Trueo is a fully onchain prediction market protocol enabling transparent, non-custodial trading on real-world outcomes using immutable market rules and decentralized resolution.In this article, we will explore Trueo Review.

Table of Contents

What is Trueo?

- Trueo is a fully onchain prediction market where users trade on real-world outcomes in a transparent, decentralized, and trust-minimized way.

- Every market on Trueo has its question, resolution rules, and data sources permanently written onchain, preventing rule changes or manipulation after launch.

- All trading and liquidity activity happens directly on the blockchain, removing dependence on centralized operators or custodial systems.

- A layered Optimistic Oracle system ensures markets resolve correctly while remaining scalable and permissionless.

- Together, these features make Trueo a censorship-resistant foundation for global prediction markets.

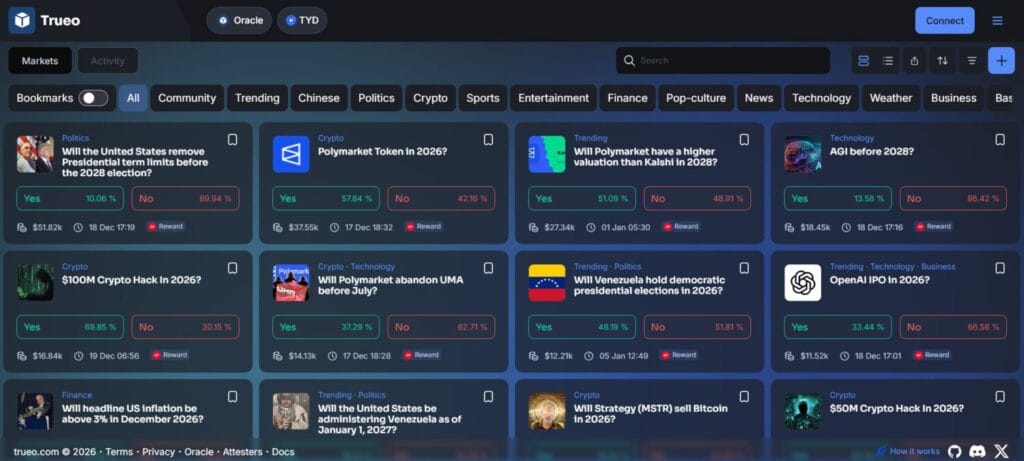

Trueo Review: Trading on Trueo

- Trueo uses binary prediction markets, meaning each market has only two possible outcomes: YES or NO.

- Market prices reflect real-time probabilities, changing as traders buy and sell outcome tokens.

- Users buy YES tokens if they believe the event will occur, or NO tokens if they believe it will not.

- Trading is fully non-custodial, so users always retain control over their funds and tokens.

- All trades execute onchain using smart contracts and a custom Uniswap v4 hook built for prediction markets.

- When the market resolves, the correct outcome token redeems for 1 TYD, while the incorrect token becomes worthless.

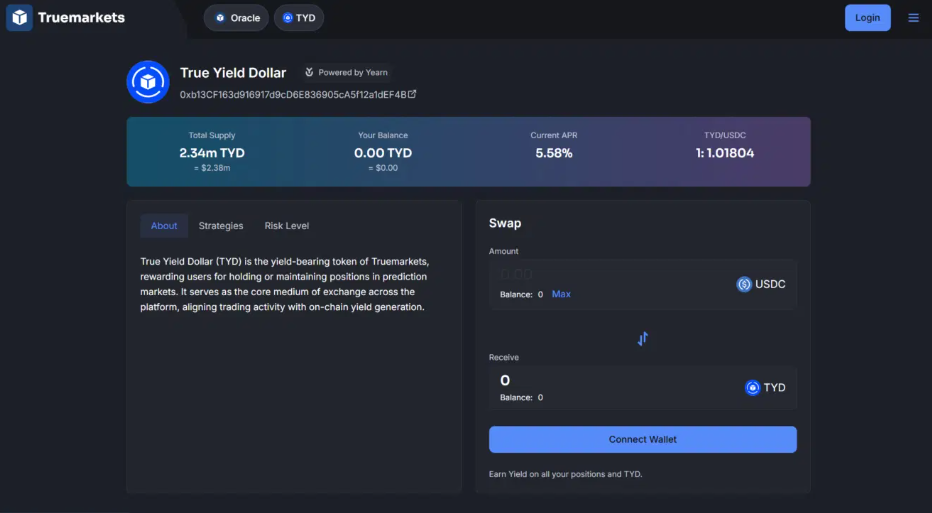

Trueo Review: True Yield Dollar (TYD)

- TYD is Trueo’s yield-bearing stablecoin, fully backed one-to-one by USDC.

- It follows the ERC-4626 vault standard, making its yield transparent and compatible with DeFi systems.

- TYD earns yield through a Yearn Finance vault created exclusively for Trueo users.

- This yield continues even when TYD is used as collateral in prediction markets.

- Yield-bearing collateral reduces opportunity cost and improves long-term market participation.

Trueo Review: Minting YES and NO Tokens

- Anyone can permissionlessly mint YES and NO tokens for a market by depositing TYD.

- For every 1 TYD deposited, the protocol mints one YES token and one NO token.

- This guarantees that all outcome tokens are always fully collateralized.

- Before resolution, one YES and one NO token can be redeemed together for 1 TYD.

- After resolution, only the winning token remains redeemable at 1 TYD.

- Each market uses separate YES–TYD and NO–TYD liquidity pools to enable onchain price discovery.

Trueo Review: Markets and Market Creation

- Each Trueo market begins with an onchain creation transaction defining its rules and structure.

- During the early phase, markets are created by a whitelisted Oracle Council.

- Market definitions include a fixed question, approved data sources, and detailed resolution rules.

- These fields are immutable, meaning they cannot be changed after the market is created.

- Anyone can inspect market details using public blockchain explorers like Basescan.

Trueo Review: Resolving Markets

- Once the real-world event has occurred, any participant can propose a market resolution.

- To propose a resolution, the participant posts a bond backing their chosen outcome.

- A 12-hour challenge window allows others to dispute incorrect or premature resolutions.

- If no disputes occur, the market finalizes automatically after the challenge window.

- Correct resolvers receive predefined rewards, released automatically during redemption.

- In rare cases like event cancellation or a true draw, markets may resolve as cancelled.

Disputing Outcomes

- Any participant may dispute a proposed resolution during the active challenge window.

- Disputes require posting a bond and providing an explanation for why the resolution is incorrect.

- Disputers help protect the system from manipulation and incorrect outcomes.

- Successful disputes return the disputer’s bond and may provide additional rewards.

- Disputes trigger a structured, multi-stage arbitration process.

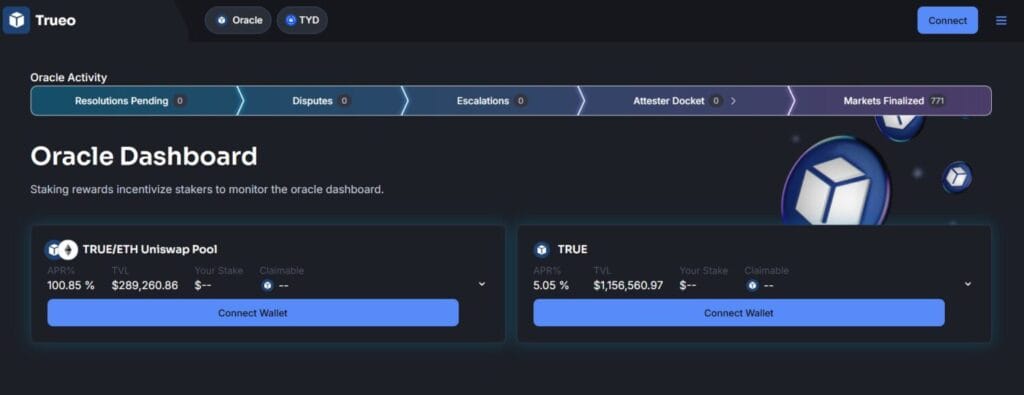

Trueo Review: Oracle Council

- The Oracle Council acts as the first arbitration layer for disputes and early market creation.

- Council members evaluate evidence and interpret market rules during resolution.

- Their authority is limited, as all decisions can be challenged and escalated permissionlessly.

- Governance can remove Council members if they are found acting in bad faith.

Attesters and Proof of Reputation

- Attesters are the final arbiters for the most escalated disputes on Trueo.

- They are selected based on real-world reputation and governance credibility.

- This Proof of Reputation model adds human judgment where automated systems fall short.

- Attesters provide final decisions on outcomes and slashing conditions.

Trueo Review: Governance

- Trueo governance combines onchain voting, Oracle Council oversight, and experimental futarchy models.

- Some governance actions occur on Snapshot, while others execute directly onchain.

- TRUE token holders ultimately control protocol upgrades and configuration changes.

- Governance is designed to evolve as decentralization increases over time.

Trueo Review: Conclusion

Trueo introduces a transparent, fully onchain approach to prediction markets that prioritizes decentralization, fairness, and trust minimization. By using simple binary markets, non-custodial trading, and yield-bearing collateral, the protocol makes participation both accessible and capital-efficient for users at all experience levels. Permissionless minting and trading ensure that anyone, anywhere in the world, can take part without relying on centralized intermediaries. At the same time, Trueo’s layered dispute resolution system protects market integrity while remaining scalable. By combining economic incentives with human reputation in its oracle design, Trueo delivers a clear, reliable, and beginner-friendly prediction market experience.

What blockchain does Trueo run on?

Trueo is deployed on Base, a low-cost, Ethereum-aligned Layer 2 network that enables fast transactions, low fees, and strong security guarantees.

Do I need a wallet to use Trueo?

Is Trueo legal to use globally?

Trueo is a decentralized protocol, not a regulated betting platform. Users are responsible for understanding local laws before participating.