Non-fungible tokens (NFTs) have exploded onto the scene in recent years, with a wide range of industries and individuals taking notice. From digital art and collectibles to music and even real estate, NFTs have disrupted traditional notions of ownership and value.

But with the market becoming increasingly crowded and prices soaring to dizzying heights, many are wondering whether this is just a passing fad or a sustainable trend.

In this article, we’ll take a closer look at the current state of the NFT market and explore the factors driving its growth and potential risks to be aware of.

NFT Market Analysis

NFT trading volume recorded a 117% increase from January to February, reaching $2 billion for the first time since May 2022.

Non-fungible token (NFT) market’s trading volume increased to $2 billion in February, reaching its pre-LUNA crash levels, according to DappRadar’s Industry Report.

The NFT trading volume recorded a 117% spike from January’s $956 million.

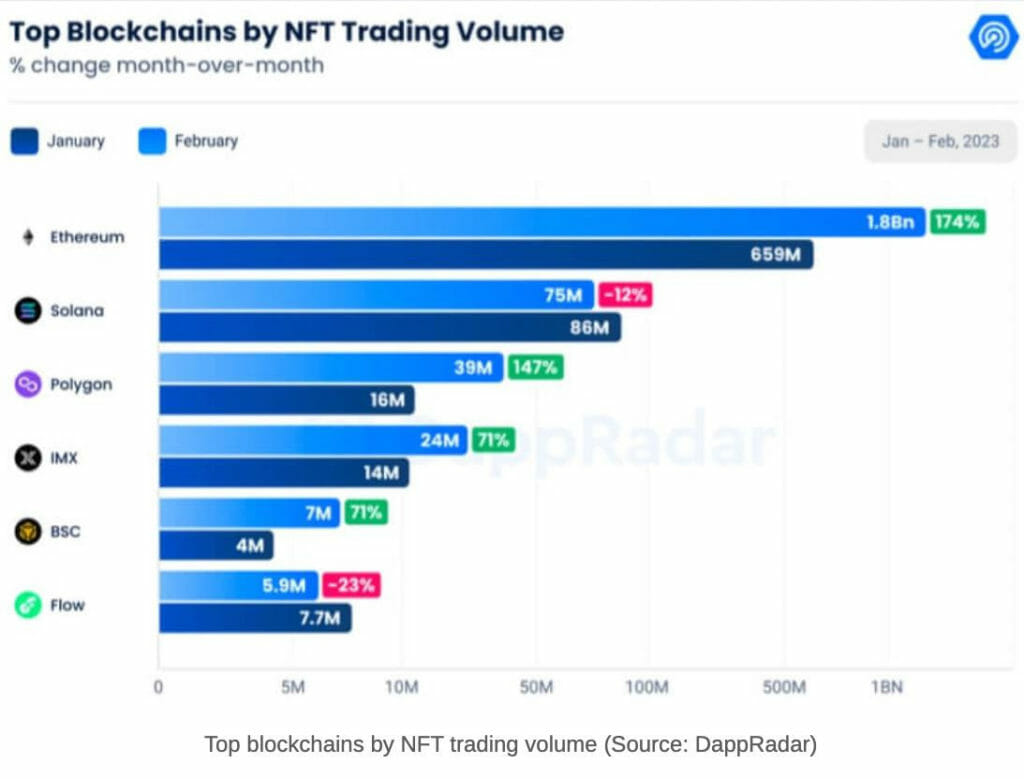

In February, Ethereum (ETH) remained the top blockchain by NFT trading volume. The chain recorded $1.8 billion in trading volume, which marks a 174% increase from the $659 million in January. Based on these numbers, ETH represents 83.36% of the entire NFT market.

Solana (SOL) and Polygon (MATIC) followed ETH as the second and third chain, with the highest NFT trading volume in February. Even though SOL ranked second by facilitating $75 million in trading volume, it still recorded a 12% decrease from January’s $86 million.

MATIC, on the other hand, marked a 147% increase in February, reaching $39 million from the $16 million of the previous month.