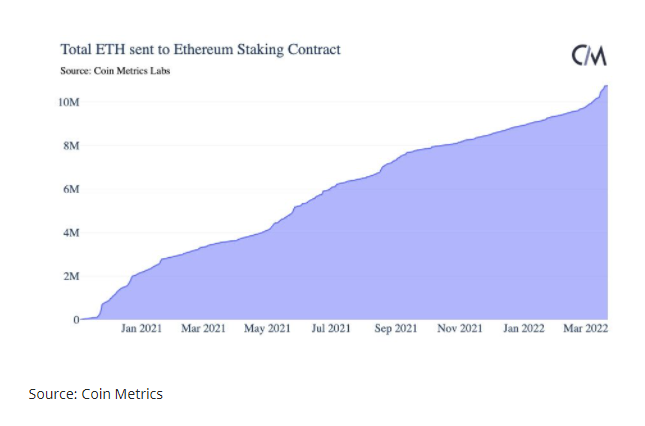

Staking of Ethereum’s native ETH coins is picking up steam ahead of ‘the Merge,’ with over 9% of the total quantity of ETH already locked in staking mechanisms. In the meantime, as more investors take their tokens into their own possession and stake them, exchanges are running out of ETH.

On March 8, the total amount of ETH transmitted via staking protocols surpassed 10 million for the first time, as per crypto analytics firm Coin Metrics. According to the company, around 9% of all ETH is now locked in staking contracts.

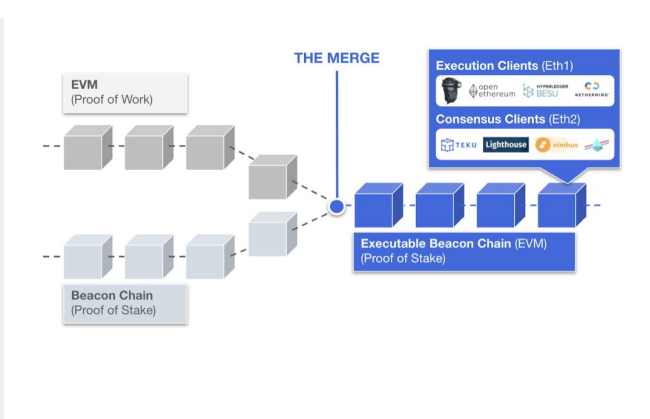

The Merge, or the switch from the existing heritage blockchain based on Proof-of-Work to the new Beacon Chain based on Proof-of-Stake, is expected to happen as soon as 2022

The most widely held belief in this regard is that it will occur between June and September.

Ethereum is currently trading above $3,000, after falling below $2,500 at the end of January.

It’s worth noting that it was well below $2,000 a year ago, and it’ll be well below $1,000 by the end of 2020.

Currently, there is a 4% interest in staking $ETH, and over 10.5 million ETH has been staked in the #Beaconchain. When this ETH combines with the PoW #Ethereum Chain, however, interest rises to 10%, which is a 2-3x increase.

Price pressure will be a problem since fresh $ETH will be issued at a reduced rate of up to 90%, causing a supply shock and eliminating the necessity for miners or validators to sell their ETH because they will no longer have to pay for their mining expenses.

It’s worth noting that it was well below $2,000 a year ago, and it’ll be well below $1,000 by the end of 2020.

@0xtanjero outlines that Ethereum has been crawling towards the #PoW to #PoS transition for a long time, but it appears that we’ve finally arrived. The #Merge is set to take place in June, three months from now. Imagine the impact of a 90 percent decline in the supply of the most extensively used blockchain network if a 50% reduction in the supply of #Bitcoin can start a new rally.

While other cryptocurrency protocols and products have been able to swiftly evolve and release new exciting features, Ethereum has been persistent and deliberate in its plodding journey towards a sustainable and scalable blockchain architecture. However, the change from proof-of-stake to proof-of-work isn’t purely cosmetic. It introduces a slew of fresh bullish dynamics to consider and invest in:

- Block times are predictable.

- The network’s security

- The dynamics of supply and demand

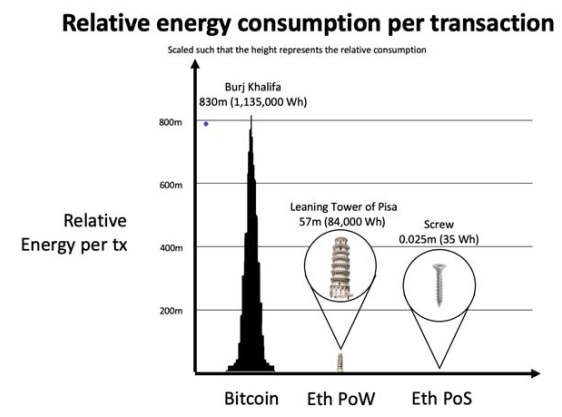

- Efficiencies in energy

Also, once the merger is accomplished, supply will become deflationary, implying that ETH will be more valuable per token because there will be fewer of them. Overall, almost everyone agrees that it’s a good thing for the network.

Beacon Chain: The Merge Fundamentals

The Ethereum merge shifts consensus from the existing PoW chain to the “Beacon Chain,” which is already operational.

The Beacon Chain’s transition to PoS consensus(the merge) is a step closer to the long-term Ethereum goal which focuses on:

- Security: Minimum of 16,384 validator nodes are required, and the system will eventually be able to run on PC-equivalent hardware.

- Sustainability :PoS consumes approximately 99 percent less energy than PoW consensus.

- Scalability: The Layer One network will be able to handle up to 100,000 transactions per second in the future, thanks to 64’shard’ chains and current scaling methods.

Understanding Staking:

The increase of staking is remarkable given that no clear date for the Merge between the new proof-of-stake (PoS) blockchain and the existing proof-of-work (PoW) chain (known as the Merge) has been set.

However, Ethereum developers announced last week that Kiln, the final testnet before the Merge, had completed the protocols required for the merge to take place.

The influx of ETH tokens into staking contracts is most likely due to investors finding the ETH staking yield appealing, especially given the poor yields observed in the traditional financial system.

Users must deposit a minimum of 32 ETH (about $90k) on Launchpad to become validators for the Beacon Chain, which excludes the vast majority of retail users. Another barrier to become a validator is liquidity: staked ETH cannot be sold until the merging.

These roadblocks have allowed firms like Lido and Rocket Pool to enter the market, allowing users who want to earn interest on their ETH but don’t want to spend it to do so.These protocols are simple and clear:

- ETH must be deposited.

- The protocol entrusts your ETH to a validator.

- You’ll get a liquid (sellable) wrapper that represents a staked ETH right.

- The ETH that has been staked earns interest.

- To increase yield, use the liquid wrapper on several DeFi protocols across the Ethereum ecosystem.

The Bear Market Comes to an End With the Triple Halvening:

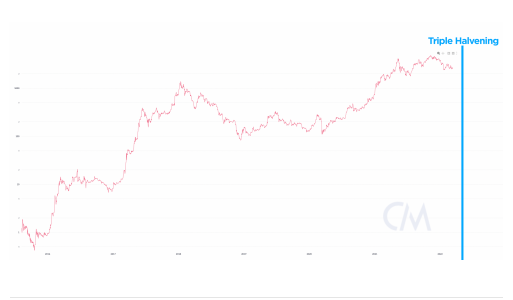

The Bitcoin halving, according to Bitcoiners, is what drives the crypto market cycles. A bull market occurs every four years, and the bull market begins at the half. As the remaining liquid supply of BTC in the secondary market dries up, the BTC production reduction lowers new supply inflows to the secondary markets, gradually manifesting a bull market. The impact of the Ethereum merger will be enormous if Bitcoin halvings are actually the source of crypto market cycles.

- The Bitcoin halving limits the supply of new BTC by 50%.

- The Ethereum merger reduces the supply of fresh ETH by 90%.

An Ethereum upgrade known as the EIP-1559, or The London Hard Fork, was executed on August 5, 2021. The hard fork was part of the greater Ethereum 2.0 transition, and its primary goal was to speed up Ethereum transactions. Here’s where you can find out everything you need to know about it.

The upgrade entails lowering the amount of ETH in circulation via a process known as burning, resulting in “deflationary pressure” on the network. Simply expressed, the increased scarcity will cause the price of ETH to rise.

The procedure is identical to the Bitcoin halving process, which occurs every four years. The effect is known as Triple Halving since it is comparable to three Bitcoin halvings.

When EIP-1559 is combined with the migration to a PoS Ethereum, the amount of ETH issued will be drastically reduced.

Because it would take three halvings of Bitcoin to generate an equivalent supply reduction, the merger has been dubbed “the triple halving.”

Bitcoin would take twelve years to achieve what Ethereum can do in three months.

The Lido Protocol:

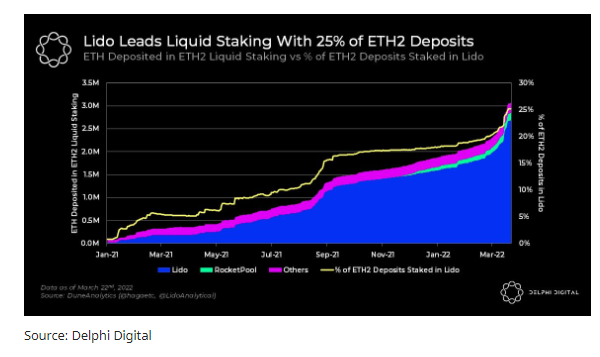

Lido is a staking deposit mechanism for stETH that performs the same duties as rETH. One of Lido’s possible benefits over Rocket Pool is the amount of ETH staked, which is north of 2.7 million vs 150 thousand for Rocket Pool. According to statistics from analytics firm Delphi Digital, Lido has remained the prevailing player among these staking providers, with the growth of ETH staked using Lido quickening in March.

Lido is still responsible for almost 25% of all ETH staked, according to the firm’s report published on Tuesday. It went on to say that the protocol had its greatest daily deposit ever last week, with ETH 197,000 deposited.

Staking on Ethereum requires a user to hold ETH 32 for at least one year in order to collect annual staking payouts, making Lido more appealing to regular users. The influx of tokens into Lido’s staking system has also resulted in a significant price increase for the network’s governance token LDO, which was trading at USD 3.58 on Thursday at 13:18 UTC, up by a whopping 111 percent in the last 30 days. Furthermore, there are more DeFi apps that employ stETH in their protocol, which allows for additional yield-boosting options, though we expect this advantage will diminish over time as more apps adopt a range of liquid ETH wrappers.

Lido functions in a similar fashion to RocketPool ETH, however incentives aren’t directly credited to the token. In the future, stETH can be used as a receipt for ETH. The method stETH works is as follows:

- Lido should be filled with ETH.

- Obtain stETH

- Lido stakes your ETH for you.

- If you keep your stETH in the protocol, it earns interest in the form of new stETH tokens.

- You can also wrap your stETH to make it work in the same way as rETH does.

The market for ETH could skyrocket in the coming days as Ethereum reduces its energy use by roughly 99 percent following the Merge. This, together with the built-in deflationary pressure, might cause prices to skyrocket.

In terms of the industry, Ethereum 2.0 will solidify the cryptocurrency’s position as the leader in DeFi and Web3, leaving little to no opportunity for competitors. For the prophecy to come true, however, a successful Merge must be accompanied by Sharding and Scalability.