In the volatile crypto arena of 2025, where memecoins and AI tokens launch by the minute, early discovery of new coin listings is your golden ticket to outsized gains—or spectacular losses. As a DeFi expert with over a decade of experience, I’ve learned that seconds count: a well-timed entry on a DEX can multiply your stake 50 times before CEX pumps dilute the edge. This guide uncovers 10 essential platforms, from speed demons like Axiom and Birdeye to vetted hubs like CoinGecko, arming you with real-time alerts and tools for hidden gems. We’ll review features, pros, cons, and pricing, emphasising the high-reward, high-risk dance of early trading. Dive in, but DYOR—rugs await the unwary.

Table of Contents

Why New Coin Discovery Matters

Early discovery in new coin listings crypto isn’t hype; it’s math. Entering at launch can yield 10-100x returns if you catch a viral memecoin or utility token before CEX listings inflate prices. Market timing advantages shine in DEX launches, where liquidity is thin and volatility peaks, or presales offering discounted entry. In 2025, with narratives like AI tokens and restaking exploding, platforms providing how to find new coins intel give you the edge over retail chasers. Whether it’s Solana’s pump.fun frenzy or Ethereum’s layer-2 drops, these tools turn chaos into opportunity—just vet contracts to dodge the 90% scams.

Platform Reviews

Axiom

Axiom stands out as an advanced trading platform with analytics and execution tailored for memecoin hunters in 2025. Backed by Y Combinator, it combines spot swaps, perpetuals, and yield farming in a non-custodial Solana interface, making it a go-to for Axiom scanner enthusiasts tracking new pairs.

Key Features:

- Real-time wallet tracking for smart money movements

- Sentiment analysis from integrated Twitter monitoring

- One-click trading with private RPC for sub-second execution

- Sniper and bundler detection to avoid front-running

- Token lifecycle tracking via Pulse for launch insights

Pros:

- Lightning-fast execution minimizes slippage in volatile launches

- Beginner-friendly UI with power-user upgrades like Axiom Pro

- Strong security protocols including cold storage and 2FA

Cons:

- High trading fees can erode profits on small trades

- Occasional undisclosed fees surprise high-volume users

- Information overload from real-time feeds overwhelms novices

Pricing: Trading fees of 0.75-0.9% per trade, tiered by volume; no base subscription required, but referrals offer discounts up to 10%.

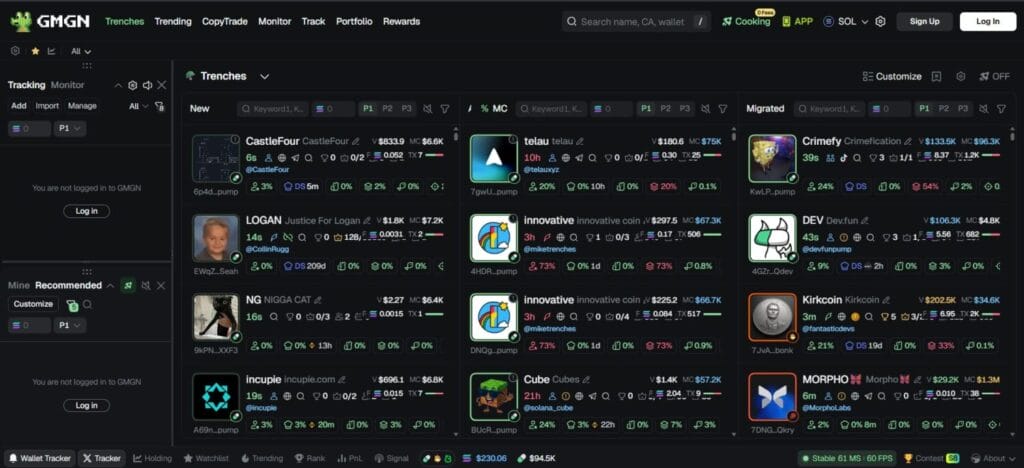

GMGN.ai

GMGN.ai has solidified its rep as a memecoin-focused intelligence platform, excelling in GMGN.ai new pairs detection across Solana and BSC. In 2025, it’s the tool for traders chasing 5-second price updates amid the memecoin surge, with a dashboard that feels like peeking into smart money’s playbook.

Key Features:

- Real-time copy trading to replicate successful wallets instantly

- Wallet tracking and analytics for up to 2,000 addresses

- AI-driven bots for customizable trading strategies

- Automated assistance with honeypot and rug-pull detection

- Integrated price charts for rapid market analysis

Pros:

- Unmatched speed for early entries in high-volume pumps

- Advanced automation features like AFK trading modes

- Multi-chain support enhances flexibility across ecosystems

Cons:

- 1% trading fee accumulates quickly on frequent flips

- Heavy focus on memecoins limits utility token coverage

- Complex interface requires time to master for beginners

Pricing: Core platform free; trading fees around 0.85% per transaction, with 30% discounts via referrals.

MevX

MevX emerges as a multi-chain trading protocol for alpha tokens, blending MEV protection with sniper tools in 2025’s fragmented DeFi landscape. Operating via Telegram and web, it’s designed for MevX crypto tools users dodging front-running while hunting DEX launches.

Key Features:

- Built-in MEV protection to prevent sandwich attacks

- Sniper mode for instant buys on new token launches

- Copy trading from top-performing wallets in real-time

- Auto TP/SL for automated profit-taking and loss limits

- Multi-chain support across Solana, Ethereum, and Base

Pros:

- Low fees and fast transactions via private RPC

- Innovative tools like liquidation alerts streamline workflows

- Seamless Telegram integration for mobile-first trading

Cons:

- Complex setup with API keys deters quick onboarding

- Per-trade fees add up during high-frequency sessions

- Telegram reliance feels clunky for desktop-heavy users

Pricing: Free core access; trading fees 0.5-0.8% per transaction, with a 3-3.5% referral fee share.

DEXTools

DEXTools remains a comprehensive DeFi gateway with analytics, powering DEXTools’ new pairs hunts since 2018 but thriving in 2025’s multi-chain era. It scans Ethereum, Solana, Base, and more for live launches, making it a staple for crypto listing platforms.

Key Features:

- Live new pairs explorer for instant liquidity scans

- Whale tracking alerts for large holder movements

- Customizable notifications for price and volume thresholds

- Built-in rug-checks and security audits

- Multi-chain support across 50+ blockchains

Pros:

- Battle-tested reputation with reliable real-time data

- Free tier provides essential tools without barriers

- Robust analytical features like pool insights aid decisions

Cons:

- Dense interface overwhelms beginners with data layers

- Premium access requires holding DEXT tokens

- High information density can bury key signals

Pricing: Basic use free; Premium features require holding 100,000 DEXT (~$47) or $75/month subscription plus 5,000 DEXT wallet balance.

DEX Screener

DEX Screener is the real-time DEX pair tracking platform that’s become synonymous with DEX Screener launch monitoring in 2025. Covering 80+ blockchains, it democratizes access to new pairs without the bloat.

Key Features:

- Automated new pairs discovery feed with timestamps

- Advanced filtering by volume, holders, and liquidity

- Trending sections highlighting rising tokens

- API access for bot integrations and custom tools

- Multi-chain coverage for cross-ecosystem scans

Pros:

- Intuitive UI loads in milliseconds for quick checks

- Comprehensive filters spot hidden gems efficiently

- Fully free with no paywalls or hidden costs

Cons:

- Limited deep analytics beyond basic metrics

- Minimal built-in automation or advanced alerts

- Relies on external tools for full trading execution

Pricing: Completely free, including all core features and API access.

GeckoTerminal

GeckoTerminal aggregates DEX data across 520+ exchanges, specialising in GeckoTerminal’s newly added pools for 2025’s exploding token ecosystem. Owned by CoinGecko, it offers pro-level insights without direct trading.

Key Features:

- New pools detection with real-time timestamps

- TradingView-integrated charts for technical analysis

- Honeypot checks and security audits on tokens

- Custom watchlists for multi-chain monitoring

- Comprehensive transaction and liquidity data

Pros:

- Massive coverage uncovers obscure launches globally

- Built-in security scanning reduces scam risks

- Professional-grade charts rival paid platforms

Cons:

- No native trading; redirects to external DEXes

- Feeds include potential scam noise without filters

- Limited bot or automation integrations

Pricing: Fully free, with no subscriptions or feature gates.

CoinGecko

CoinGecko’s New Cryptocurrencies section curates CoinGecko recently listed coins with rigorous verification, a beacon in 2025’s token flood. Tracking 19,000+ assets, it prioritizes quality over quantity.

Key Features:

- Sortable curated listings by volume and age

- Detailed market data including cap and holders

- Community scores and sentiment insights

- Holder distribution and supply metrics

- API access for developers and advanced queries

Pros:

- Gold-standard reputation ensures quality filtering

- Rich, comprehensive data supports thorough research

- Mobile-optimized for on-the-go discovery

Cons:

- Slower curation process delays ultra-fresh launches

- Focus on established projects misses raw alphas

- Limited real-time alerts compared to DEX tools

Pricing: Free access to all features; API Premium starts at $5/month for enhanced data pulls.

CoinMarketCap

CoinMarketCap’s New Cryptocurrencies hub tracks new tokens with daily/weekly drops, an industry staple for 2025 listings. It blends data with exchange intel for holistic views.

Key Features:

- Daily and weekly fresh listings with cap metrics

- Integrated exchange listing details

- Community ratings and engagement scores

- Mobile app notifications for updates

- Vetted inclusion criteria for reduced spam

Pros:

- Unmatched industry-standard vetting minimizes junk

- Comprehensive coverage spans DeFi to mineables

- Seamless mobile app enhances accessibility

Cons:

- Conservative delays mean days for full inclusion

- Limited automation or custom alert depth

- No chain-specific deep dives

Pricing: Completely free, with no premium tiers needed.

Birdeye

Birdeye dominates as a Solana-focused trading data aggregator, with Birdeye Solana new listings feeds catching launches in seconds amid 2025’s meme boom. It’s the chain’s real-time pulse.

Key Features:

- Instant new token detection and pair feeds

- Liquidity and holder analytics dashboards

- Real-time wallet flows and tracking

- Mobile alerts for volume spikes

- Advanced filtering by market thresholds

Pros:

- Unbeatable Solana speed with sub-second updates

- Pro mobile app for seamless on-the-go trades

- Deep chain-specific insights for natives

Cons:

- Limited to Solana, ignoring multi-chain plays

- Assumes user familiarity with Solana wallets

- Mobile-first design feels cramped on desktop

Pricing: Standard access free; pro API plans start at $99/month for advanced features.

CoinMarketCap

CoinMarketCap’s Upcoming Cryptocurrencies calendar provides advanced intel on planned launches and presales, a forward-looking gem in 2025’s ICO revival. It spotlights Ethereum, Solana, and more

Platform Comparison Summary

| Platform | Best For | Speed Rating | Security Focus | Free Tier? | Starting Price |

|---|---|---|---|---|---|

| Axiom | Memecoin Sniping | High | Medium | Yes | 0.75% fee/trade |

| GMGN.ai | Smart Money Copying | Very High | High | Yes | 0.85% fee/trade |

| MevX | Multi-Chain Bots | High | High | Yes | 0.5% fee/trade |

| DEXTools | Analytics & Alerts | Medium | Medium | Yes | ~$47 (DEXT hold) |

| DEX Screener | Quick Pair Scans | High | Low | Yes | Free |

| GeckoTerminal | Broad DEX Coverage | Medium | High | Yes | Free |

| CoinGecko | Curated Quality | Low | High | Yes | Free ($5 API) |

| CoinMarketCap | Vetted Listings | Low | High | Yes | Free |

| Birdeye | Solana Speed | Very High | Medium | Yes | $99/mo pro |

| CMC Upcoming | Presale Planning | Low | High | Yes | Free |

DEX tools like Birdeye excel in speed for DEX launches but trade security for velocity; aggregators like CoinGecko prioritize vetted picks. Free tiers suffice for casuals, but premiums unlock bots—balance based on your risk appetite.

Risk Management and Best Practices

In 2025’s wild west, contract verification is non-negotiable—use tools like GeckoTerminal’s scans or Etherscan for Solana equivalents before aping in. Size positions at 1-2% of portfolio to survive dumps, and cross-validate across platforms: Spot a gem on DEX Screener? Confirm liquidity on DEXTools. Enable 2FA, hardware wallets, and anti-phishing extensions; avoid unverified Telegram bots. Set stop-losses at 20-30% drawdowns, and diversify chains to hedge rugs. Discipline turns opportunities into wins.

Conclusion

As 2025’s token frenzy accelerates, mastering these 10 platforms isn’t optional—it’s your edge in a market where alpha evaporates overnight. Blend speedsters like GMGN.ai and Birdeye for lightning launches with safeguards from CoinGecko and CoinMarketCap to filter noise. Pricing ranges from free essentials to modest fees under 1%, ensuring accessibility without barriers. Yet, remember: Tools amplify smarts, not replace them. Layer verification, stake small, and exit ruthlessly. In DeFi’s Darwinian dance, the prepared thrive—forge your systematic hunt, balance FOMO with fortitude, and let calculated risks fuel sustainable wins. Trade on, wisely.

Frequently Asked Questions (FAQs)

How do I find new crypto coins before they are listed on exchanges?

Use DEX scanners like DEX Screener or Birdeye for real-time Solana/Ethereum pair launches. Track presales on CoinMarketCap’s Upcoming and smart money via GMGN.ai. Add Axiom for social sentiment sniping. With over 600,000 tokens monthly in 2025, verify contracts to snag 10x entries amid the flood—speed and diligence are key.

What are the safest platforms for discovering new tokens?

Choose vetted aggregators like CoinGecko and CoinMarketCap for curated listings with audits and scores, filtering 90% scams. GeckoTerminal offers honeypot checks across 520+ DEXes; pair with DEXTools for rug scans. These prioritise quality in 2025’s meme surge, suiting beginners who value security over raw speed in volatile markets.

Which platform is best for Solana’s new listings?

Birdeye leads for Solana with sub-second token detection, wallet tracking, and mobile alerts amid pump.fun booms. GMGN.ai adds memecoin copy trading; DEX Screener filters pairs easily. These capture 2025’s chain surges, but check liquidity to evade rugs—Solana’s speed demands quick, verified plays for alpha.

How can I set up alerts for new coin launches?

Set notifications on DEXTools for volume spikes, DEX Screener for trending pairs, and CoinMarketCap for daily drops. Birdeye pushes Solana pings; GeckoTerminal watchlists new pools. Use MevX Telegram bots for snipes. This 2025 multi-tool setup catches alphas 24/7 without endless monitoring—customise for your chains.

What risks are involved in trading newly listed coins?

New tokens risk rugs, honeypots, and crashes—90% flop fast with high volatility and low liquidity causing slippage. 2025’s surges offer 100x upside but demand audits via GeckoTerminal. Limit stakes to 2%, use 20% stop-losses, and cross-validate—high-reward plays thrive on discipline, not blind FOMO.