Key Takeaways

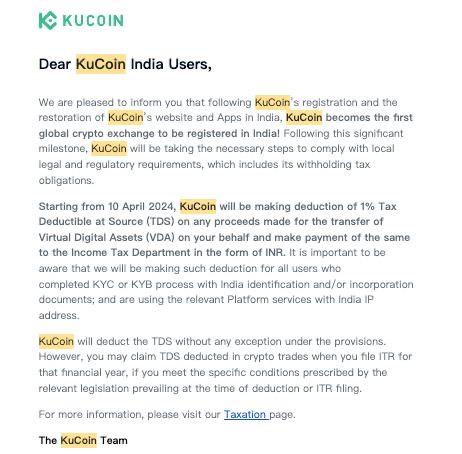

- Starting April 10, 2024, the platform will enforce a 1% Tax Deducted at Source (TDS) on Virtual Digital Assets (VDA) transfers.

- Indian users can monitor deducted TDS by checking completed orders or requesting the exchange’s full trade report.

KuCoin, a prominent cryptocurrency exchange, has unveiled a significant update affecting its Indian user base. Effective April 10, 2024, the platform will implement a 1% Tax Deducted at Source (TDS) on Virtual Digital Asset (VDA) transfers, aligning with directives from the Indian Government.

The latest development comes days after KuCoin garnered attention by achieving compliance with the Financial Intelligence Unit-India (FIU-IND).

The TDS deduction will impact various trading activities, excluding INR/Crypto market purchases. Transactions such as selling in the INR/Crypto market, buy-sell activities in the Crypto/Crypto market, and selling in the P2P market will be subject to the 1% deduction. However, purchases in the INR/Crypto market will remain unaffected.

In its official statement, the exchange noted that it will deduct tax for all users who have completed the KYC process with the India identification process.

For most transactions, the deduction rate stands at 1%. Nevertheless, according to section 206AB of the Income Tax Act, an additional 5% may apply in certain cases. This provision pertains to users who have not filed an Income Tax Return for at least two years and have had TDS amounts exceeding ₹50,000 in each of those years.

To ensure transparency, users can track the TDS deducted from completed orders or request a comprehensive trade report from the exchange.

The introduction of the 1% TDS follows India’s move in July 2022 to impose a 30% tax on crypto profits. This high rate of TDS adds a layer of challenge, creating a liquidity crunch for both Indian digital asset platforms and end-users alike. This crunch can lead to poorer execution prices and hinder the fluidity of transactions within the ecosystem.

With KuCoin’s implementation of TDS on crypto transfers, Indian users may explore alternative platforms such as Bybit, Pionex, or Gate.

This announcement coincides with legal challenges for KuCoin, as the U.S. Commodity Futures Trading Commission (CFTC) recently filed a lawsuit against the exchange for allegedly engaging in transactions involving futures, swaps, and leveraged retail commodity transactions related to cryptocurrencies without proper registration.