In this article, we will review Vauld, which was founded in 2018, and its headquarters are in Singapore. They help you manage your cryptocurrencies and allow you to lend, borrow, and trade crypto assets. You can instantly swap between supported cryptocurrencies and FIAT currencies. Additionally, they help you grow your capital by earning interest. They were earlier also known as Bank of Hodlers.

They have raised 2 million dollars in seed feed. They have successfully partnered with Pantera, Coinbase ventures, CMT Digital, LuneX, Better, and Robot Ventures. BitGo and Binance are their custody and exchange partners, respectively.

Earn interest on your Bitcoin and other crypto assets

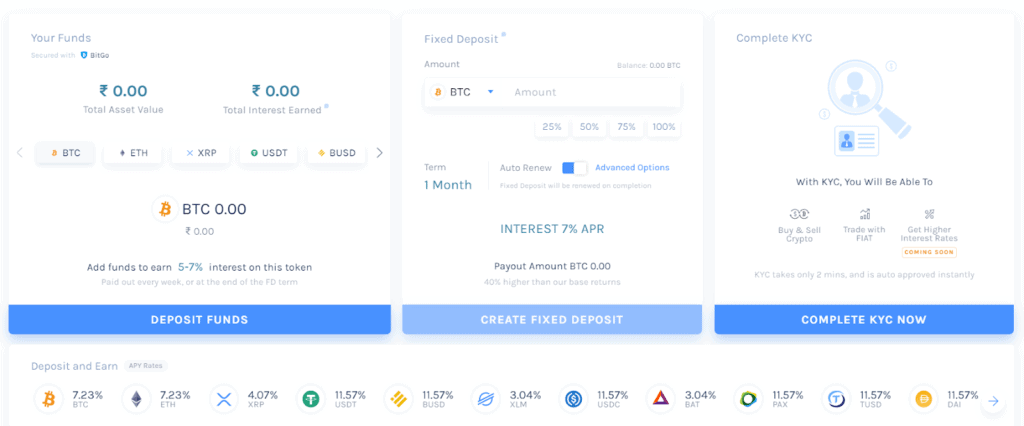

Vauld allows you to earn interest on your Bitcoin and other cryptocurrencies as soon as you deposit your funds. The interest is calculated daily, and the payouts are rolled out weekly. You can withdraw anytime.

The minimum deposit is $1 worth of tokens. There is no limit on the maximum deposit. The tokens are reflected instantly in your account except for Bitcoin that usually takes one to six hours.

The fixed deposits offer higher interest rates. The locking period can be one, three, or six months and there is no penalty charged for opting out. If you opt-out, you will receive fixed base interest rates for the duration in which you had deposited.

For earning interest, the funds must be present in the Vauld wallet. You can use external wallets such as Metamask and Trust.

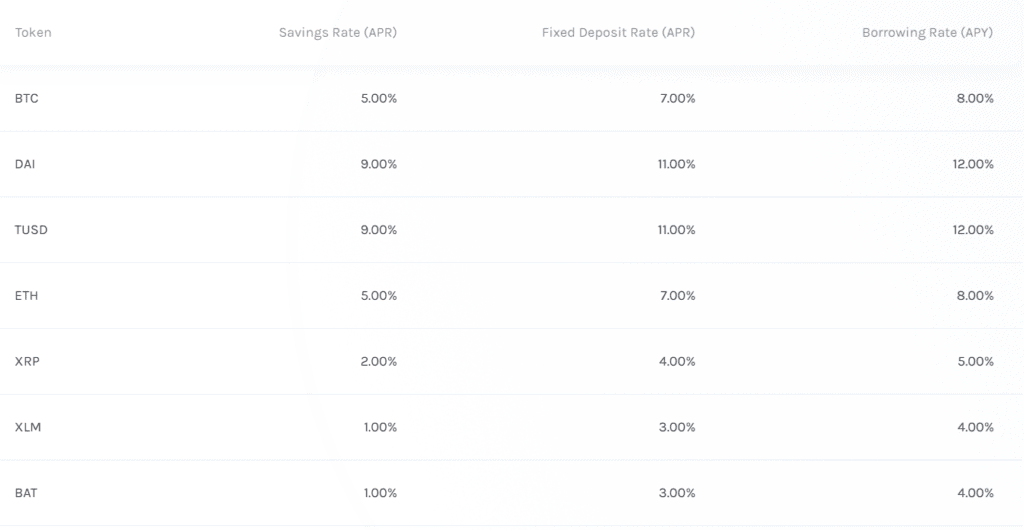

The interest is compounded every week or at the end of the term. The interest rates are different for each token. There are three different types of rate – Savings, Fixed Deposit, and Borrowing rate.

Vauld Review: Crypto Lending

You can borrow low-interest crypto loans by using your existing crypto assets as collateral. The loans will be approved instantly, and the tokens will be deposited. You can borrow up to an LTV of 66.67%. There are no additional charges or a fixed number of instalments.

The minimum loan amount is 100 dollars. The loans are offered at a collateralization ratio of above 150 %, and the collateral is liquidated once it reaches 100%.

INR (Indian Rupee) Trading

Vauld allows you to buy and sell crypto with INR. They have liquidity of over $50 M. All the deposits and withdrawals are processed instantly.

For trading in India, you will be required to complete your Know Your Customer (KYC). You have to submit the following information-

- Name, phone number, and email id

- PAN card

- Address Proof( AADHAR card, Voter Id card, Passport or Driving License)

- A photo

It takes thirty minutes for KYC to be approved. If you are not from India and want to access INR related dependencies, you can write to [email protected], and they will help you.

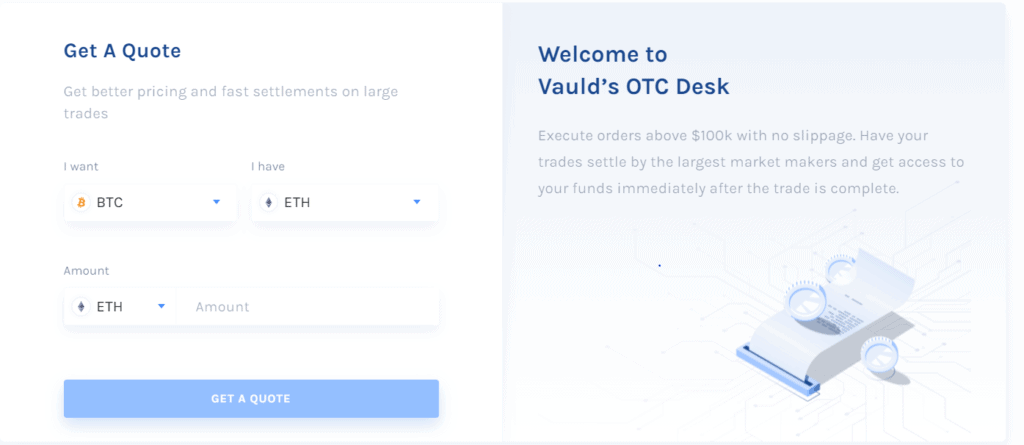

They support only Over-The-Counter (OTC) trades for crypto and INR pairs. The limit orders, buying, and selling of tokens all take place at the market rate. Hence you cannot view the crypto/INR order books for now. The Vauld team is currently working on this.

Vauld Review: Enterprise API

Enterprise API helps you create a cryptocurrency wallet in less than ten minutes. It provides you one API to create and manage wallets for all cryptocurrencies. You can create one central wallet for the entire organization or unlimited wallets for each user. Additionally, they also provide multi-signature wallets.

They support BTC, ETH, USDC, USDT, TUSD, BUSD, PAX, DAI, XRP, BAT, and XLM. Vauld does not store your private key.

The instant exchange facility is available for all supported cryptocurrencies. All you funding details can be easily tracked from a customizable dashboard.

You can earn interest by integrating your funds with Vauld’s lending API’s. The interest is compounded every week. The APY rates for lending are mentioned in the table below.

| Token | APY Rates |

|---|---|

| BTC | 7.23% |

| DAI | 11.57% |

| TUSD | 11.57% |

| ETH | 7.23% |

| XRP | 4.07% |

| BUSD | 11.57% |

| PAX | 11.57% |

| USDT | 11.57% |

| USDC | 11.57% |

| BAT | 3.04% |

By integrating with Vauld’s borrowing APIs, you can borrow fiat and cryptocurrencies against your existing crypto assets. You can replay the loan anytime. They provide a 66.67% LTV ratio. and there are no hidden charges. The APY rates for borrowing are mentioned in the table below.

| Token | APY Rates |

|---|---|

| BTC | 8.00% |

| DAI | 12.00% |

| TUSD | 12.00% |

| ETH | 8.00% |

| XRP | 5.00% |

| BUSD | 12.00% |

| PAX | 12.00% |

| USDT | 12.00% |

| USDC | 12.00% |

| BAT | 4.00% |

API for INR FIAT Rails

They are a set of versatile APIs for enterprises to integrate FIAT Rails in India. They allow you to create INR and Crypto wallets that can deposit and withdraw to any wallet of Bank account.

You can buy, sell, and instantly swap all the supported cryptocurrencies. There is no fees charged for INR Deposits or withdrawals. The INR can be deposited via Cards/UPI/ NEFT/ RTGS/IMPS. It takes one business day to withdraw money from the Vauld account to any bank account.

To get more information on how to get started with Vauld enterprise APIs you can check here.

Vauld Tokens

Vauld recently launched 238 new tokens and integration of Binance Smart Chain for select tokens.

- You can now access 85 new tokens including FET, AXS, HOT and previously trade-only tokens like CAKE, SOL,SHIB and many more.

- Now, you can also buy,sell and trade 153 new trade-only tokens likeCELO, KAVA, LUNA snf many more with INR and USDT.

- Moreover, you can enjoy reduced network fee for tokens like BNB, DOGE, ZIL,DOT and many other tokens with Binance Smart Chain integration.

Vauld Review: User Experience

Vauld provides a beginner-friendly interface. The application is also available on Android and iOS platforms. You can check your transaction history and filter it according to your need.

They provide you a customizable dashboard to manage and track your funds.

There are no complicated jargons. It supports both Light and Dark Mode.

Security

Vauld uses Multi-Factor Authentication to secure your account. They use Google Authenticator to receive a dynamically changing passcode that you have to enter whenever you perform any critical action on the platform. It is not enabled by default.

Vauld’s custody partner is BitGo, one of the highest trusted custodians in the crypto industry.

Lloyds London insures them for 100 million dollars against threats.

Vauld review: Fee

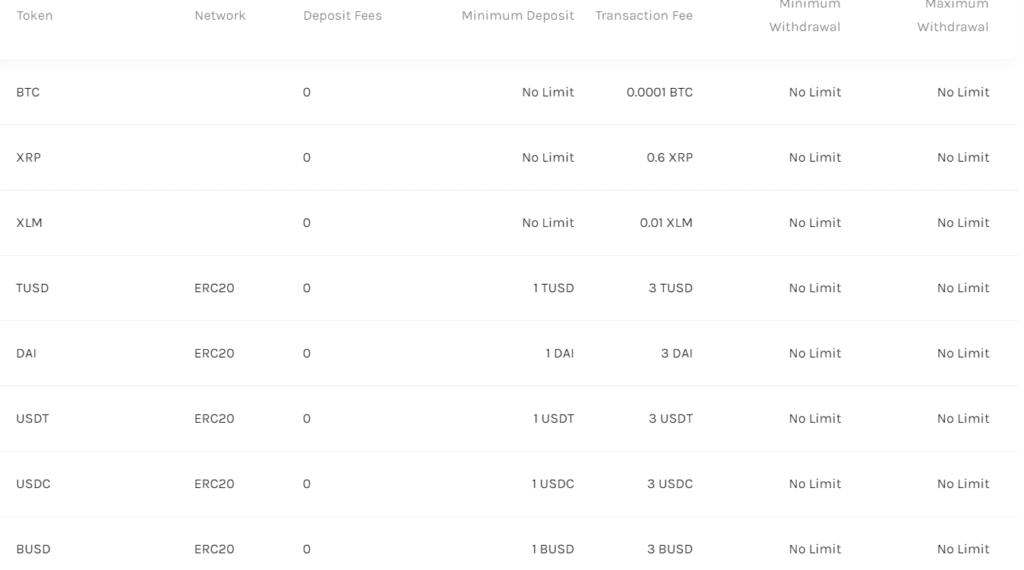

There is a minimum deposit, transaction fee, minimum and maximum withdrawal for every token. There is no deposit fee.

All withdrawals are processed instantly. If the withdrawal amount is more than $100k, it is verified manually with a Vauld Manager for additional security. The verification is completed within six hours.

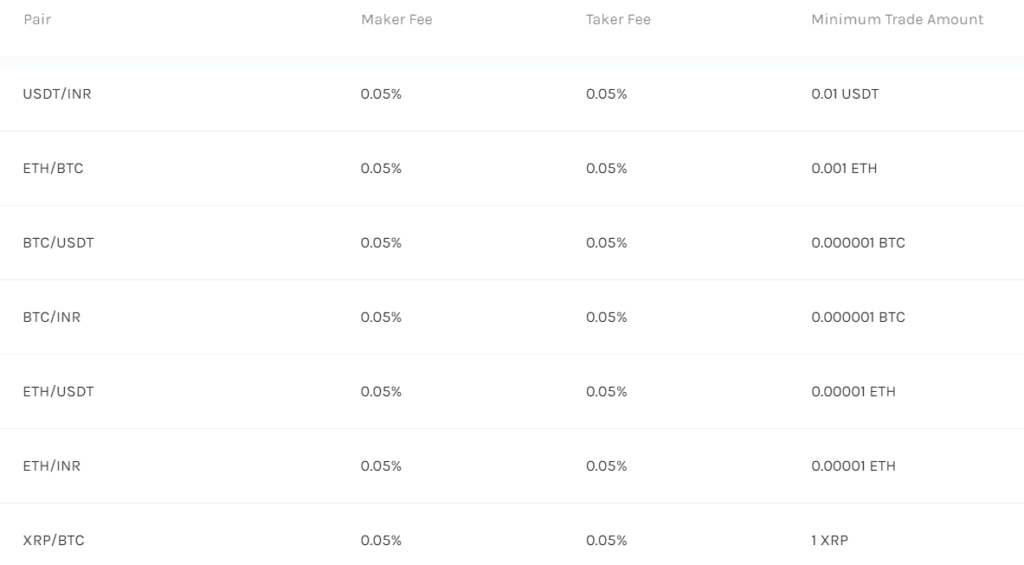

Vauld follows a maker-taker model. There is a minimum trading amount for every pair.

The deposit and withdrawal fees when using INR differs according to the mode of payment. There is a different minimum and maximum amount allowed for each mode.

They offer two types of plans for API product offerings.

- The Start-Up Plan is affordable and is for companies on a tight budget looking to start their user base.

- The Enterprise Plan – It has top tier features with customizable options and priority support.

To know in detail about either of the plans, you can get in touch with the Vauld team.

Vauld Referral System

The Vauld referral system is quite simple. You get 40% of the fees on the trades of your referrals, 5% of the interest that they pay on their assets and 5% overall interest accrued on their loans. Further, this has been created in order to encourage the participation and encouragement of the new users.

Customer Support

You can connect with them on Twitter. You can also write to them at [email protected]

Additionally, they provide live chat functionality where you will receive a response in less than five minutes.

Vauld Review: Pros and Cons

Pros

- Lending, Borrowing, and Trading of crypto assets

- You can instantly swap between the supported cryptocurrencies and FIAT.

- They offer a beginner-friendly interface.

- Enterprise API’s helps you to create and manage multiple wallets. They also integrate with INR FIAT rails.

- Big names from the crypto industry back them.

- The platform is entirely secure and is insured.

Cons

- It is a relatively new platform.

- You cannot view INR/ crypto order books now.

Vauld Review: Conclusion

In conclusion, Vauld assists you in managing your crypto assets seamlessly. They provide a store of value, capital growth, easy spending, and exchange of cryptocurrencies.

A user-friendly interface helps beginners to get started. They provide a holistic banking system for your assets.

Vauld FAQ ( Frequently Asked Questions)

Yes, you need to complete your KYC to start trading using Vauld. It takes less than 30 minutes for your KYC to get approved.

You have to deposit your funds in the Vauld account. As soon as your funds are deposited, you will start earning interest. You will get your interest payout every week

You can repay the loan anytime. The loans are provided at collateralization of above 150%. The collateral will be liquidated if it reaches 100%. The minimum amount you can loan is $100.

Also Read