On-Chain and Derivatives

Bitcoin experienced its first downward difficulty adjustment since 2021.

This week I will try to structure this by breaking down the section into two parts, value and momentum; given that these are the two main types of market participants in BTC. Regarding value, I think this should be broken into two parts as well; short and long-term market participants.

Let’s start with the short term.

Short term we still view the low to mid-30s as value for BTC.

This is made evident by several factors: with order book confluence across various venues and viewing broader price structure as a range between 30k-60k being the main two.

Spot premium regime persists, although starting to retrace a bit after the recent 14% candle BTC had this week.

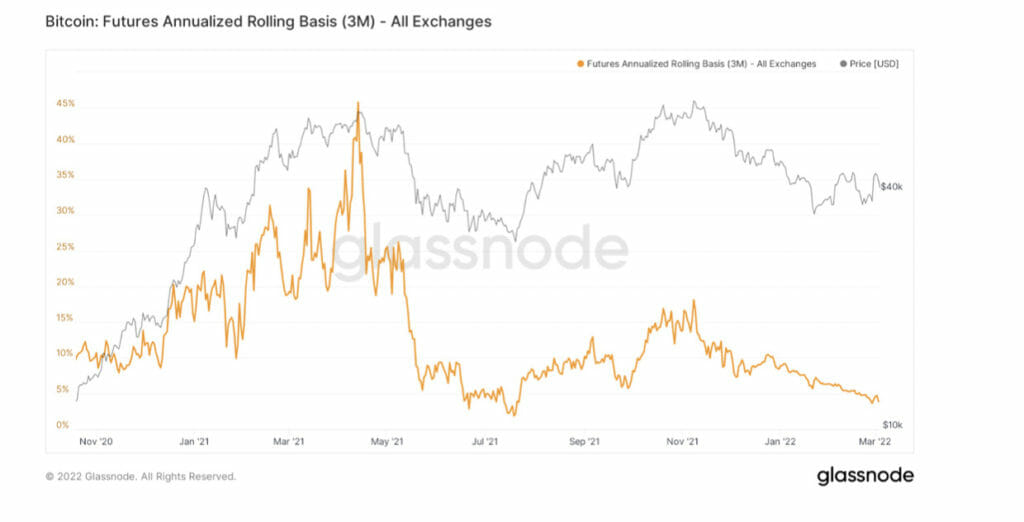

Also on derivatives, the 3-month spot/futures basis is at 3.89%, showing a lack of euphoria from the derivatives market. Keep in the back of mind the biggest no-brainer buy is if this was to go negative though.

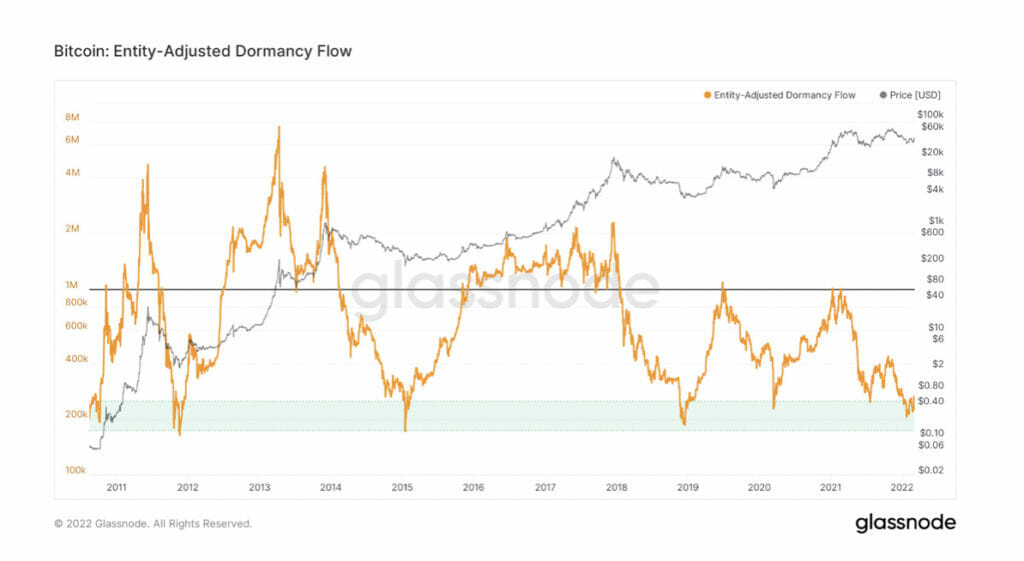

From a broader standpoint, for someone with a long time horizon, these areas are favourable to begin averaging more heavily. Not at absolute “pico” bottom levels, but not to sound like a broken record from prior letters, in the lower 25th percentile for historical valuations. Dormancy flow, comparing the spending of overall coins relative to yearly trend.

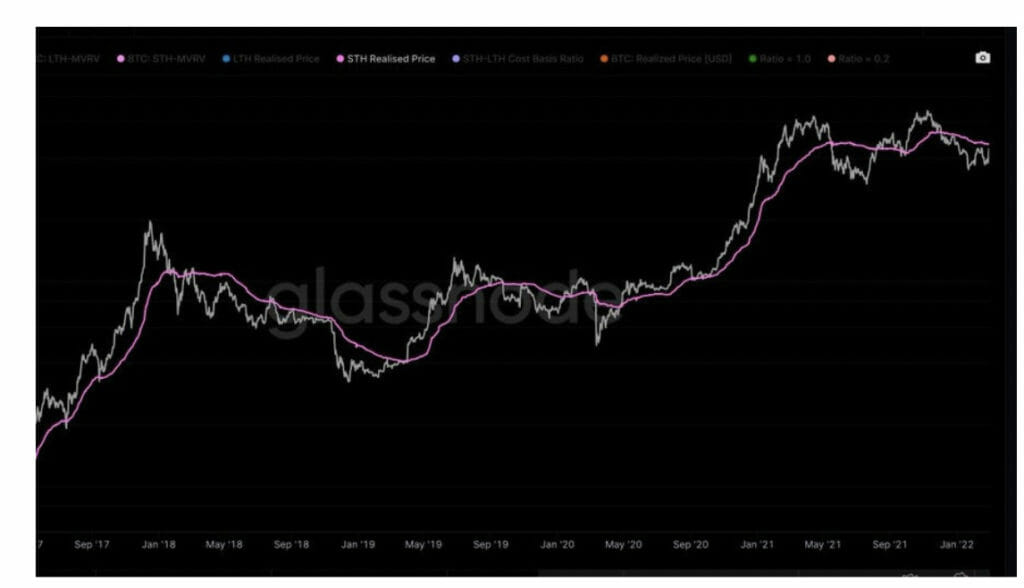

MVRV, comparing Bitcoin’s valuation relative to the value “stored” in the network by using the aggregated cost basis of all coins moved on-chain.

Mayer multiple, looking at Bitcoin’s price relative to the 200 days moving average.

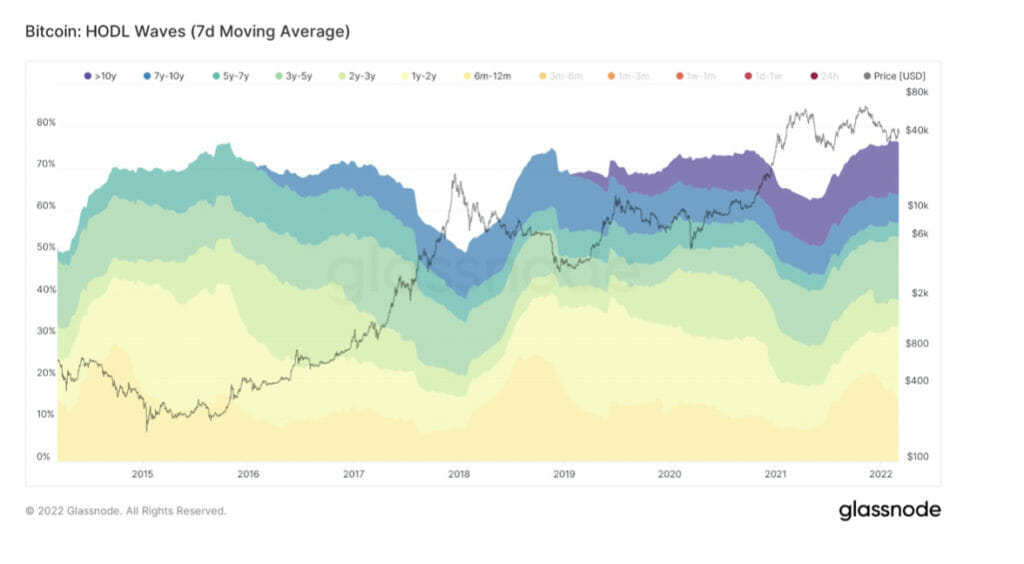

HODL waves, showing the amount of supply not moved in “x” amount of time.

Now on to the momentum.

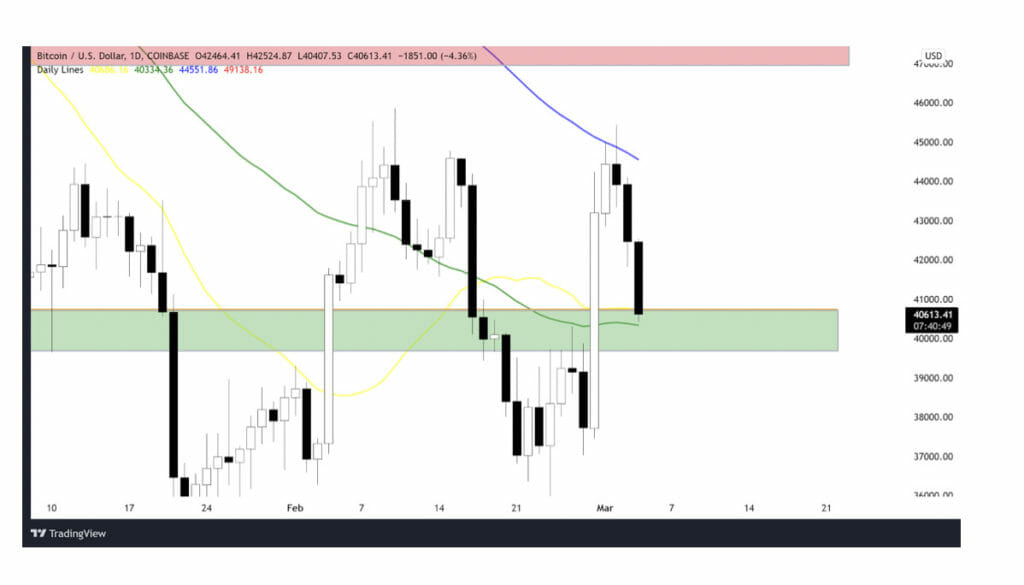

Ultimately I think the main level for BTC to reclaim from a high time frame perspective is 46-47K.

This is a confluence of several things including general price structure, the yearly open, and short-term holder cost basis; a key price band through the last 5+ years of Bitcoin market history.

Showing some early signs of momentum including flipping the 20 and 50-day moving averages and retesting them now, but rejected at the 100 days and still far from the momentum.

Another momentum indicator I like is the EHMA 180.

BTC attempted to reclaim this over the last few days but has since been lost.

High level on the momentum side: Early signs of attempts to reclaim momentum, but still not there.

Closing Thoughts

The most important part of trading is discipline and patience. So, again, it’s your hard-earned money you’ll be investing, so Do Your Own Research before investing and nothing in this article is financial advice.

Also read,