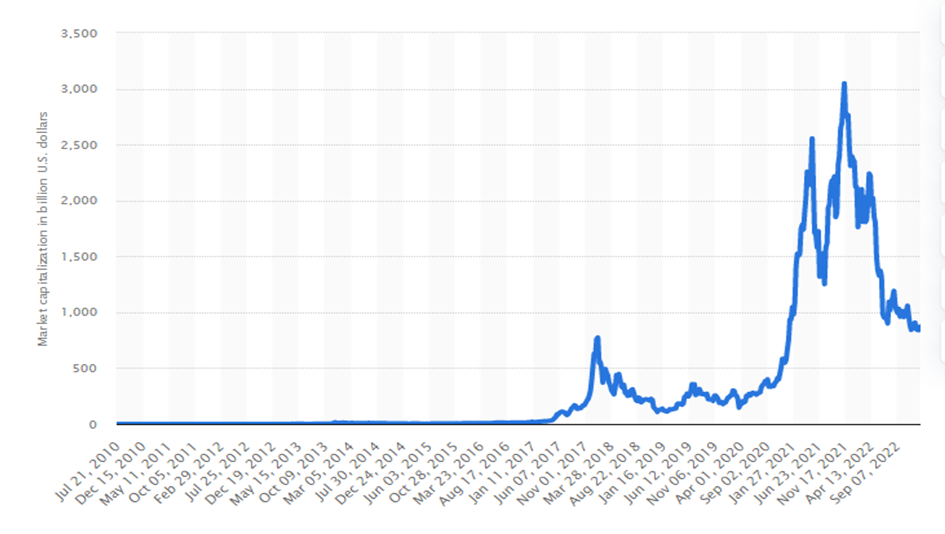

Defi had a critical situation in 2022 because of many reasons such as uncontrollable inflation of superpower of the world, USA, as well as Russia / Ukraine war and etc. In that time plenty of crypto projects were disappeared and their users lost all of their collateral. At the end, the bankruptcy of Alameda Research Company, parent company of FTX, by sentiments the cryptocurrencies total market cap decreased from more than 3 million dollars to less than 850 billion dollars. Therefore, this article includes some of the best projects of Solana of 2023.

This chart is the cryptocurrency market cap from 2010 to January of 2023.

Financial experts believe that more than 90 % of Defi projects faced with liquidity in 2022. Some projects, however, in this situation few projects developed their infrastructure and being ready to prosperity in 2023 -24.

If you wondered that why projects want to develop in this situation, I can say that, when weak projects give up from the champ it’s time to prosperity of the main projects.

Financial markets participants can experience reasonable growth after 2nd quarter of 2023, furthermore, if inflation controls via federal reserve’s contraction policies, blockchain will be grown after Bitcoins having in March of 2024. “Sources said “

Table of Contents

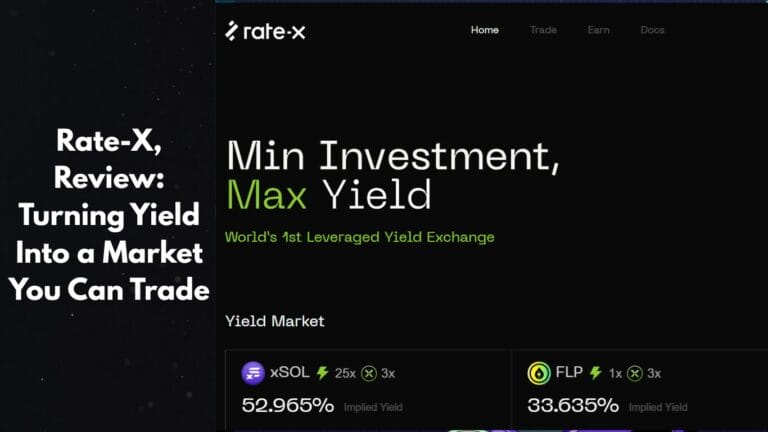

Potential growth projects on Solana in 2023

Solend

Solend is a lending & borrowing protocol based on Solana blockchain. This project provides more than 80 assets across 52 pools on the fastest, lowest fee, and most scalable Defi lending protocol.

Solend has many features that’s make a difference between this project and others. You can supply and borrow plenty of tokens in this area with fantastic APY for both sides. Borrower pays a borrow API to suppliers.

Liquidity mining rewards are another feature of this project, you can get rewards on SLND, UST, stSOL and mSOL, furthermore, these rewards are claimable on 3rd of every month at UTC midnight.

Additionally, if you borrow some tokens such as USDC and SOL, you will receive SLND rewards, and these are claimable 3rd of each month same as LM rewards. This project has another token that called SOCN which will be launched soon.

Solends LM 2.0

As you know the native token of this project is SLND, so, Solend has another program for this token and that’s Solends liquidity mining version 2.0, which, users will receive SLND tokens.

10% of SLND tokens have been earmarked for LM rewards with following parameters:

- Price: 50% of SLND price at the end of the month

- Expire: one month

This means that you can pay 1 USDC to receive 1 SLND token worth $2.

Solend uses two oracles (Pyth and Switchboard) for pricing and calculating health factors of customers, moreover, Solend governed via DAO and it’s a big point!

This project has an insurance section that covers some main pools by the treasury. You can see which pools are insured in UI. Solend also uses isolated pools because of quarantining riskier tokens before joining to main pool. Everyone can build an isolated pools and earns 20% of origination fees.

30% of liquidation penalty enters to DAO insurance pool.

All solends smart contracts are open source and you can get each data that you need in Github.

Raydium

One the main problems of Defi is AMM DEXs and Defi protocols access to their own pools and have no access to a central order book, furthermore, plenty of platforms run on some blockchains, like as Ethereum, where transactions are slow (12 to 20 TPS) with high gas prices, so, Raydium tries to solve this problem.

Raydium is an AMM built on the Solana blockchain with central limit order book to enable:

- Lighting fast trades

- Shared liquidity

- Earing yield

Accordingly, Raydium provides: Faster and cheaper TXs, high liquidity with Order book and third-party access, as well as trading interface for better experience.

Additionally, you can:

- Trading and swap: you can swap two tokens quickly and set limit orders.

- Earn RAY: by staking and farming liquidity pools you can earn Raydium native token that called RAY.

- Power your project with Raydium: will be explained below!

Raydium provides on-chain liquidity to serum’s orderbook and after bankruptcy of serum, Raydium was defeated badly.

One of the big points of this project is, Raydium in AcceleRaytor section serving as a launchpad for innovative projects to raise capital and drive initial liquidity, so, it’s always in demand. Additionally, RAY token’s volume has increased more than 500% in last 24 hours.

Intelligent protocol

The project combines the technology and finance with innovative programs which help to prosperity of this project. Intelligent protocol is multi asset protocol based on the Solana blockchain. You can trade and invest in new generation of brokerage industry.

The development process of this project is lasted from 2017 to 4th quarter of 2022 with more than 5 professional teams including: innovation team, foresight team, programming team and etc.

This project provides on-chain orderbook with fully decentralized collateral pool.

Intelligent have 3 main phases:

- Centralized phase (CEX)

- Decentralized phase (DEX)

- Tokenized share

You can trade or invest more than 5 asset classes in intelligent protocol on Solana blockchain with 400 millstone block time and 65,000 transactions per second, that’s fantastic!

As I mentioned, intelligent protocol is famous for combing foresight and innovation with technology and finance for the first time in the financial markets.

Artificial intelligent and intelligent protocol

Intelligent protocol’s team had some ideas in 2017 such as using AI in finance, after 5 years they succeed to implement these ideas. You can experience AI services in all sections of this platform, such as:

- Asset recommendation

- Portfolio building

- Portfolio custom section

- Portfolio analysis

- Portfolio optimization

- Education

- News

- Research

- Alarms

- AI guides

- charting section (Smart chart)

Intelligent protocol has been launched in October of 2022 and provides all the features that written in Intelligent Road map.

More than 90% of Defi projects have liquidity problem, however, intelligent uses hybrid liquidity model for stable liquidity via connecting orders to liquidity pools if order being imbalanced, so, intelligent protocol is Defi 2.0 protocol.

Additionally, intelligent uses reinforcement learning method (one of AI method) for order matching system, and it make intelligent as a brokerage from future.

Why intelligent protocol deserves to grow in 2023 -24?

Intelligent road map has been released recently and surprised financial participants, because of the programs that will be released in 2023. Let’s read more ….

- Main launch with many wonderful features

- Fund rising sources says that intelligent have a 30 million dollars contract for 2023 with some famous VCs.

- Decentralized hedge fund: one of the main purposes of intelligent is providing a decentralized fund managing system including the largest hedge funds like as: Bridge water, Berkshire and Block rock and etc. in fully DAO management system.

- ROBO adviser: smart robot that works with AI and can help you in your long time investing.

- INTG token IDO

- Regulation and providing real share services.

- And etc.

Intelligent protocol has 3 different tokens:

- INTG DAO token

- LP token: fantastic risk reducer token for liquidity providers

- Bundle token: sell your position or accounts amount in format of NFT while your position and account are yours and the NFT is for buyer (risk reducer)

Drift

Drift Protocol is an open-sourced, decentralized exchange built on the Solana blockchain, enabling transparent and non-custodial trading on cryptocurrencies.

Drift also provides:

- Perpetual trade swaps with up to 10x leverage

- borrow and lend at variable yields.

- swap spot tokens

- liquidity services like staking and providing.

You can earn yields with your deposits to Drift.

Drift is one of the best perpetual providers with many fantastic features for example, you can approach in bog bounty program and earn up to 500.000 USD.

Borrowers are only able eligible to borrow from depositor overcollateralized fashion, and this plays a big role in Drifts security.

Drift uses Keeper network for the protocols orderbook, liquidity and liquidation process. The Keepers can route orders throughout the multi-sourced liquidity mechanisms that are designed to effectively scale and offer competitive pricing even with larger order sizes.

Unlike others, Drift provides low slippage and low fees for trades.

Some Drifts solutions for blockchain problems:

- Just-in-Time (JIT) Auction Liquidity: provided by market makers prior to each transaction.

- Limit Orderbook Liquidity: provided by our decentralized orderbook (DLOB) made up of limit orders placed by takers that can be filled by makers; and

- AMM Liquidity: provided by Drift’s AMM if no makers step in to provide liquidity.

Conclusion

As conclusion, we made a decision to introduce these projects and be careful this isn’t NFA (not financial advice), by reading and analyzing more than top 15 projects based on the Solana, these 4 projects listed on the top of our list because of the reasons which mentions before and their fantastic road map for 2023.

As advice, you have to do your own research (DIOR) for your investment or trading strategies.