Choosing the right crypto market data API hinges on coverage breadth, historical depth, latency, and licensing that fits your product roadmap, from lightweight dashboards to institutional analytics and execution pipelines. Leading providers offer real-time and historical prices, OHLCV, order books, and reference methodologies across centralised and decentralised venues with REST and WebSocket delivery. Tiered pricing and rate limits determine scalability, while enterprise vendors add benchmarks, indices, and compliance-grade distribution for regulated use cases. This guide compares 10 top APIs on features and pricing to help teams optimise cost, performance, and data quality across production workloads.

Table of Contents

How this list was chosen

- Emphasis on reliability, coverage across exchanges and assets, historical depth, and integration options (REST/WebSocket/cloud) suitable for both startups and institutions.

- Inclusion of enterprise-grade vendors and widely used exchange/public APIs to cover diverse needs and budgets.

- Preference for transparent pricing pages or clear statements regarding free tiers, paid plans, or custom enterprise quotes.

Best Crypto Market Data APIs

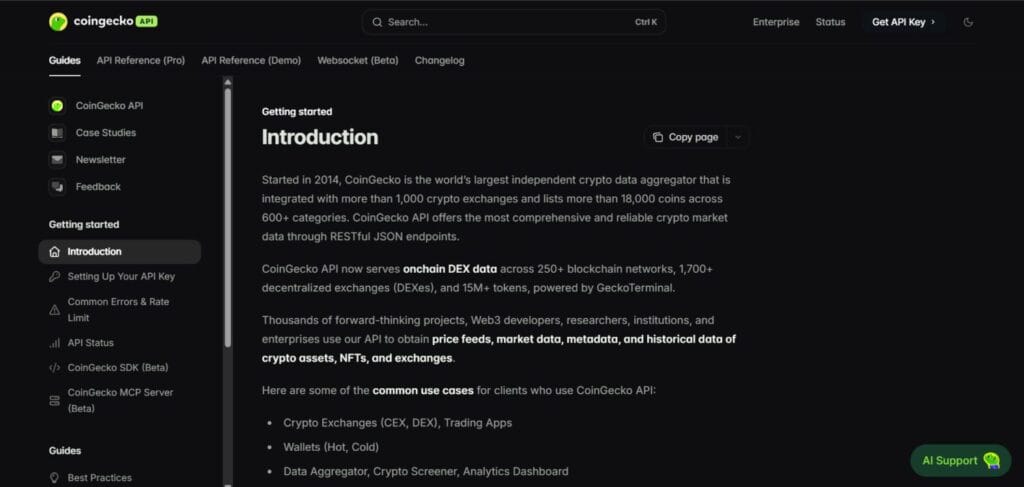

CoinGecko API

CoinGecko provides a comprehensive crypto data API spanning prices, market caps, volumes, OHLCV, metadata, multi-chain coverage, and select NFT/DEX datasets with rapid update intervals via REST, plus early-access WebSocket options. Coverage and methodology are documented, with deep historical time series available for research and production use.

Key features

- 60+ market data endpoints, multi‑chain coverage, and data freshness from 20 seconds on paid tiers.

- Free tier with 30 requests/min and 10k calls/month; paid tiers increase limits substantially.

- Historical daily since 2013 and hourly since 2018 on paid tiers; broad token metadata coverage.

Pricing

- Free “Demo” tier; paid tiers commonly listed at Analyst ($129/mo), Lite ($499/mo), Pro ($999/mo), and Enterprise (custom) with higher rate limits and call quotas; enterprise custom.

CoinMarketCap API

CoinMarketCap’s API delivers real-time quotes, OHLCV, listings, and exchange data with robust REST endpoints and commercial licensing for high-scale consumer and institutional applications. It supports portfolio, analytics, and research workflows with tiered plans aligned to call quotas and rate limits for production scalability.

Key features

- Endpoints for latest quotes, OHLCV, listings, metadata, and exchange metrics supporting market dashboards and analytics.

- Tiered plan structure with increasing rate limits and call quotas to support growth from testing to enterprise usage.

Pricing

- Free and paid plans with escalating quotas and features; enterprise options available via Pro tiers and custom arrangements.

Kaiko

Kaiko is an enterprise data provider offering real-time and historical trades, order books, and aggregated prices across 100+ exchanges and 35,000+ pairs, plus indices and benchmarks for financial products. Delivery spans REST, CSV, and WebSocket streams, with licensing designed for institutional-grade use and redistribution.

Key features

- Trade, order book, and aggregated price data with streaming and bulk delivery options for latency-sensitive workloads.

- Indices/benchmarks licensing and custom data plans for regulated or product-creation use cases.

Pricing

- Custom enterprise pricing; third-party benchmarks indicate low five-figure to mid five-figure annual ranges depending on scope and data volume; subscriptions start from $1,000/mo for entry-level.

CoinDesk

CoinDesk aggregates multi-exchange spot and derivatives data, providing real-time feeds and historical datasets with 60+ endpoints, WebSocket access, and the CCCAGG volume‑weighted methodology for robust reference pricing. Plans span personal to enterprise, supporting analytics, research, and application development at varying scales.

Key features

- 60+ endpoints, real-time and historical data, and WebSocket delivery for streaming use cases.

- CCCAGG methodology with outlier detection and exchange vetting to improve price robustness.

Pricing

- Personal free tier, commercial tiers, and enterprise custom pricing; example quotas and price points outlined for SMB and Pro levels.

CoinAPI

CoinAPI delivers crypto market data via REST, WebSocket, and FIX, including trades, quotes, and order books, plus exchange rates and historical flat-file distribution for backfills and modelling. Plans differentiate by daily REST credits, real-time access, and protocol options suitable for varied production workloads.

Key features

- Real-time WebSocket for trade, quote, and book data; optional FIX connectivity for institutional integrations.

- Historical datasets via flat files for large‑scale research and replay use cases.

Pricing

- Startup $79/mo, Streamer $249/mo, Pro $599/mo with increasing quotas and features; enterprise custom with dedicated infrastructure.

Glassnode

Glassnode offers on-chain market intelligence through structured metrics APIs covering fees, activity, supply, and exchange flows, suitable for research, risk monitoring, and signal development. Access is gated by plan, with studio tiers and dedicated data products for advanced or enterprise needs.

Key features

- Programmatic access to on‑chain metrics in JSON/CSV with documented parameters, status codes, and rate limits.

- Studio plans and specialized data products to expand metric availability and commercial usage rights.

Pricing

- Free and paid plans via Glassnode Studio, plus bespoke data offerings for enterprise licensing and distribution needs.

Amberdata

Amberdata provides institutional market and blockchain data across L1/L2 spot, options, and futures, with deep historical coverage and delivery through REST, WebSockets, S3, and Snowflake. Price services include raw and weighted prices, DeFi datasets, and reference rates aligned with benchmark best practices.

Key features

- Coverage for 3,600+ spot assets and 8,500+ pairs with raw and weighted pricing and DeFi data.

- Distribution via REST, WebSockets, S3, and data clouds tailored to enterprise pipelines.

Pricing

- Enterprise-oriented pricing with sales engagement; packaging aligns to institutional coverage and delivery requirements.

Binance API

Binance offers public market data endpoints and WebSocket streams for spot, margin, futures, and options markets, enabling retrieval of klines, tickers, depth, and trades without authentication where designated. Documentation covers REST endpoints and market data-only URLs for straightforward integration.

Key features

- Public REST endpoints for klines, ticker prices, book tickers, depth, trades, and exchange info without API keys on data domains.

- Public WebSocket streams for market data suitable for streaming analytics and dashboards.

Pricing

- Public market data endpoints are free to use within documented rate limits and usage policies.

Messari API

Messari provides a free API for prices, market data metrics, on-chain metrics, and qualitative asset profiles, powering research and application features at low integration overhead. Many endpoints are accessible without an API key but are rate‑limited and require attribution/usage adherence for redistribution.

Key features

- Programmatic access to prices, market metrics, on-chain indicators, and qualitative asset data for due diligence.

- Free tier with rate limits and attribution requirements; community clients available for quick starts.

Pricing

- Free API with rate limits; commercial redistribution and higher‑scale access may require licensing or subscriptions via Messari’s broader offerings ($5,000/year Enterprise).

Conclusion

The best API depends on requirements: broad retail-friendly coverage and fast time‑to‑value favour CoinGecko or CoinMarketCap, while enterprise pipelines often select Kaiko or Amberdata for institutional delivery, licensing, and indices. On‑chain analytics are well served by Glassnode, while exchange-native latency and depth are readily accessed via Binance’s public endpoints. CryptoCompare and CoinAPI bridge mid-market needs with both streaming and historical options at transparent prices. Messari and CoinDesk round out research‑grade options with accessible endpoints and commercial plans for production. Match tiers, rate limits, and rights to your roadmap to scale efficiently.

Frequently Asked Questions (FAQs)

How was this list of best crypto market data APIs selected?

The list prioritizes reliability, broad exchange/asset coverage, historical depth, and integration ease (REST/WebSocket) for startups to institutions. It includes enterprise vendors like Kaiko alongside free/public APIs like Binance, favoring transparent pricing from free tiers to custom enterprise plans for diverse budgets and needs.

Which API is best for beginners or free usage in crypto projects?

CoinGecko or Messari APIs are ideal starters, offering free tiers with 30 req/min limits, prices, OHLCV, and metadata via REST. CoinGecko adds multi-chain NFT/DEX data; Messari includes on-chain metrics—all with easy docs, no keys needed, and attribution for quick prototypes or dashboards.

What makes enterprise APIs like Kaiko or Amberdata stand out for institutions?

Kaiko and Amberdata excel in institutional-grade features: 100+ exchanges, order books, benchmarks/indices, and compliant licensing for redistribution. They support low-latency WebSockets, S3/Snowflake delivery, and custom pricing ($1k+/mo), ensuring scalability for regulated analytics, trading pipelines, and deep historical trades across 35k+ pairs.

How do pricing models vary across these crypto data APIs?

Free tiers (Binance, Messari) suit low-volume use with rate limits; mid-tier like CoinAPI ($79-$599/mo) adds WebSockets/historical files; enterprise (Kaiko, Amberdata) starts at $1k/mo custom for benchmarks/compliance. CoinGecko/CoinMarketCap scale from $129/mo Pro plans with escalating quotas for production growth.

Can these APIs handle real-time streaming and historical backfills?

Yes—most offer WebSockets for real-time (e.g., Binance for spot/futures, CoinAPI for FIX trades). Historical depth varies: CoinGecko from 2013 daily, Glassnode on-chain metrics, Kaiko bulk CSV for 35k pairs. Choose based on latency needs and plan tiers for seamless backfills in modeling.