Cash App and Robinhood are both US-based exchange platforms that allow you to trade crypto. Further, Cash App might be the most popular payments app in the USA and Robinhood would be the go-to exchange to trade stocks, commodities, and metal. However, both of the platforms also offer crypto trading services. Here’s a brief Cash app vs Robinhood comparison:

| Features | Cash App | Robinhood |

| Launched in | 2013 | 2013 |

| Mobile Application | Android and iOS | Android and iOS |

| Supported Cryptocurrencies | Bitcoin Only | Bitcoin (BTC), Bitcoin Cash (BCH), Bitcoin SV (BSV), Dogecoin (DOGE), Ethereum (ETH), Ethereum Classic (ETC), Litecoin (LTC) |

| Trading limit | 3 day trades in a 5 day trading period. | 3 day trades in a 5 trading day period. |

| Trading Fee | 2%-3% | $0.000119 per share (equity sells), and $0.002 per contract (options sells) |

| Headquarters | New York | California, United States |

Table of Contents

What is Cash App?

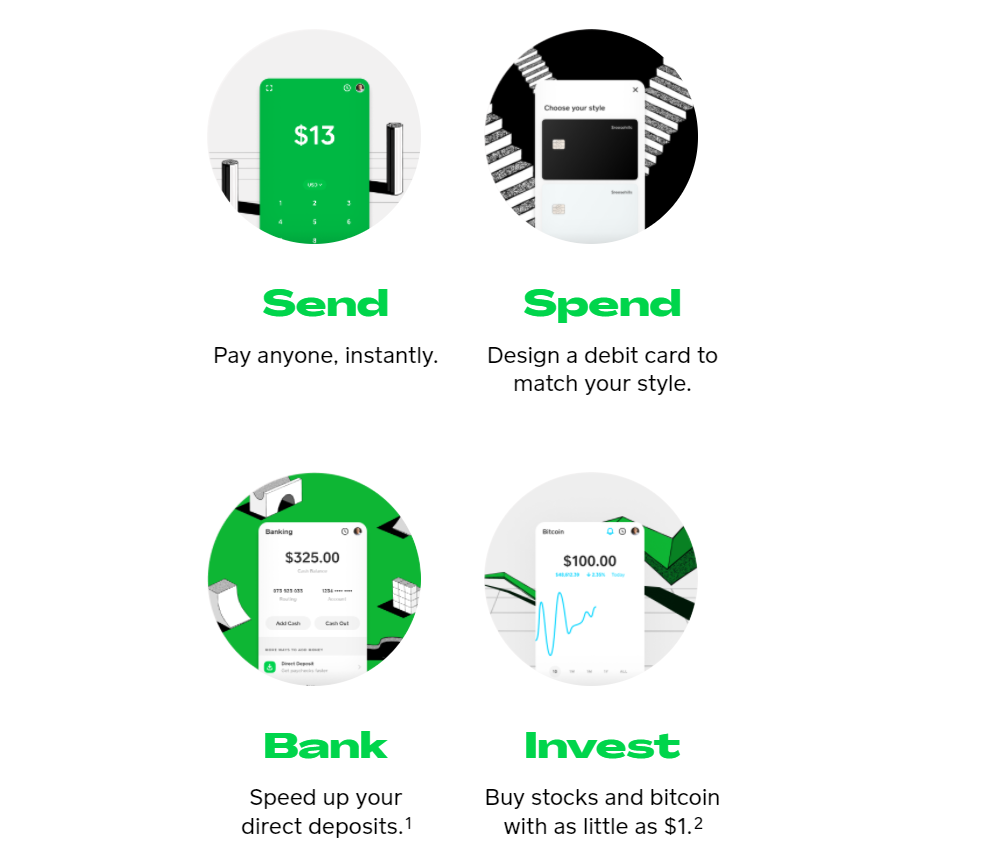

With its headquarters in San Francisco, the Cash App platform claims to be a financial services company that is the easiest way to send, spend, save, and invest your money, as well as allows you to trade your stocks and Bitcoin.

This is a peer-to-peer payment app created back in 2013; it offers a distinct set of features to its users, including the customizable, fee-free debit card which can be used anywhere along with discounts when used every day, receiving paychecks up to 2 days early, ATM withdrawals are free and makes it easy for the users to invest in stocks and Bitcoin. Banking services are offered by Cash’s Bank partner(s). It is incredibly simple to get started with this app with no commission and invest in your stocks as little as $1.

Also, read How to Buy Bitcoin on the Cash App?

What is Robinhood?

With an average of 22.5 million users, the Robinhood offers Commission-free investing in stocks, options, and ETFs along with the tools that might be needed to put their money in motion in Robinhood Financial. Further, you can easily buy and sell crypto like Bitcoin, Ethereum, & Dogecoin with Robinhood Crypto.

Robinhood’s cash management provides features that will allow the user to earn 30% APY. The recurring investment feature enables the trader to automate their investment to a fixed dollar amount periodically, such as once per month. Everything that is needed to manage their assets is available in one app. It also allows the user to set up customized news and notifications to stay on top of the user’s assets as casually or as relentlessly as you like as well as being in charge of the flow of info is up to you.

Cash App vs Robinhood: Trading Features

Cash App

- With Cash App, the user can pay anytime and anywhere, It’s fast and free, and a cashtag is all one needs to get started.

- In addition, it allows its users to design a customizable and fee-free debit card to match their style, with which the user can earn instant discounts on their everyday spending.

- If you’re a user who has a Cash App account, you can receive paychecks up to 2 days early. Furthermore, ATM withdrawals are free when you have at least $300 coming in each month.

- Whether you’re a beginner or an experienced trader, the Cash App platform makes it simple to invest in stocks as well as Bitcoin.

Robinhood

- Investors with even a small amount of money can create an account on the Robinhood app and avoid commission fees. The platform does not require a minimum balance to get started with investing.

- With Robinhood, the user can also buy fractional shares. Fractional investing benefits its users by allowing them to build a diverse portfolio, and a lack of funds won’t stop them from owning a piece of the companies they wish.

- Further, the Robinhood platform lets its users set up their accounts and automatically reinvest their dividends back into the stock they are originally from, allowing them to grow their portfolios.

- Moreover, you can set up customized news and notifications to stay on top of your assets.

- This platform wants its community of users to learn as they grow.

Cash App vs Robinhood: Fees

Cash App Fees

Cash App offers a fee structure that is compatible with its users.

- A fee of 3% is charged when the user deposits money (via credit card).

- On the Instant transfer feature, there is a charge of 1.5% (minimum of 25 cents).

- If the user is buying or selling Cryptocurrency, the nominal fee of 2%-3% is charged, but it might vary.

- A fee of $2 per withdrawal is imposed in Cash App. This particular platform will reimburse up to $7 charge per withdrawal up to three times every 31 days after receiving $300 or more in qualifying direct deposits per month.

Robinhood Fees

Another main reason why Robinhood has become one of the most popular platforms is because of its fee structure.

- Robinhood provides a commission-free platform to its users as well as no deposit fee or no inactivity fee.

- However, they charge a $75 fee if the user transfers their assets out of Robinhood, regardless of the transfer being partial or complete.

- Furthermore, the Trading Activity Fee is $0.000119 per share (equity sells), and $0.002 per contract (options sells) is charged.

- The Security and Exchange Commission fee is $5.10 per $1,000,000 of principal (sells only).

Cash App vs Robinhood: Security and Privacy

Is Cash App Safe?

Cash App goes a long way in order to make sure that they provide a safe platform for all its users. The list of safety measures include:

- The foremost is the Security Locks, with the help of PIN entry, Touch ID, or Face ID verification, protects payments.

- In Addition, Encryption through PCI-DSS level 1 certification means they are protecting all the data of the user.

- With the Coin Storage facility, Bitcoin balance is securely stored in the platform’s offline system.

- The platform allows the user to Disable Anytime and Pause card spending instantly if they lose it.

- Cash App provides Fraud Protection and helps protect the investor from unauthorized charges.

Is Robinhood Safe?

To make sure of the safety of its customer and make the platform secure, the Robinhood Security Team uses various industry-standard measures, which include:

- The platform stores user’s account passwords in the form of the hash using the industry-standard BCrypt hashing algorithm that means they’re stored in a scrambled format making it difficult and time-intensive for attackers to crack them.

- In addition, all sensitive and vital information is protected by encryption. The servers are secured with the help of the Transport Layer Security (TLS) protocol with up-to-date configurations and ciphers, which maintains privacy.

- They use a trusted Third Party to access information about the user’s bank account.

- All accounts created on this platform are protected with Two-factor Authentication for new devices. This provides a layer of security applied to all accounts and ensures it’s really you signing in to your account.

Cash App vs Robinhood: Supported Exchanges

Cash App

Cash App only offers users to buy, hold, send, receive, and sell Bitcoin and carry out Cryptocurrency trade. This gives Robinhood significant leverage as Cash App only offers Bitcoin. Still, it makes it very simple for the user if he is a Bitcoin Enthusiast, and only with one click can the user carry out trade activities effortlessly.

Robinhood

Robinhood Platform has a lot to offer as compared to the Cash app and lets its user create a decent little portfolio that includes the list of the following supported cryptocurrencies:

- Bitcoin (BTC)

- Bitcoin Cash (BCH)

- Bitcoin SV (BSV)

- Dogecoin (DOGE)

- Ethereum (ETH)

- Ethereum Classic (ETC)

- Litecoin (LTC)

Cash App vs Robinhood: Customer support

Cash App Customer Support

A separate tab is dedicated to the frequently asked questions where you may find answers to all your queries. Further, you can contact their customer care team by calling them at this phone number: 1 (800) 969-1940.

Robinhood Customer Support

- The customer service is provided through the app or the website, which has a section for frequently asked questions with all the information and answers one might need for assistance and guidance.

- Moreover, Robinhood has chatbot capability, which makes the platform customer care team easily approachable.

- However, no telephone number is provided, but the user can enter their phone number for a callback. As a customer, they can also contact the support team on social media.

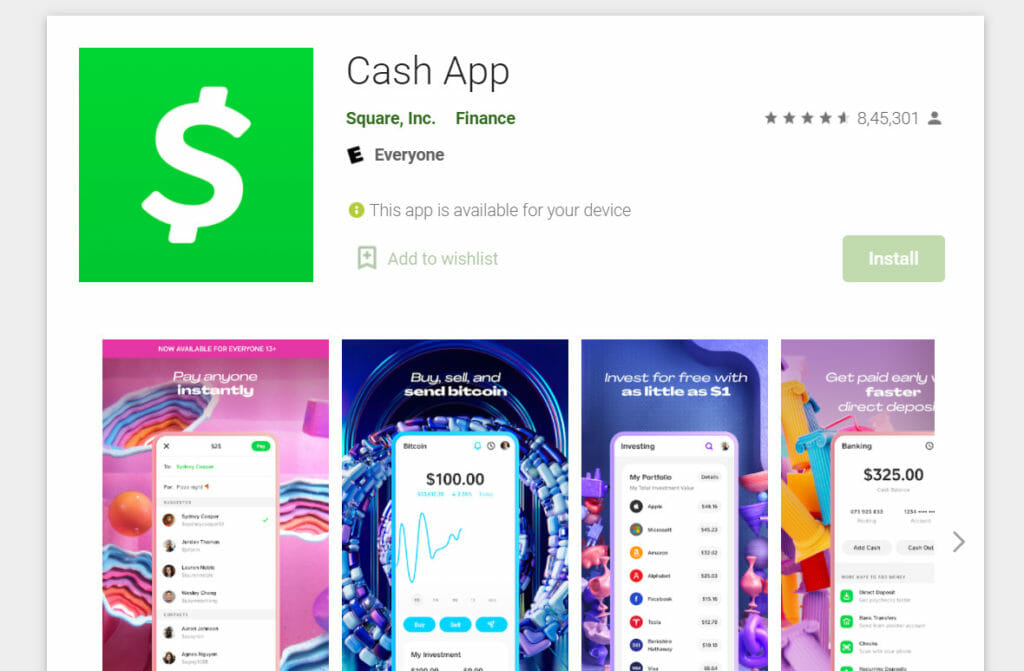

Cash App vs Robinhood: Mobile Application

Cash App

The Cash App is available for iOS and Android users respectively. This application has a simple and interactive user interface which makes it very easy to use. It provides you with all the features on the website and has more than 8 lakh users already.

Robinhood

With more than 4 lakh users currently, the Robinhood mobile application is again available for iOS and Android mobile devices. In addition, users can access it on the web platform, their tablets, and mobile devices. One drawback is that cryptocurrency offerings are limited in this application. However, the app allows users to create a demo account on the app for new users. Furthermore, the application sends push notifications when there are any alterations in the stock prices.

Cash App vs Robinhood: Pros and Cons

Cash App

| Pros | Cons |

|---|---|

| Easy to use and sign-ups | Supports only Bitcoin |

| Automatic Investing | Basic charting features |

| Low costs | Lack of customer support |

Robinhood

| Pros | Cons |

|---|---|

| Commission-free trading | No withdrawal of cryptocurrency holdings |

| You can deposit as little as you want | Limited Customer Support |

| Very simple interface for new crypto users | Limited research and educational resources available |

Conclusion

To conclude, if you are in for using crypto as a payment or would like to easily convert your crypto to Fiat and vice versa, Cash App might be your choice. However, if you’re a trader primarily interested in trading crypto, stocks, metal, etc. all with a single portfolio Robinhood might be your go to exchange.

Frequently Asked Questions

Q1. Does Robinhood charge fees?

Robinhood app does not charge any commission or trading fees for stocks, crypto, options, and ETFs trades. However, there is a transfer fee of $75 that the user needs to pay if you’re transferring from one brokerage to another.

Q2. How to claim the Referral Bonus on Cash App?

To claim their invitation bonus amount, the user must tap the profile icon on your home screen. To receive the bonus, make sure this new member:

Enter the referral code during the process of signing up.

They must link a new debit card or bank account to their Cash App account.

They must send $5 within the duration of 14 days of entering the referral code.

Q3. How to activate the Cash app card?

To activate your Cash Card using the given QR code and scan it:

1. Tap the Cash Card tab on your Cash App home screen

2. Tap the picture of the Cash Card

3. Tap Activation of Cash Card

4. Tap OK when your Cash App asks for permission to use your camera.

Also read,