A crypto prop trading firm is a type of proprietary trading firm that focuses specifically on trading cryptocurrencies. These firms provide traders with access to capital to trade digital assets like Bitcoin, Ethereum, and altcoins, using the firm’s funds rather than their own.

Among other firms in space, Crypto Fund Trader is a proprietary trading firm (prop firm) that offers crypto‑native funded trading programs where traders can access substantial trading capital by successfully completing structured evaluation challenges. Read on this Crypto Fund Trader to know more about is as a proprietary trading firm.

Table of Contents

What is Crypto Fund Trader?

Crypto Fund Trader is an online prop trading evaluation platform that enables traders to demonstrate their skills in a simulated trading environment and access performance‑based rewards and capital. It positions itself as a specialized crypto‑oriented proprietary trading firm offering structured challenges and tools aimed at improving and evaluating traders’ performance.

It allows users to trade a wide range of markets including cryptocurrencies, forex, indices, commodities, and stocks using virtual capital. Traders can participate in evaluation challenges and, upon successful completion, become eligible for performance‑based rewards with access to up to $300,000 in virtual trading capital.

Crypto Fund Trader: Key Features

- Multi‑Asset Virtual Evaluation Environment

Crypto Fund Trader offers a virtual evaluation platform where traders can practice and test their skills across a wide range of markets. This includes cryptocurrencies, forex, indices, commodities, and stocks. Traders who successfully complete challenges can unlock access to up to $300,000 in virtual capital and performance rewards. - Large Instrument Selection

The platform supports trading across more than 900 instruments, including over 715 cryptocurrency pairs. Traders can access a broad array of assets in the crypto space as well as traditional markets. - Competitive Trading Conditions

Crypto Fund Trader provides low spreads starting at 0 pips and industry‑competitive fees, with leverage up to 1:100 available across all supported instruments. This makes it an appealing choice for traders seeking flexible trading conditions. - Flexible Evaluation Structure

The platform offers multiple evaluation formats including Instant, 1‑Phase, 2‑Phase, and Ascend. Each format is designed with different profit targets and risk rules, offering flexibility for traders at different skill levels. - No Time Limits for Evaluations

Traders are not pressured by time limits during the evaluation phases, allowing them to progress at their own pace without the stress of fixed deadlines. - Competitive Ranking and Rewards

The platform features a gamified ranking system, where traders can earn free prizes based on their trading performance. This adds an element of competition and rewards top-performing traders. - No Restrictions During News Events

Traders on Crypto Fund Trader can trade during major market news events without any additional restrictions, enabling them to take advantage of high-volatility opportunities. - Comprehensive Educational Resources

Crypto Fund Trader offers a variety of educational tools such as tutorial videos, live streams, e‑books, podcasts, and personal mentoring. These resources aim to support traders in improving their skills and advancing their careers. - Platform Options for Different Preferences

Traders have the flexibility to choose from a variety of trading platforms, including MetaTrader 5, Match‑Trader, and Bybit integration, catering to different trading styles and preferences.

Also, you may read FundedNext: Review

How Crypto Fund Trader Works – Step-by-Step Guide

Step 1: Choose Your Evaluation Program

- Visit Crypto Fund Trader and select a funding challenge that fits your trading goals.

- Choose between one-phase, two-phase, or other structured evaluation formats.

- Decide the account size and type of evaluation you want to start with.

Step 2: Register and Pay the Evaluation Fee

- Complete the registration by providing your personal details.

- Pay the evaluation fee via available payment methods, such as credit/debit card or cryptocurrency.

Step 3: Set Up Your Trading Platform

- Set up your account on the trading platform.

- You can choose from MetaTrader 5, Match‑Trader, Bybit integration, or the proprietary CFT platform.

- Receive your login credentials and access to the challenge account.

Step 4: Begin the Evaluation Challenge

- Start trading in your evaluation account based on the challenge rules.

- Your performance will be tested by meeting profit targets and adhering to risk limits (such as drawdowns).

Step 5: Meet Profit and Risk Criteria

- Trade until you meet the profit objective while following the risk management rules.

- Ensure that you do not breach daily drawdown limits or other risk thresholds.

Step 6: Pass the Evaluation

- Successfully complete the evaluation challenge.

- If you meet all the profit and risk criteria, you will pass the evaluation and qualify for a funded account.

Step 7: Access a Funded Account

- After passing, you gain access to a funded trading account.

- You can now trade with the firm’s capital, which can be up to $300,000 in virtual capital.

Step 8: Trade and Earn

- Continue trading under the firm’s terms and conditions.

- You will receive a profit share based on your trading results, typically keeping a significant portion of the profits.

Step 9: Withdraw Profits

- Once you meet the platform’s withdrawal requirements, you can request to withdraw your share of profits.

- Follow the platform’s payout process to receive your earnings.

Challenge Structure Overview

| Parameter | 1-Phase | 2-Phase | Instant | Ascend |

|---|---|---|---|---|

| Phase 1 Profit Target | 10% | 8% | N/A | Unknown |

| Phase 2 Profit Target | N/A | 5% | N/A | Unknown |

| Daily Loss Limit | 4% | 5% | 5% | 5% |

| Max Loss Limit | Trailing 6% | Fixed 10% | Varies* | Fixed 5% |

| Minimum Trading Days | 5 days | 5 days per phase | 5 days (for first withdrawal) | Unknown |

| Scaling Structure | No scaling | Every 3-4 months | 2x account doubling per 10% profit | Single redemption |

| Max Account Size | $300,000 | $300,000 | $1,280,000 | No limit |

| Max Concurrent Evaluations | Unlimited | Unlimited | 3 per user | No limit |

| First Withdrawal Timing | 15 days traded | 15 days traded | 5 trading days | Immediate (Phase 2 complete) |

| Profit Split | 80-90% | 80-90% | 80-90% | Unknown |

| Time Limit | Unlimited | Unlimited | Unlimited | Unlimited |

| Leverage Available | 1:100 | 1:100 | 1:100 (Advanced) / Variable (Student) | Unknown |

| News Trading | Permitted | Permitted | Permitted | Restricted (2 min buffer) |

| Copy Trading | N/A | N/A | N/A | Prohibited |

| Account Outcome | Live funded account | Live funded account | Scaling account (up to $1.28M) | Redeemable ticket |

Fee Structure

| Account Size | 1-Phase Fee | 2-Phase Fee | Instant Fee | Ascend Fee |

|---|---|---|---|---|

| $2,500 | – | – | $125 | |

| $5,000 | $63 | $58 | $240 | $45 |

| $10,000 | $120 | $110 | $475 | $90 |

| $25,000 | $262 | $240 | – | $225 |

| $50,000 | $450 | $389 | – | $450 |

| $100,000 | $789 | $660 | – | $899 |

| $200,000 | $1,480 | $1,250 | – | $1798 |

Crypto Fund Trader: Safety and Security

Crypto Fund Trader states in its Privacy Policy that it applies reasonable technical and organizational measures to protect users’ personal data collected through the website, with the objective of preventing unauthorized access, misuse, or alteration. At the same time, the company explicitly discloses that no online system can be guaranteed to be fully secure, and therefore it cannot provide absolute assurance that transmitted or stored information will never be compromised. This limitation is clearly acknowledged as part of its data-protection disclosure on the official site.

Additionally, Crypto Fund Trader clarifies that its platform is a simulated trading and evaluation environment, not a regulated brokerage, and that service availability may be interrupted due to maintenance or technical issues, reinforcing that participation carries inherent operational and security risks as disclosed on the official website.

Also, you may read 5 Best Risk Management Books

Crypto Fund Trader vs HyroTrader: Which Crypto Prop Firm Fits You Best?

| Category | Crypto Fund Trader | HyroTrader |

|---|---|---|

| Core Model | Crypto proprietary trading evaluation firm that provides funded accounts after traders pass defined evaluation challenges. | Crypto proprietary trading firm offering trading challenges that lead to funded accounts with profit sharing. |

| Challenge Types | Instant (0-phase), 1-Phase, 2-Phase, and Ascend evaluation programs across multiple account sizes. | One-step and two-step crypto trading challenges. |

| Evaluation Structure | Structured evaluations with defined profit targets, daily loss limits, and maximum overall drawdown. | Evaluations with profit targets, maximum drawdown limits, and mandatory risk controls. |

| Trading Platforms | Bybit integration plus additional platforms such as MetaTrader 5 and MatchTrader depending on program selection. | Bybit and CLEO trading platforms. |

| Tradable Markets | Crypto trading plus additional instruments (such as forex, indices, commodities, and stocks) depending on platform choice. | Primarily crypto markets using exchange-listed pairs. |

| Profit Split | Profit-sharing model offered on funded accounts; split percentage depends on the selected program. | Traders can retain up to 90% of profits on funded accounts. |

| Risk Management Rules | Enforces daily loss limits, overall drawdown caps, and prohibited trading behaviors as outlined in official rules. | Enforces drawdown limits, stop-loss requirements, and structured risk rules during challenges and funded trading. |

| Funding Access | Funding is granted after successful completion of evaluation criteria, or immediately under Instant Funding programs. | Funding is granted after successful completion of challenge requirements. |

| Payouts | Payout availability and timing depend on funded account terms and program structure. | Payouts are available after meeting minimum profit and trading requirements post-funding. |

| Account Setup | Traders choose a challenge type and account size, complete evaluation in a simulated environment, then move to funded trading. | Traders select a challenge, choose a supported platform, and complete evaluation to access a funded account. |

| Official Positioning | Emphasizes scalable funding, multiple evaluation paths, and integration with major crypto exchanges. | Emphasizes real exchange execution, trader discipline, and high profit retention. |

Also, you may read Is HyroTrader Worth It? An In-Depth Review

Partnership and Affiliate Programs

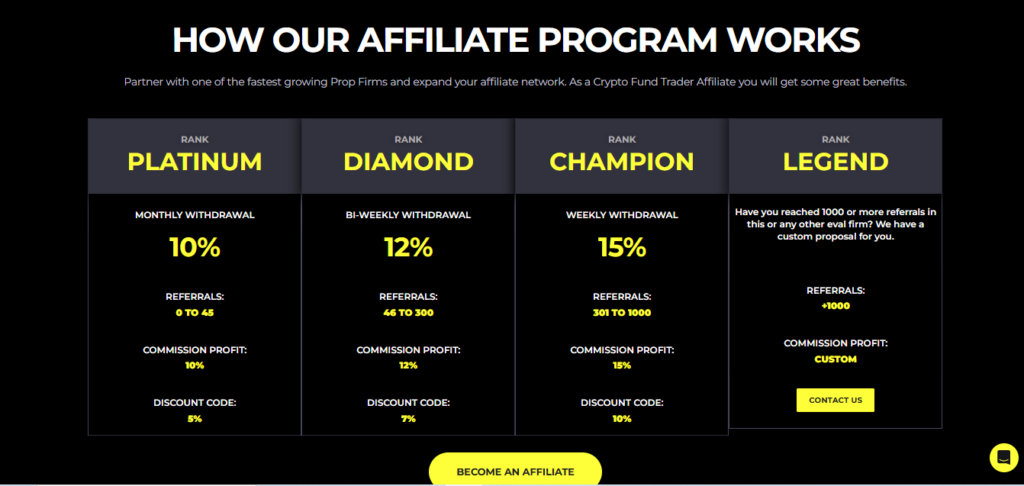

- Earn up to 15% commission by referring traders to Crypto Fund Trader, with tiered rewards based on referral volume.

- Progress through Platinum, Diamond, Champion, and Legend ranks, unlocking higher commissions, larger discount codes, and more frequent withdrawals.

- Tier-Based Commission System: Your commission rate increases as you refer more people in a single month.

- Receive monthly, bi-weekly, or weekly payouts depending on rank, with custom partnership terms available for top affiliates (1000+ referrals).

- Commissions apply to first-time purchases, tracked via a 60-day referral cookie.

- Withdraw earnings in USDT or BTC, or use commissions to purchase plans directly.

- Influencers can access CPM-based earnings aligned with audience reach and engagement.

- Participate in affiliate competitions with team-based promotions and additional reward opportunities.

- Built for creators, communities, and long-term partners seeking scalable, performance-based earnings.

| Rank | Withdrawal Frequency | Referrals Range | Commission Profit | Discount Code |

|---|---|---|---|---|

| Platinum | Monthly | 0 – 45 | 10% | 5% |

| Diamond | Bi-Weekly | 46 – 300 | 12% | 7% |

| Champion | Weekly | 301 – 1000 | 15% | 10% |

| Legend | Custom | 1000+ | Custom | Custom |

Support and Community Ecosystem

Crypto Fund Trader provides a dedicated support system that includes official email assistance, a contact form, live chat availability, and a structured FAQ section to help traders resolve issues related to accounts, rules, and evaluations efficiently. These channels are designed to ensure traders receive clear guidance and timely responses throughout their journey on the platform.

In addition to support, Crypto Fund Trader promotes a growing community and educational ecosystem. The platform offers learning and theory tools to help traders improve skills and better understand evaluation requirements, while official social and community channels enable communication, updates, and engagement. The site also highlights trader activity and achievements, reinforcing a sense of transparency, participation, and shared progress within the Crypto Fund Trader community.

Also, you may read FundedNext: Review

Conclusion

Crypto Fund Trader presents itself as a structured proprietary trading evaluation platform designed to help traders demonstrate skill, discipline, and risk management without risking personal capital. With multiple challenge formats, flexible timelines, educational resources, and community support, the platform is best suited for aspiring and experienced traders who are comfortable operating within defined rules and evaluation criteria and who seek access to larger trading capital through a performance-based progression model.

How long is the trading period?

There is no maximum trading period, the evaluation offers traders the freedom to progress at their own pace.

What are the available platforms?

Crypto Fund Trader supports the Match-Trader web/desktop/mobile platform, MetaTrader 5, and integration with Bybit for evaluations.

What instruments can be traded?

Depending on the platform, you can trade over 715 crypto futures on Bybit, and on Match-Trader/MetaTrader 5 more than 200 instruments including crypto, forex, indices, commodities, and stocks.