Table of Contents

Key Takeaways:

- To maintain itself secure, Ethereum, like most other blockchains, relies on a dispersed network of volunteers. While the network used Bitcoin’s resource-intensive proof-of-work (PoW) methodology for transaction validation, it is currently migrating to a more efficient proof-of-stake (PoS) model, in which anybody can stake 32 ether to be a network validator and install a node.

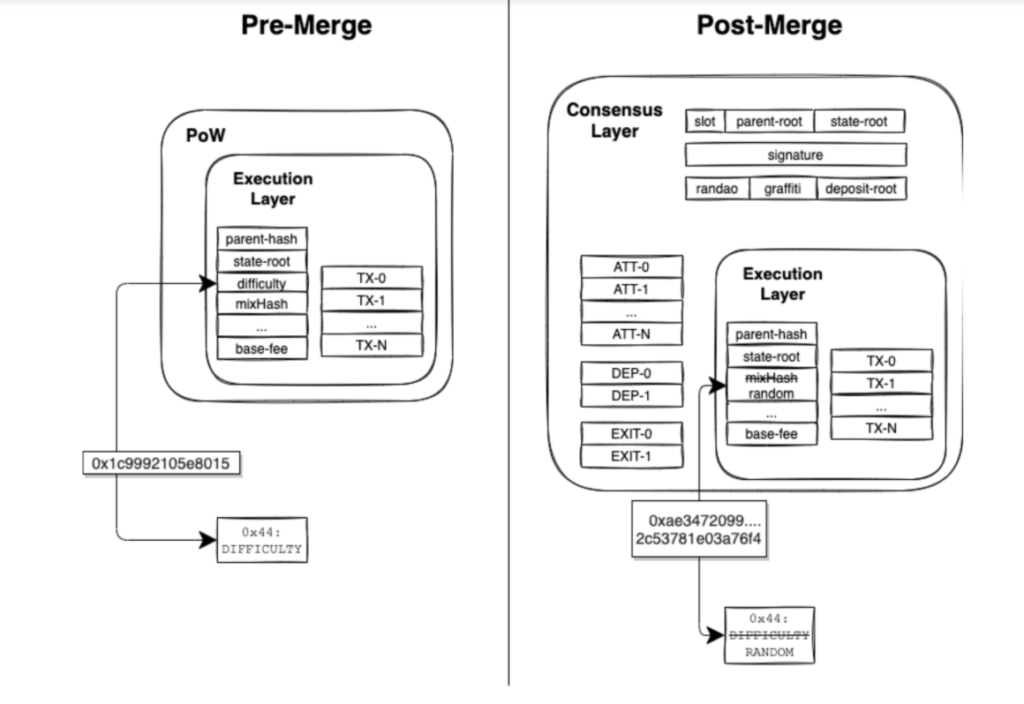

- Since the already-running beacon chain will combine with the existing Ethereum mainnet chain, the switch from PoW to PoS is known as “the Merge.” This keeps the network’s past and functionality, but it modifies the consensus process.

It’s almost unfathomable to conceive that Ethereum (ETH) may fall below $2000 right now. It will indicate that the coin is in the midst of a bear market.

As the entire upgrade to Proof-of-Stake approaches, Ethereum appears to be fully dedicated to its strategy this year. On March 10, Marius van der Wijden, one of Ethereum’s main developers, revealed that the final testnet had gone public in a blog post.

The Proof of Work consensus process is not long-term scalable or maintainable.

Proof of Stake makes network participation more accessible to a wider range of users, not only huge miners. Despite a lower ETH issuance rate and smaller block rewards, a more fair distribution of network rewards would promote good conduct and open up return to many more users.

Marius van der Wijden, a developer at the Ethereum Foundation, said: “We spun up the Kiln testnet to test ethereum’s forthcoming switch to proof-of-stake.”

Which implies we’ll get to see the merger take place, with the Proof of Work network evolving into Proof of Stake, with all the dapps, NFTs, and other services running on it, and miners being replaced by stakers to take unanimous ‘orders.’

Indeed, experts predict that it will spark widespread selling across all exchanges, perhaps driving ETH down to $1800. Furthermore, in recent days, Ethereum has demonstrated very little positive momentum. The coin is now worth roughly $2500 and has been unable to break through the $3000 barrier.

Although the transition to Ethereum 2.0 is a high-impact event that will increase ETH volatility, it is ultimately beneficial. After all, Ethereum’s primary problem has always been its network’s poor speed and expensive gas prices.

This will be fixed if Ethereum 2.0 is adopted. It means that more apps and projects will now be available on Ethereum. This will have a major influence on the chain’s continued expansion.

This should please eth investors because the cost of running the network, which they pay, will drop from around 14,000 eth per day, or $36 million, to just 1,387 eth per day, or $3.6 million.

That’s a massive 90 percent decline in fresh supply in just a few months, with Ethereum’s inflation rate plummeting to around 0.4 percent from its current rate of 4 percent. Making eth a deflationary asset with a decreasing supply due to the burning of a portion of each transaction’s fee.

Vitalik Buterin remarked Ethereum 2.0 will not be any faster. It Will, however, scale vastly.

Ethereum 2.0 will become an order of magnitude more scalable than the existing blockchain, which has been sighing for years underneath the weight of its own success. Transactions per second, or TPS, are commonly used in the payments sector to describe speed. However, in the blockchain world, “scalability” is the phrase used to refer to TPS. The term “speed” refers to something altogether different: block time. Buterin was talking about how quickly new blocks of transactions are added to the Ethereum blockchain when he mentioned “the restrictions on making block time faster” in a recent Reddit discussion forum, which he later reposted on Twitter. And this is a security issue rather than a scalability issue.

The proof-of-stake consensus mechanism in Ethereum 2.0 “attempts to provide blocks to a very high level of confirmation [indicating agreement on validity], which necessitates thousands of signatures… This procedure is time-consuming and incurs delay.”

Sharding, or the creation of new side chains that run in parallel with the main blockchain and distribute the burden, is how Ethereum 2.0 will get around the trilemma. This allows it to process many more transactions without lowering the number of nodes or speeding up the security verification process.

What’s the gap between Proof-of-Work and Proof-of-Stake?

Bitcoin was the first to use the Proof-of-Work (POW) consensus algorithm. Miners must solve challenging cryptographic issues in order to update the blockchain and add new blocks of transactions, which is a high computational process. The more processing capacity you have, the better your chances of solving issues rapidly, because finding answers becomes easier.

Proof-of-stake is a consensus algorithm in which players must stake a certain amount of money in order to participate and validate transactions. Ethereum is the most well-known example of this sort of cryptocurrency, as it features an incentive structure called “Ethereum Foundation Grants,” which rewards those who are chosen as validators with grants.

The distinction:

Miners in a POW system employ computer power and energy to solve challenging challenges, and when they do, they are rewarded with new currencies or tokens. The higher the likelihood of discovering an answer at any given moment, the more computer power utilised to try to solve the problem. This means that somebody will always be more probable than other users to find the answer first, lowering security because anyone may check transactions without access to specialist software or hardware.

A POS system only gives new coins or tokens to node operators once they confirm each transaction on their own node. Because no single answer can be identified first, all nodes on the network will be similarly secure as long as each operator confirms their own transactions. Because nodes are verified before transactions are validated on all nodes on the network, there is less mining competition because miners have no edge over others in finding solutions. This also increases security because nodes are authenticated before transfers are validated on all nodes on the network.

Threat of Attack: Proof of Stake vs. Proof of Work

Proof of work protects against attacks by forcing miners to compete for resources in order to solve cryptographic equations faster and verify each blockchain block. It is dependent on miners acting in good faith and adhering to consensus norms.

A majority attack is a significant threat in proof of work networks. When a faction takes control of more than half of the mining power, they can prevent transactions from being validated, spend coins twice, and fork the blockchain, making rival copies of the blockchain appear valid.

To protect the system from prospective hackers, Proof of Work relies on the cost of electricity it consumes. Proof of Stake, on the other hand, is based on direct economic incentives. The scalability difficulty and energy consumption are noteworthy differences.

Bitcoin’s Proof-of-Work consensus only allows for five transactions per second. A single Bitcoin transaction can consume over 750 kWh of electricity. Ethereum, on the other hand, can process fifteen transactions per second while using about 60 kWh of electricity. As a consequence, networks that depend on PoW have had to hike their gas fees.

Technocrats, on the other hand, have an unique view on the security concerns raised by PoS and PoW. Proof of Work is harder to execute and requires more computing power. As a result, it is less vulnerable to spam and fraud.