This article reviews the Hodlerhacks Balance Bot, a free and open-source crypto trading bot that automates the popular crypto portfolio rebalancing strategy.

Table of contents

Summary

- Balance Bot automates a portfolio balancing/ rebalancing strategy.

- It is available free of charge, with no strings attached.

- It supports a wide range of deployment options, providing total flexibility to run your bot(s) from almost any machine.

- Balance Bot has a rich feature set and offers excellent insights into the performance of your portfolio.

- It rebalances every 10 seconds and supports (almost) an unlimited number of bots.

- The web application offers a great-looking user interface and is smartphone-friendly.

- It comes with a Telegram bot, so you can receive notifications and check the bots’ status while on the go.

What is Portfolio Rebalancing?

Crypto trading strategies are plentiful. Therefore, every strategy comes with its risk profile and time investment. If trading is not for you, but you still want to get onto the crypto train, HODLing (buying crypto and holding on to it for the long-term) is a great option. However, as with most financial instruments, prices never go up or down in a straight line. And the crypto market is incredibly volatile. By simply HODLing, you’re not benefitting from price fluctuations, but this can be quickly resolved.

That is where balancing, or rebalancing, comes in. This strategy is very straightforward. Furthermore, the basic principle is that a portfolio of cryptocurrencies is to be kept in balance, which means that each crypto portfolio is held with a predefined allocation.

Portfolio Rebalancing: Example

If an equally distributed portfolio consists of 5 currencies, each will have a 20% allocation. Furthermore, you need to maintain that allocation as the respective price levels change over time. The effect of this is as follows: when a cryptocurrency’s value goes up more than the rest of the portfolio, the bot will sell some of the coins to bring its distribution down to the target level. Vice versa, when its price goes down, the bot buys some of that coin.

This is exactly what a good crypto trader does: sell on a high, buy on a low. Many people struggle to trade like this because of emotions (e.g., FOMO and FUD). Portfolio balancing takes the feelings out completely. You just follow a simple strategy, and you don’t need to think ‘what if’ all the time.

This strategy is the subject of plenty of publications. There is an excellent whitepaper, written by Shrimpy.io, which describes the strategy, its different flavors and options, and likely results in great detail.

You can balance your portfolio manually, for instance, by checking and adjusting allocations daily or weekly. However, imagine all those rises and drops, a.k.a. selling and buying opportunities, that you lose out on. You can push yourself and go for hourly, or even more often, but hey, you need to sleep sometimes as well.

This is where automation comes in. Balance Bot is specifically designed to execute portfolio balancing, 24×7. All you need to do is create a portfolio with your favorite cryptocurrencies, and Balance Bot takes it from there.

[optin-monster-inline slug=”kypqbd8bxbsurarmqsxd”]Balance Bot Review: Features

Balance Bot is a relative newcomer in the market. It was first launched in March 2021. However, dispite its young age, its feature set is quite impressive.

Web application

Balance Bot is a web application, which can run on almost anything. Options range from Windows and macOS computers to Raspberry Pi, NAS boxes, and most cloud computing platforms. If you have any of these options already available, you can run Balance Bot without any costs. If you prefer to run it in the cloud, Hodlerhacks provides an easy-to-use script to deploy Balance Bot on a Linux server, and it has suggestions for great cloud options that go as low as $3.50 per month.

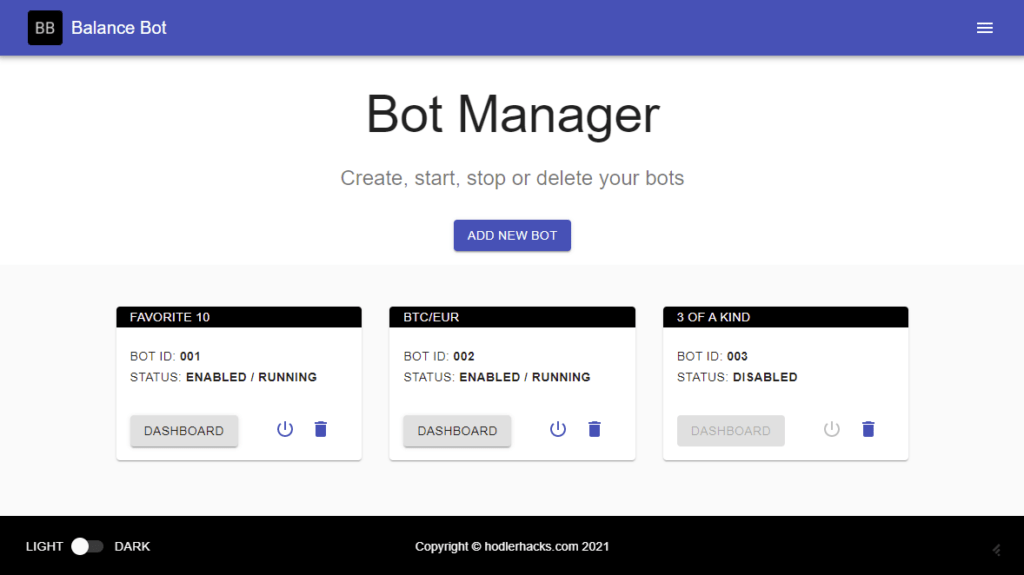

When you start the application, it shows the so-called Bot Manager. This is where you create, launch, stop or delete your bots. And yes, that’s plural. You can create as many bots as you like.

Dashboard

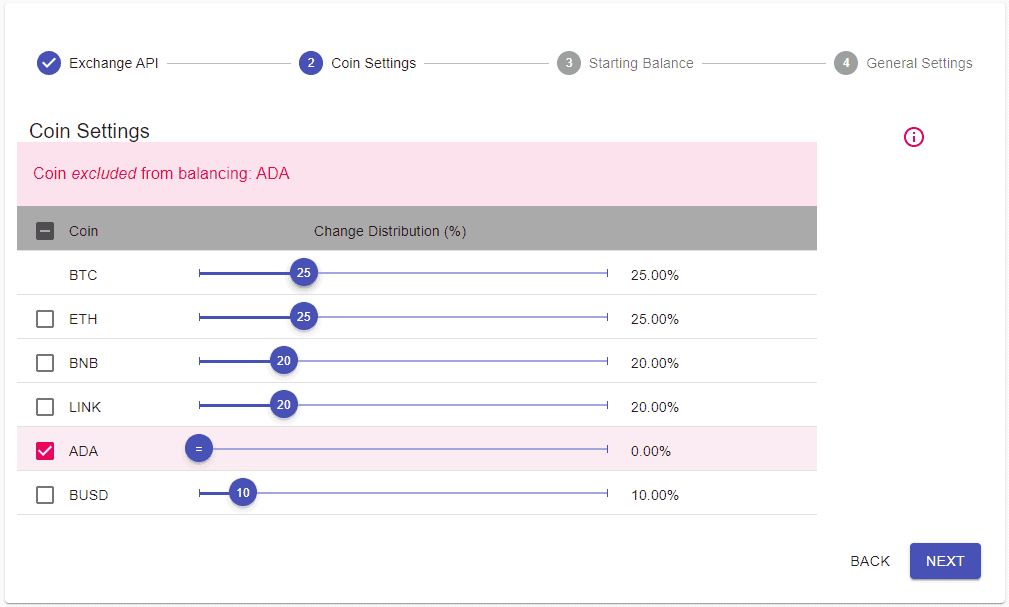

Every bot has its dashboard. Furthermore, using the dashboard, you configure the bot. Configuration is a simple 4-step process. You provide your portfolio’s API keys, set the target distribution for each crypto, and define the threshold at which Balance Bot starts rebalancing. For example, let’s say you have a portfolio of 10 coins with equal distribution, and you set the point to 3%, then the bot will buy any coin with an allocation of less than 9.7% and will sell any coin with an allocation of more than 10.3%.

You can also set the starting balance in the configuration used to calculate your bot’s performance. If you have used another balancing bot before or have been balancing manually, you can use the ‘recreate history’ option. Balance Bot will then analyze your past transactions to calculate the performance over time, appearing in some insightful graphs. But more on that in a bit.

Cooldown Trigger

The configuration also allows you to set a ‘cooldown trigger.’ In case of extreme volatility in the market, there is a risk that your exchange triggers too many transactions. Furthermore, it is also possible that the exchange’s trading API gets overloaded in such a situation and doesn’t respond. Therefore, to avoid unnecessary trading fees on your crypto exchange, a cooldown period is triggered. This is when the bot processes a defined number of transactions within 5 minutes. Moreover, it is a great way to protect your portfolio and keep transaction fees under control.

Manual Mode

There is an option to run Balance Bot in manual mode. This way, you can use it to signal buy/ sell opportunities. If you decide to rebalance, a single click is enough to perform the transaction(s) required to get your portfolio back in balance.

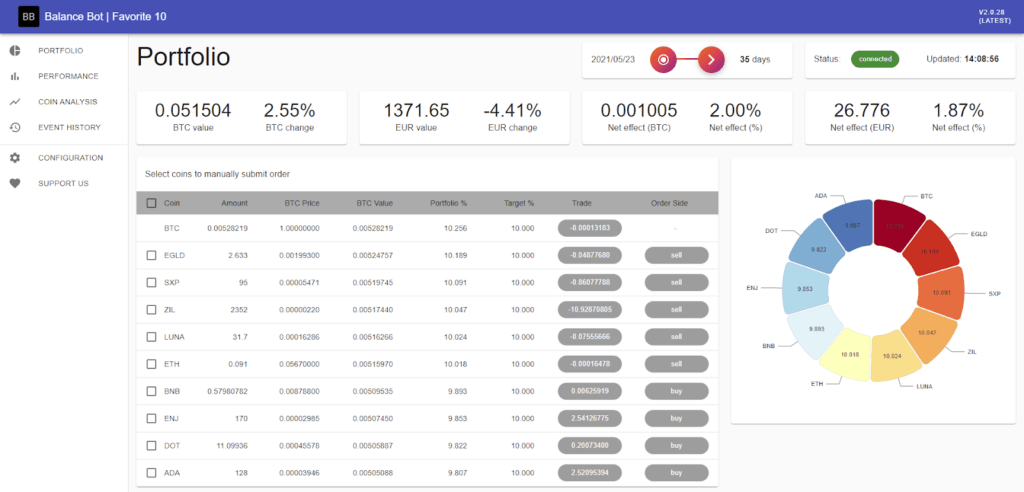

But honestly, although this may be useful when you get started to build up some confidence in the crypto trading bot; however, once you see that everything is configured and works correctly, you’ll probably switch over to automatic mode. Once set up, the dashboard shows your portfolio and the distribution of your coins.

KPI Performance Section

It shows some key performance indicators (KPIs) as well, which are very insightful:

- The current value of the total portfolio is BTC, EUR, or USD.

- The relative change of total portfolio value since the start.

- The net balancing effect in BTC, EUR, or USD. This shows the difference of the portfolio value with balancing versus what it would have been without balancing.

- The relative change of the net balancing effect since the start.

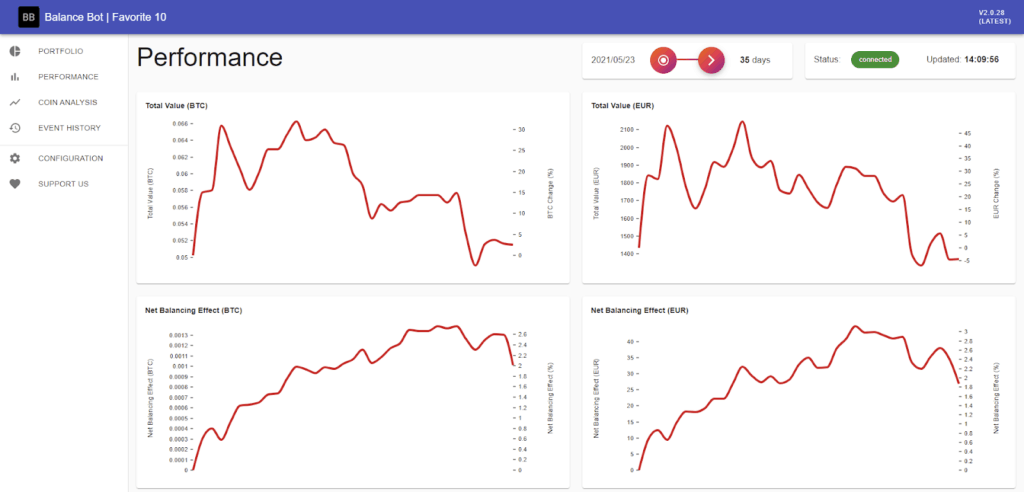

If you want to dig deeper, there is a performance section that shows graphs for the various KPIs to see how things evolved.

Coin Chart

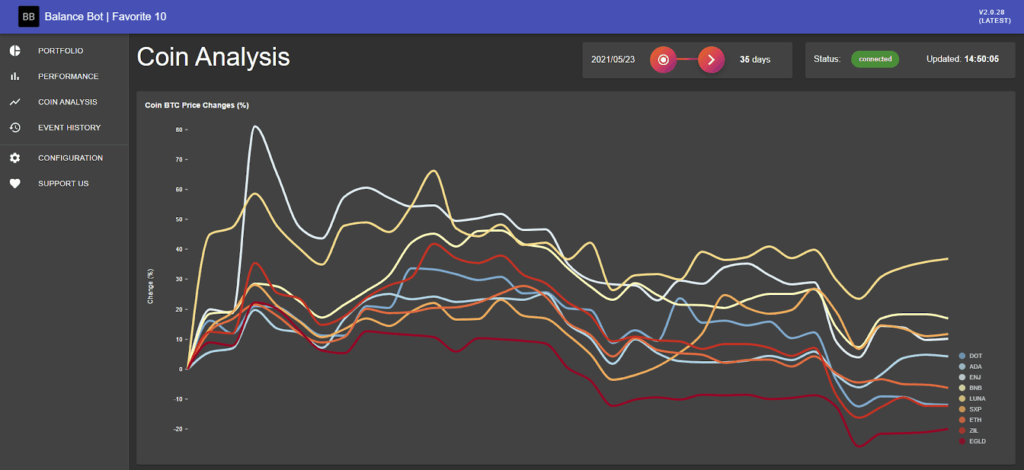

Another helpful way to analyze your portfolio is a coin chart, which shows the relative price change versus the BTC of each coin since the start of balancing. In one view, you’ll see which coins are your outperformers and which are your underperformers. And yeah, this is where the application’s ‘dark mode’ really shines.

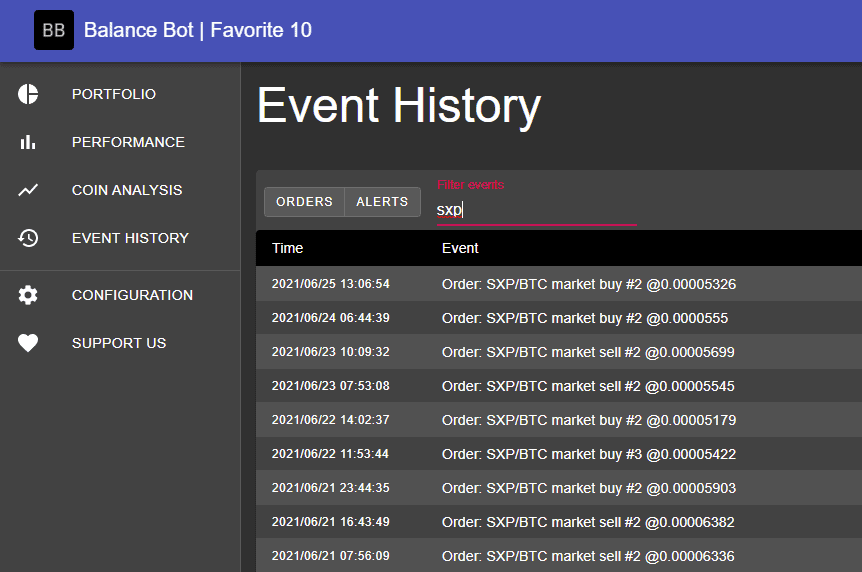

Event History

The event history stores information of all important happenings and transactions. This is where you can always go back in history and find out what happened. There is a handy filter that lets you search for transactions of specific coins.

You can even access the Bot Manager and the bots’ dashboards from your smartphone. Of course, not all options are available, but the critical functionality to manage your Balance Bots and check their performance is.

To enhance the mobile experience, Balance Bot has a neat integration with Telegram. In a few simple steps, you can set up your Telegram bot that integrates with Balance Bot. Therefore, from within Telegram, you can check your bots’ status, receive the order and other event notifications and restart a bot.

How do the Balance Bot works?

You do need some basic computer skills to get Balance Bot up and running. It is not available as an entirely operated online service. Competing applications do offer this; however, there is a price you pay for that, literally. Hodlerhacks decided not to go down that path to keep their costs low, so Balance Bot can be offered free of charge. For most people, the step-by-step instructions provided on their website should be easy enough to get things up and running.

There are two ways to install the application:

- Manual installation: this works on Windows and macOS computers, and most other machines

- Cloud deployment: an easy-to-use script installs Balance Bot on a Linux server in the cloud.

We won’t discuss the installation process here. Head over to the Hodlerhacks website to find out more, and you’ll have your first bot up and running in no time. If you run into any problems, there is a link to a Telegram community on the website to ask experienced users for help.

Comparison with other products: Hodlerhacks Balance Bot vs Shrimpy

There are similar products available on the market. At the beginning of this article, we already referred to Shrimpy.io for their whitepaper. They are probably one of the best-known alternatives. Balance Bot is completely cloud-based, and it supports various exchanges while working exclusively with Binance. However, compared to Balance Bot, it has some critical downsides as well.

First, Shrimpy.io is a paid service. The cheapest plan comes at $19/month, and it goes up to a whopping $299/month. You’ll need a significant portfolio to see any net positive results, even at $19/month.

Furthermore, in Shrimpy’s cheapest plan, the balance refresh rate is only once every 15 minutes. Note that Balance Bot rebalances every 10 seconds. This may not sound like a big deal, but zoom in on some random cryptocurrency chart, and you’ll see plenty of spikes or dips that will be missed with a 15 minute rebalance rate. And that means you’re missing out on some great buying and selling opportunities.

Finally, Shrimpy’s cheapest plan only supports up to 3 bots. Well, you’ll probably never need that many, but just in case. Again, Balance Bot has a significant advantage, as it supports up to 1000 bots.

If you don’t shy away from the somewhat more elaborate installation process, with Balance Bot’s extensive feature set and free charge no strings attached policy, it is a clear winner for most people.

Balance Bot Review: Pros and Cons

Balance Bot is a slick and feature-packed application, which keeps your crypto portfolio balanced, fully automated. The bot does require some basic computer skills to install. However, once you go through the step-by-step instructions, you’re all set and can rely on Balance Bot to do the actual work.

Through portfolio balancing, you benefit from crypto price volatility, and you make sure your emotions don’t get in the way of executing a sound trading strategy. Balance Bot currently only supports Binance, but with its very attractive trading fees (and the additional 10% discount offered through Hodlerhacks), it is one of the best options for portfolio rebalancing.

Balance Bot Review: Conclusion

If you’re looking for a portfolio balancing bot and don’t mind a few installation steps, Balance Bot is a great option. Its free-of-charge offering is quite impressive. There are excellent competing options available in the market, but with Balance Bot, there is hardly any reason to pay for such services anymore. Sometimes free shows, but that’s not the case with Balance Bot. It offers a rich set of features and tools to analyze your portfolio’s performance, all in a great-looking user interface.

Frequently Asked Questions

Is Balance Bot free of charge?

Encouraged by their initial users, Balance Bot today offers a way to support the project in the form of donations. In addition, on their website, there are a few affiliate links that help the project (to set up a Binance account with a 10% discount on trades and to set up a Linux server in the cloud on the Vultr platform). If you plan to use Balance Bot, consider using these affiliate links and donate if you like their work.

Are there any specific portfolio requirements?

To use Balance Bot, you first need to set up your portfolio by creating a Binance account and buying some of the cryptocurrency you want to balance. It is required to have BTC as one of your coins. The reason is that BTC is used for every trade. Finally, because of the minimum trading amounts that Binance enforces, ensure that your total portfolio value is not too small.

Is Balance Bot protected against Binance API issues?

Yes, Balance Bot has a few mechanisms in place to protect against Binance API issues:

– Every trade triggered by Balance Bot is validated.

– As mentioned earlier, you can enable a cooldown period, which kicks in when a defined number of trades is executed within 5 minutes.

– Also worth noting: the Bot Manager monitors every bot, and in case of a crash, it automatically restarts the respective bot immediately.

Are my API keys and access to my bots secured?

Hodlerhacks doesn’t have access to your API keys. The keys are stored on the machine where you run Balance Bot. When installed on your PC, for instance, the keys don’t leave your PC, except when communicating with the Binance API.