Are you thinking about buying Bitcoin?

If yes, you are not alone.

According to various reports, around 46 million people in the United States alone own Bitcoin or shares of it. However buying Bitcoin is easier than ever, there’s no reason to not jump into the market.

There are several questions that come to the mind of people who are buying Bitcoin for the first time.

Is it safe?

How can I buy Bitcoin for cheap?

How to store bitcoins?

These are just some of the many questions that we will address today.

There are numerous variables involved in the purchase of Bitcoin. For example, which marketplace you choose plays an important role in securing your purchase. There are several other factors that you need to take care of when buying Bitcoin for the first time.

Table of Contents

How to purchase bitcoin and choose the best wallet?

In the initial segments, we will talk about buying bitcoin safely from reputed sources. Then we will get into crypto wallets and why they are an important component in the process of crypto investment.

Finally, we will look into the future of Bitcoin investment at large. Without further ado, let’s dive right in. You can have more insights in our article about the best crypto wallets.

Different ways to buy bitcoin

There are multiple ways to buy bitcoin on Moonpay, but chances are, you are most familiar with cryptocurrency exchanges.

To be more specific, most people are now familiar with centralized cryptocurrency exchanges. While crypto exchanges are the most popular option for buying cryptocurrencies, they are not the only ones.

One of the best things about bitcoin is that you do not need an intermediary to buy or sell it. If you have a friend who owns bitcoin and is in need of cash, you can initiate a direct transaction with them.

Similarly, there are P2P marketplaces where buyers are matched with sellers. You can now buy Bitcoin even from payment providers like PayPal.

With so many options to choose from, first-time buyers can often get confused. For most people, centralized and decentralized crypto exchanges remain the most popular medium for buying cryptocurrencies.

Why cryptocurrency exchanges are the most popular way to buy crypto?

There are a couple of reasons behind the growing popularity of cryptocurrency exchanges. First, crypto exchanges offer unmatched convenience to their users.

When it comes to pairing buyers with sellers, exchanges generally do not have any wait time. You can simply log into your account and buy Bitcoin with your credit card or another payment method. The entire process does not take more than a few minutes.

The convenience and ease of transactions make cryptocurrency exchanges the most popular choice for buying cryptocurrency. They also protect people from scams to a large extent.

Stay away from suspicious sellers!

The world of cryptocurrencies is replete with scams, frauds, Ponzi schemes, and all sorts of unethical ways of getting money from someone.

If you are buying bitcoin for the first time, you should stick to the recognized and authorized methods only.

First, go for cryptocurrency exchanges that are known and popular. Coinbase, Kraken, Crypto.com, Binance, Moonpay – there are multiple options to choose from. No matter what you do, do not go for an exchange about which you haven’t heard before.

Cryptocurrency scams have increased by 516% in 2021. If you are not careful, the chances of getting scammed are very high.

As a rule of the thumb, do not transact with any person or entity about which you are not sure. You should also be aware of the current price of Bitcoin before buying it. Lower than normal prices are always a red signal.

Problem with peer-to-peer transactions

Buying bitcoins directly from another person is one of the oldest ways of buying bitcoin. While it’s a safe option if you know and trusts the person you are buying from, in every other case, this is extremely risky. Even if you are using a platform that matches buyers with sellers, it can also be risky if there is no intermediary authority.

When you do not know anything about the person at the other end of the transaction, getting scammed is very easy. That’s one of the reasons centralized crypto exchanges have become popular.

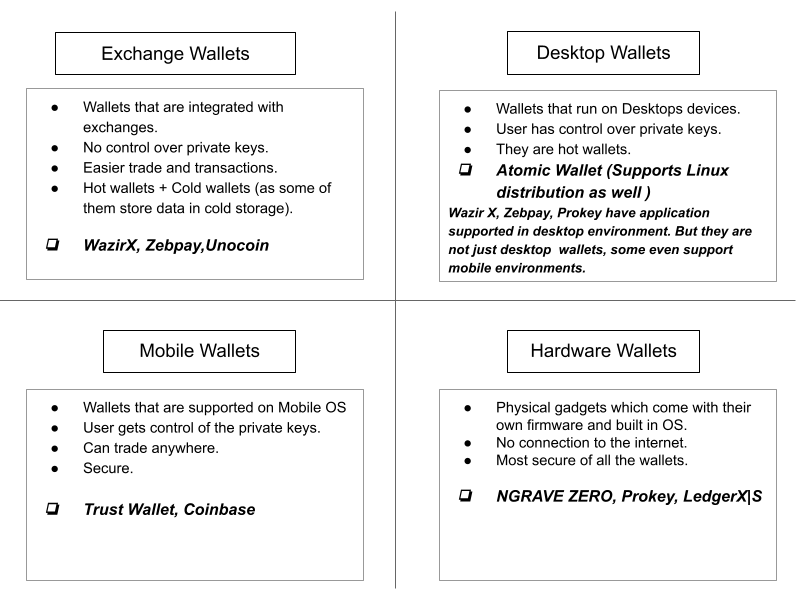

Cryptocurrency wallets

Buying crypto is one thing, storing it is a completely different thing. Just like you would not withdraw cash from an ATM and keep it anywhere, you should not store cryptocurrencies in insecure places.

But what counts as insecure when it comes to storing crypto?

To understand that, we have to first understand the difference between custodial wallets and non-custodial wallets. Even before that, you need to understand what cryptocurrency wallets are in the first place.

Let’s start with understanding what cryptocurrency wallets are.

What are cryptocurrency wallets?

You can think of cryptocurrency wallets as normal wallets where you store cash. Instead of cash, you store your digital coins in the crypto wallet. It’s the fundamental storage medium for all cryptocurrencies, Bitcoin or otherwise.

Now if you keep your cash in a bank savings account, you don’t really own the money. Instead, you own a promise of having access to that money. The banks, on the other end, can use your money to extend loans. Similar things happen in the crypto space as well, and that brings us to the difference between custodial wallets and non-custodial wallets.

Custodial wallets vs non-custodial wallets

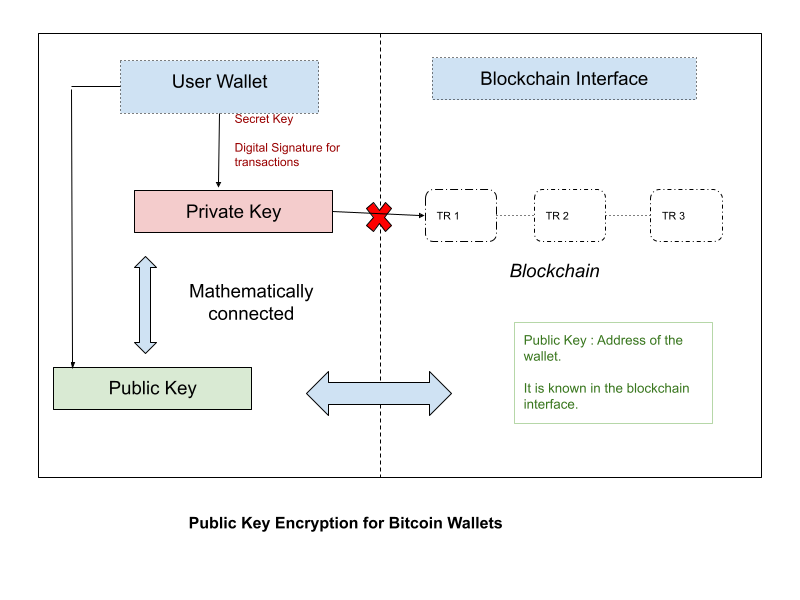

There’s a saying in the crypto community that as long as you own your keys, you own your crypto. The moment you do not own your keys, you are essentially not in possession of your cryptocurrencies.

Every crypto wallet has a unique key. You can think of it as a physical key in the form of an alphanumeric series. In the case of custodial wallets, you do not have access to your wallet keys. Instead, the cryptocurrency exchange from where you buy your cryptocurrencies stores them for you. They also hold the key to your cryptocurrencies. It is comparable to storing your money in a bank. While the money is assigned to you in your account, you do not own it. The bank owns your money just like centralized crypto exchanges own your digital coins.

Non-custodial wallets refer to those wallets that give you complete freedom to access your digital coins. They give you access to your wallet key. Among more serious bitcoin traders and investors, non-custodial wallets are the only choice.

There are several reasons behind it, and if you are starting your crypto journey, you should also try to start it with a non-custodial wallet. However, many people like the convenience of a custodial wallet. As long as you are dealing with a reputed cryptocurrency exchange, you are relatively safe.

To learn more you can read our article on different types of crypto wallets.

Why non-custodial wallets are a safer choice?

In several past incidents, cryptocurrency exchanges have faced cyberattacks and lost millions of dollars worth of crypto.

Crypto.com is among the latest victims of a large-scale cyberattack. When you are leaving your cryptocurrencies with an exchange, you always run the risk of losing them to hacks. However, most leading crypto exchanges now have insurance against cyberattacks. That is how Crypto.com managed to prevent losses for its users.

When you use a non-custodial wallet, these risks are essentially nil. Only you own your secret key, and in most cases, hackers do not target individual wallets. Even if they do, non-custodial wallets give you an option to be immune. To do that, you have to choose a cold wallet instead of a hot wallet. Here’s what it means.

Cold wallets vs hot wallets

To put it in simple words, hot wallets are connected to the internet at all times while cold wallets aren’t. There’s another way of looking at them. Hot wallets are software wallets, while cold wallets are hardware wallets. That means when you buy a cold wallet, you get a physical wallet in your hand.

When you connect this to your computer, it is also connected to the internet. When you disconnect it, it’s no longer connected to the world wide web. Since something that is not on the internet cannot face cyberattacks, cold wallets are the safest way to store your digital coins.

Hot wallets are also safe, but not as much as cold wallets. But we also need to keep in mind another consideration. Losing a physical wallet is more common than we think.

There are stories and legends where people have lost millions of dollars simply because they misplaced their cold wallet or forgot its key. With hot wallets, the chances of this happening are significantly lesser. Accessing hot wallets is also more convenient.

To sum it up, custodial and hot wallets are more convenient, while non-custodial and cold wallets are more secure.

Conclusion

We hope this guide clarifies some of the most pertinent questions related to buying bitcoin and storing them safely. Keep in mind that safety is of utmost importance whenever you are buying bitcoin or any other cryptocurrency. Consistent bitcoin investments while Dollar Cost Averaging is a great way to build wealth in the long term.

![How To Buy Bitcoin On Wazirx? [ Also Works On Mobile ] 6 Buy Bitcoin On Wazirx](https://coincodecap.com/wp-content/uploads/2021/03/Buy-Bitcoin-on-WazirX-768x432.png)