PMX is an emerging decentralized prediction-market protocol built on Solana, designed to combine permissionless market creation with a powerful liquidity architecture optimized for traders and liquidity providers. In this article, we will dive deep into the PMX Review.

Table of Contents

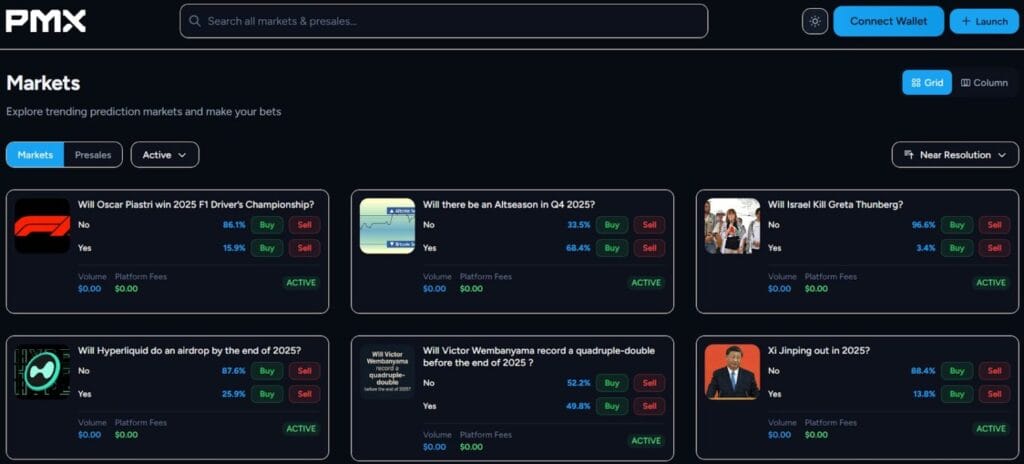

What is PMX?

PMX (Prediction Markets Exchange) is a decentralized prediction-market platform built on the Solana blockchain. It enables users to create markets, provide liquidity, and trade on future events with transparent mechanics and fair resolution processes.

PMX Review: Key Features

- Decentralized market creation and trading

- Automated liquidity provision with uncapped gains for liquidity providers

- Transparent resolution mechanisms

- Cross-platform token trading on Solana DEXs

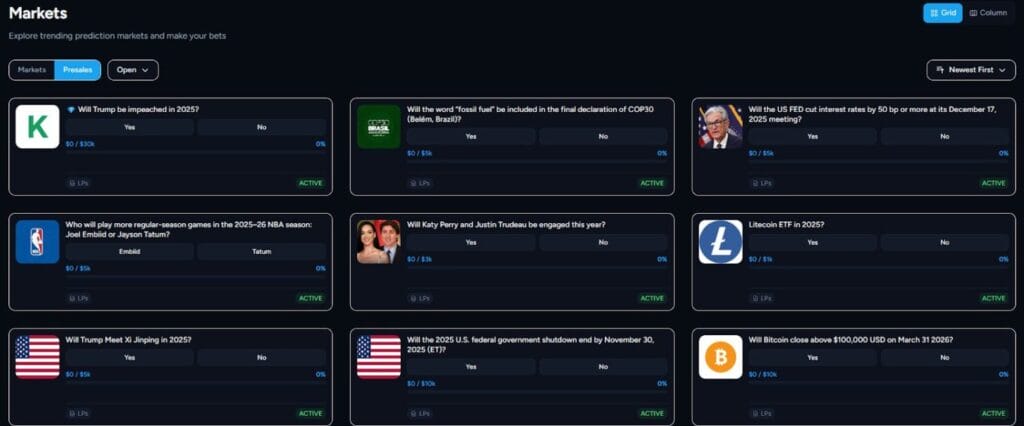

Presales: How Market Creation Works

Market Creation via Presales

Anyone can launch a prediction market through the PMX presale system. Instead of immediately opening trading, the market creator must first raise funds from the community via a presale, thereby demonstrating interest and viability.

Funding Requirements

Creators choose a tier in the $10,000 – $100,000 USDC range. Once contributors fund the presale up to the target, the market is submitted to the PMX team for manual approval. Contributors are automatically whitelisted proportionally to their contribution.

How to Participate

- Find a presale market you want to support.

- Send SOL or USDC to the funding wallet.

- On contribution you are automatically whitelisted according to your share.

- After the presale goal is met and PMX approves, the market launches.

Liquidity Provision: How LPs Earn

Uncapped Gains for Liquidity Providers

Liquidity providers (LPs) in PMX markets can not only recover their initial capital, but also share profits or fees depending on the market’s stage. This setup allows for potentially unlimited upside depending on the market’s volume and performance.

Two Stages: Pre-Bond & Post-Bond

Pre-Bond Markets (before the “LP × 2 Volume” threshold is reached):

- LPs get back their initial contribution.

- LPs receive 20% of profits from the losing side’s liquidity, fees, sellers.

- The profit split is: 60% Traders, 20% LPs, 20% PMX.

- Example: seed $10,000 in a $50,000 presale (20% share). Market is pre-bond. Suppose profits from losing side total $50,000 → LP profit share = $50,000 × 20% × 20% = $2,000 → total LP return = $12,000 (initial + profit).

Post-Bond Markets (after “LP × 2 Volume” threshold):

- LPs receive a guaranteed fee share: 50% of all trading fees generated by the market, proportional to their initial contribution.

- Example: seed $10,000 in $50,000 presale (20% share). Suppose post-bond with volume $100 M → total fee pool = $100 M × 1% = $1 M → LP share = $1 M × 50% × 20% = $100,000 → total LP return = $110,000 (initial + fee payout).

Risk-Reward Profile

- Capital preservation: LPs get back their initial investment in both pre-bond and post-bond.

- Pre-bond upside: 20% profit share from losing side’s liquidity/fees/sellers.

- Post-bond upside: 50% guaranteed share of all trading fees.

- Uncapped potential: No built-in cap on potential gains from market volume and performance.

- Market selection efficiency: LPs can choose which markets they believe will generate high volume or go viral.

Trading Mechanics

Token Launch Structure

Once a market is approved and goes live, PMX mints two separate tokens (YES and NO) for each outcome, enabling flexible trading across the Solana ecosystem.

Token Specifications by Tier

- $10K – $50K tier: Market cap per token: $500K → Total market cap: $1M. Tradeable on all Solana DEXs.

- $50K – $100K tier: Market cap per token: $5M → Total market cap: $10M. Tradeable on all Solana DEXs.

Note: Each tier maintains 50:50 odds at launch by adjusting token supply rather than price.

Trading Platforms

The outcome tokens can be traded on any Solana DEX, including: Jupiter, Raydium, Orca, Axiom, Meteora, and more.

Orderbook-Style Liquidity

PMX uses a liquidity architecture where a bet on one side removes liquidity from that side and adds it to the other side. For example:

- Betting on YES: liquidity removed from YES pool, added to NO pool

- Betting on NO: liquidity removed from NO pool, added to YES pool

This mechanism creates dynamic, responsive odds that reflect market sentiment, while preserving balanced liquidity.

Market Resolution & Payouts

Resolution Process

When a market reaches its resolution date, the settlement process is automatically executed by the platform. The winning outcome is determined, liquidity withdrawn, and payouts are distributed based on whether the market is pre-bond or post-bond.

Pre-Bond Markets (Before LP × 2 Volume)

Variable Payout System

- Traders on the winning side: get back all initial capital (including slippage) and receive 60% of profits from the losing side’s liquidity/fees/sellers — guaranteed profit, zero downside risk.

- Liquidity Providers: get back initial LP and receive 20% of profits from losing side’s liquidity/fees/sellers.

- PMX Platform: receives 20% of those profits.

Users can view their estimated payout via the “Payouts” button on each market’s page.

Post-Bond Markets (After LP × 2 Volume)

Guaranteed Payouts

- Traders: Receive 100% guaranteed payout at 100% odds.

- Liquidity Providers: Receive a guaranteed 50% split of trading fees, proportional to initial contribution.

Settlement Steps

- Liquidity Withdrawal: All liquidity is withdrawn from both tokens to prevent further trading.

- Winner Determination: The winning side is determined based on the real-world event outcome.

- Payout Distribution: Payouts are distributed via airdrop based on market type.

Internal Mechanics & Risk Management

Arbitrage System

PMX uses automated arbitrage mechanisms to maintain market efficiency and generate additional profits for LPs.

Option Wallets

- 99% of both YES and NO token supply is moved to separate “option wallets” which act as automated market makers.

- These wallets ensure total market cap targets are maintained: below the target, the wallets buy tokens; above the target, they sell tokens.

- The arbitrage profits generated by this system are shared with liquidity providers.The benefits: fair pricing, liquidity maintenance, market stability, and arbitrage profit sharing.

Risk Management System

- Available Funds = liquidity in pools + USDC in arbitrage wallets + swap fees.

- Required Payouts = initial LP + circulating tokens × 100% odds payout value.

- If the “Available Funds − Required Payouts” is negative, risk exists. PMX caps maximum risk threshold at 10% of initial LP.

- Dynamic Liquidity Withdrawal: Withdrawal % = (Risk % ÷ 10%). Example: Risk = 5% → Withdraw 50% LP. Risk ≥ 10% → Withdraw 90% LP.

- Fee Rate + Volume Requirements: Fee rate is 5% on all trades. LP × 2 Volume requirement generates ≈10% of initial LP in fees, which aligns with the 10% risk threshold. Sufficient USDC can offset volume requirement.

Architecture & Roadmap

Phase 1: DAMMV2 AMM (Current)

In Phase 1, PMX uses a DAMMV2 AMM architecture that manages liquidity and risk through dynamic pool allocation and automated arbitrage. Example: A 70/30 odds situation with $10K initial LP sees $3K each in YES and NO pools regardless of odds. The automated arbitrage system triggers when the odds sum exceeds 100% (e.g., 60/50 → triggers sell both sides proportionally to restore 55/45). The risk-management system is built into this architecture.

Phase 2: DLMM (Future)

PMX is developing a Dynamic Liquidity Market Maker (DLMM) system for later rollout, featuring:

- Concentrated liquidity distributed across price bins

- Bid-ask spread experience akin to an orderbook

- Limit order-like functionality

- Automated market making using user LP

This future architecture aims to bring PMX in line with established prediction-market platforms (e.g., Kalshi, Polymarket) while retaining decentralized liquidity benefits.

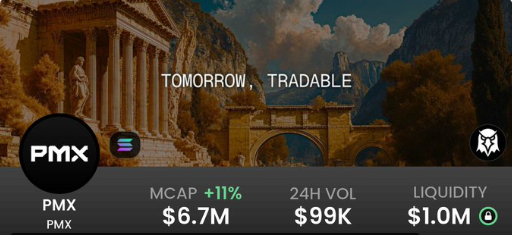

PMX Review: $PMX Token

Revenue Distribution Mechanism

PMX will implement either a buyback program or staking mechanism to redistribute platform revenue directly to $PMX token holders, thereby aligning value accrual with platform growth.

Revenue Distribution Options

- Buyback Program: Platform profits will be used to buy back $PMX tokens from the market, reducing supply and increasing token value.

- Staking Rewards: Stake $PMX tokens to receive proportional shares of platform profits — creating a direct revenue stream for committed token holders.

- Implementation Details Coming Soon: Specifics on the revenue-distribution mechanism will be announced via PMX’s official Twitter channel.

Governance & Resolution

Current Resolution System

PMX currently uses a manual resolution system (similar to the approach used by Kalshi). Only approved markets with objective outcomes are allowed, and the PMX team handles resolution.

Future Decentralization

In future phases, PMX intends to move toward token-based governance for market creation and resolution. For now:

- PMX team manually resolves markets

- Only those markets with clear, verifiable outcomes are approved

- Fast resolution timelines are prioritized

PMX Review: Conclusion

Daily trading activity surged sharply between Aug 14 and Aug 18, jumping from ~1.9 to ~81.1 in volume, indicating a rapid acceleration in user engagement and liquidity that increased the cumulative volume by more than 40× in just four days. The vision is clear — democratize market creation, provide risk-controlled upside for liquidity providers, and become the infrastructure backbone for a broader prediction-market ecosystem. Meanwhile, token-holders of $PMX will eventually benefit via revenue-sharing mechanisms and governance roles.

What makes PMX different from traditional prediction markets?

Outcome tokens (YES/NO) are tradable across all major Solana DEXs, not locked to a single platform.

PMX uses a presale-based market creation model, allowing anyone to launch a market.

LPs have risk-controlled, uncapped upside with guaranteed return of initial liquidity.

How do PMX presales work?

Market creators set a fundraising goal between $10K and $100K USDC.

Contributors fund the presale and receive proportional whitelist positions.

If the presale fails, all funds are fully refunded.

If it succeeds, the market is reviewed and activated by PMX.

What are YES and NO tokens?

They represent the two outcomes of each prediction market.

Tokens are minted at market launch and tradable on Solana DEXs.

PMX adjusts token supply, not token price, to maintain 50:50 odds at launch