Matchr is redefining how traders access prediction markets by aggregating liquidity, identifying price discrepancies, and enabling optimal execution across platforms like Polymarket and Kalshi through a unified, data-driven trading interface. In this article, we will explore the Matchr Review.

Table of Contents

What Is Matchr?

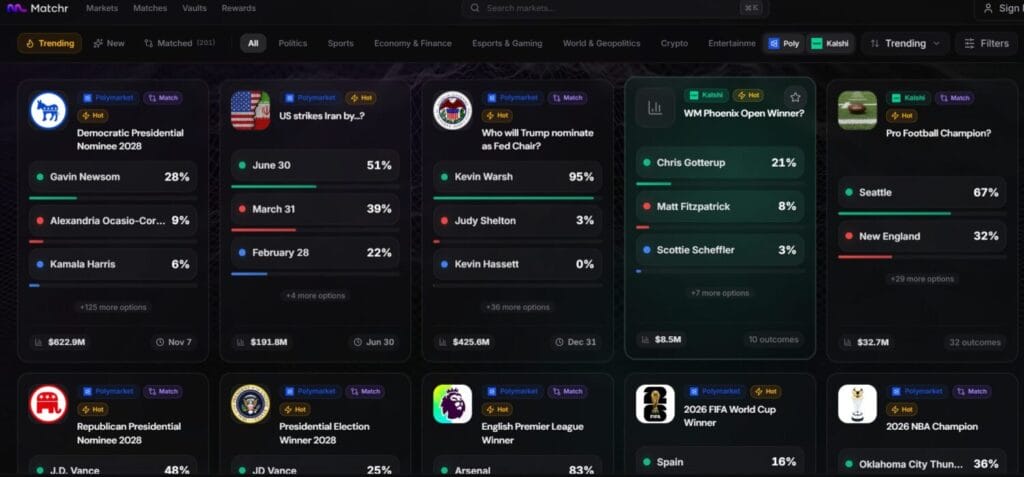

Matchr is a prediction market aggregation platform designed to unify fragmented markets into one efficient trading ecosystem. It collects data from major platforms like Polymarket and Kalshi, applies AI-based semantic matching to identify equivalent markets, and routes orders to optimal venues. By tracking over 10,000 markets and more than 900 matched pairs, Matchr enables traders to access better pricing, minimize spreads, and improve execution efficiency. It functions as a trading terminal, portfolio manager, and analytics engine for modern prediction market participants.

Matchr Review: Key Features and Products

- Matchr aggregates over 10,000 active prediction markets from multiple platforms into a single dashboard, allowing traders to compare prices, liquidity, and volumes without switching tabs or managing multiple trading interfaces.

- Its AI-powered semantic matching engine analyzes textual similarity using embeddings, achieving confidence scores above 90 percent for high-quality matches, ensuring users can reliably compare equivalent events across different platforms.

- Smart order routing evaluates bid-ask spreads, platform fees, slippage, and settlement differences in real time, automatically recommending the most cost-efficient execution venue for every trade.

- The unified portfolio system consolidates positions, orders, realized profits, and unrealized gains from multiple wallets and platforms, offering traders a centralized performance and risk management interface.

- Gasless trading through Safe smart contract wallets eliminates transaction fees and repeated signature requests, significantly improving execution speed and reducing operational friction for high-frequency and active traders.

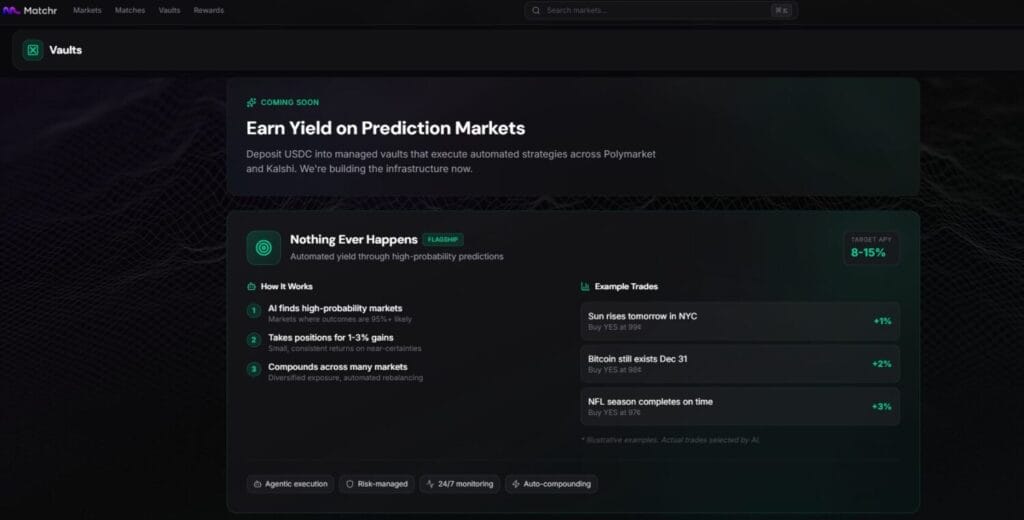

- Upcoming automated vaults will enable passive strategies such as arbitrage, momentum trading, and event-driven investing, allowing users to access professional-grade systematic trading without manual intervention.

Matchr Review: Fees and Pricing Structure

- Matchr does not charge for browsing, market discovery, or price comparison, making its core aggregation and analytics tools freely accessible to both retail and professional traders.

- Trading fees are derived from platform-level builder fees, meaning users typically pay similar or identical costs compared to trading directly on Polymarket or Kalshi.

- Gas fees are fully subsidized by Matchr through server-side execution, eliminating Ethereum or Polygon transaction costs that often range from one to fifty dollars per trade.

- Withdrawal and bridging fees depend on the underlying blockchain and bridge provider, with transparency ensured through pre-trade fee breakdowns shown before confirmation.

- Future vault products follow a traditional 2 percent management fee and 20 percent performance fee structure, aligned with industry standards for managed trading strategies.

- Institutional and power users are expected to access premium analytics and API services under separate commercial agreements, although detailed pricing has not yet been publicly disclosed.

Matchr Review: Mobile App

- Matchr currently operates primarily through a responsive web-based interface optimized for desktop and mobile browsers, enabling consistent access across devices without requiring native app installation.

- Wallet connectivity through Privy, MetaMask, Coinbase Wallet, Rainbow, and WalletConnect ensures compatibility with both mobile-first and desktop-first trading environments.

- The platform’s lightweight architecture ensures sub-second execution times, even on mobile networks, making it suitable for monitoring fast-moving political, crypto, and macroeconomic markets.

- Portfolio dashboards and price comparison modules automatically adapt to smaller screen sizes, preserving usability without sacrificing access to advanced trading features.

Matchr Review: Security

- User funds are stored in Safe smart contract wallets, which are non-custodial and widely used across DeFi, securing billions of dollars in on-chain assets.

- Server-side execution is isolated from user private keys, ensuring Matchr never gains direct control over wallet credentials or withdrawal permissions.

- Embedded wallets managed through Privy provide social-login-based recovery mechanisms, reducing the risk of permanent asset loss due to forgotten seed phrases.

- Smart contracts supporting future vaults will undergo professional third-party audits before deployment, minimizing exposure to protocol-level vulnerabilities.

- Multi-wallet support allows users to segregate strategies and capital, reducing concentration risk and improving overall portfolio security.

- Continuous monitoring of execution latency, API health, and transaction integrity ensures operational reliability and minimizes downtime-related risks.

Matchr Review: Affiliate, Referral, and Rewards Program

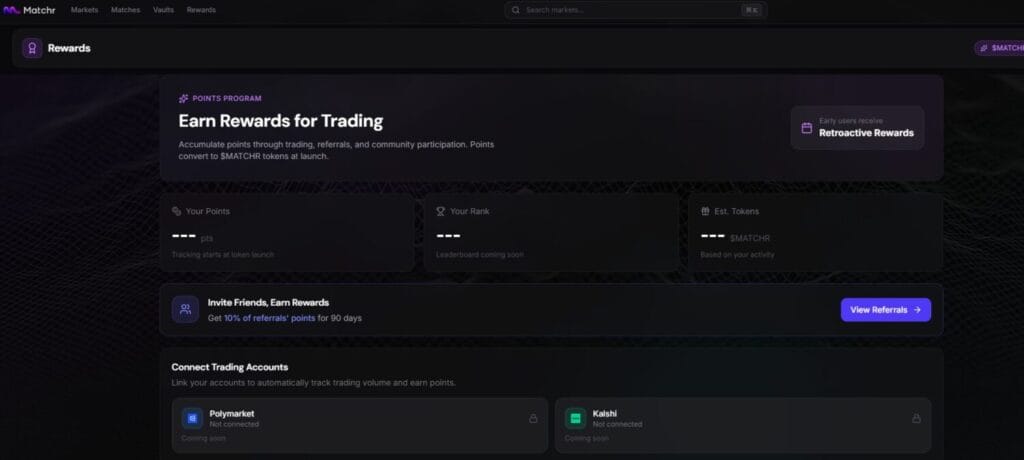

- Matchr operates a points-based rewards system where users earn points through trading volume, referrals, early participation, and community engagement activities.

- Referrers receive 10 percent of their referrals’ accumulated points for a 90-day period, creating long-term incentives for organic user acquisition.

- Customizable referral codes enhance brand visibility and enable influencers and community leaders to build identifiable trading networks.

- Referral dashboards track clicks, accepted users, pending sign-ups, and future volume metrics, ensuring transparency in reward distribution.

- Accumulated points are expected to convert into tokens upon the platform’s token launch, offering early adopters potential upside beyond trading profits.

- Welcome modals and referral attribution systems ensure consistent user onboarding and minimize referral disputes or manipulation.

Matchr Review: Data Analytics and Performance Insights

Matchr’s infrastructure generates significant operational and market-level data. The following table summarizes key performance indicators and analytical implications:

| Metric | Reported Value | Analytical Insight | Trader Impact |

| Markets Tracked | 10,000+ | Indicates broad coverage across political, crypto, and macro events | Improves diversification and opportunity discovery |

| Matched Pairs | 900+ | Demonstrates strong AI matching efficiency | Enables systematic arbitrage strategies |

| Average Spread | 3–7% | Reflects persistent market inefficiencies | Creates recurring profit opportunities |

| Execution Time | <1 second | Low-latency infrastructure | Reduces slippage during volatile periods |

| Price Latency | <500 ms | Near-real-time updates | Improves timing accuracy |

| API Response (p95) | <200 ms | Enterprise-grade reliability | Suitable for automated strategies |

| Data Freshness | <5 minutes | Continuous market refresh | Ensures relevance of analytics |

- The presence of 900+ matched pairs with average spreads between 3 and 7 percent indicates that prediction markets remain structurally inefficient, providing consistent arbitrage potential.

- Sub-500 millisecond price updates and sub-second execution times position Matchr as a low-latency trading layer, comparable to professional trading terminals.

- The combination of high market coverage and frequent refresh cycles enables traders to build diversified portfolios without sacrificing informational accuracy.

- Aggregated liquidity data reduces information asymmetry, allowing users to assess true market depth rather than relying on fragmented orderbooks.

- Performance metrics suggest suitability for both discretionary traders and future algorithmic or AI-driven trading agents.

Matchr Review: Conclusion

Matchr represents a significant evolution in prediction market infrastructure by addressing fragmentation, inefficiency, and operational complexity through advanced aggregation and AI-driven matching. With over 10,000 markets tracked, more than 900 matched pairs, and average spreads ranging from 3 to 7 percent, the platform systematically converts market inefficiencies into actionable trading opportunities. The upcoming vault system and tokenized rewards further strengthen its long-term value proposition. While direct cross-platform execution is still developing, Matchr already functions as a high-performance trading terminal for prediction markets. For users seeking better pricing, deeper analytics, and streamlined execution, Matchr stands out as one of the most strategically positioned platforms in this rapidly expanding sector.

Can I use Matchr without connecting a wallet?

Yes. You can browse markets, compare prices, analyze spreads, and explore matched pairs without connecting a wallet. However, trading, portfolio tracking, and rewards participation require wallet connection.

Does Matchr support automated trading bots or APIs?

Yes. Matchr provides API endpoints for accessing price data, spreads, routing recommendations, and historical market information. These APIs are suitable for building custom bots, dashboards, and algorithmic trading systems.

Can I export my trading data for tax or accounting purposes?

Yes. Matchr allows users to export trade history, portfolio performance, and P&L data in CSV format, which can be used for tax filing, accounting, or third-party portfolio tracking tools.