BNB (Binance Coin) is trading near $875, supported by its dominant role in the Binance ecosystem and steady institutional and retail usage. The token benefits from ongoing platform activity and systemic token burns that help maintain its value.

With bullish technical indicators and strategic use cases, BNB looks poised for measured gains if key resistance levels are breached.

For on-demand analysis of any cryptocurrency, join our Telegram channel.

BNB Crypto Next Target

- Price: ~$875 USD

- Market Cap: ~$121–122 billion USD

- 24-Hour Trading Volume: ~$1.9 billion USD

- Circulating Supply: ~139.2 million BNB

- Total/Max Supply: ~200 million BNB (fully diluted valuation tracked)

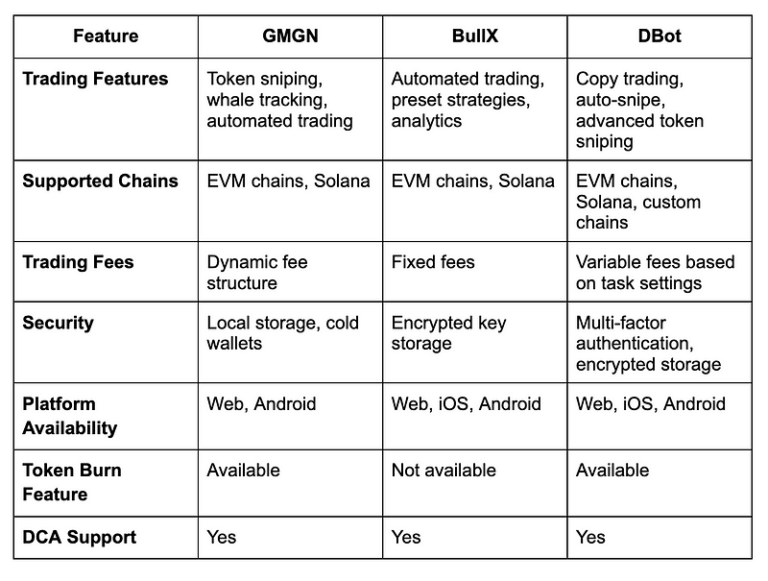

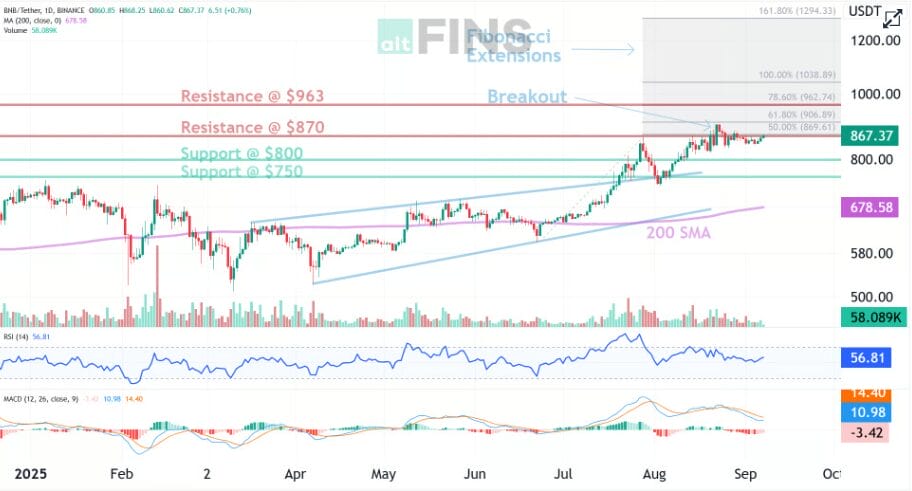

Price has broken above the ATH of $869 from just 3 weeks ago and we are in a price discovery phase again (no prior history of resistance). We used a Fibonacci Extension tool to find possible price targets (see chart) but the most logical next major resistande is $1,000 (+20%). Stop Loss at $826.

Why BNB Is a Strong Pick Now

- Burn Mechanism Supports Valor: The BEP-95 upgrade regularly burns BNB via gas fee mechanisms, reducing supply and supporting price over time.

- Network Utility & Adoption: BNB powers essential functions across Binance Chain, Binance Smart Chain, staking, dApp fees, and more. It remains a crucial token for DeFi, NFTs, and cross-chain activity.

- Technical Momentum: Both weekly and monthly moving averages are trending upward, indicating bullish momentum and increasing investor confidence.

What to Watch

- Resistance Level: BNB needs to clear ~$880–$900 to confirm a sustainable breakout.

- Support Floor: Holding above the $850 zone is crucial—breaching this could invite short-term weakness.

- Technical Signals: RSI is trading neutral, suggesting room to move either direction. Watch for MACD cues to confirm trend strength.

- Price Forecasts:

- Near-term outlook ranges from $821 to $962, with an average target around $899 entering September.

- Medium-term forecasts see a potential push toward $950–$1,000 if bullish patterns sustain.

- Longer-term projections (if adoption and macro tailwinds align) suggest BNB may reach $1,050–$1,150 later in Q4.

Conclusion

The token benefits from strong utility across the Binance ecosystem, continuous supply-burning mechanisms, and positive technical momentum.

Investors should watch the $880–$900 resistance and defend against a drop below $850 support. Sustainable movement through this zone could launch BNB toward $950–$1,000, while maintaining structural strength for further upside.

For on-demand analysis of any cryptocurrency, join our Telegram channel.