Key takeaways

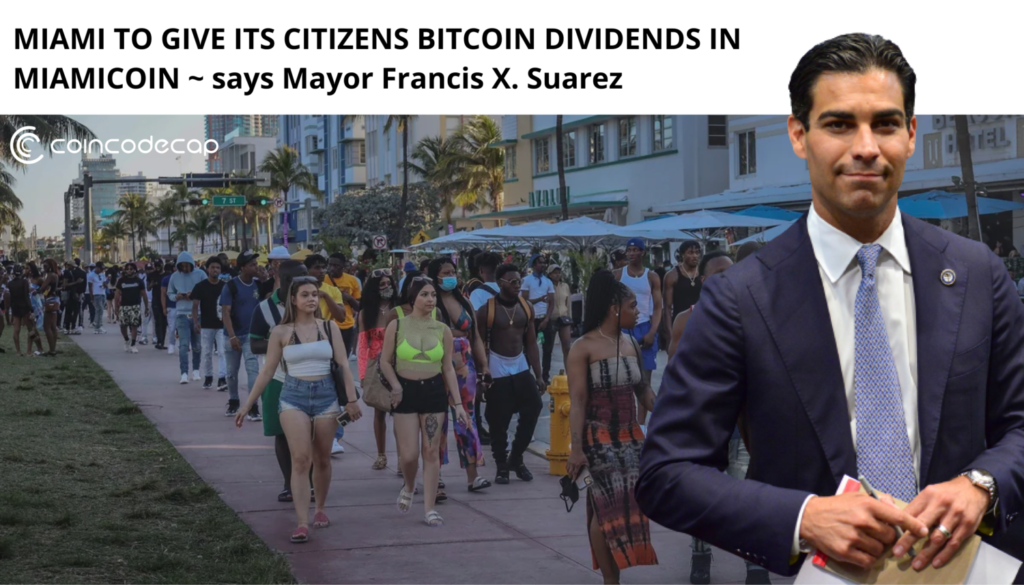

- Miami to be the first city in the US to give people a bitcoin yield claims Mayor Francis Suarez.

- According to Suarez, there is still a lot of work to be done to develop a bitcoin yield registration and verification mechanism.

On Thursday, the Mayor of Miami claimed that the city would soon provide its residents with a “bitcoin dividend” from the staking of its cryptocurrency.

“We’re going to be the first city in America to give a bitcoin yield as a dividend directly to its residents,” Mayor Francis Suarez announced on CoinDeskTV.

According to the mayor, payments will be made using digital wallets. In addition, his team hopes to collaborate with a few cryptocurrency exchanges to help locals find a platform that meets their needs.

It’s unknown how much Bitcoin Miami residents will earn from this project or when it will be implemented.

The revenue comes from the stake of MiamiCoin, the city’s cryptocurrency, which was launched earlier this year and has earned the city more than $21 million in the last three months.

According to the Mayor, the dividend from MiamiCoin earnings might offset any taxes that residents pay to the city. Suarez described it as “revolutionary.”

Suarez stated that the city would make the payments via a digital wallet. It will collaborate with many cryptocurrency exchanges to enable citizens to obtain a wallet, register, and be confirmed.

Suarez “just converted his city into an oil-producing country that offers Bitcoin yield to its inhabitants,” said Patrick Stanley, Community Lead for CityCoins.

Citizens reaping the benefits of public assets is not a novel concept. Alaskans have received annual dividends from the Permanent Fund since the 1970s. The state-run initiative intends to help residents generate long-term wealth by tapping into the state’s massive – but finite – oil reserves. The Permanent Fund has a balance of $80 billion in assets.

Sovereign wealth funds aim to maximize the value of public assets worldwide, from Finland’s forests to Dubai’s deserts. But, as one think tank’s in-depth proposal shows, the concept of a sovereign wealth fund for the United States is not new.

In addition, a small but rising number of lawmakers, like 2020 presidential contender Andrew Yang, have begun to call for universal basic income in recent years (UBI). In its most basic form, Universal Basic Income (UBI) is a government program in which citizens regularly receive a set amount of money. A sovereign wealth fund might be one approach to support a UBI scheme.