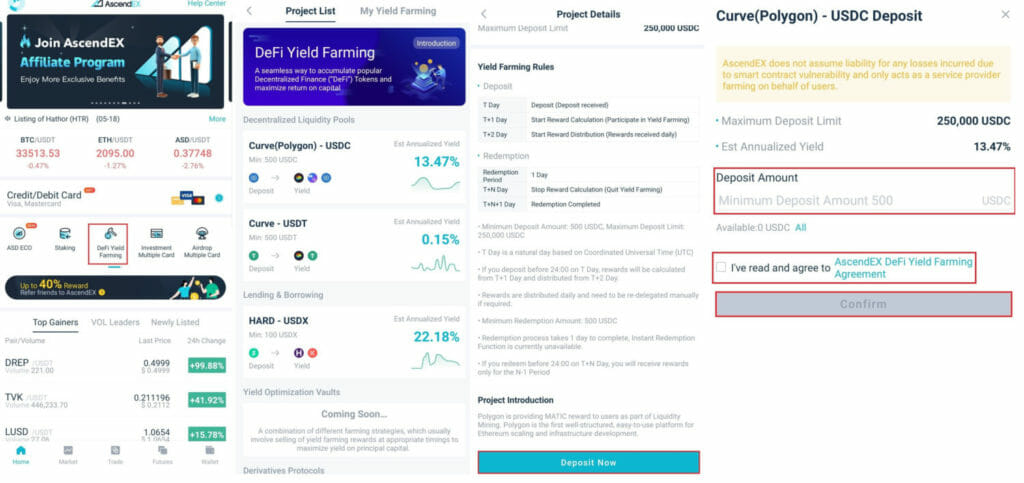

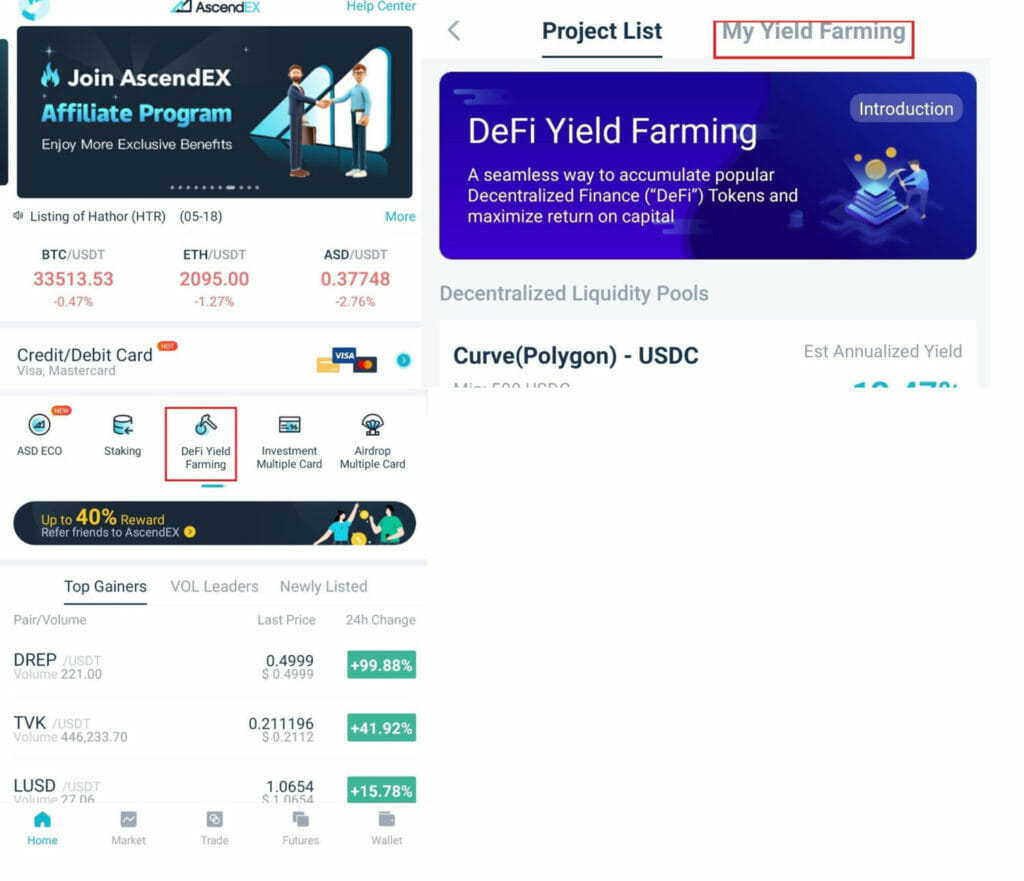

AscendEx Staking: Using Mobile App

- Open AscendEx App.

- Click on “DeFi Yield Farming”.

- On the “Project List” page, you will find the list of yield farming projects offered by AscendEx. For example, select “Curve (Polygon) – USDC”.

- This will take you to the “Curve (Polygon) – USDC” project page, where you will find project introduction and yield farming rules. Then, click on “Deposit Now”.

- Thereafter, on the next page enter “Deposit Amount”.

- Click on the “Confirm” button.

Where to see my yield farming?

On website

- Go to AscendEx’s DeFi Yield Farming page.

- Click on “My Yield Farming”. This will lend you to the My Yield Farming page.

On Mobile app

- Open AscendEx App.

- Click on “DeFi Yield Farming”.

- Go to “My Yield Farming”. On the My Yield Farming page, you will find all your yield farming projects’ investment details.

AscendEx Staking: Staking vs. Yield Farming

Staking and Yield Farming are similar in terms of rewards. But both have different purposes. Staking aims to help blockchain networks stay secure, and yield farming focuses on gaining the highest possible yield.

Yield farming can be considered the most profitable option to earn passive income, but it is highly risky. For example, APY (Annual Percentage Yield) can be highly affected by Ethereum’s gas fees. Hence, if the market turns bearish or bullish suddenly, the rate of profit will drop.

In Yield farming, there is also the possibility that developers create a scam project. For example, after listing a new token and allows users to deposit funds into liquidity pools, the project’s creator will close the project and disappear with funds.

Staking might require you to lock your assets (in some projects) for a year. During this time, you can’t even withdraw or sell your staked assets. And if the market turns to a bear market, you will suffer more loss than what you will gain from staking.

AscendEx Staking: Conclusion

Staking and Yield Farming both allow users to temporarily lock up their holdings and earn rewards. Staking’s purpose is to help blockchain networks to stay secure, and yield farming’s focus is to gain the highest possible yield.

AscendEx provides around 50 staking products and 3 DeFi Yield Farming products. But remember, AscendEx doesn’t guarantee that you will receive any specific rewards over time. It depends on the project owner or token network. So it’s your responsibility to find a well-growing project to invest in.

Frequently Asked Questions

Does KYC verification require participation in staking?

No.

Can I trade my assets while they are staked?

Staked assets can’t be traded directly. Instead, they can be used as collateral for margin trading. If you want to sell your staked assets, you have to unstake them first.

Can I unstake staked assets anytime at AscendEx?

Yes, you can unstake your staked assets anytime at AscendEx. To unstake your assets, you have two options: Instant unbounding and regular undelegation. By choosing instant unbounding, you can unstake them instantly, but it will charge 2.5% of the fee.

How are staking rewards calculated?

In most scenarios, if you stake your assets on T day, Staking rewards will be calculated from T+1 day and will start to distribute on T+2 day. However, suppose you stop staking or undelegate between 0:00 to 24:00 on T+M day. In that case, your total staking period will be M-1 days, and you will receive rewards only for M-1 days.

How does compound mode work?

Compound mode is a feature that automatically restake or redelegates a user’s staging rewards each time when a user receives any.

Do estimated rewards the same as actual rewards?

Actual rewards depend on the project’s network conditions. Any changes in network conditions can affect actual rewards.

What is the difference between “DOT” and “DOT-S”?

A ticker ending with “-S” represents a staked balance. So, for example, DOT-S means staked DOT because we have staked or delegated DOT tokens. And you can’t directly trade or withdraw staked tokens.

![Earn Crypto - Passive Income By Staking Coins [Mycontainer Edition] 13 Staking Coins](https://coincodecap.com/wp-content/uploads/2020/02/Earn-passive-income-with-staking-cryptocurrencies-768x432.png)