The increase in remote work is changing the way the world works. Rise offers a solution to the challenges this change brings.

Rise’s Crypto Payroll Software is a cutting-edge way to manage employees. As more people work remotely and teams spread out, old payroll systems can’t keep up.

Rise provides a smooth combination of payroll, compliance, and HR processes. This helps businesses stay flexible and well-managed in the digital economy while ensuring they follow all laws.

Table of Contents

Navigating Global Workforce Management

As organizations grapple with the intricacies of managing a decentralized global workforce, the efficacy of their operations hinges on the robustness of their payroll infrastructure.

Rise presents an avant-garde solution that is meticulously tailored to meet the multifaceted demands of Web3 spaces.

By fortifying companies with a dexterous payment system that is both crypto and fiat-friendly and reinforces compliance across disparate jurisdictions, Rise empowers businesses to navigate the complexities of international labor laws and taxation with unparalleled finesse.

Automating Compliance

In an ecosystem rife with regulatory exigencies, automating compliance is more than convenience—it’s a strategic imperative.

In the realm of payroll, automation mitigates risk, ensuring compliance consistency, precision, and up-to-date adherence to evolving legal frameworks.

Leveraging technology, Rise deploys strategic automation to manage intricate compliance landscapes, dynamically adapting to changing regulations and minimizing human error, thereby safeguarding operations with certainty and ease.

Efficiency and accuracy converge in Rise’s compliance automation, equipping organizations to seamlessly handle the complexities of global workforce management with robust systems that anchor themselves in the bedrock of regulatory compliance.

Streamlining Onboarding

Onboarding new talent, particularly in a distributed environment, demands a systemized approach to ensure seamless and rapid integration.

Rise’s onboarding module expedites this process, utilizing digital automation to simplify administrative procedures and immediately engage incoming personnel.

Documentation and verification are accomplished digitally, cutting down time significantly without undermining thoroughness, which is crucial for establishing a legally sound relationship with new hires.Moreover, the automation extends to contract generation, initiating pre-configured legal templates (tailored to local regulations) that expedite the agreement process.

This responsive feature adapts to the diverse legal landscapes across different jurisdictions, safeguarding against potential non-compliance.

The onboarding solution also aligns with payroll setup, triggering workflows that connect individual profiles with their compensation structure. This integration ensures that payment preferences, bank details, and tax information are accurately captured and processed, establishing a foundation for reliable disbursements.

A distinctive aspect of the Rise platform is its commitment to perpetuating a first-class experience for all stakeholders.

Onboarding is therefore designed to be as informative as it is efficient, providing new joiners with insights into their payroll, benefits, and organizational procedures from the outset.

Lastly, safeguarding the integrity of the global workforce starts with verified on-chain professional IDs.

Flexible Payment Ecosystem

Rise’s platform stands as a testament to its adaptability, enabling payment in fiat and cryptocurrencies alike to align with team members’ preferences and regional norms.

By incorporating extensive currency support, corporations can deliver payments in over 90 local currencies and more than 100 cryptocurrencies, simplifying the payroll process and catering to the diverse needs of a global workforce.

This level of flexibility is extended to the payment schedules themselves, where Rise enables the tailoring of payment frequencies to fit various employment models—be they milestone-based, recurring, hourly, or even ad hoc arrangements.

This adaptability ensures that payment modalities are consistent with the dynamic workflows and project timelines that characterize the modern digital workspace.

Moreover, with the deployment of instant mass payouts, companies gain the capability to compensate teams swiftly and securely, regardless of their location.

Rise’s payment infrastructure is designed to streamline international transactions, reducing transaction times and ensuring that employees and contractors receive their compensation promptly and efficiently.

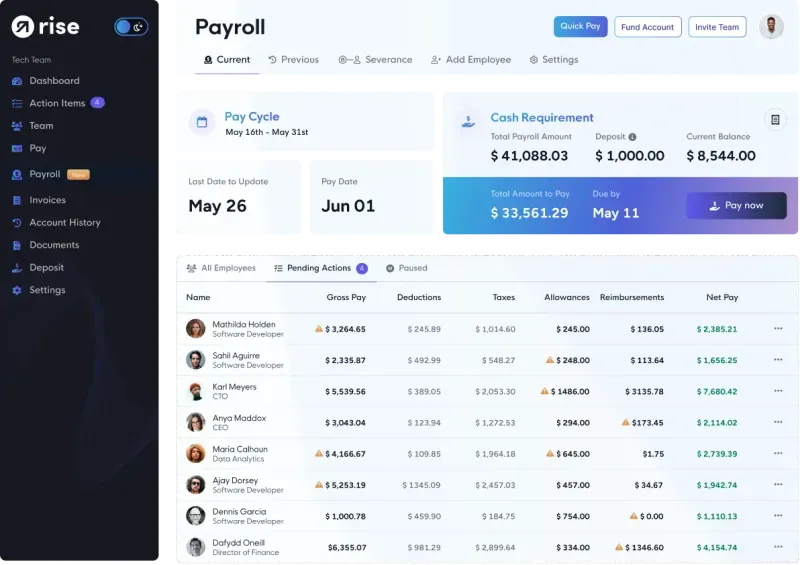

Rise Crypto Payroll Software Review: Multi-Currency Payroll Options

The Rise platform deftly maneuvers the complexities of multi-currency payroll systems.

This flexibility eases the administrative load on companies by allowing them to cater to the personal or local currency preferences of their distributed team members.

In embracing the global nature of the Web3 workforce, Rise’s solution extends beyond conventional fiat payouts to embrace over 100 cryptocurrency options.

This broad range of payment methods is significant for teams ingrained in the digital asset economy, ensuring easy integration of payroll with their existing financial ecosystems.

Furthermore, the inherent volatility associated with cryptocurrencies necessitates a robust platform capable of adapting to real-time exchange rates. Rise’s infrastructure ensures seamless conversion and payment processes, maintaining payroll integrity regardless of currency fluctuations.

On a strategic level, the multi-currency payroll framework offered by Rise can be a lever for attracting and retaining top talent in the blockchain space.

By providing the option to receive payment in a cryptocurrency of choice, professionals may be incentivized to engage with companies utilizing Rise, leading to a symbiotic ecosystem of enhanced productivity and satisfaction.

Instant Mass Payouts

The convenience of Rise’s instant mass payouts is a standout feature, significantly reducing the administrative workload.

- Simultaneously disburse funds to your entire global workforce with a single command.

- Simplified user interface ensures ease of execution for initiators of mass payouts.

- Automated and manual payment options provide flexibility to suit various operational styles.

- Preconfigured security measures protect transactions against unauthorized access.

- Integration with tax compliance tools streamlines the post-payment reporting process.

With flexibility at the core, these payouts can be triggered manually or set to run automatically.

Efficiency meets compliance; the system inherently aligns with global regulatory frameworks during each mass payment transaction.

Enhancing Payroll Security

In the realm of global workforce management, Rise’s dedication to payroll security is paramount. Utilizing advanced encryption technologies and continuous monitoring protocols, they provide a fortified environment against external threats.

By focusing on such robust measures, Rise ensures that sensitive payroll data is safeguarded with the utmost diligence, offering peace of mind to employers and employees alike.

Employing a multi-layered security approach, Rise also leverages secure on-chain professional IDs to establish an additional tier of authenticity and protection.

This cutting-edge feature not only fortifies the integrity of payroll transactions but also streamlines the verification process, reinforcing the overall security infrastructure of the platform.

Tax Automation

Navigating the complexities of global tax obligations requires precision and unwavering attention to detail. Rise’s tax automation feature is methodically designed to manage such intricacies, offering businesses respite from the laborious tasks associated with tax compliance.

By integrating an array of compliance checks and balances, the software ensures that each transaction adheres to the relevant local and international tax laws.

This holistic approach not only simplifies the payroll process but also minimizes the risk of non-compliance penalties.

From generating tax reports to filing the necessary documentation, Rise empowers businesses to handle all aspects of tax management with confidence and efficiency.

Furthermore, the platform’s proactive stance on tax automation extends to keeping up with the ever-shifting tax landscape.

As regulations evolve, Rise’s agile framework adjusts to reflect new tax codes and requirements, thereby maintaining ongoing compliance without any manual intervention by company personnel.

In essence, Rise’s tax automation capabilities provide a strategic advantage by offering a seamless integration of compliance, reporting, and reconciliation within the payroll process.

Such sophistication enables seamless transactions across borders and mitigates potential risks associated with tax regulation discrepancies, ensuring companies can focus on growth while Rise handles the complexities of global tax compliance.

Rise Crypto Payroll Software Review: Secure On-chain IDs

The evolution of digital identities is epitomized by Rise’s implementation of secure on-chain IDs. These IDs serve as immutable anchors of trust within the blockchain ecosystem, bolstering verification processes.

Employing cryptographic methods, these on-chain IDs authenticate user identities, ensuring a tamper-proof record of professional credentials. This facilitates unequivocal proof of work history and accreditations, thus streamlining recruitment and onboarding.

On-chain IDs inherently provide enhanced security for payroll transactions. By linking transactions to verified identities, they significantly reduce the risk of fraud and errors, which are often prevalent in the payroll domain.

Further reinforcing trust, Rise’s on-chain IDs are pivotal in establishing a transparent and auditable transaction history. This level of traceability is essential for maintaining integrity in financial dealings, particularly in the decentralized finance space.

Ultimately, these secure professional IDs protect both employers and contractors. By integrating such robust digital identities, Rise ushers in a new age of confidence in remote and digital workforce management.

Supplementary Benefits & Management

Rise’s platform extends beyond simple payroll processing; it offers an encompassing ecosystem for benefits management and distribution.

With emphasis on seamless integration, employment perks such as health and wellness programs are easily managed, ensuring global teams have equitable access to desirable benefits.

Such holistic attention to an employee’s wellbeing is a testament to Rise’s commitment to fostering a supportive and inclusive work environment.

In managing supplementary benefits, Rise adeptly navigates the complexities of diverse regulations and norms.

Equipped with a robust infrastructure, the platform enables a harmonious orchestration of ancillary perks, optimizing the allocation of resources and ensuring a meticulous approach to employee satisfaction and retention.

Insurance Coverage for Teams

Rise acknowledges the indispensability of comprehensive insurance for internationally deployed teams. They incorporate insurance provisions directly into their payroll platform, offering a seamless solution for global workforce coverage through SafetyWing.

This ensures that teams, regardless of their location, can access quality health and travel insurance options.

By delivering a unified approach to payroll and insurance, Rise reinforces the safeguarding of team welfare. Such comprehensive risk management is pivotal in building resilient and productive remote workforces.

Expense Management Simplified

Navigating expenses in a global team has never been more straightforward. Rise’s platform eradicates the intricacies of cross-border finance.

Through intuitive dashboards, managing international expenses becomes a polished, error-free process. Automation is key, ensuring accurate currency conversions and timely reimbursements.

Rise’s approach to expense management is transformative, allowing users to track, submit, and approve expenditures with remarkable ease. This yields a more efficient cash flow and procurement cycle, instrumental for any global entity.

Enhanced by user-friendly interfaces, Rise guarantees an empowered experience for finance teams. The otherwise laborious task of expense authorization and tracking is deftly streamlined.

Ultimately, Rise delivers a comprehensive system where fiscal oversight and control are seamlessly maintained, simplifying the financial complexities of modern businesses.