Meta Pool is one of the easiest ways to stake NEAR. It allows token holders to stake and earn rewards and provides an easy way to unstake with no lockup. Furthermore, when users deposit their NEAR tokens into Meta Pool, they receive stNEAR, which can be used on other Defi platforms, while their NEAR tokens earn 11% APY. In this blog guide, we will get a complete understanding of the Meta Pool ecosystem. We will also understand how Meta Yield works and how projects like PembRock Finance have utilized the platform.

Table of Contents

Summary (TL;DR)

- NEAR is a layer-one blockchain designed as a community-run cloud computing platform that eliminates the limitations of traditional blockchains, such as low transaction speeds, low throughput, and poor interoperability.

- Meta Pool is the first liquid staking solution on NEAR Protocol that enables NEAR token holders to leverage their holdings.

- Users select the amount of NEAR tokens to stake. In return, we will receive a staked NEAR (stNEAR).

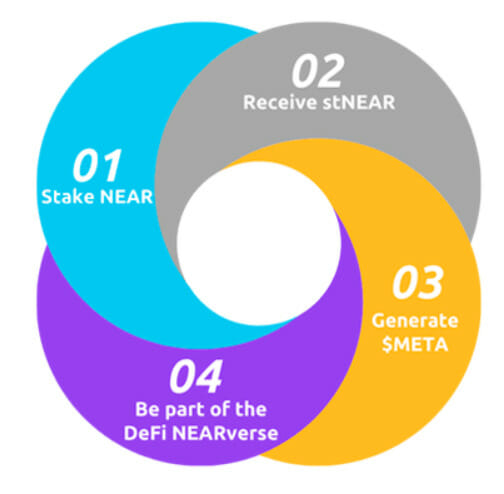

- Every staker and liquidity provider gets META governance tokens to participate in the DAO.

- Meta Recipes is a tool that enables anyone to migrate existing liquidity into new pools and farms on DEXes and AMMs such as Ref Finance and JUMBO with just a few clicks.

- Meta Yield is a kickstarter for new projects on NEAR to get funded by the community.

- PembRock Finance is the first leveraged yield farming application on NEAR Protocol.

- It couples lenders and yield farmers who are rewarded for providing liquidity within the NEAR ecosystem.

- Initially, it will support two base assets, NEAR and USDT, and will integrate leveraged farming with Ref Finance.

- Meta Pool team tries to verify projects launching a fundraising campaign on Meta Yield, nothing is guaranteed, and there are always risks. SO, users should always DYOR(DO YOUR OWN RESEARCH).

- Token holders of $META will have a right to create and vote on proposals to the platform as part of its governance system on a ASTRO DAO.

- Total supply of $META is 1,000,000,000 tokens.

- META Treasury comprises of a 2% staking fee charged on the staking reward and a 0.3–3% liquidity fee charged on liquid unstaking.

An Overview of NEAR Ecosystem

NEAR is a layer-one blockchain designed as a community-run cloud computing platform that eliminates the limitations of traditional blockchains, such as low transaction speeds, low throughput, and poor interoperability.

It uses human-readable account names, unlike the cryptographic wallet addresses common to Ethereum. It also introduces unique solutions to scaling problems and has its consensus mechanism called Doomslug.,i.e., a variation of the proof-of-stake consensus mechanism. It is based on two rounds of consensus, where a block is considered finalized as soon as it has received the first communication round. This allows for near-instant finality by having validators take turns producing blocks rather than competing directly based on their stake.

It uses its Nightshade, i.e., a variation of sharding technology, to improve transaction throughput massively. Here, individual sets of validators process transactions in parallel across multiple sharded chains, improving the overall capacity of the blockchain. Here, shards in Nightshade produce a fraction of the next block, called chunks. In doing so, It can achieve up to 100,000 transactions per second and achieve near-instant transaction finality thanks to a one-second block cadence while simultaneously keeping transaction fees at virtually zero.

Here is a curated list of all projects building on NEAR. Some popular projects built on NEAR are Ref Finance, Octopus Network, Meta Pool, Astra DAO, etc.

What is Meta Pool?

Meta Pool is the first liquid staking solution on NEAR Protocol that enables NEAR token holders to leverage their holdings by allowing them to earn staking rewards and participate in different DeFi protocols simultaneously.

Features:

- Meta Pool smart contract distributes funds across many validators. It automatically rebalances the allocation to each validator based on several parameters, such as the percentage of funds staked with each validator and the overall performance of a validator.

- This distribution of funds leads to an increase in decentralization and censorship-resistance of the overall network.

- We can stake and unstake NEAR anytime or become a liquidity provider to the NEAR-stNEAR pool.

- Users can also explore additional DeFi yields using their tokenized stake positions.

- We can also earn a position in Meta Pool DAO by using META tokens and participating in governance.

How Meta Pool Works?

In this section, we will learn how Meta Pool works in a step-by-step manner.

Firstly, Users select the number of NEAR tokens to stake. In return, we will receive a staked NEAR (stNEAR). Also, according to the platform’s policy, every staker and liquidity provider gets META governance tokens to participate in the DAO. Users are free to use their staked NEAR (stNEAR) in DeFi platforms anytime or swap it back to NEAR.

Meta Pool Products: Meta Pool Recipes

In this section, we will get an overview of Meta Pool Recipes.

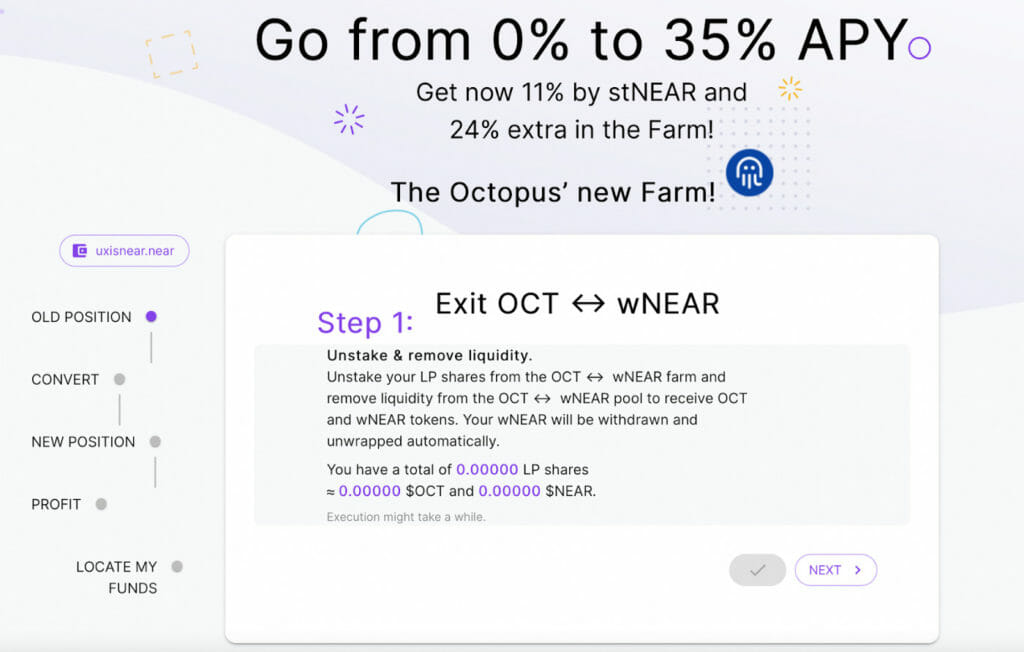

Meta Recipes is a tool that enables anyone to migrate existing liquidity into new pools and farms on DEXes and AMMs such as Ref Finance and JUMBO with just a few clicks.

Working: Users have to log into Meta Recipes and follow the prompts. The platform itself identifies users’ current positions and opportunities and guides them throughout the process. Then, users only have to perform a series of actions within the same screen as directed by the platform.

Advantages of Meta Recipes:

- It reduces the friction of migration to new pools.

- It eliminates the chance that users will get lost along the way. Enter Meta Recipes!

- It brings all the opportunities in one screen.

Meta Pool Products: Meta Yield

In this section, we will get an overview of Meta Yield and how it works.

Meta Yield is a kickstarter for new projects on NEAR to get funded by the community.

Working:

- Step 1: Liquid staking of $NEAR tokens with Meta Pool by users to get stNEAR.

- Step 2: Locking of stNEAR to support projects by users

- Step 3: Then they get tokens from new projects launching on NEAR at seed price.

- Step 4: At the end of the locking period, users can recover 100% of their NEAR.

Projects can request an amount of $NEAR that they need to launch their product/dApp. Then, the Backers get the opportunity to back projects they feel will increase in value over time and be deemed valuable for the NEAR ecosystem. They will receive a specific number of the project’s native tokens proportional to their support of the project.

If any project is interested to get listed on Meta Yield to raise funds, they should get in touch with Meta Yield team via: [email protected]

Meta Yield currently has a pipeline of more than 30 projects willing to leverage the unique opportunity the platform provides.

Advantages of Meta Yield:

- De-Risked Backing: Backers are not giving away their NEAR tokens to a project, just the staking rewards generated during the lock period.

- Backers get all their NEAR back after the locking period.

- Projects get a good medium to get funding from the community.

- Projects also get an accessible channel to distribute their tokens.

What is PembRock Finance?

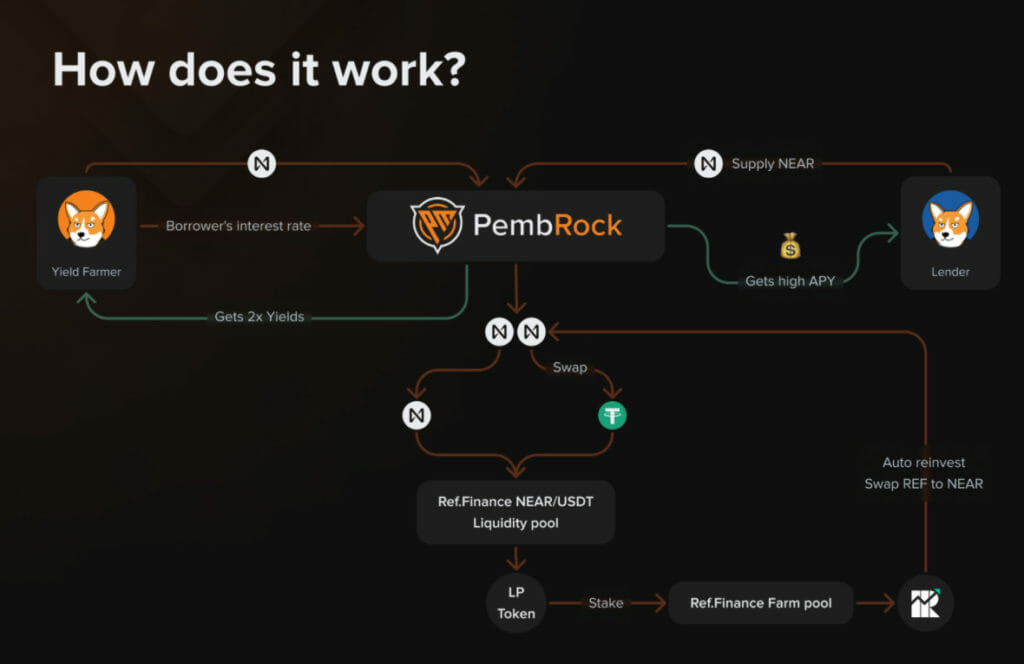

PembRock Finance is the first leveraged yield farming application on NEAR Protocol.

Leveraged yield farming is an upgraded version of yield farming, i.e., the practice of borrowing external liquidity to farm a larger amount of crypto, thus gaining the ability to get increased returns. Many DeFi lending platforms still require users to overcollateralize, but PembRock Finance under collateralized. This means a lower barrier to entry, fewer funds are laying dormant and greater rewards for users.

It couples lenders and yield farmers who are rewarded for providing liquidity within the NEAR ecosystem. Initially, it will support two base assets, NEAR and USDT, and will integrate leveraged farming with Ref Finance.

The lender deposits their NEAR and earns interest from the borrowing fees paid by yield farmers. The yield farmer opens a leveraged yield farming position on a trading pair, borrowing NEAR from the vault and joining the farming pool with leverage. The yield farmer gets higher returns due to the larger stake but pays a 10% premium for the privilege of using borrowed funds.

The liquidator bot monitors all yield farming positions, liquidating those that become too risky. If a leveraged yield farming position does get liquidated, 5% of the position’s fee goes to the protocol and is then distributed among those who have staked the PEM token.

How PembRock Finance use Meta Yield Platform?

In this section, we will see how PembRock Finance has utilized Meta Yield Platform in a detailed manner.

PembRock Finance has announced a Fundraising Campaign on the Meta Yield Platform, which is already started on May 11th, 2022, at 5 AM UTC.

PembRock Finance has allocated up to 3 million PEM tokens for their fundraising campaign on MetaYield. Backers will receive a PEM token, which supports the financial ecosystem of the platform, provides staking rewards, and acts as a governance tool for the community. They will have three weeks to commit their tokens and unlock the different fundraising goals to increase the number of PEM tokens in reward.

To participate in the fundraising campaign of PembRock Finance. Meta Pool users should go to https://metayield.app/ and choose PembRock. Then, Stake stNEAR to receive PEM according to the allocation and goals achieved. The minimum deposit is 1 stNEAR mandatory.

Let’s take an example; suppose if we liquid stake 10 NEAR now, we will get around 9.246 stNEAR. This also means that if we unstake our stNEAR after 12 months, we will get back our 10 NEAR, and the staking rewards will be around 1 NEAR. If we back a project with around 9.246 stNEAR. This means that only the 1 NEAR staking reward generated after 12 months goes to the Project backed, and we will get back all of our 10 NEAR tokens.

What are the Risks Associated with Meta Yield Platform?

Although Meta Pool team tries to verify projects launching a fundraising campaign on Meta Yield, nothing is guaranteed, and there are always risks. So before supporting any specific project on Meta Yield team has released a set of questions that users should ask themselves:

- Do I understand the Project’s offering?

- Am I convinced by the Project (product, service, team, roadmap, etc.) and its value proposition?

- Do I believe this project is going to increase in market share, TVL, and token value over time?

- Do I consider that all the above and the reward (project token) is good enough for me to back it?

Users can also verify Project’s profile on Meta Yield.

Meta Pool: Tokenomics & Governance

In this section, we will learn about the Tokenomics and Governance of Meta Pool.

META token is the native governance token of Meta Pool.

Token holders of $META will have a right to create and vote on proposals to the platform as part of its governance system on a ASTRO DAO.

Total supply of $META is 1,000,000,000 tokens.

META Treasury: It comprises a 2% staking fee charged on the staking reward and a 0.3–3% liquidity fee charged on liquid unstaking. In addition, Treasury is used to cover operational costs like paying for hosting servers, bot transaction fees, operators, maintainers, and META buybacks.

Distributions of META Tokens:

- Founders: 30%

- Team & Advisors: 2.6%

- Investors: 10%

- Allocation for venture rounds: 4% Seed round, 6% A round

- Community & Treasury: 57.40%

Meta Pool Team believes that on-chain governance is the future. It is on a journey towards full decentralization where the protocol will be owned and controlled by the $META holders. Metapool governance will be taken place on AstroDAO and utilize a token-weighted voting mechanism.

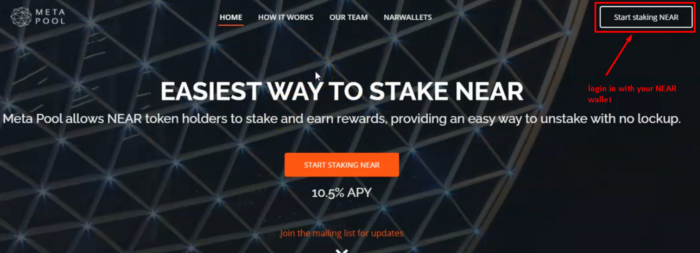

How to Stake NEAR in Meta Pool?

In this section, we will see how to stake NEAR in Meta Pool in a step-by-step manner.

- Step 1: Go to https://metapool.app/ and click on Start staking NEAR in the upper right corner of the screen.

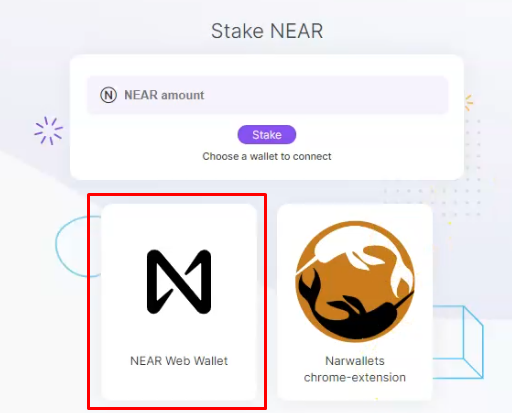

- Step 2: Choose Wallet.

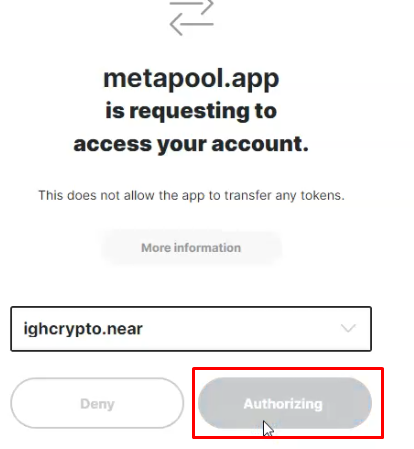

- Step 3: Allow the Meta Pool app to access the NEAR wallet by clicking on Authorize.

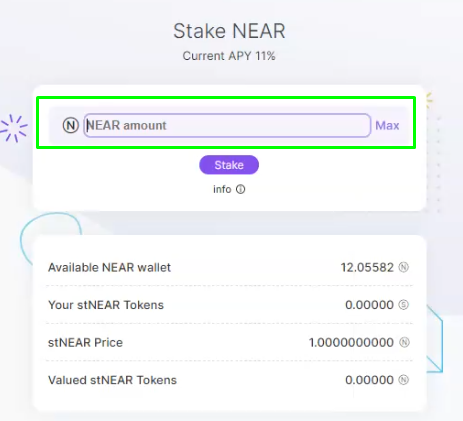

- Step 4: Now, Enter the amount to stake and click on the Stake button. Disclaimer: We should always leave some NEAR in our wallets to cover transaction costs. Also, the minimum staking amount is equivalent to 10 NEAR.

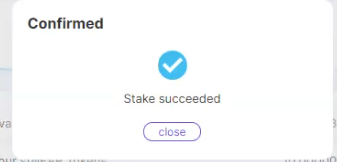

- Step 5: We will get a confirmation after the transaction has been processed by the blockchain and our stake deposit has been successful.

How to Unstake NEAR in Meta Pool?

In this section, we will see how to unstake NEAR in Meta Pool in a step-by-step manner. There are two available options to unstake NEAR in Meta Pool;

1. Liquid Unstake, i.e., unstake immediately

We can easily unstake stNEAR token immediately by paying a small fee.

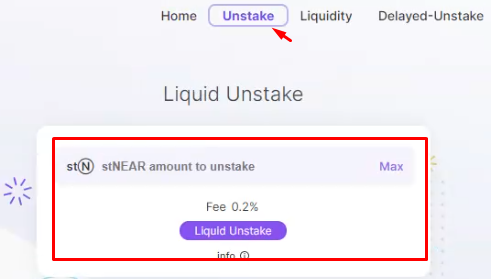

- Step 1: Go to the Unstake tab in the navigation menu.

- Step 2: Now, check the current Fees. Disclaimer: Fees are in the range of 0.3% to 3%. It varies linearly according to the quantity of liquidity available in the Meta Pool liquidity pool.

- Step 3: Enter the amount of stNEAR to unstake.

- Step 4: Click on the Liquid Unstake button and approve the transaction.

- Step 5: After transaction confirmation, we will see our unstaked NEAR available in our NEAR wallet.

- Traditional Unstake, i.e., delayed by 48-72 hours.

It is the traditional form of unstaking from any validator on the NEAR protocol. Here, validators wait for 4 – 6 epochs, i.e.,48-72 hours before releasing the staked funds back to the user. There are no fees charged in this case.

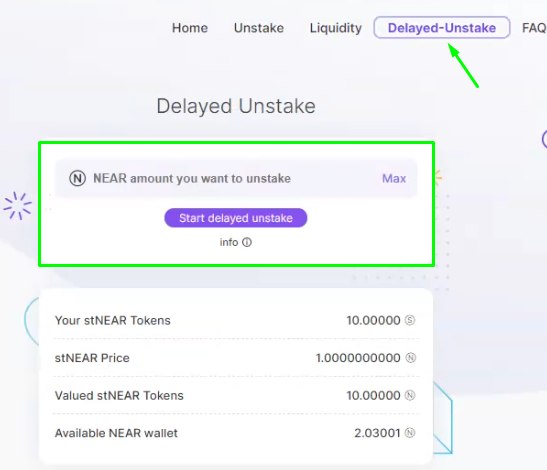

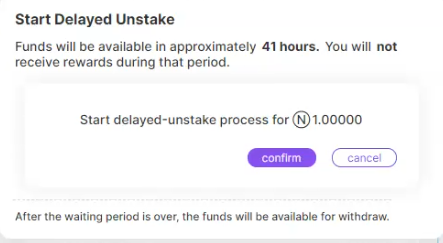

- Step 1: Go to the Delayed-Unstake tab in the navigation menu.

- Step 2: Enter the amount of NEAR to unstake and Click on the Start delayed unstake button.

- Step 3: We will see the approximate waiting time for unstaking and then Click on confirm.

- Step 4: We will be prompted to Authorize the transaction on the NEAR wallet and then Click on Authorize.

- Step 5: After transaction confirmation, we will see our unstaked NEAR available in our NEAR wallet.

How to Harvest META in Meta Pool?

In this section, we will see how to harvest NEAR in Meta Pool step-by-step. We should have some META tokens in our NEAR wallet to harvest META. And then, Go to the Harvest tab in the navigation menu, and the rest of the process is simple and can be quickly done, as we have seen in the above scenario.

How to Provide Liquidity in Meta Pool?

In this section, we will see how to provide liquidity in Meta Pool in a step-by-step manner.

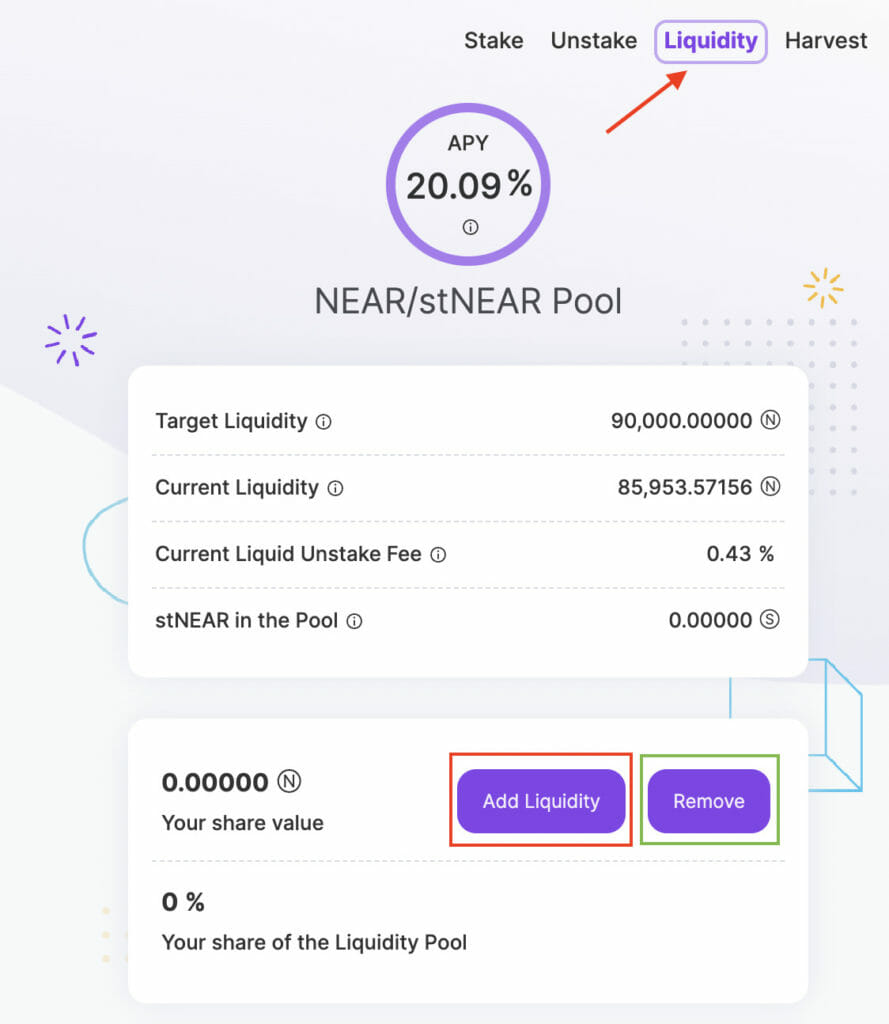

- Step 1: Go to the Liquidity tab in the navigation menu.

- Step 2: Now, select and enter the amount to Add or Remove Liquidity. Disclaimer: Minimum Amount Required to provide liquidity is 2 NEAR.

- Step 3: Now, confirm the amount and sign the transaction.

Conclusion

We have tried to explain everything from scratch in step by step manner. We have tried to use images for every step wherever needed. Readers will now get an idea of how Meta Pool ecosystem works with Meta Recipes and Meta Yield. We have explained how to stake, unstake, harvest, and provided liquidity in a step-by-step manner. All credits of images and information used here belong to Meta Pool.

Frequently Asked Questions (FAQs)

Are NEAR tokens secure in Meta Pool?

When users transfer their NEAR tokens for staking in Meta Pool, they will receive staked NEAR (stNEAR) tokens back in their wallets. If our readers want to know more about the security mechanisms used by Meta Pool, then they can check out the Security section of this blog guide.

What happens if the fundraising fails in Meta Yield?

Suppose the fundraising of any specific project fails. In that case, its backers will get all their staked NEAR (stNEAR) back immediately after the closure of the fundraising, and the native tokens of the project will be returned to the project itself.

How Meta Pool choose Validators?

Meta Pool has an automatic process for choosing validators. Still, if someone is interested in it, they can fill out the Meta Pool Validators form. But, it depends on the Meta Pool team whether they will consider it or not. Here is the list of all Meta Pool validators. There are generally four factors that are taken into account while selecting a validator:

1. An uptime greater than 95%

2. Fees less than 10%,

3. Nakamoto Coefficient, i.e., a metric to check the decentralized nature of a blockchain, represents the no. of validators or nodes needed to slow down the blockchain network from functioning properly.

4. Enough tokens to accomplish the seat price of the NEAR protocol

What is the difference between staking NEAR on NEAR Wallet and staking NEAR on Meta Pool?

When we stake in Meta Pool, we distribute our staked NEAR into 95 validator nodes. It improves the decentralization of the network, whereas if we decide to stake through the NEAR web wallet, then we are staking only to 1 validator node that we choose in the list of validator nodes. Here, users can only stake to 1 validator, which creates most of the NEAR being staked to the top ten nodes on the network. This reduces the decentralization of the network.

What is staked NEAR (stNEAR) token?

It is a NEP-141 token representing the users’ share of the MetaPool stake. After staking, we can use our stNEAR in other markets while still earning rewards. stNEAR tokens price increases as long as staking rewards are added to the pool on each epoch.