As per a 2022 cryptocurrency crime report, crypto thieves made off like bandits as digital assets grew in prominence.

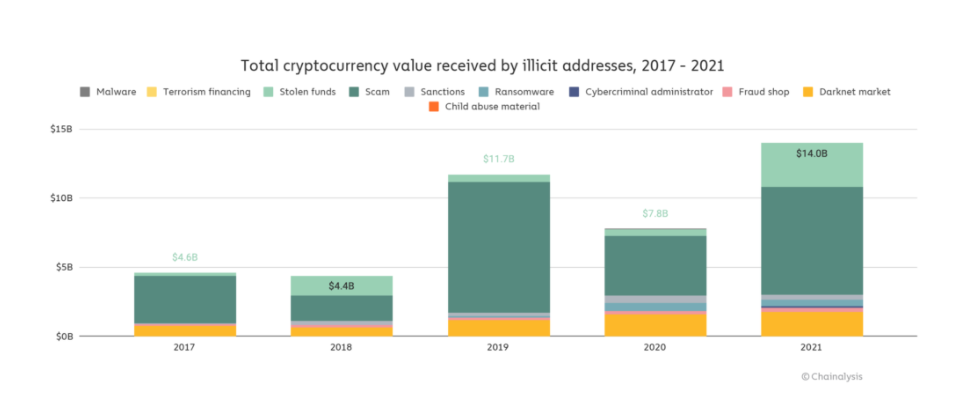

According to blockchain analytics firm Chainalysis, illegal transactions increased by about 80% to US$14 billion (RM58 billion) in 2021, an all-time high. However, the total amount of transactions increased by 567%, indicating that lawful transactions outperformed criminal activity. Nonetheless, the data reveal that unlawful activity tracks major development categories in cryptos, such as decentralised finance or DeFi initiatives.

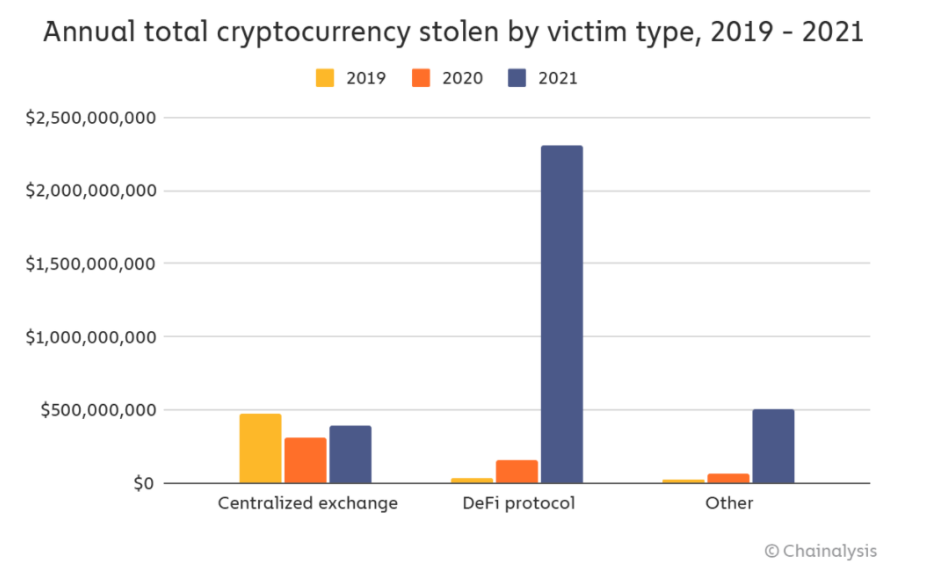

Illicit activity increased the most in DeFi year over year. Around $162 million in cryptocurrencies was stolen through DeFi platforms in 2020. In 2019, the total amount of money from DeFi platforms increased by 335%. According to Chainalysis research, that number will have increased by 1,330% by 2021.

Rug pulls are often used in DeFi for two reasons. One is the burgeoning interest in the area. The fantastic profits on decentralised tokens have many people enthusiastic about betting on DeFi coins, which has seen a 912% increase in transaction volume in 2021. Simultaneously, anyone with the necessary technical expertise can easily manufacture new DeFi coins and publish them on exchanges, even without a code audit.

A code audit is a process in which a third-party firm or listing exchange examines the code of the smart contract that underpins a new token or other DeFi project and publicly certifies that the contract’s governance rules are unbreakable and that no mechanisms exist that would allow the developers to steal funds from investors. Numerous investors could have prevented losing money due to rug pulls if they had only invested in DeFi companies that had gone through a code audit – or if DEXes mandated code audits before listing tokens.

Cryptocurrencies theft increased even more in 2021, with nearly $3.2 billion worth of cryptocurrency stolen, up 516% from 2020. DeFi procedures were responsible for almost $2.3 billion of the monies, or 72% of 2021.

According to Blockchain analytics company Chainalysis, darknet market funds come in second with $448 million, followed by scams with $192 million, fraud shops with $66 million, and ransomware with $30 million.

Balances in the criminal justice system fluctuated throughout the year, ranging from $6.6 billion in July to $14.8 billion in October.

According to the study, the fluctuations serve as a reminder of the need for haste in cryptocurrency investigations since illegal money that has been effectively identified on the Blockchain can be liquidated rapidly.

Scamming revenue has risen to approximately $7.8 billion in bitcoin. Rug pulls contributed $2.8 billion to the total. Rug pulling is a new scam in which developers create a legitimate-looking cryptocurrency project to attract investors, then take their money and vanish. Around 90% of the overall scam value lost through rug pulls in 2021 is attributed to Turkish crypto company Thodex, which suspended consumers’ ability to withdraw payments and then vanished. Due to the US Department of Justice’s $3.6 billion seizure of Bitcoin stolen in the 2016 Bitfinex hack, there was a significant decline in criminal balances in February this year.

“Following that seizure, criminal balances currently stand at roughly $5 billion as of February 9, 2022”, as shown in the report.

Overall, Chainalysis has discovered 4,068 criminal whales that own almost $25 billion in cryptocurrencies.

According to the research, criminal whales account for 3.7% of all cryptocurrency whales, referring to private wallets containing more than $1 million in cryptocurrency.

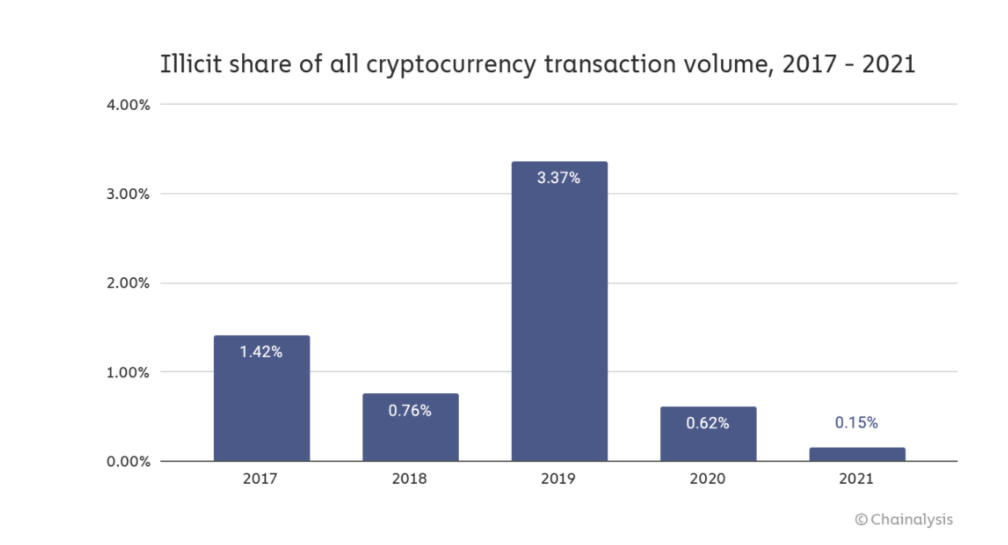

According to the research, the numbers do not tell the whole story. It’s no surprise that more thieves embrace cryptocurrencies, with global transaction volume reaching $15.8 trillion in 2021. The rise of real cryptocurrency continues to outstrip that of criminal cryptocurrency.

Another encouraging aspect is law enforcement’s increasing capacity to seize illegally obtained bitcoin. According to the study, the IRS Criminal Investigations seized approximately $3.5 billion in bitcoin in November 2021. In addition, other law enforcement authorities worldwide have also made significant arrests.

1,333 criminal whales received anywhere from 25% to 90% of all monies sent to illegal addresses.

According to the research, illicit monies received by criminal whales originate from a broader range of sources than funds that make up aggregate criminal balances.

Russia, South Africa, Saudi Arabia, and Iran have the most criminal whales.

Crypto Crime Trends for 2022: Illicit Transaction Activity Reaches All-Time High in Value

In 2021, cryptocurrency-related crime reached a new high, with unlawful addresses receiving $14 billion in the year, up from $7.8 billion in 2020. Cryptocurrency adoption is increasing at a faster rate than ever before. Total transaction volume across all cryptocurrencies tracked by Chainalysis climbed to $15.8 trillion in 2021, up 567% from totals in 2020. Given its rapid adoption, it’s no surprise that more fraudsters are utilising cryptocurrency. However, the fact that the growth was just 79% — nearly an order of magnitude smaller than overall adoption — may be the most surprising factor of all.

In addition, with legitimate bitcoin usage significantly surpassing illegal usage, the fraction of cryptocurrency transaction volume devoted to unlawful activity has never been lower. Although the raw value of illegal transaction traffic reached its greatest level ever in 2021, transactions involving illicit addresses accounted for only 0.15% of cryptocurrency transaction volume. When customary, we must qualify this figure by stating that it is expected to climb as Chainalysis discovers new addresses linked to illegal activities and combines their transaction activity into our historical records. The ability of law enforcement to tackle cryptocurrency-based criminality is also changing. Several examples of this will be seen in 2021, ranging from the CFTC bringing charges against several investment scams to the FBI’s strike of the widely distributed REvil ransomware strain to OFAC’s imposition of Suex and Chatex, two Russia-based cryptocurrency services heavily involved in money laundering.

We must also weigh the benefits of increased legal bitcoin use against the fact that $14 billion in illegal activity is a big problem. Illegal usage of cryptocurrencies presents significant barriers to adoption, increases the possibility of government prohibitions, and, most importantly, victimises innocent individuals worldwide. In this research, we’ll look at how and where cryptocurrency-related crime has grown, the newest trends among various sorts of cybercriminals and how cryptocurrency firms and law enforcement organisations throughout the world are reacting. But first, let’s take a look at some of the most critical developments in cryptocurrency-based crime.

What can be Done by Law Enforcement?

The IRS Criminal Investigations division, for example, claimed in November 2021 that it had seized over $3.5 billion in cryptocurrency in 2021, all from non-tax investigations, accounting for 93% of all funds collected by the division during that period. Other successful seizures include $56 million seized by the Department of Justice in a cryptocurrency scam investigation, $2.3 million seized from the ransomware group behind the Colonial Pipeline attack, and an undisclosed amount seized by Israel’s National Bureau Counter-Terrorism Financing in a terrorism financing case.

As law enforcement agencies strengthen their blockchain-based investigative skills, notably their ability to seize illicit bitcoin, they must grasp these figures.

Blockfi Agrees to Pay $100 Million in Penalties:

Blockfi, a crypto lending platform, has agreed to pay $100 million in fines to the Securities and Exchange Commission (SEC).

The SEC stated that it “charged Blockfi Lending LLC with failing to register the offers and sales of its retail crypto lending product, Blockfi Interest Accounts (BIAs), in this first-of-its-kind case.”

Gary Gensler, Chairman of the Securities and Exchange Commission, said:

This is the first case of its kind with respect to crypto lending platforms.

Blockfi agreed to pay a $50 million penalty and stop making unregistered offers and sales of the lending product to settle the SEC’s claims. The corporation also agreed to pay an additional $50 million in fines to 32 states to address similar claims.

According to the SEC, Blockfi offered and sold BIAs to the general public from March 4, 2019. For monthly interest payments, investors leased their crypto assets to the company.

BIAs are securities, per the SEC, and must be filed with the agency. Blockfi also functioned as an unregulated investment business for more than 18 months, according to the securities authority.