Key takeaways:

- Spot Bitcoin ETFs are scheduled to begin trading tomorrow after the US SEC anticipated approval of the investment products today.

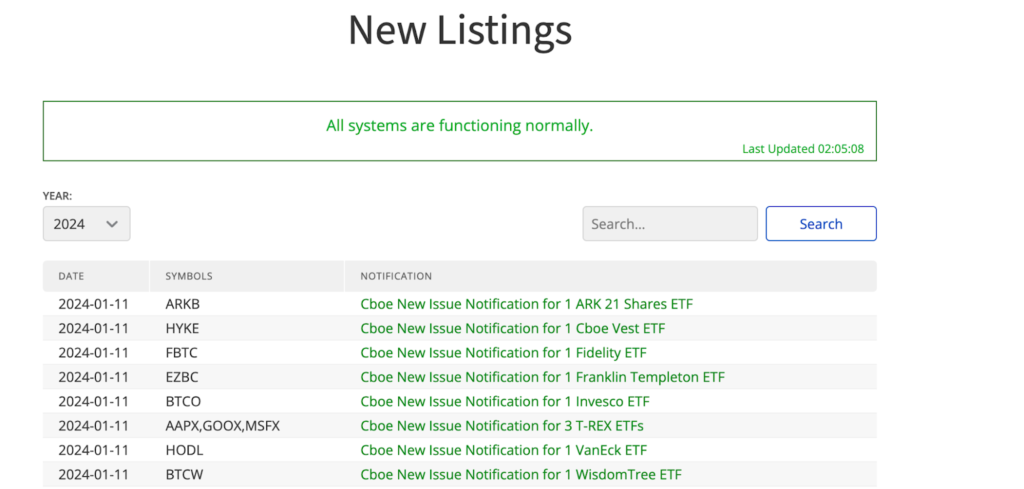

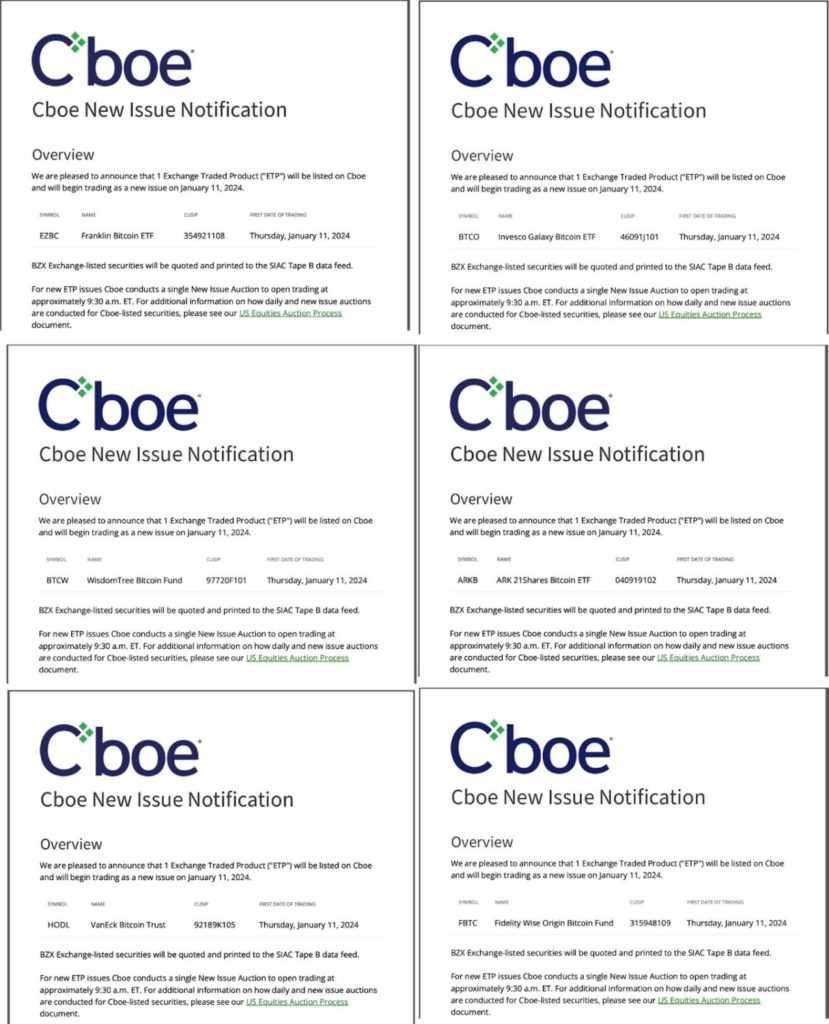

- CBOE has already said that the investment products will be listed as subject to SEC approval.

Spot Bitcoin ETFs are scheduled to begin trading tomorrow, according to the Chicago Board Options Exchange (CBOE), after the US Securities and Exchange Commission’s (SEC) anticipated approval of the investment products today. Six out of the eleven pending ETFs will, in fact, start trading on Thursday, according to confirmation from the exchange.

In particular, the Invesco Galadxy Bitcoin ETF (BTCO), Franklin Bitcoin BTF (EZBC), ARK 21Shares Bitcoin ETF (ARKB), VanEck Bitcoin Trust (HODL), Fidelity Wise Origin Bitcoin FUnd (FBTC), and WisdomTree Bitcoin Fund (BTCW) are scheduled to be listed by the CBOE.

On the other hand, CBOE has already said that the investment products will be listed as subject to SEC approval.

The digital asset market has been dominated by talk about the impending Spot Bitcoin ETF for the past few months. However, doubts about the SEC’s viewpoint jeopardized its prospects. But as 2024 approaches, ten days in advance, the approval seems inevitable.

Spot Bitcoin ETFs are expected to begin trading tomorrow, according to the CBOE. The exchange appears to have validated the growing probability that permissions will be granted by today’s end, just hours after they approved the listings.

Six of the eleven pending Spot Bitcoin ETFs will be listed on the exchange. These comprise ETFs distributed by Ark Invest, VanEck, WisdomTree, and Franklin Templeton. Approval is still pending for the other Spot Bitcoin ETFs, which are listed on the Nasdaq and New York Stock Exchanges.

Experts from across the industry have estimated that trade might begin as early as Thursday morning. There’s now some evidence to suggest that this might be the case. It is nearly certain that the industry will receive approvals by Thursday evening after a false approval post last night.

Applications for Spot Bitcoin ETFs are anticipated to be approved by the SEC following today’s trading close, according to a senior executive at one of the applying firms.

According to Fox Business, the first applications are expected to be accepted shortly after 4:00 pm ET today. This aligns with earlier expectations that the approvals would happen on Wednesday.

For many potential issuers, today is also the deadline. Nonetheless, preliminary sources guarantee that the US SEC will probably accept more than one application. For the investment product, there are now over a dozen pending applications.

There will be a lot of competition because many Spot Bitcoin ETFs are anticipated to be approved by the SEC. This was evident in the debate over advertisements that began prior to approvals.

Furthermore, it has persisted in terms of price, with asset management companies Grayscale, Fidelity, and BlackRock trying to outbid one another on investment businesses’ pricing schemes.

In addition, with the introduction of the Bitcoin ETF, global banking behemoth Standard Chartered has forecast that the price of Bitcoin (BTC) might hit $200,000 by the end of 2025.