TrendX is an AI-powered Web3 platform that helps you find what’s starting to trend (tokens, themes, wallets) and trade it in the same interface. Think of it as a scanner + trading terminal: it listens to on-chain data and social signals, uses AI to highlight opportunities, then lets you place trades via its built-in DEX pages. In this article, we will review TrendX and explore what it offers to its users.

Table of Contents

What is TrendX?

TrendX is an AI-powered Web3 radar + trading terminal. It ingests large amounts of on-chain and off-chain data, applies AI, then surfaces what’s heating up (tokens, themes, wallets/KOLs) so you can act inside the same interface via its DEX trading pages. In short: discovery and execution under one roof.

For beginners and pros: New users get a guided trading flow; advanced users get deeper modules (Smart Money, Alpha Square) to build signals and strategies.

How TrendX Works?

- Data intake & AI: TrendX pulls real-time on-chain and social/data signals and applies AI to rank themes, tokens, and wallets (e.g., “smart money,” KOL/“influencer” flows, sentiment indicators).

- Surfacing opportunities: You browse modules like KOL Square, Alpha Square, Smart Money, and Project Search to find what’s trending.

- Trade in-app: Use the One-Click DEX (and Exchange sub-modules like Speed DEX, Pro DEX, Flash Trade) to place market or limit orders, set TP/SL, anti-MEV, and custom slippage.

- Automate/scale: TrendX also runs Owlbot, a distributed computing network that powers AI workloads and has its own miner client and reward system. (Optional, more advanced.)

TrendX : Products & Features

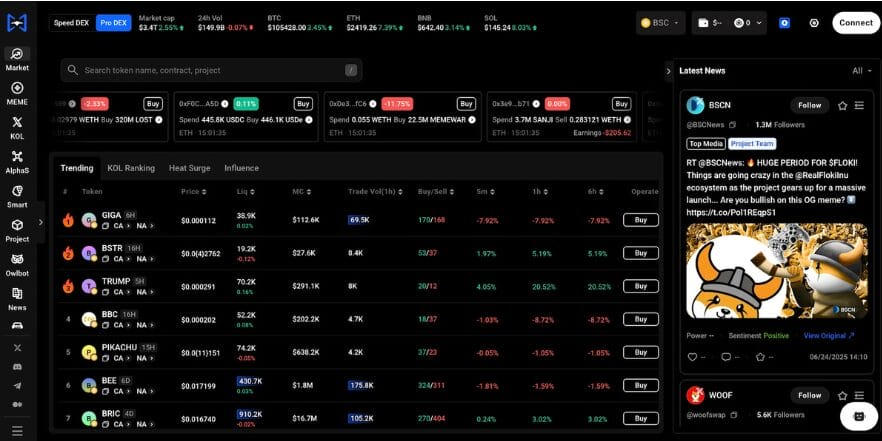

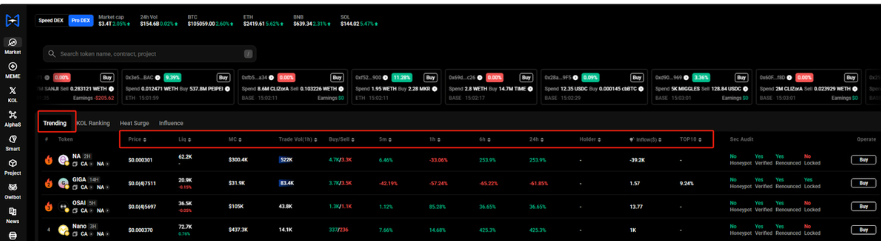

One-Click DEX (Speed / Pro / Flash)

One-Click DEX is TrendX’s built-in trading flow that lets you go from idea to executed trade in one step—without moving funds to an exchange or switching tabs.

What it does

- Instant execution: Place trades quickly from the same page where you discover tokens.

- Self-custody: You keep your private keys; funds stay in your wallet (no exchange custody).

- Multi-chain in one place: Trade assets across supported chains without hopping between apps.

- Controllable slippage: Set a maximum price movement you’ll accept to avoid bad fills.

- Low friction: No manual routing or extra approvals every time.

- Combines AI signals (trending tokens, sentiment) and Smart Money tracking so you can mirror whale activity or react to trends immediately.

- Collapses the full loop—discover → order → execute—into a single, streamlined action.

How a beginner uses it

- Spot a token in KOL/Smart Money/Alpha screens.

- Click Trade → set size, slippage, and (where available) anti-MEV.

- Confirm the market or limit order; your wallet signs the transaction.

- Optionally add Take-Profit/Stop-Loss so exits happen automatically.

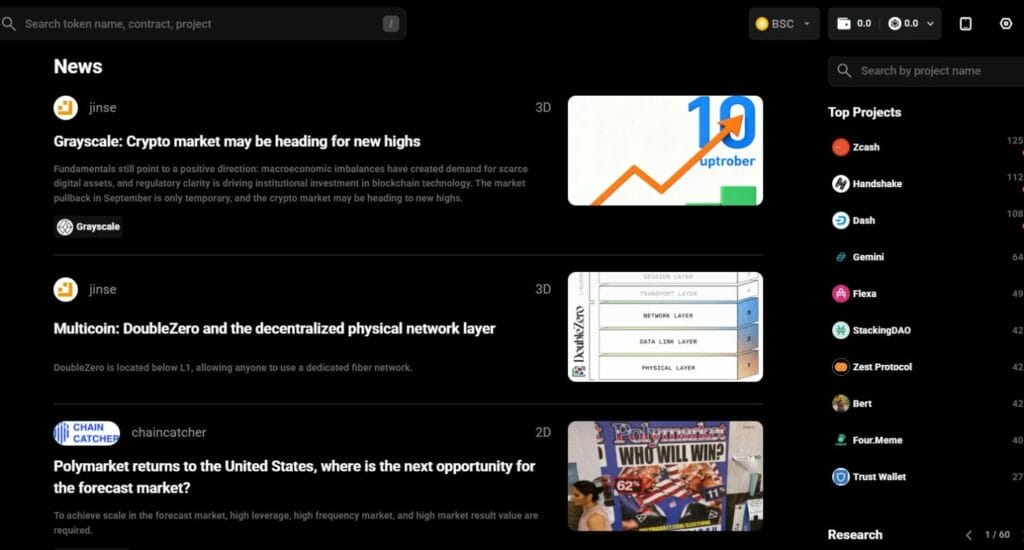

News Hub (Market News & Research)

- Curated crypto/Web3 headlines and platform research summaries so you don’t need separate news tabs. Great for keeping context while you trade.

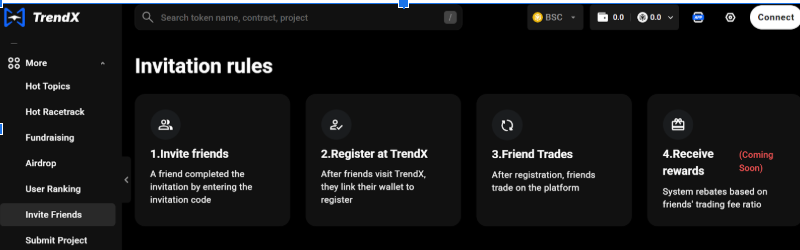

Earn / Invitation (Referrals & Points)

- Invite friends via your link, earn points/rebates as they join and use the platform. Terms can change, so always check the current in-app rules.

Owlbot (AI Layer) & Owlbot Academy

- Owlbot Mining is TrendX’s plan to power its own AI models for Web3 using a global, shared computer network. With Owlbot, TrendX users can contribute some of their device’s computing power (optional).

- This crowdsourced power, combined with TrendX’s large Web3 database and tools, cuts AI costs and speeds things up. As more people join, the AI becomes more available, more accurate, and easier to scale.

- The goal is to keep improving efficiency and size so TrendX can push new ideas in Web3 and AI faster than traditional setups.

- Owlbot allows you to earn substantial $XTTA rewards as it makes the mining process really user friendly and high rewards to Owlbot holders.

- Owlbot Academy offers bite-size explainers, setup guides (including any miner/compute clients if you choose to participate), and best practices—handy for true beginners.

Alpha Square (Build Your Strategy)

- Alpha Square is TrendX’s idea engine. It scans the market in real time with a multi-factor model (price/volume action, smart-money flows, KOL sentiment, etc.) to spot high-potential tokens and push them to you instantly. Every pick comes with factor scores and the reasoning behind it, so you can see why it was flagged—transparent and traceable.

What makes it useful:

- Personalized strategies: Build your own rule set using Smart Money and KOL signals instead of generic alerts.

- Full customization: Name the strategy, choose target wallets/addresses, pick tokens, set triggers (e.g., wallet buys, volume spike, sentiment shift), and select notifications (so you don’t miss moments).

- Real-time, one-click action: When conditions hit, you get an alert and can move straight to execution.

How a beginner might use it:

- Start with a simple strategy (e.g., “Alert me if smart-money wallets buy Token X + 24h volume up 50%”).

- Turn on notifications and review the factor scores when an alert fires.

- If it checks out, place a small trade and set TP/SL; refine your triggers over time.

Alpha Square turns TrendX’s data into clear, customizable signals you can trust and act on quickly—without hunting across five tools. Always double-check liquidity and risk before entering.

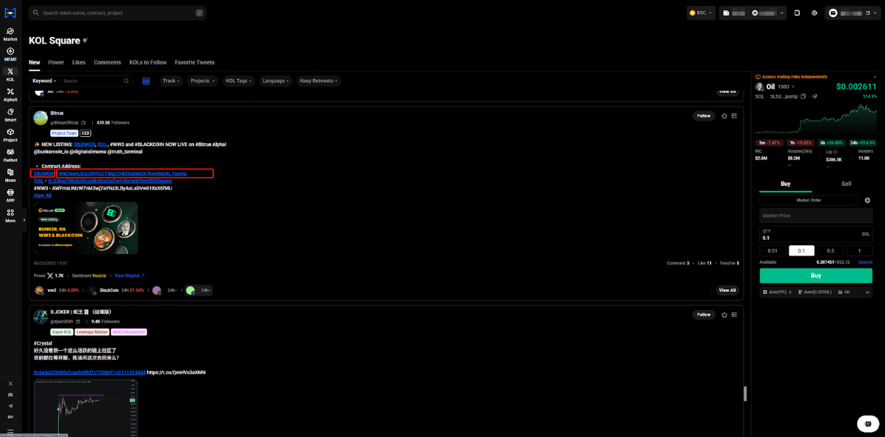

KOL Square

- KOL Square is TrendX’s hub for tracking what influential voices (“Key Opinion Leaders”) are saying about crypto projects—and turning that insight into trades.

- It connects to 50,000+ KOLs, analyzes their posts with TrendX’s algorithms to gauge sentiment and investment trends, and then highlights trending tokens you can filter and act on with one-click execution.

- You can tailor the feed across 80 sectors, 15 KOL tags, and 7 major languages, so it matches your interests and region.

- In short: it’s a KOL-driven radar that helps you spot narratives early and trade them quickly—just remember to verify liquidity and risk before entering.

How a beginner might use it:

- Open the report for a token on your watchlist.

- Confirm sentiment is improving, KOLs are active, and smart money isn’t dumping.

- Ensure liquidity/volume look healthy to avoid slippage.

- If it clears those points, place a small test trade and set TP/SL.

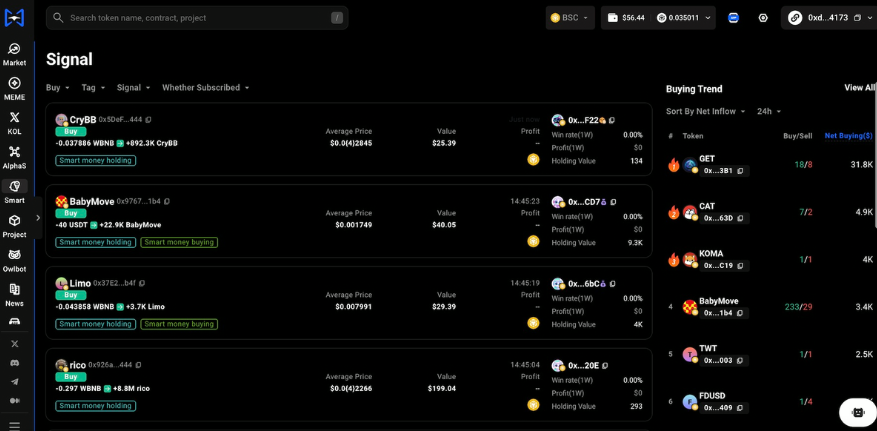

Smart Money (Wallet/Whale Tracking)

Smart Money is TrendX’s radar for high-performing wallets (whales, funds, consistently profitable traders). It lets you track their buys/sells in real time, filter for quality, and turn signals into trades.

What it does

- Wallet tracking: Monitors selected whale/institutional addresses across supported chains.

- Real-time signals: Alerts on buy/sell activity, sized moves, and timing.

- Quality filters: Screen by liquidity, holders, token age, top-holder ratio, and blacklist rules.

- Risk guardrails: Exclude risky contracts (e.g., modifiable fees, mintable supply, non-renounced ownership).

- Direct to trade: Jump from an alert to One-Click DEX for execution.

- Signal precision: Focuses on wallets with proven track records, not generic hype.

- Fully customizable: Choose networks, addresses, triggers, token requirements, and risk exclusions.

- Actionable flow: Collapses observe → validate → execute into a single, streamlined path.

How a beginner uses it

- Open AI Strategy → Create New Strategy → Smart Money Strategy; name it (e.g., Smart_Whale1).

- Select the Network (e.g., BSC, SOL) and paste whale addresses (semicolon-separated).

- Choose Buy/Sell triggers and enable Filter Non-Proactive to ignore airdrops/unlocks.

- Add Trigger Conditions (up to 3) and Token Requirements (up to 6) to reduce noise.

- Set Risk Exclusions (up to 12) for contract safety; pick App Push/Telegram alerts.

- Click Complete, then act on signals with small size, conservative slippage, anti-MEV (where supported), and TP/SL.

Meme/Hot Pairs Tracking

- Shows new/trending tokens (esp. memecoins) in real time with filters and short time windows (1m/5m/30m/1h).

- Displays core data—price, volume, holders, liquidity, market cap—plus color-coded moves.

- Adds safety checks (Pixiu, open-source, mint status, locked liquidity) and one-click trade access.

- Helps you spot early momentum on fresh pairs.

- Puts charts, on-chain trades, and Smart Money (last 2h) in one panel.

- Layers KOL/X sentiment so you can confirm social buzz before acting.

How a beginner uses it

- Pick a time window and apply filters → check safety indicators.

- Confirm liquidity/volume and review Smart Money + KOL signals.

- Click Trade → choose market/limit, set size, TP/SL, and keep slippage conservative.

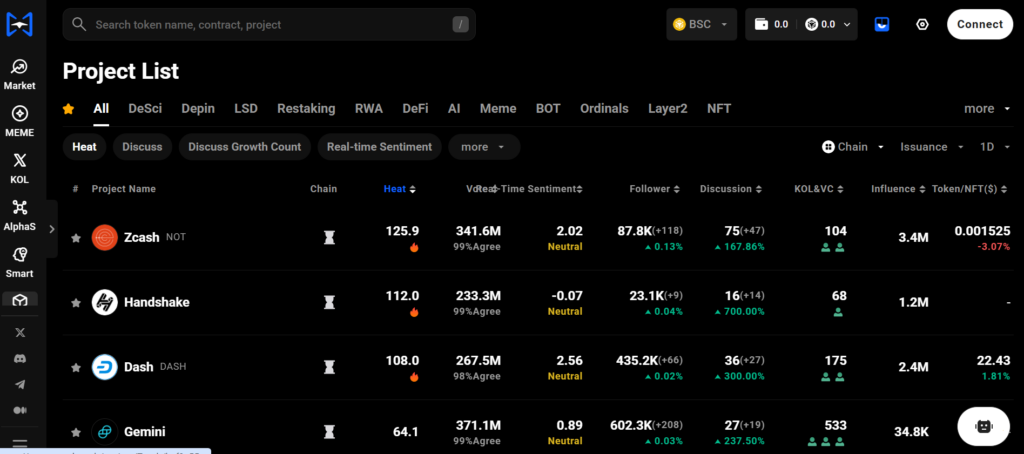

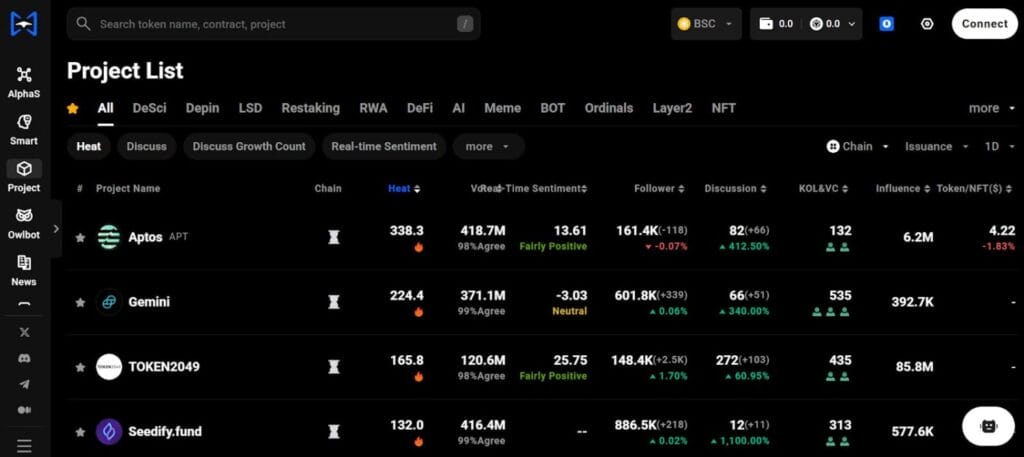

Project & NFT Search

- Broader discovery beyond the tokens you already know—handy for research and watchlist building.

VIP / Advanced Tiers

- TrendX VIP is a tiered membership unlocking 28 advanced AI tools. Qualify by holding and staking $TTA—the more you stake, the higher your VIP level (LV1–LV4) and the more features you get.

What you get by tier:

- LV1: Smart-money live feed (30k+ wallets), AI Hot Topics, 50k+ KOL stream, Project/Token encyclopedias, and full project reports.

- LV2: Smart-money rankings, Popular Airdrops, Hot News heat, AI assistant, Market Influence scores, 2 Alpha strategy subs, holdings lists.

- LV3: Smart-money address database + dynamic reports, KOL Prediction Master, category/track filters, 4 Alpha strategies.

- LV4: Super Smart Money, custom retrieval tools, all Alpha strategies, exclusive strategies, and X Points for LaunchPad whitelists.

AI & Analytics

- TrendX LLM + Sentiment Indicators: Proprietary language models and real-time sentiment from diverse sources help compress noise into digestible insights.

- Project Activity Reports:

TrendX’s Project Activity Reports are bite-size, one-page intelligence sheets for any token or project. They pull key signals into one view so you can decide faster:

- AI sentiment graphs: shows whether recent chatter/news skews bullish, neutral, or bearish—and how it’s changing.

- KOL analytics: tracks what influential accounts are saying and how much attention those posts get.

- Smart-money holdings: highlights if high-performing wallets are buying, holding, or exiting.

- Liquidity & volume: checks how easy it is to trade (depth) and how active the market is.

- Media/user signals: summarizes headlines, community buzz, and notable mentions.

Why it’s useful: Instead of opening five tools, you get a single snapshot to gauge momentum, risk, and tradeability—then jump straight to an order screen if it passes your checks.

How a beginner might use it:

- Open the report for a token on your watchlist.

- Confirm sentiment is improving, KOLs are active, and smart money isn’t dumping.

- Ensure liquidity/volume look healthy to avoid slippage.

- If it clears those points, place a small test trade and set TP/SL.

TrendX : User Interface & Experience

- Idea →This platform allows you to trade in one place. You don’t need separate scanners and DEX tabs; Speed DEX guides you through settings → preview → confirm.

- Beginner-friendly controls: Ensure that you set the slippage (price cushion), choose gas priority (speed vs cost), and toggle anti-MEV (front-run protection, where supported). Attach take-profit/stop-loss at entry so exits trigger automatically—you don’t babysit charts during volatile moves. Start with conservative defaults.

- Clarity and feedback: The trade preview shows what you’ll pay and your risk controls; status updates show submitted → pending → confirmed (or failed) with plain hints on what to adjust next.

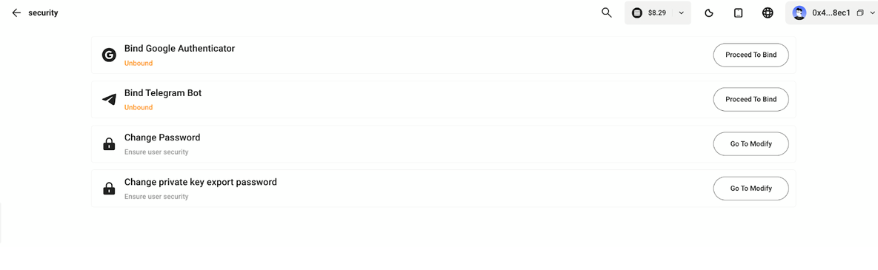

TrendX : Security & Trust

- Transaction-level protections: Anti-MEV routing (where available) can reduce front-running risk; custom slippage caps how much price can move against you.

- Account hygiene: Use a unique, strong password; enable 2FA where provided; always access the app via official links to avoid phishing.

- Back up Google Auth: When binding Google Authenticator, save the backup/secret key (or QR) offline so you can recover if you lose your phone. Binding can’t be undone.

- Reality check: On-chain trading is risky. Smart contracts can have bugs; volatile tokens can move fast. Always start small and verify token safety cues (liquidity, holders, suspicious permissions).

- MEV Protection: activate the MEV protection toggle and protect your account from sandwich attacks and display a real time protection status.

- slippage: conservative slippage setting on thin liquidity; use Limit orders when speed isn’t critical.

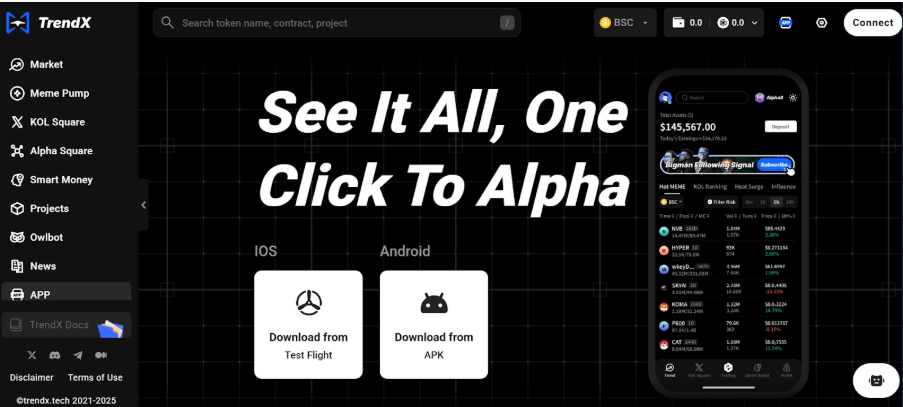

TrendX : Mobile App

- Web app on phone: TrendX runs in your mobile browser; no need for a separate app store download which is available for both iOS and Android devices.

- Tip: Create conservative defaults on mobile (lower slippage, clear TP/SL) so you don’t fat-finger trades on the go.

- The platform provides the QR code for the user to directly download the web app on your respective iOS and Android devices.

TrendX : Rewards & Referral

- Invite to earn: Share your link; invitees may get perks, and you may earn points/rebates based on activity.

- Airdrops / tasks (if active: check the current status in-app or in announcements): Watch the announcements and News hub for time-limited reward tasks or allocation rules.

- Tokens (if applicable): If the platform has ecosystem tokens for rewards/governance, read the in-app pages carefully before participating.

TrendX : Customer Support & Learning

- Docs / Guides: Walk-throughs for Speed DEX, order types, TP/SL, anti-MEV, and safety settings—great for self-serve learning.

- Official communities: Use the official links page to find the correct Discord/Telegram/X. Avoid impostors by bookmarking the real link hub.

- Owlbot Academy: Short explainers, setup guides (including Owlbot miner/compute), and best practices for new users can be explored by users in the Owlbot Academy.

TrendX : Pricing & Fees

When you trade on TrendX, your total cost usually comes from three places:

(a) Blockchain gas

- Paid to the network (validators/sequencers), not to TrendX.

- How much? Variable and usually shown as a fixed amount in the chain’s native coin (e.g., SOL/ETH/BNB). On low-fee chains it can be pennies; on busy Ethereum it can be dollars. Gas depends on congestion and your gas priority choice.

(b) Slippage / price impact

- This is market movement, not a fee to TrendX.

- You set a slippage % (e.g., 0.5–2% for liquid pairs; more for thin pools). If the price drifts within your limit, you’ll effectively “pay” that difference. If it moves beyond your limit, the trade fails to protect you.

(c) Any platform/trading fee

- This is the app/route fee for using the trading flow and/or underlying liquidity.

- There isn’t a single posted % that applies to every chain/route. The best practice is to place a tiny test trade and read the in-app breakdown to learn your route’s actual fee on your chain.

Quick, illustrative example (not a quote)

- Trade size: $100 on a fairly liquid pair

- Gas: ~$0.01–$0.20 (chain-dependent)

- Slippage: set 1%; execution consumes 0.4%

- Platform/route fee: assume ~0.30% (example only—check your route)

- Estimated total impact: gas (~cents) + 0.40% (slippage) + 0.30% (fee) ≈ ~0.70% + gas

On Ethereum at peak times, gas might be $1–$5+, so always test first.

How to Get Started?

- Open TrendX from official links (bookmark it to avoid phishing).

- Create an account and enable 2FA if available.

- Go to Exchange → Speed DEX and set slippage, gas priority, and anti-MEV (start conservative).

- Fund your wallet with a small amount of native gas and trading capital.

- Place a tiny trade (Market or Limit) to learn your real gas/fee/slippage profile.

- Add TP/SL on the next trade so exits are automatic.

- Explore KOL Square / Alpha Square / Smart Money / Meme and the News hub; save what works to your routine.

- If you like it, share your referral link to join any active Earn/Invite program.

Conclusion

TrendX is a strong “learn it and trade it here” platform for new users who want a simple path from idea to execution. The News hub, Alpha, KOL, Smart Money discovery, and Meme tracking feed directly into Speed/Pro DEX, where you can set slippage, anti-MEV, and TP/SL in one place. Rewards,referrals and learning resources (Owlbot Academy) round out the experience.

Start with tiny trades to learn your real costs (gas + any route fee + slippage). Use conservative settings, attach exits, and scale only after you’re consistent. If you like having discovery and trading under one roof—without juggling five tabs—TrendX is well worth a trial run.

Do I need KYC? Are there regional or age limits?

Browsing usually doesn’t require KYC. On-chain trading via your wallet typically doesn’t either, but some regions/features may. Check in-app terms; you must be legally allowed to trade crypto in your jurisdiction.

Which wallets (and hardware wallets) are supported?

Common EVM/Solana wallets (e.g., MetaMask, Phantom) are typically supported. Hardware wallets (Ledger/Trezor) often work via those wallet apps. Verify current support on TrendX’s official links/docs.

Is there a minimum trade size or rate limits?

Minimums are chain/pool dependent (very small trades can fail due to gas/slippage). Rate limits, if any, are noted in-app. Do tiny test trades first.