Key Takeaways

- Li plans to sell 60% of his stake in Huobi at $1 billion.

- As per reports, the potential buyer’s list includes Justin Sun and FTX’s Sam Bankman-Fried.

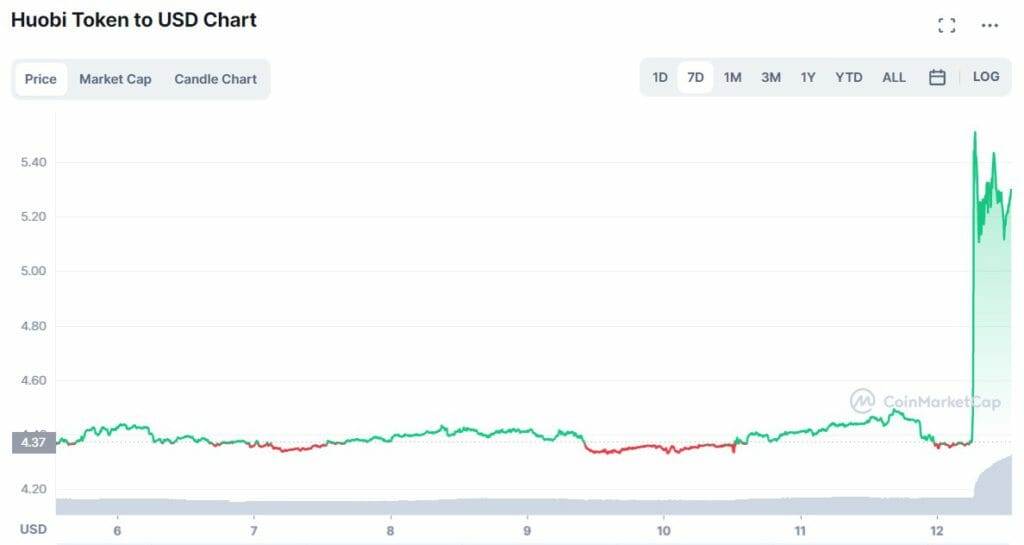

- HT’s price jumped nearly 25% to $5.43 following the Bloomberg report.

Leading crypto exchange Huobi Global’s Group Founder Leon Li is talking with investors to sell most of his stake in the company at nearly $1 billion. According to the Bloomberg report, Li has discussions with several financiers, seeking to sell a roughly 60% slice of the company he founded almost a decade ago.

The potential buyer’s list reportedly includes big names in the crypto industry, such as Justin Sun, founder of Tron, and CEO of FTX exchange Sam Bankman-Fried. According to people familiar with the matter, SBF and Sun had earlier established talks with Huobi concerning the potential acquisition. Justin Sun had, however, denied any involvement.

Apart from Sun and SBF, the report also mentions Sequoia China as “existing backers,” who were made aware of Li’s decision in the shareholder’s meeting held in July.

If the deal goes through, it could be the first instance of a majority stake sale by one of the bigger crypto firms. As per the report, the acquisition deal could be completed by the end of this month. Li is reportedly seeking an overall valuation of $2 billion-$3 billion, which means that the stake sale could fetch upwards of $1 billion.

Following the Bloomberg report, HT-the native token of the Huobi exchange, surged nearly 25% to $5.43.

Founded in 2013, Huobi is one of the world’s biggest cryptocurrency exchanges. As per Coingecko, Huobi has a daily trade volume of more than $1 billion.

The reports on Huobi founder looking to sell his stake first surfaced in early July when Colin Wu-a crypto journalist, put out a tweet.

“With a profit of over $1 billion in 2021, Huobi may be the most profitable exchange in the world after Binance in 2021, and it holds many compliance licenses. But when the market is down, it may be difficult to sell higher value,” Wu’s tweet reads.

In late June, there have also been reports of the exchange laying off at least 30% of its staff. The crypto bear market has swept big names in the industry. Recently, OpenSea, the biggest NFT Marketplace, laid off around 20 % of its staff. Celsius and Voyager are some major crypto firms that were beaten by market volatility and filed for bankruptcy recently.