Table of Contents

Bitcoin News: 30th October 2021

- Ethereum hits new ATH after Altair upgrade shows clear path to the merge

- Binance NFT x CyBall x GuildFi to Hold World’s First Triple IGO

- Blockchain Play-To-Earn Games Are Making Founders And Players Rich

- Major Russian bank explores crypto investment amid strong demand

- Crypto Adoption Boosts Travel: Travala Rises From The Ashes

- Blockchain technology can make micropayments finally functional

- Here’s Why Shiba Inu ($SHIB) Doesn’t Need a Robinhood Listing Any Longer

- BXH lending agreement hacked, almost 4000 ETH stolen.[LINK]

Ethereum hits new ATH after Altair upgrade shows clear path to the merge

Recently, the price of ETH has been on a bullish streak. It has gained 147 percent since July 21, when it was approximately $1,780, and is now around $4,400.

According to the ETH/USD price indexes on Coinbase and Coinmarketcap, the price of Ethereum (ETH) has risen to a new all-time high (ATH) today, hitting $4,400.97 at roughly 1:02 a.m. UTC.

At this moment, ETH is trading at $4,380, representing a 46.6 percent increase since the beginning of October. The previous ATH, according to Coinmarketcap’s price index, was only eight days ago, on Oct. 21, when the asset reached a price of $4,308.48.

Since dipping to roughly $1,780 on July 21, ETH has gained 147 percent to reach a new price discovery milestone.

The Ethereum 2.0 Altair Beacon Chain update had a successful start, according to Cointelegraph, with 98.7% of nodes upgraded at the moment. The successful upgrading of Altair to the Beacon Chain was seen as a key component in paving the way for Ethereum 2.0’s integration with the mainnet and move to a proof-of-stake (PoS) consensus method.

The platform’s popularity is further fueled by its use in the booming decentralised finance (DeFi) and nonfungible token (NFT) industries. They emphasise Ether’s future expanding demand, assuring more tailwinds for its positive prognosis in Q4 2021 and possibly beyond 2022.

Since July, Ethereum has undergone significant modifications, including the London Hard Fork, which added a deflationary burning mechanism to the asset’s fee structure.

The SEC recently approved seven Bitcoin futures-based ETFs to list on the New York Stock Exchange, indicating that overall market confidence in crypto has improved. Bitcoin prices have reached new all-time highs in the wake of the news.

Binance NFT x CyBall x GuildFi to Hold World’s First Triple IGO

The historic news could usher in a new era in how GameFi projects debut in the future, with the triple offering providing three times the potential exposure.

The world’s first-ever Triple IGO (Initial Game Offering) is taking place at the same moment on Binance NFT, CyBall, and GuildFi.

CyBall is a Non-Fungible Token (NFT) game with a football theme in which players can acquire, trade, and tutor CyBlocs (short for Cyborgs on the Blockchain). Members of the team have been working tirelessly behind the scenes with Binance and GuildFi to plan and launch this long-awaited event. The CyBall team is grateful to their two collaborators and proud to be one of the first gaming projects to be included to Binance NFT’s IGO list, as well as the first game to be added to GuildFi’s IGO platform.

Binance NFT has only recently presented the notion of IGO to the market in order to start a promising game. The CyBall team is certain that, with the quick development of the NFT gaming revolution, IGOs will become the new norm within this industry for presenting exceptional games to a wider public audience.

CyBall’s Genesis Packs will be listed on Binance NFT’s Marketplace, their Genesis Site, and GuildFi’s NFT platform as part of the Triple IGO event. Approximately one week following the IGO, each Genesis Pack will be redeemable for a single Genesis CyBloc NFT. (Please note that each pack will contain three CyBloc NFTs, as previously stated.) That material is now out of current, and it has been updated for the Triple IGO preparation. In a separate CyBall Medium article, we’ll provide more information.)

To ensure the game’s successful launch, CyBall has strategically partnered with Coin98, Yield Guild Games (YGG), Ninja Traders, Ancient8, Good Games Guild (GGG), Merit Circle, and GuildFi (to name a few) to not only ensure the game’s successful launch, but also to shape the future of Play-to-Earn gaming and bring this phenomenon to the masses.

“A very fun game with an active community, well-thought-out game economics, and above all, it appears to be a pleasant and exciting game to play,” Merit Circle’s CEO and Co-founder Marco van den Heuvel said.

“CyBall is an exciting blend between Football Manager and Pokémon,” said Jeff Holmberg, YGG’s Head of Investments, “with four different game modes to attract both casual and competitive players with a lively game flow and Play-to-Earn principles that provide players several ways to earn.”

The game’s popularity has skyrocketed in recent months, earning goals in the NFT gaming area, with their latest Triple IGO announcements indicating significant signs of development in the Game Finance (GameFi) business. The Triple IGO, CyBall believes, will ensure that its Genesis CyBlocs are taken up by not only NFT fans, but also community members and gamers who have been looking forward to playing a CyBall game later this year.

“The CyBall team would like to extend an invitation to everyone to attend this historic event. The CyBall Team stated, “We will be releasing the precise Triple IGO date and details of the tournament very shortly.”

Blockchain Play-To-Earn Games Are Making Founders And Players Rich

Four new additions to the Australian Financial Review’s 2021 Young Rich List have made their fortunes using blockchain-based crypto play-to-earn games. These games take place in the’metaverse,’ which is currently in its early stages of development.

Some people may have heard of Axie Infinity, a blockchain and cryptocurrency game in which players nurture and combat charming creatures known as Axies.

The game’s undeniable success, as measured by the number of regular players and its fast-growing $8.5 billion market cap, is one of the key reasons it has reached so many people’s ears.

One of the new entrants to the young wealthy list for 2021 is embroiled in the realm of Axie Infinity, according to Business Insider Australia. To give you an indication of how much money is worth in this universe, the Axie Infinity market place has seen AU$850 million worth of transactions in the last three days.

There are four Australian brothers on the list as well. Three of them are co-founders of Illuvium, a blockchain game in development. In-game ILV tokens worth AU$463 million, AU$425 million, and AU$196 million are held by Kieran, Aaron, and Grant Warwick, respectively.

Illuvium is also owned by a fourth brother, who is worth an estimated $879 million.

Illuvium is still in the works, and it won’t be released until next year. ILV is now rated 158 on Coin Gecko and has a market cap of roughly $600 million, based only on speculation.

These are only two of the numerous blockchain games that are currently being played or developed. All of them are expected to live in a metaverse where value can be exchanged between game networks one day. Some of the elements utilised in one game may be recognised and used in another.

According to the Business Insider study, games like Axie Infinity and Illuvium will have a long way to catch up to competitive platforms like Fortnite or Roblox. Blockchain, cryptocurrency, and play-to-earn games, on the other hand, are only getting started.

When you add in the possibility of an all-encompassing metaverse, some predict the rise of a behemoth that will utterly change gaming as we know it today.

Major Russian bank explores crypto investment amid strong demand

Even if they travel outside, Russians will be exposed to cryptocurrency in some form, according to Tinkoff Investments’ CEO.

Despite the Bank of Russia’s prohibition on the bank introducing cryptocurrency investing services, Tinkoff Investments, the online brokerage of big Russian private bank Tinkoff, is looking into it.

Dmitry Panchenko, the head of Tinkoff Investments, stated that the bank’s brokerage portal is considering cryptocurrency investment opportunities, but that it is too early to discuss particular ideas.

In a Thursday interview with Russian news agency TASS, Panchenko said the company is now focusing on research and development projects aimed at a variety of crypto-related services. Tinkoff Investments is particularly interested in crypto products from firms such as PayPal, the world’s largest payment processor, as well as crypto-friendly apps like Revolut and Robinhood.

Despite local regulators’ refusal to allow companies like Tinkoff Investments to provide crypto investment services, Panchenko stressed that Russians are still actively trading crypto on global platforms, with more than $15 billion in crypto assets on exchanges:

“One way or another, people get exposure to crypto and they do it outside of the country. It would be potentially correct to provide such services within the Russian legal system. This is not possible legally today, but the issue needs to be discussed and studied more deeply.”

Brokerages like Tinkoff, according to Panchenko, will benefit from the adoption of crypto investment services. He also mentioned that the bank has noticed an increase in demand for crypto investments rather than payments, which is forbidden in Russia under the country’s crypto law “On Digital Financial Assets.”

Tinkoff did not immediately react to a request for comment from Cointelegraph.

Tinkoff CEO Oliver Hughes alleged months ago that the Russian central bank was preventing Tinkoff from offering crypto trading services. “At the present, there is no mechanism for us to provide that product to them in Russia since the central bank is in such a difficult position,” Hughes explained.

Crypto Adoption Boosts Travel: Travala Rises From The Ashes

During the third quarter of 2021, Travala.com, the top crypto-friendly travel platform, announced “explosive growth,” with the use of cryptocurrency playing a key role. Customers can make payments in over 50 digital tokens using its blockchain-based platform.

CEO Juan Otero revealed in July that digital coins were used to pay for 70% of the bookings, resulting in weekly gains of over $1 million. He went on to say that

“With more people holding cryptocurrencies and more businesses accepting it for real-world things, travel is naturally a desirable experience to use crypto”

Travala teamed up with Viator, a Tripadvisor-owned company, and Expedia Group, despite the fact that Expedia does not accept bitcoin payments directly. They offer over 700,000 hotels and rooms, as well as 400,000 bookable activities, all of which may be paid for with cryptocurrencies through these partnerships.

“Travala.com offers over 3 million travel products, making us not only the largest crypto-friendly [online travel agency], but one of the largest overall,” Otero said earlier.

Only 12% of hotel bookings were made using traditional currencies, while 75% were paid with cryptocurrencies. Only 13% were paid with travel credits, and only 12% with traditional currencies. With 14 percent usage, Travala’s native AVA altcoin rose to the top, followed by Binance Pay (12 percent) and Bitcoin (8 percent). Other cryptocurrencies were used by 41% of people.

The CEO undoubtedly lived up to his previous statement, which is now reflected in the Q3 report:

Despite the fact that the last several years have been the most difficult on record for the travel industry, Travala.com has grown at an exponential rate as cryptocurrency use has more than offset the pandemic’s negative impact.

The Binance Mini-App integration, which allows consumers can buy services straight from their Binance exchange wallets, “has developed swiftly to drive more bookings than any particular token,” according to Travala’s study.

Travala started employing decentralised AVA token governance to establish the Community Pool and Community Vote, giving their users the actual ability to make improvements.

The community proposals came up with a notion they’re working on now: “proof-of-travel” NFTs, which received 89.6% of the vote. It entails allowing their users to claim NFTs as part of their Smart membership status by keeping a blockchain-based record of their travels.

This launch is expected to happen in Q4, as they have stated that they are “dedicating a lot of resources to this as a priority.”

Travala stated that they intend to continue growing and expanding their platform’s reach, with an emphasis on improving the booking experience “for crypto tourists around the world.” Because the tourism business was severely impacted by the epidemic, the company intends to achieve exponential development by incorporating crypto advancements into the industry.

Many people can understand how crypto acceptance can lead to growth, innovation, jobs, and even new ways to travel and enjoy the world just on Travala’s study alone. Given how the pandemic affected so many elements of people’s lives, it’s encouraging to see how blockchain technology has improved things.

Blockchain technology can make micropayments finally functional

I recently came across a 2014 article by Marc Andreessen about Bitcoin (BTC). It is forward-thinking in many aspects (no surprise). I’ve been in the sector for four years, with the majority of my attention on blockchain’s social impact. Andreessen was able to define Bitcoin’s potential economic and social effect for the future in 2014, before there was any institutional presence in Bitcoin — or, indeed, a widespread grasp of this new technology.

I’d want to discuss one of the subjects from his paper, micropayments, about eight years after he wrote it. I’ll look at how blockchain might help revolutionise micropayments, allowing not just for the monetization of some areas of enterprises that are in need of a solution, but also for the assistance of society’s most vulnerable members.

Micropayments aren’t a brand-new idea. Micropayments have been popular in varying degrees since the mid-1990s. Micropayments are defined as transactions with a value less than a particular threshold. Importantly, below that threshold, the transaction charge becomes a major fraction of the total transaction value and, as a result, is no longer cost-effective. Another crucial distinction is that micropayments exclusively refer to digital transactions of non-tangible items due to the small monetary amounts involved. Any rise in handling and shipping costs could result in a hundredfold increase in the original transaction value, rendering it completely irrelevant.

For the fees they collect, credit card companies provide retailers with a variety of pricing arrangements. These programmes often have a flat fee each transaction and a percentage taken out of it. Not unexpectedly, the card providers do not make this information publicly available; instead, it is released by third parties who compare rates as a service to merchants. Let’s look at what a merchant may be charged for a micropayment in that circumstance.

We make the following assumptions:

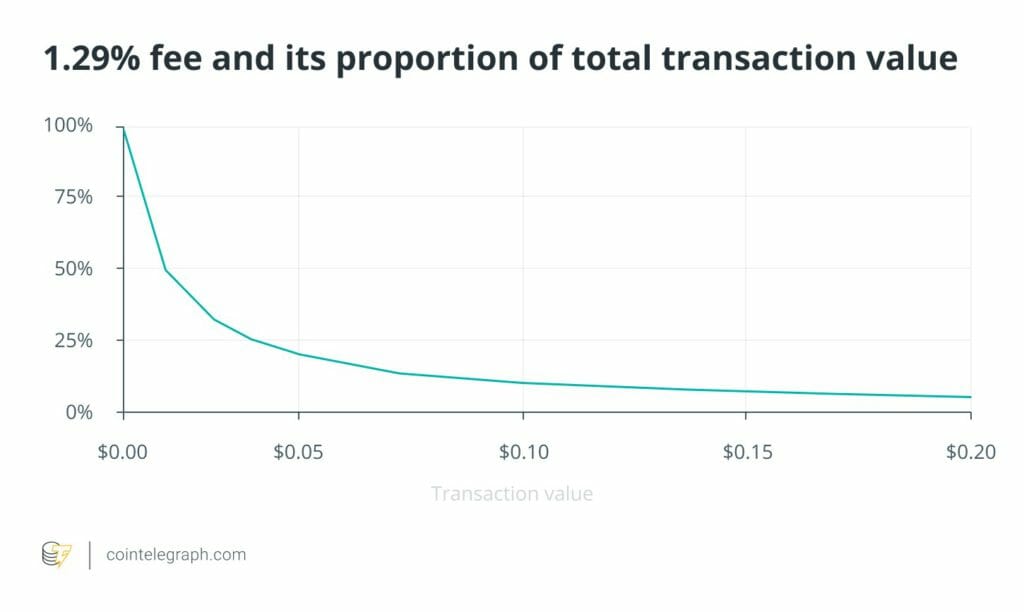

The lowest fee we found was 1.29 percent of the transaction value, and there was no lump payment fee.

Because the smallest building component of (most) fiat currencies is 1/100 of the total — i.e., $0.01 — the credit card firm would charge this as the minimum fee, regardless of whether it is more than 1.29 percent.

The chart below shows the proportion of the transaction charge as a function of the transaction value. A $0.01 transaction, for example, has a cost of 100%, whereas a $0.10 transaction has a fee of “just” 10%. Naturally, this demonstrates the irrationality of conducting micropayment transactions using these sites.

Furthermore, crypto wallets may be simply integrated into any digital device, such as a smartphone, laptop, or other Internet of Things device. While rates vary considerably between networks and on different occasions, many protocols do not have fees, which can be as low as fractions of a cent.

Last but not least, there’s the issue of user privacy. Due to the asymmetric encryption of blockchain, the payer only exposes their public address while making a payment, giving hackers virtually little information about their wallets. Unfortunately, the same cannot be said for a credit card transaction, which necessitates the payer divulging their entire credit card number and hoping that the payment is received.

Here’s Why Shiba Inu ($SHIB) Doesn’t Need a Robinhood Listing Any Longer

Shiba Inu ($SHIB) continues to rule the meme money market, surpassing Dogecoin ($DOGE) to become the ninth most valuable cryptocurrency. The meme currency witnessed a massive price retrace of about 50% as its price plummeted to $0.000057 after hitting new highs just a few days earlier, posting another ATH of $0.000088. However, the altcoin’s bullish momentum helped it recover the majority of its losses the same day, and it is now consolidating near the $0.000075 mark.

In October, $SHIB saw a near 1,000 percent price increase, overcoming substantial obstacles including as Elon Musk’s stress test and a massive 31.04 billion token dump. All of this is happening while the Shiba Inu community continues to demand that it be added to Robinhood. There is an online petition on change.org with over 400K signatures, however given what the meme coin has done in the last month, where its worth has risen faster than Robinhood’s, it appears that the fintech exchange app is in greater need of a $SHIB listing.

In its most recent financial report, Robinhood revealed a drop in crypto activity on the site, and its stock dropped 8% as a result of the news. As a result, a $SHIB listing would provide them a boost in terms of trading activity and exposure. Coinbase is also cashing in on the $SHIB craze, replacing the $DOGE ticker with $SHIB as the app’s highlight image.

Shiba Inu is a meme currency with a large following that continues to top social sentiment statistics. Despite a price drop and a consolidation phase, Shiba Inu remained a trendy topic on social media, according to Santiment data.

$SHIB managed to overtake Polkadot ($DOT) and $XRP at one time, and if it can replicate that rally again, it might very well remove another zero from its price.

BXH lending agreement hacked, almost 4000 ETH stolen.

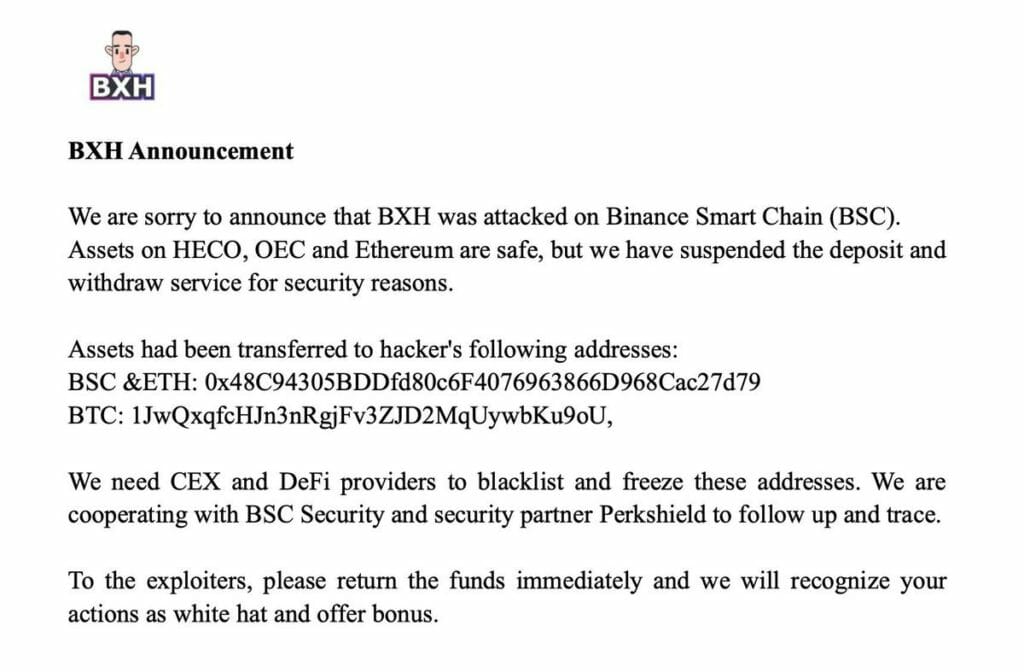

Yet another havoc was created in customers today when Wu Blockchain’s twitter handle announced the official statement of BXH being hacked, as their lending agreement was quite drooling worthy to the customers so was it to the hackers, it was hard to announce it officially but they did,

The company stated that

We are sorry to announce that BXH was attacked on Binance Smart Chain (BSC). Assets on HECO, OEC and Ethereum are safe, but we have suspended the deposit and withdraw service for security reasons.

Assets had been transferred to hacker’s following addresses:

They gave 2 addresses which you’re currently watching on the screen

We need CEX and DeFi providers to blacklist and freeze these addresses. We are cooperating with BSC Security and security partner Perkshield to follow up and trace.

To the exploiters, please return the funds immediately and we will recognize your actions as white hat and offer a bonus.

Read Yesterday’s news here.