Crypto options can be a lucrative trading opportunity, especially for traders who want to avoid the hassles of spot crypto trading. After all, in India, the crypto tax laws dictate any gains made from crypto trading are to be taxed at a fixed rate of 30% (with 4% cess), which can be a steep price to pay for the spot traders. Crypto options can allow some respite, if you are picking a platform like Delta Exchange India to trade in the derivative instrument!

Delta Exchange India is the first FIU-registered, fully compliant crypto futures and options trading platform in India, growing at a breakneck speed. As of writing, they are recording daily trading volumes of over $300 million.

Why Delta India Is A Good Choice

Delta Exchange India is registered with the FIU-India or the Financial Intelligence Unit of India, which ensures complete compliance with relevant Indian laws. This can be a great reason to pick Delta India for crypto options trading, along with their simplified user interface and the dedicated support team.

What’s more, when you trade options on Delta Exchange India, you do not need to come in direct contact with crypto at any point since all settlements are done in INR. You can deposit INR to your Delta India account through a bank transfer, and you can take your earnings in INR, too.

What are crypto options?

For the uninitiated, crypto options are derivatives instruments that give the buyer the right, but not the obligation, to buy or sell a specific amount of the underlying cryptocurrency at a predetermined price, known as the strike price, on or before a specified expiration date.

What use are they? Similar to options in traditional financial markets, crypto options are frequently used for hedging risks, speculating on crypto price movements, and enhancing portfolio returns. Further, for those who want to avoid holding cryptocurrencies after spot trading, crypto options are a good pick, because you can make the settlements in fiat currency without getting your hands on the actual crypto.

Crypto options can be divided into two main types: call options and put options. A call option gives the buyer the right to purchase an asset at the strike price. On the contrary, a put option provides the buyer with the right to sell the asset at the strike price.

How to trade crypto options through Delta Exchange India?

Below we have provided a step-by-step guide to trading crypto options through the exchange:

- Once you are on the Delta Exchange India website, first you have to navigate to the Options section.

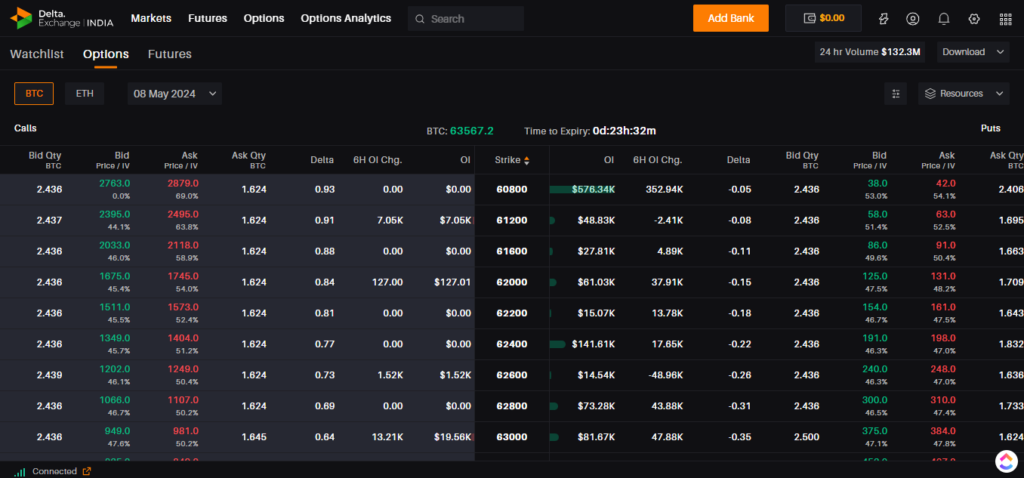

- On the respective page, you can find the Delta Exchange option chain, with crypto options in BTC and ETH with daily, weekly, and monthly expiries.

Now, an option chain is a list of all available options for a particular crypto, showing various strike prices along with their corresponding expiration dates and other details. The Delta Exchange option chain seen in the image above can be used to analyze and select the options that best suit your strategy.

Each row represents a different strike price, and columns display data such as bid and ask prices and quantity (the prices buyers and sellers provide), implied volatility, and options Greeks like delta- a metric showing how much an option’s price might change depending on market movement. These metrics are, of course, crucial for assessing the risk and reward that might come with different options.

- Decide whether you want to trade a call or a put option based on your predictions for the future of BTC/ETH. Buy a call if you have a bullish outlook, and consider a put if you expect prevailing bearish sentiments.

- Choose a strike price that aligns best with your predictions for the crypto’s price movement, and of course, pick an expiration date that gives your prediction time to materialize. Note that crypto options with shorter expiration periods usually ask for less premium (the upfront cost you pay), but may be subjected to high risks as there is lesser time for the crypto to reach the expected price.

- Take the premium into account, as well as the implied volatility or IV, indicating the market’s forecast for the crypto’s price volatility.

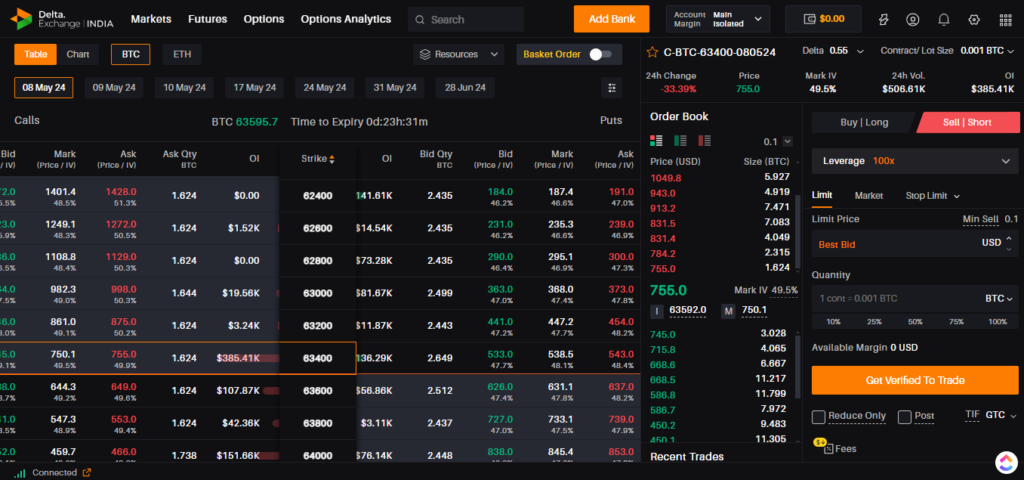

- When you select an option of your choice on Delta Exchange India, you’ll see the order book open up, along with more metrics like contract size (amount of underlying asset) and open interest or OI (the total number of outstanding crypto options left unsettled). Assess these metrics as well.

- After selecting a crypto option that fits your strategy and goals, place your order on Delta India.

- Keep monitoring your crypto options position; you can hold until expiration, exercise it beforehand if it’s in-the-money (its value or strike price is more profitable compared to the current market price of the underlying crypto), or sell it back to the market before it expires if it proves lucrative that way.

Remember that regardless of the crypto exchange you choose, trading crypto options needs a good understanding of the historical performance of the crypto of your choice, as well as the specifics of options. Be sure to do your due diligence and understand the risks before you set out to trade crypto options!

Follow Delta Exchange India’s website as well for more information, and take a look at their socials on X and Instagram for updates!