Market Monkey is a browser-based crypto order-flow terminal that combines liquidity, depth, tape, and derivatives context in one workspace, so traders read microstructure faster than standard charts. In this article, we will explore Market Monkey Review.

Table of Contents

What is Market Monkey?

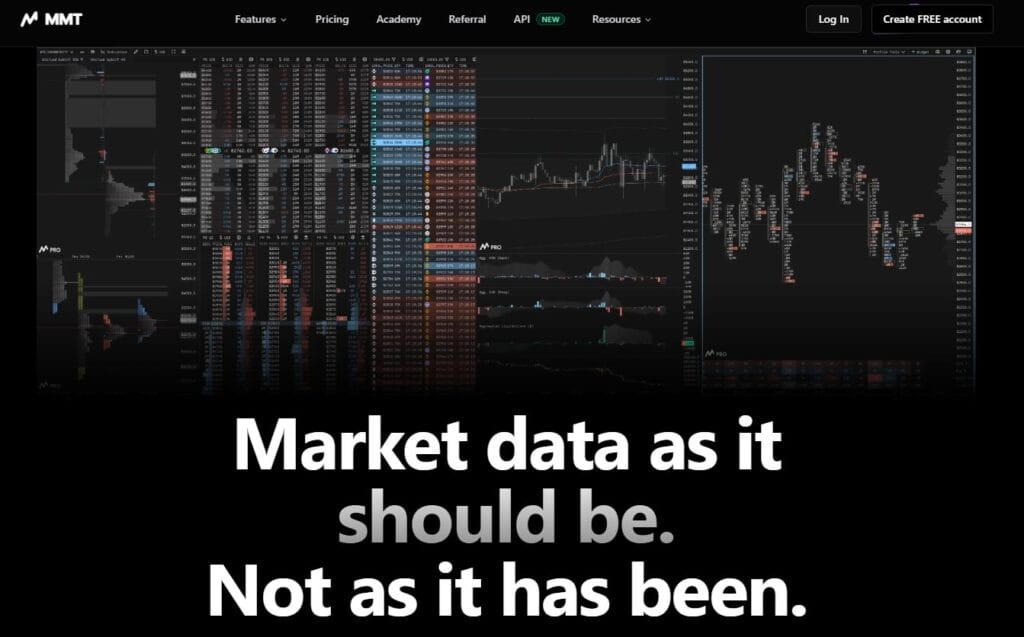

Market Monkey, also called MMT, is a crypto analytics terminal focused on liquidity and order flow, not trade execution. It aggregates exchange data into a single interface, so you can study how price interacts with resting liquidity and aggressive market orders. The platform emphasizes tools like heatmaps, order books, DOM ladders, and derivatives metrics such as open interest and liquidations. It also includes an education layer through MMT Academy and a separate API product for developers.

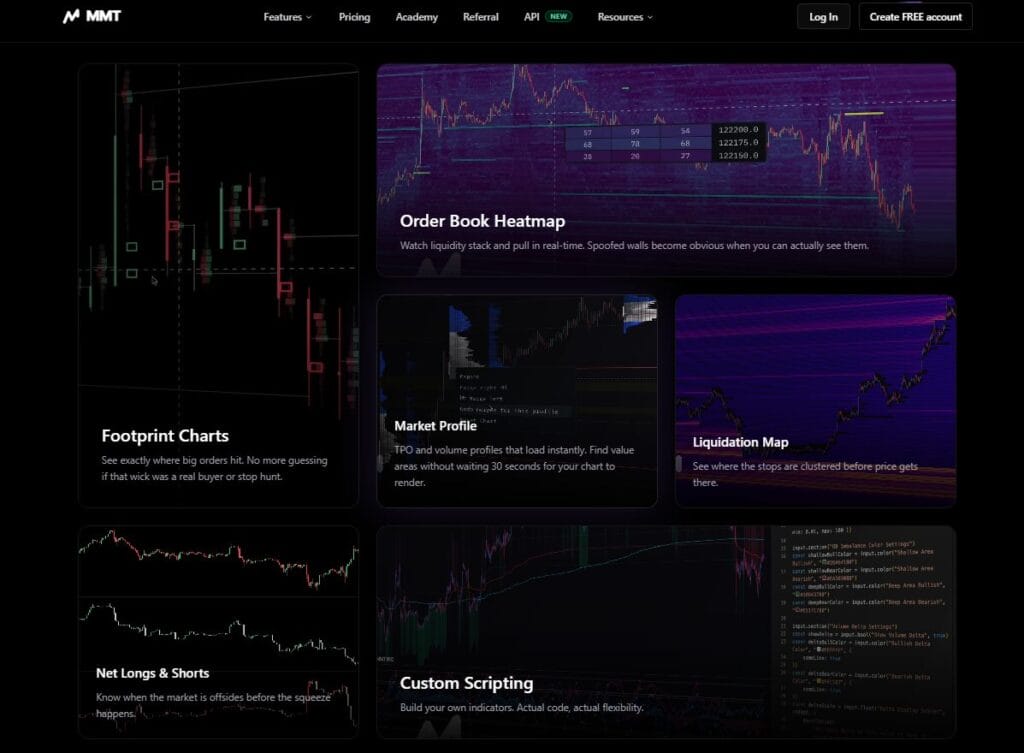

Market Monkey Review: Features and products

- Market Monkey aggregates markets across 20+ exchanges, so you can compare liquidity behavior and flow across venues without juggling symbols, tabs, and inconsistent market naming conventions between platforms.

- The chart widget supports layered analysis, letting you combine candles with liquidity heatmaps, footprint style views, and profile tools, so execution context stays aligned with price action.

- Liquidity heatmaps visualize historical order book changes across time, helping you identify where size was stacked, pulled, or absorbed, and where price is likely to react.

- DOM depth-of-market tools give ladder style visibility into bids and asks with grouping and volume context, which helps scalpers monitor imbalance shifts and stacked liquidity zones.

- Tape and trade flow views highlight bursts, sweeps, and tempo changes near key levels, helping you validate breakouts, detect absorption, and avoid chasing noisy moves.

- Derivatives modules track open interest changes and liquidation activity, providing clues on whether moves are driven by fresh leverage, position unwinds, or forced liquidations.

- Liquidation map style tools attempt to estimate potential liquidation clusters, helping traders visualize where trigger liquidity may sit, even when it is not visible in spot order books.

- The product ecosystem includes the main terminal, the Academy learning component, and a separate market data API for builders who need normalized schemas and real-time delivery.

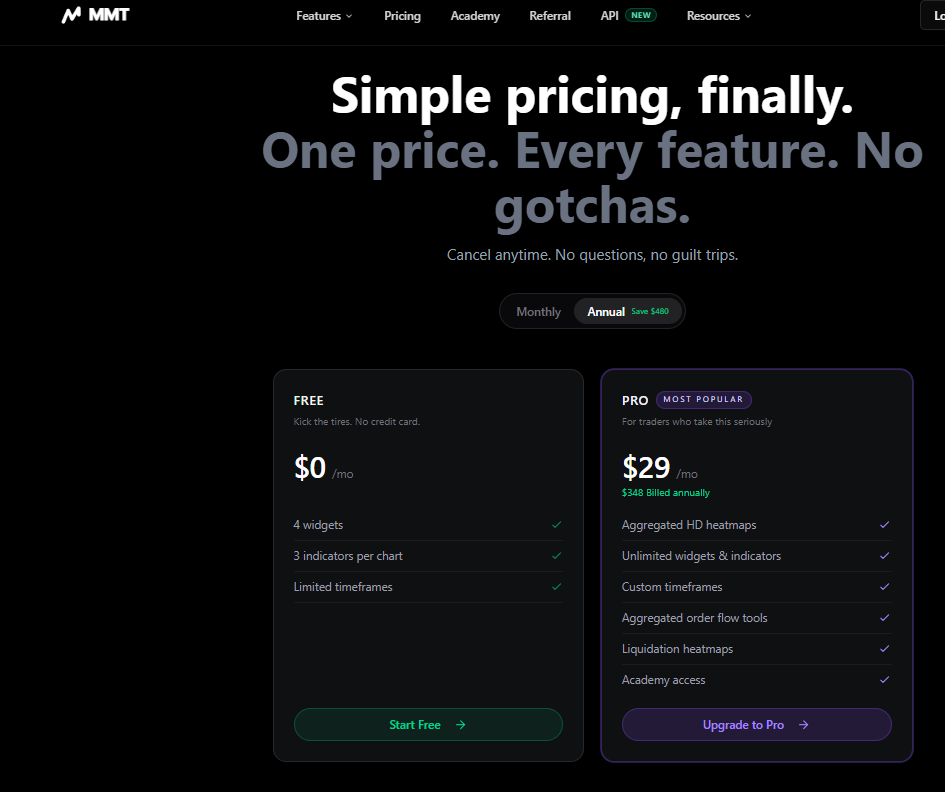

Market Monkey Review: Fees

- The forever-free plan requires no card, but limits you to four widgets, three indicators per chart, and fewer timeframes, so it is best for testing workflows and layout habits.

- Pro is priced at $29 per month or $348 billed annually, and unlocks unlimited widgets, unlimited indicators, custom timeframes, and more advanced heatmap and liquidation capabilities.

- Annual plans can be paid using stablecoins like USDC or USDT, which is useful for crypto-native users who prefer not to rely on cards or region-specific payment rails.

- API access is priced separately with plan tiers, capacity limits, and enterprise options, which matters if you are building dashboards, trading tools, or internal analytics pipelines.

Security

- Account security is based on standard SaaS patterns such as email login and hashed passwords, reducing direct exposure of raw credentials if storage systems are compromised.

- The platform may collect technical signals like IP address, device type, and browser information for security, fraud prevention, and debugging, which is typical for hosted analytics products.

- Billing is handled through a third-party payments provider, and the platform states it does not store card or bank details directly, reducing sensitive payment handling internally.

- Like most analytics terminals, it is an informational product, so you still carry decision risk, and you should use strong passwords, careful session hygiene, and cautious permissions.

Market Monkey Review: UI and UX

- The interface is designed around modular widgets and layouts, so you can build a workspace that matches your strategy, from minimal setups to heavy microstructure screens.

- Layout sharing and preset layouts reduce onboarding friction, helping new users start with proven configurations instead of building from scratch and misusing tools without a workflow.

- Documentation is organized by widgets and indicators, which supports practical learning, because you can understand each module, then combine them into a repeatable trading routine.

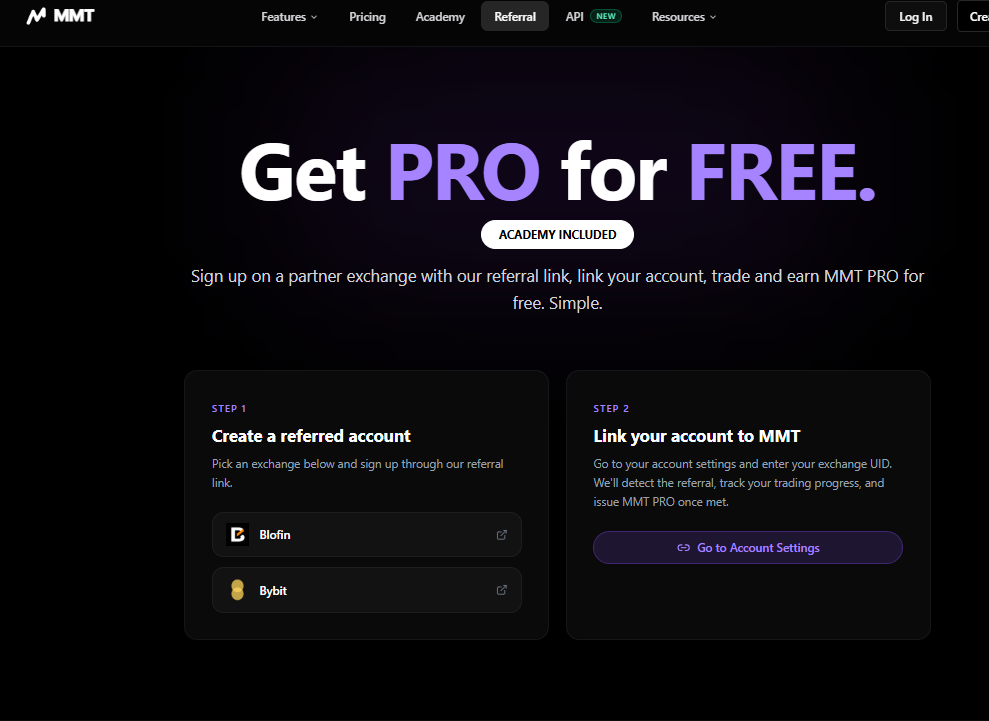

Market Monkey Review: Affiliate, referrals, and rewards

- Market Monkey offers a referral route to earn Pro by signing up to partner exchanges via their links, then linking your exchange UID inside your account for tracking.

- Progress accumulates based on eligible activity rather than strict monthly quotas, which helps traders who are inconsistent, and makes rewards feel like a slow rebate, not pressure.

- Each successful redemption grants one month of Pro, you can repeat it, and if you already pay, the reward typically extends your renewal rather than creating duplicate subscriptions.

Market Monkey Review: Conclusion

Market Monkey is best treated as a decision-support terminal for liquidity and order-flow traders, not a basic charting website. The value comes from combining depth behavior, tape activity, and derivatives positioning in one place, so you can validate moves with execution context instead of guessing from candles alone. The free plan is a solid way to test whether you actually use heatmaps, DOM, and liquidation tools, but active traders will quickly feel the widget limits. Pro is most justified for intraday futures and perp traders who rely on liquidity levels and need unlimited layouts. If you only use classic indicators, you will underuse the platform.