Wonderland is the Avalanche Network’s first decentralized reserve money protocol based on the TIME token. A basket of assets backs each TIME token in the Wonderland treasury (e.g., MIM, TIME-AVAX LP Tokens, and so on), giving it an intrinsic worth that it cannot go below.

However, when you go to Wonderland’s website, Wonderland.money, you will be immediately drawn in by the APY offered.

Get Free Crypto Signals, Join Our Telegram Channel Now!

Safely earn interest in your crypto, read 10 Best Crypto Lending Platforms to learn more.

The Annual Percentage Yield (APY) is the rate of return on an investment after considering the principal and compounded interest. A high annual percentage yield (APY) suggests that users get more money back on their money.

The platform claims to provide ~82000% APY.

Another OlympusDAO Fork

The OlympusDAO is the first time a bond mechanism has been used to offer a viable alternative to the liquidity mining strategy. Olympus is able to purchase LP positions from the market by issuing its native token, OHM, at a discount in order to provide protocol-owned liquidity.

Every OHM is backed by one DAI, and the higher the OHM price, the more DAIs enter the pledge agreement, resulting in bigger rewards from OHM pledge participation. This technique keeps the price of OHM above one DAI and forces its market cap to surpass the whole value of Olympus Treasury’s overall assets.

What about their Smart Contracts?

A Smart Contract (or dumb contract) is a set of promises between two parties meant to be fulfilled. It manages the transfer of digital assets between parties directly and automatically under specified conditions. A smart contract functions similarly to a standard contract while additionally enforcing it through code. Smart contracts are programs that run exactly as their developers intended (coded, designed). Smart contracts are enforceable by code, just like regular contracts are by law.

Solidity’s code is contained in contracts, which implies that a Solidity contract is a set of commands (its functions) and data (its state) that exists at a specific Ethereum blockchain address. A contract is a crucial component of every Ethereum application.

Significance of Smart Contract Audits

This technology has necessitated the creation of crypto audits to provide independent verification of the blockchains’ legitimacy, security, and authenticity.

The discovery of high-severity defects in a code is the primary purpose of crypto audit. Before conducting an audit, the crypto audit company’s security team must first gain a thorough grasp of the project’s architecture and use cases, as well as recognize the target system’s main components. Threat modeling, which uncovers data spoofing and data tempering and enables the identification of DDoS attacks on a blockchain system, is a critical element of blockchain audit.

Security audits enable individuals with no coding background to trust projects that are audited by famous auditing companies to discover vulnerabilities and then manually executing a systematic and structured code review of the blockchain project.

The exploitation of discovered vulnerabilities is one of the key stages of a crypto audit. Security specialists, on the other hand, do not inflict any real harm to the project under test by exploiting discovered bugs.

Independent security audits or financial transparency reports will testify to the validity of the most well-known cryptocurrency initiatives. Cardano, for example, has passed many security audits as well as an independent source code audit. A project that lacks a third-party audit isn’t inherently dishonest, but it does indicate that you should do your homework before investing.

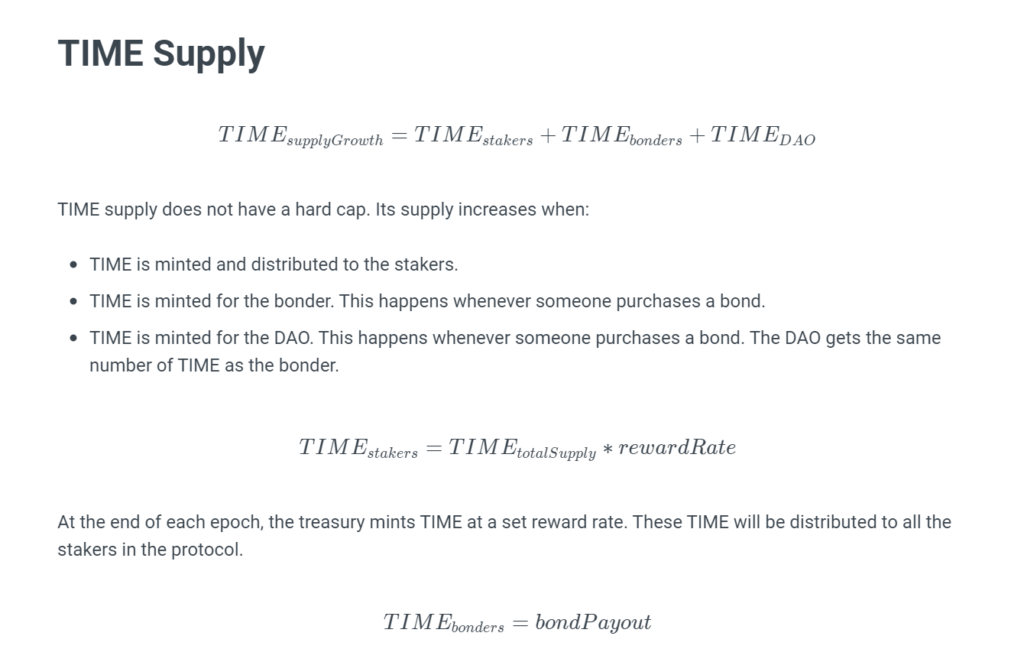

TIME, a non-pegged stablecoin created by Wonderland. Wonderland anticipates that by focusing on supply expansion rather than price appreciation, TIME will be able to maintain its purchasing power independent of market turbulence.

The Avalanche blockchain is home to Wonderland and its $TIME and $MEMO currencies. This is a blockchain, similar to Ethereum, Cardano, Cosmos, Solana, and others.

Wonderland is not audited by any auditing firm.

One thing to keep in mind is that the OlympusDAO team does not support Wonderland. In other words, they are not in favour of the proposal and do not encourage it.

The APY of the project looks insane, and it is probably too good to be true. Time token has no hard cap, suggesting that the platform can create as many tokens as it wants. The strange thing is that the yield’s weight does not correspond to the fact that the coin has no hard cap. Furthermore, there is no white paper on the website and no information about the platform or how it operates. Moreover, the documents available provide very little information, making it difficult to trust this platform.

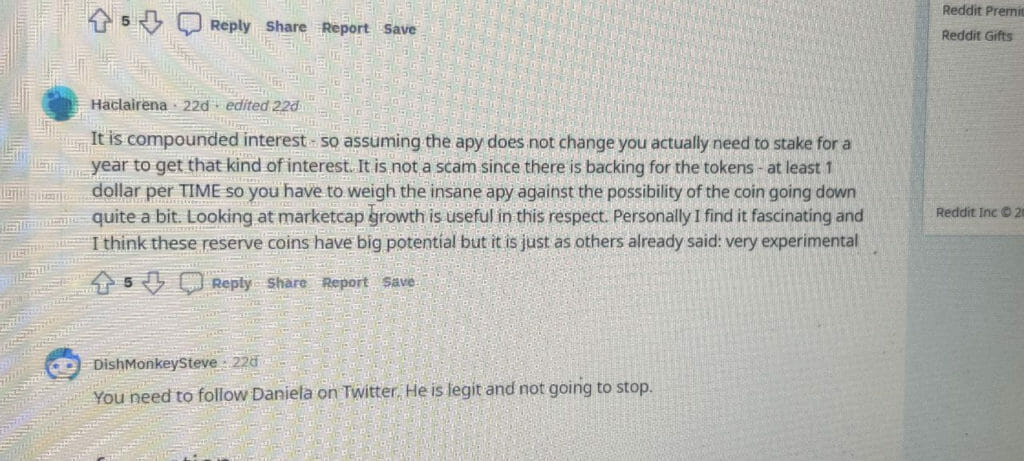

However, there has been some disagreement regarding how compounded interest could be why the initiative isn’t a scam. So, if the APY stays the same, you’d have to stake for a year to receive that kind of return. So, it might not be a scam because the tokens are backed by at least one dollar per TIME, so you must measure the ridiculous apy against the potential of the currency falling significantly in value.

It seems intriguing that these reserve coins have a lot of promise, but as others have stated: really experimental and uncertain.

However, it is crucial to keep in mind that the current price is ~$8000 and if it falls to the price it’s backed by it’ll still be a major loss for investors. Further, giving the developers here the upper hand as they have entire control on the release of more coins. Therefore, this might pave a path for a rug pull scam, until the developers are too honest about the protocol.