With the rise of mobile apps, investors can now manage their portfolios on the go. This article will explore the best 10 mobile apps to invest in stocks in the United States that provide a seamless and user-friendly experience for investing in stocks. They offer a range of features, from real-time market data to educational resources, making them ideal for beginners and experienced investors.

Table of Contents

Summary

- Robinhood is a commission-free trading of stocks, ETFs, options, cryptocurrencies, personalized watchlists, instant deposits, and educational resources.

- TD Ameritrade platform for stocks, options, futures, and forex. Advanced charting tools, real-time quotes, and customizable watchlists. Furthermore, features like Paper trading and retirement planning tools are available.

- E*TRADE is a trading platform that offers Real-time market data, research tools, and portfolio management.

- The Fidelity Investment platform provides advanced trading tools, research resources, and a customizable dashboard.

- Charles Schwab is a brokerage platform that has diverse investment opportunities. Fee-free mutual funds, retirement planning tools, and banking products.

- Webull is a commission-free trading platform with real-time market data, customizable charts, and paper trading.

- Acorns offers micro-investing and automated savings. Moreover, There are features like Invests spare change, pre-built portfolios, and automatic recurring investments.

- The Stash Investment app is best suited for beginners. It offers stocks, ETFs, and fractional shares. Personalized recommendations, automatic recurring investments, debit cards with stock rewards.

- M1 Finance is an online brokerage platform for automated investing and customizable portfolios. Individual stocks, ETFs, automatic rebalancing. Pre-built portfolios, dynamic rebalancing, mobile app.

- Betterment is a robo-advisor platform for automated investing and personalized portfolio management, Algorithms, automatic rebalancing, and tax-loss harvesting.

10 Top Mobile apps to invest in stocks in USA

Robinhood

- Robinhood lets users buy and sell stocks, ETFs, options, and cryptocurrencies without paying commission fees.

- The app offers an intuitive and straightforward interface, making it easy for experienced and beginner investors to navigate and trade.

- Robinhood allows users to purchase fractional shares of stocks, making it more accessible for investors with limited funds.

- Users can get real-time market data, including stock prices, charts, and news, to make informed investment decisions.

- Robinhood allows users to create personalized watchlists to track their favorite stocks and receive relevant updates.

- Users can link their bank accounts to Robinhood and make instant deposits and withdrawals, enabling quick access to funds for trading.

- Robinhood provides educational resources, including articles and videos, to help learn about investing and make informed decisions.

- Robinhood can be downloaded from the Apple App Store for iOS mobiles and the Google Play Store for Android devices.

TD Ameritrade

- TD Ameritrade offers a powerful and user-friendly platform allowing investors to trade stocks, options, futures, and forex. It provides advanced charting tools, real-time quotes, and customizable watchlists.

- Users can access market news, analyst reports, and educational videos to make informed investment decisions.

- TD Ameritrade offers a paper trading feature, allowing users to exercise trading strategies without risking real money, which is a great tool for beginners to get experience and confidence before entering the live market.

- TD Ameritrade’s mobile app is available for download on iOS and Android mobiles through the Apple and Google Play store.

- The app provides all the desktop platform features, allowing users to trade on the go, monitor their portfolios, and receive real-time market updates.

- TD Ameritrade has a vibrant investor community where users can connect with other traders, share ideas, and learn from experienced investors.

- TD Ameritrade has a range of retirement planning tools to help users set and achieve their retirement goals. These tools include retirement calculators, investment guidance, and access to retirement accounts such as IRAs.

- TD Ameritrade provides round-the-clock customer support through various phone, email, and live chat channels.

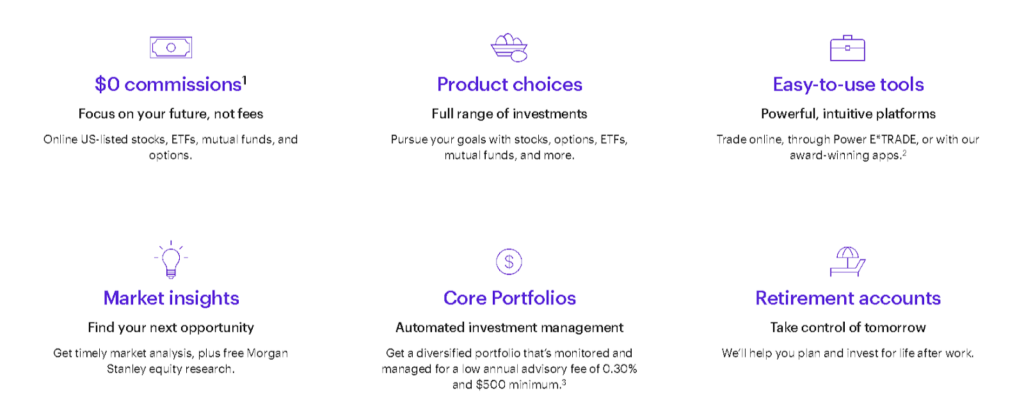

E*TRADE

- E*TRADE offers a powerful trading platform that lets users trade stocks, options, futures, and ETFs.

- It provides real-time market data, advanced charting tools, and customizable trading strategies.

- Extensive Research and Analysis tools to help users make informed investment decisions. It offers access to market news, analyst reports, and educational resources.

- E*TRADE provides portfolio management tools that allow users to track and analyze their investments.

- E*TRADE offers retirement planning tools and resources to help users plan for their future.

- Furthermore, It provides retirement calculators, investment guidance, and access to retirement accounts such as IRAs.

- E*TRADE offers customer support through various phone, email, and live chat channels.

- E*TRADE prioritizes the security of user accounts and employs advanced security measures.

- The E*TRADE app can be downloaded from the app stores for iOS and Android mobiles.

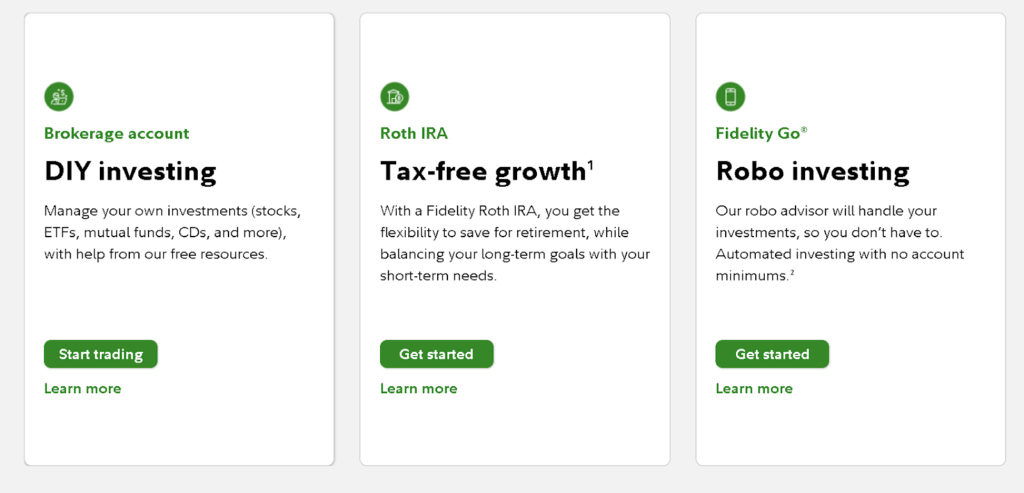

Fidelity

- Fidelity is a comprehensive investment platform that provides several investment options, including stocks, bonds, mutual funds, and ETFs.

- It provides advanced trading tools and research resources to help investors make informed decisions.

- A customizable dashboard interface greets you. Cards cover everything from market headlines to portfolio and watch list insights.

- Fidelity’s mobile app is available for download on iOS and Android devices, allowing users to manage their investments on the go.

- The app also offers real-time market data, customizable watchlists, and the ability to place trades and track portfolio performance.

- Fidelity’s app can be downloaded from the Apple App Store for iOS mobiles and the Google Play Store for Android devices.

- Fidelity Bloom uses behavioral finance principles and positive reinforcement to overcome emotional barriers to financial goals.

Charles Schwab

- Charles Schwab is a popular brokerage platform that offers several investment products and services. It provides access to stocks, bonds, mutual funds, ETFs, options, and futures.

- Charles Schwab’s mobile app is available for download on iOS and Android devices, letting users manage their investments on the go.

- The app offers real-time quotes, customizable watchlists, and the ability to place trades and track portfolio performance.

- With more than 30 global markets available for trading, you have access to a diverse range of investment opportunities.

- The availability of over 3,500 fee-free mutual funds provides flexibility and cost-effectiveness for investors.

- Additionally, selecting over 600 mutual funds with ratios under 0.50% offers options for those seeking lower expense ratios.

- Charles Schwab’s wide selection of account types, including taxable brokerages, IRAs, custodial accounts, and trusts, caters to various investment needs and goals.

- Furthermore, the availability of banking products such as the Charles Schwab High Yield Investor Checking account, CDs, and credit cards adds convenience and additional financial services for customers.

Webull

- Webull is a commission-free trading platform that grants many investment options, including stocks, ETFs, and options.

- It provides customizable charts, technical analysis tools, and real-time market data to allow users to make informed trading decisions.

- The app also offers features like paper trading, which empowers users to practice trading without risking real money.

- Webull’s app can be downloaded from the Apple App Store for iOS mobiles and the Google Play Store for Android mobiles.

- Webull offers commission-free options trading, making it a favorable choice for investors.

- No assignment or exercise fees are charged by Webull, adding to its appeal for options trading.

- Webull does not hold a minimum deposit requirement, allowing users to start investing with a small amount.

- Investors can trade cryptocurrencies like Bitcoin, Bitcoin Cash, Ethereum, and Litecoin on Webull.

- Unlike other brokers, Webull provides free stocks to customers with small deposit thresholds instead of cash bonuses.

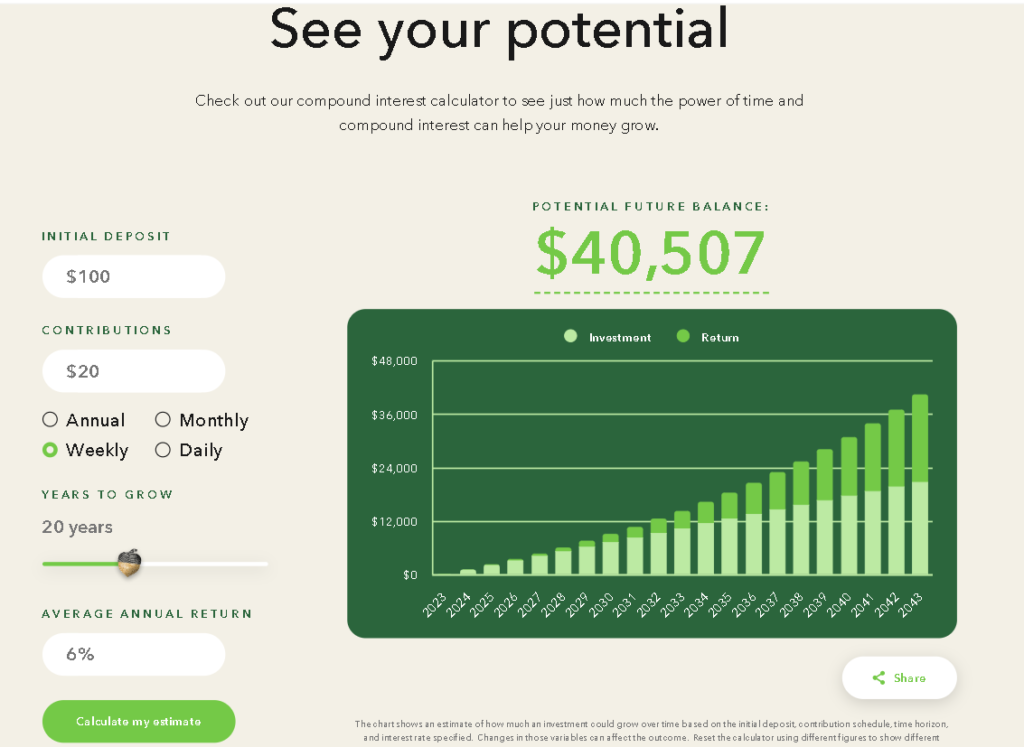

Acorns

- Acorns investment app aims to focus on automated savings and micro-investing.

- It permits users to invest their spare change by rounding off their daily purchases and investing the difference.

- Acorns also offers pre-built portfolios based on the user’s investment goals and risk tolerance.

- The app provides features like automatic recurring investments, personalized investment recommendations, and the ability to track investment performance.

- Acorns’ app can be downloaded from the Google Play Store for Android devices and the Apple App Store for iOS devices.

- Acorns also offers a checking account encompassing numerous characteristics of a conventional bank account: direct deposit, the power to deposit checks through a mobile, and a debit card.

- Furthermore, it offers the convenience of fee-free withdrawals from over 55,000 Allpoint ATMs worldwide.

Stash

- Stash investment app that aims to make investing accessible to beginners.

- It proffers a variety of investment options, including stocks, ETFs, and fractional shares.

- Stash provides educational content and personalized investment recommendations based on the user’s financial goals and risk tolerance.

- The app also offers features like automatic recurring investments, a debit card with stock rewards, and the ability to track portfolio performance.

- Stash offers a limited selection of cryptocurrency assets, including Bitcoin, Ethereum, and Avalanche.

- Stash allows you to buy shares of Grayscale Bitcoin Trust and Grayscale Ethereum Trust.

- Auto-Stash features include Set Schedule, Round-Ups, and Smart-Stash for automatic saving and investing.

- Stash enables users to purchase fractional shares of companies at any dollar amount.

- Stash’s app can be downloaded from the Apple App Store and the Google Play Store for their devices.

M1 Finance

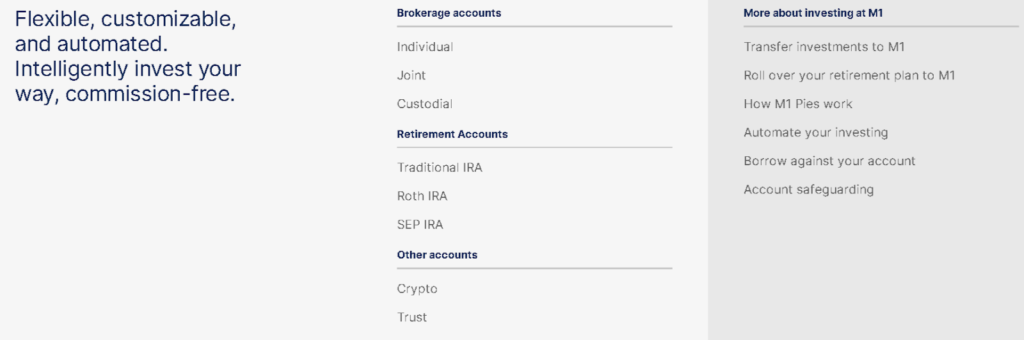

- An online brokerage platform, M1 Finance offers automated investing and customizable portfolios.

- Users can create and manage their portfolios by selecting individual stocks and ETFs.

- M1 Finance offers features like automatic rebalancing, fractional shares, and the ability to schedule recurring investments.

- The platform also provides access to pre-built portfolios called “Pies” that are designed to align with specific investment strategies.

- M1 Finance’s app can be downloaded from the Apple App Store for iOS devices and the Google Play Store for Android devices.

- M1 Finance utilizes dynamic rebalancing to maintain the desired allocation of your portfolio. It automatically identifies underweight segments and prioritizes depositing money there while selling overweight portions when you withdraw funds.

- Unlike self-directed investment portfolios, M1 Finance offers automation by implementing an algorithm that manages the allocation of assets based on your chosen preferences.

- With M1 Finance, you have the advantage of a system that actively adjusts your portfolio to keep it on track, saving you the time and effort of manually rebalancing your investments.

Betterment

- Betterment is a robo-advisor platform that offers automated investing and personalized portfolio management.

- It uses algorithms to create and manage diversified portfolios based on the user’s financial goals and risk tolerance.

- Betterment provides features like automatic rebalancing, tax-loss harvesting, and goal-based investing.

- Betterment’s app can be downloaded from the Apple App Store and the Google Play Store.

- Betterment provides easy access to certified financial planners (CFPs) for optimizing Betterment accounts and discussing broader financial topics.

- Betterment offers guided cryptocurrency investing through a partnership with Gemini, allowing users to access four cryptocurrency portfolios: universe, meta, defi, and sustainable.

- The app includes a charitable-giving tool that enables users to donate securities directly to their preferred charity, potentially resulting in a tax benefit.

- Betterment’s retirement-planning tool comprehensively analyzes users’ financial situation and provides recommendations for optimizing savings and portfolios to achieve their retirement goals.

Conclusion

Investing in stocks has always been challenging, thanks to the availability of mobile apps that provide a seamless and user-friendly experience. Whether you are a beginner looking to dip your toes into the market or an experienced investor seeking advanced trading capabilities, these apps have covered you. So, download one of these mobile apps to invest in today and start your journey towards financial success.

How do trading apps work?

Trading apps allow users to sell and buy stocks directly from their mobile devices. These mobile apps to invest in connect users to stock exchanges, allowing them to conveniently place orders, track market prices, and manage their investment portfolios.

What features to look for in a stock investment app?

When choosing a mobile apps to invest in, look for features like a user-friendly interface, real-time market data, customizable watchlists, research tools, access to financial news, portfolio tracking, order placement options, and reliable customer support. These features can enhance your investing experience and help you make informed decisions.

Are there any limitations on the types of stocks or investment products available on these apps?

The types of stocks and investment products available on these mobile apps to invest in may vary. Most apps offer a wide range of stocks listed on major exchanges, including common stocks, ETFs, and sometimes even options. However, some apps may have limitations on certain types of securities, such as penny stocks or international stocks. It’s important to check the app’s offerings and ensure they align with your investment goals.