Key takeaways:

- Bitcoin was expected to conclude the year at $60,000 or higher, according to 55% of JPMorgan’s clients.

- In a study, global investment bank JPMorgan questioned its clients what they expect bitcoin’s price will be by the end of the year.

- JPMorgan Chase & Co. has polled its clients to see what they expect the price of bitcoin will be by the end of the year. According to the responses, 55 percent of the bank’s clients believe the price of bitcoin would conclude the year at $60K or higher.

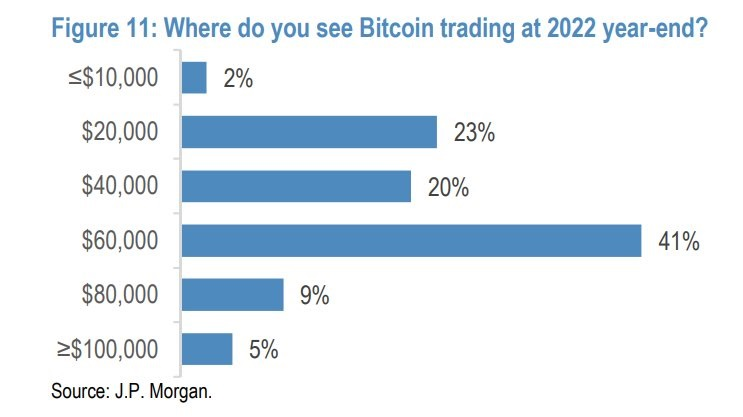

J.P. Morgan asked its clients where they expect the price of Bitcoin will be by the end of the year in the study. Between the 13th of December and the 7th of January, 47 bank employees took part in the poll. The study results are intriguing, with the majority of respondents predicting that BTC will hit $60k this year (41 per cent voted for the same). We also have 20% of individuals predicting that Bitcoin will stay at $40k this year, and 23% predicting that it will reach $20k this year.

Furthermore, 9% anticipate the price of BTC will reach $80,000, 5% believe it will reach $100,000 or higher, and 2% believe it will collapse to $10,000 or lower.

Is it the moment to be bullish?

It’s time to buy when the market as a whole is bearish. This is also true in this scenario. There is panic in the market, and the reason for it is that Bitcoin is trading so near to the crucial $40k barrier, and the price hasn’t seen any significant relief in weeks. According to J.P. Morgan analysts, the market is currently oversold, based on their indicator. Futures are oversold as well. All of this points to a swift reversal, with the beginning of 2022 seeming to be a little better. We can be reasonably confident that $100k will be raised this year. It’s just impossible to say when.

JPMorgan strategist Nikolaos Panigirtzoglou, one of the authors of the research note that featured the survey, said:

“I’m not surprised by bitcoin’s bearishness … Our bitcoin-position indicator based on bitcoin futures looks oversold”

He went on to say that the cryptocurrency’s fair worth ranges from $35,000 to $73,000, depending on how investors perceive its volatility compared to gold.