Key takeaways:

- The Bank for International Settlements, or BIS, a monetary institution controlled by central banks throughout the world, published a report on Monday examining the state of the decentralized finance, or DeFi, industry.

- “There’s a “decentralization illusion” in DeFi since the lack of governance forces some degree of centralization, and structural elements of the system result in a focus of energy,” the essay began. It went on to say:

- According to BIS, all DeFi protocols include intrinsic elements of centralization as a result of their central governance structures, in a manner similar to authorized entities such as businesses.

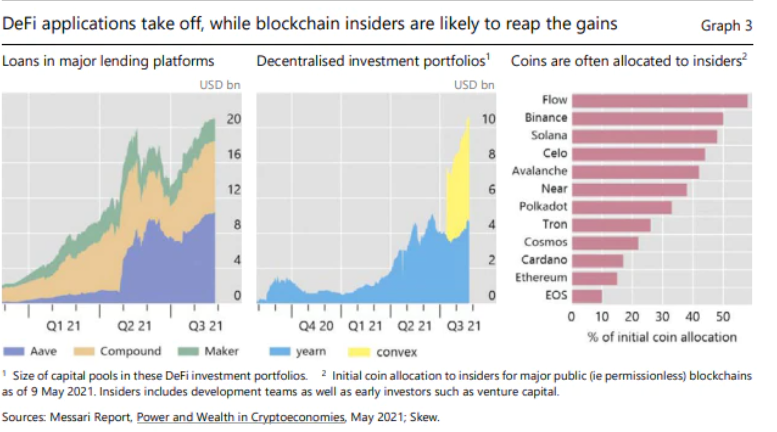

- Furthermore, certain DeFi blockchains concentrate power in the hands of large coin holders or insiders in token sales.

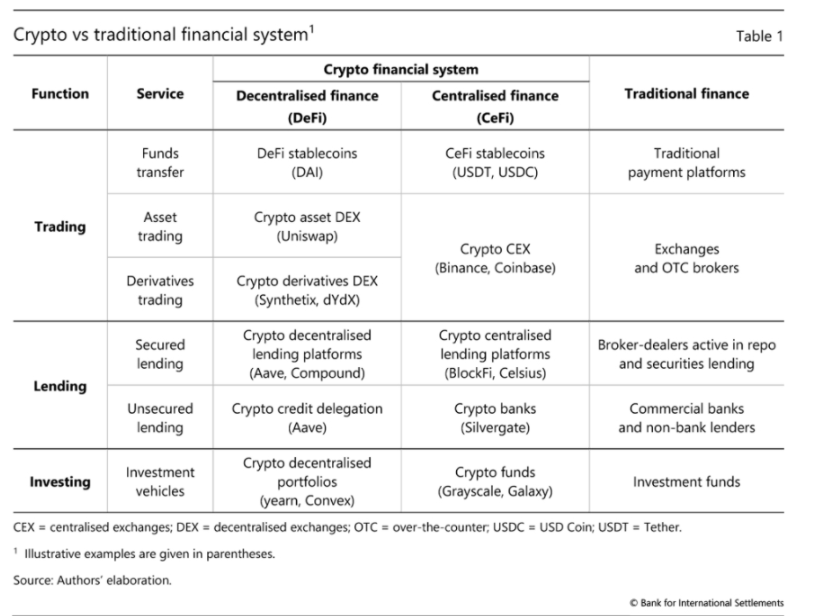

DeFi platforms allow users to lend, borrow, and save in crypto-assets and stablecoins without going via traditional, centralized financial gatekeepers like banks.

The Bank of International Settlements, or BIS, a financial organization controlled by central banks throughout the world, released a report on Monday that examined the growth of the decentralized finance, or DeFi, business. “There is a “decentralization illusion” in DeFi since the requirement for governance necessitates some level of centralization, and structural characteristics of the system contribute to a concentration of authority,” the article began. It went on to say:

“If DeFi were to become widespread, its vulnerabilities might undermine financial stability. These can be severe because of high leverage, liquidity mismatches, built-in interconnectedness, and the lack of shock absorbers such as banks.”

The BIS stated in its quarterly evaluation that DeFi has the potential to supplement traditional financial activity, but it presently has limited real-world applications and mostly facilitates speculation and arbitrage across multiple crypto assets.

According to BIS, due to their central governance structures, all DeFi protocols include intrinsic characteristics of centralization, akin to legal entities such as companies. Furthermore, on some DeFi blockchains, power is concentrated in the hands of large currency holders or insiders in token sales.

DeFi is vulnerable to criminal activities and market manipulation because to the insufficient application of anti-money laundering standards and consumer inspections, as well as transaction anonymity, according to the Swiss-based worldwide forum for central banks.

The investigation condemned DeFi trading and lending platforms for their extreme leverage, with Binance’s margin exceeding 100x at one point. It further stated that stable coins fragility, which is defined by their lack of transparency and regulation, as well as liquidity concerns and market risk, can result in an investor’s bank-run, causing them to plummet substantially below par value in a short period of time.

The BIS added that DeFi’s core premise of lowering costs by eliminating intermediaries has yet to be realized.

“There is a ‘decentralization illusion’ in DeFi since the need for governance makes some level of centralization inevitable and structural aspects of the system lead to a concentration of power,” the BIS commented.

“If DeFi were to become widespread, its vulnerabilities might undermine financial stability.”

Major investors have put their money on the sector’s expansion, with the Caisse de Dépôt et Placement du Québec, a Canadian pension fund, investing $400 million in major lending platform Celsius Network in October.

“At present, it is geared predominantly towards speculation, investing, and arbitrage in crypto assets, rather than real-economy use cases,” said the report.

Stablecoins are prone to runs, and possible fire sales of the assets underpinning them might cause funding shocks for enterprises and banks, the BIS stated, flowing through to the entire financial system if DeFi risks are not effectively controlled.

“Since the main challenges in DeFi resemble those in traditional finance, established regulatory principles can serve as a compass,”

Also, read