Key Takeaways

- Alameda Research was Voyager‘s largest single creditor, with unsecured loans of $75m.

- 3AC is the largest borrower owing over $600 million to Voyager.

On 1st July, Crypto lending platform Voyager Digital suspended withdrawals, trading and deposits citing difficult market conditions. Few days after the lender filed for Chapter 11 bankruptcy in New York. Voyager’s descent into insolvency was mainly owing to several high-notch firms failing to repay its loans.

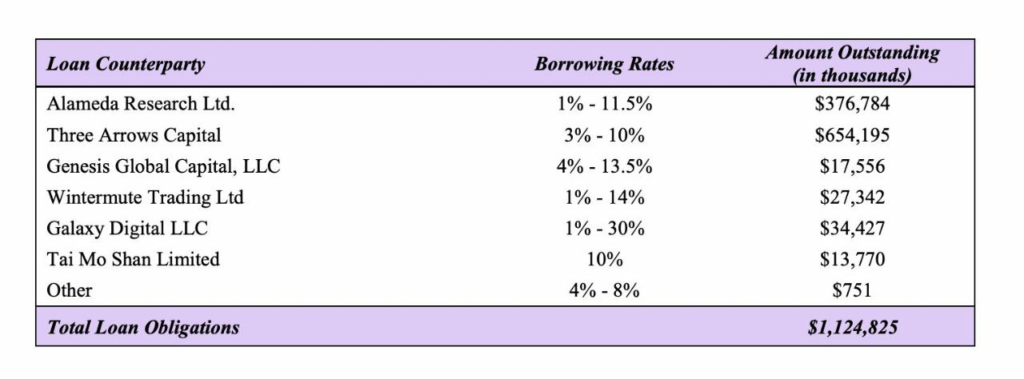

A filing with the bankruptcy court showed that Alameda Research – a cryptocurrency trader – was Voyager‘s largest single creditor, with unsecured loans of $75m. Alameda Research, the firm founded by crypto billionaire Sam Bankman-Fried owes Voyager $377 million at an interest rate of 1% to 5%.This makes Alameda Voyager Digital’s second-largest borrower after Three Arrows Capital(3AC) which recently also filed for bankruptcy.

In June, 3AC was issued a default notice by Voyager after the exchange failed to make payments on a loan of 15,250 Bitcoins, amounting to roughly $324 million, as well as USDC stablecoins worth nearly $350 million. 3AC currently is formally liquidated by the order of a British Virgin Islands court.

Apart from 3AC and Alameda, several other big names in the business is in the list of companies that owe Voyager money. According to the court document, Cryptocurrency market maker and lending firm Genesis Global Capital owes Voyager $17 Million. Genesis recently confirmed that Three Arrows Capital was the large counterparty that failed to meet a large margin call in June, forcing liquidation of the related collateral. Galaxy Digital LLC is another firm that failed to repay its loan worth $34 Million.

According to the bankruptcy filing, Voyager also owes Google nearly $1 million. Voyager which failed to meet its customer’s liquidity needs, is expected to have more than 100,000 creditors and about $1 billion to $10 billion in assets. The Toronto-based crypto firm had claimed in its blog post that it had $110 million in cash, $350 million in cash at Metropolitan, $1.3 billion in crypto and was owed $650 million from 3AC.

Voyager is the latest casualty in an already battered digital asset market. Celsius, another lending platform on the brink of insolvency, is exploring strategic transactions and restructuring liabilities to preserve its assets, which were around $12 billion under management as of May.