Key takeaways:

- In 2022, Arcane expected that a soaring stablecoin supply would result in more regulatory attention and the expansion of algo stables.

- It should be anticipated that various regulatory authorities will become more involved as time goes on, especially regarding stablecoins.

- The algorithmic stablecoin balloon also lost air in 2022, and many industry players have written them off due to their intrinsically faulty development model.

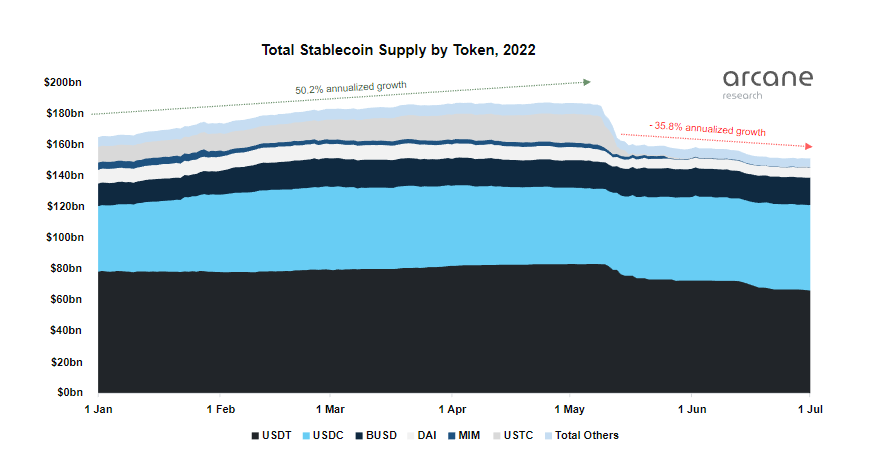

According to Arcane research, The total supply of stablecoins decreased globally by 18.8 percent at the end of the second quarter of 2022 as the equities markets, and risky assets experienced volatile times owing to increasing inflation and other macroeconomic reasons. After Terra’s UST unexpectedly collapsed, the stability of stablecoins has become the biggest debate in the cryptocurrency space.

There are countless stablecoin design designs in use, but when it comes down to it, there are only three main types: fiat-backed, crypto-backed, and algorithmic stablecoins. Users need to be aware of the compromises of any design architecture.

The Arcane Research paper detailed the supply pattern and the assessment and examined supply information for popular tokens like USDT, USDC, BUSD, DAI, MIM, and USTC.

The study claims that the significant reduction, estimated to be worth $35.1 billion, is the greatest quarterly supply drop in stablecoin history. This occurs when the cryptocurrency market is struggling, and market leaders like Bitcoin prices have fallen dramatically.

Arcane, meanwhile, has the following stablecoin forecasts for 2022:

- In 2022, the stablecoin supply will soar, putting them under more legal oversight.

- The USD Coin will surpass tether’s dominance as the largest stablecoin.

- In 2022, algorithmic stablecoins will significantly increase due to heightened federal regulation of centralized stablecoins.

USDC is Anticipated to outperform USDT in the stablecoin arena:

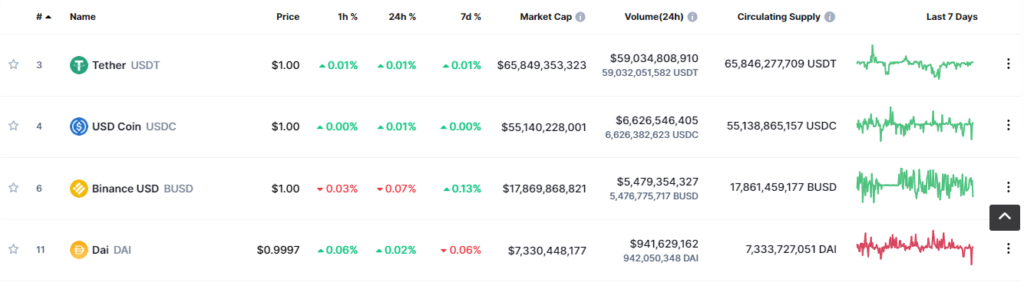

Compared to its $66 billion competing stablecoin titan Tether, Circle’s native stablecoin USD Coin (USDC) has experienced phenomenal growth in the last two months. As institutional involvement in the stablecoin sector rises, USDC’s enhanced regulatory status and Defi capabilities have increased its popularity. Arcane reported that the stablecoin balloon had been expanding for a while. This functioned satisfactorily for the first four months of 2022 before a rapid trend reversal rocked the market.

The top two stablecoins in cryptocurrency at the time of publication are USDT and USDC. The market capitalization of both tokens is over $50 billion. Binance USD (BUSD), the nearest rival, comes in third with a market worth of roughly $17.83 billion.

While USDT’s growth rate has decreased by 28.7 percent, USDC’s growth rate was at 70.4%. On October 10, 2022, the USD coin will overtake Tether as the largest stablecoin if the current rate holds. The market capitalization of USDC will surpass 61.3 billion.

It is significant to highlight that USDC adheres to regulations more closely. As its market worth increased from $42.2 billion to $55 billion in 2022, it saw significant growth. It has experienced an enormous increase with annualized growth of 70%.

Beginning in 2022, USDC had a market share of 25.8 percent compared to 47.5 percent for USDT. With 43.8 percent and 36.3 percent of the market share, USDT and USDC presently dominate.