Key Takeaways:

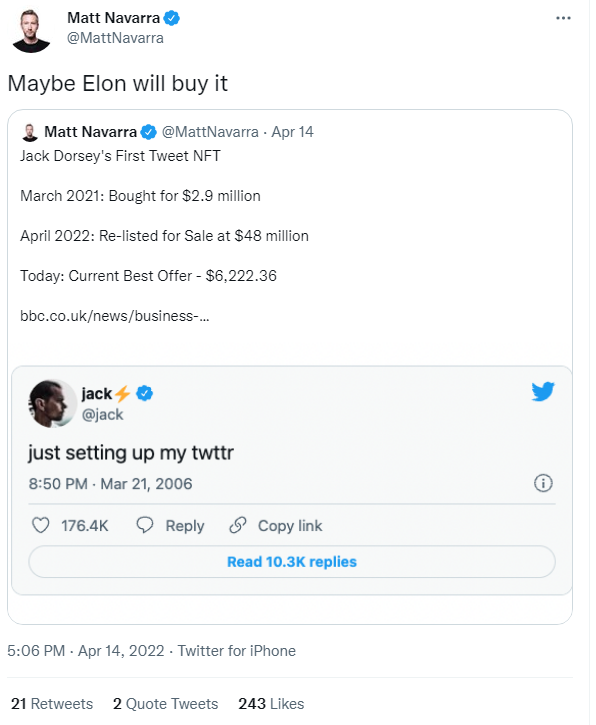

- In March 2021, Twitter’s then-CEO, Jack Dorsey, auctioned his first tweet as an NFT on the “Valuables” marketplace for $2.9 million. Sina Estavi, an Indian-born crypto entrepreneur, bought Jack Dorsey’s first tweet, “just putting up my twttr.”

- Last Thursday, Estavi revealed his intention to sell the NFT, pledging to donate half of the revenues to Give Directly, an organisation that aids East African households in extreme poverty “by sending unrestricted cash transfers to them via mobile phone.”

- He predicted that the cost of the proceedings would rise to $25 million. Despite this, no one bid more than $280 for it in an auction this week, and current OpenSea offers only amount to about $10,000, a 99 percent decline in value.

- Estavi appears to be unfazed by the decrease in value. He retweeted a post that said “maybe Elon will purchase it,” referring to Elon Musk’s takeover offer for Twitter.

The picture of the very first tweet made on Twitter, which he established in 2006, was Jack Dorsey’s first NFT. He created an NFT by converting a single frame of a five-word tweet into a digital file stored on a blockchain. A Dorsey’s tweet sold for 2.9 million dollars in March 2021, at the onset of the NFT boom, after a fierce bidding war in which Tron founder Justin Sun was a prominent player. Sun was defeated by Sina Estavi, an entrepreneur whose crypto enterprises have since collapsed as a result of his detention in May.

Dorsey’s NFT drew little interest at first, with some people bidding a few thousand dollars in December 2020, when few people believed in NFTs.

However, in March 2021, the market exploded, with monthly sales on OpenSea surging to nearly $150 million, up from $8 million just two months before. Sina Estavi, an Iranian crypto entrepreneur, joined the craze by purchasing Dorseys NFT for $2.9 million. According to Forbes, he paid such a high price for NFT because of its rarity and relationship with such a significant company as Twitter.

The NFT was then listed for $48 million earlier this month, with Estavi tweeting that he would contribute half of the revenues to GiveDirectly, a nonprofit that helps impoverished people in Africa. “Why not 99 percent?” says Dorsey jokingly.

Estavi auctioned the NFT for 14,969 ethers, or roughly $50 million, on April 5. Unfortunately, no one offered more than $280 in the auction. No one knows why the bids are so low, according to Estavi. Few people seemed to take him seriously. The bidders are only now realising how much of a publicity stunt that was. According to Blake Moser, an NFT collector with approximately 400 NFTs, it’s a method to get noticed.

However, when Dorsey’s NFT was auctioned again last week, no one bid more than $280, bringing the price down by 99 percent. On OpenSea, where anyone can list an NFT even if no bidding period is open, the highest bid is now around $12,000, which is still a fraction.

The unsuccessful sale, according to Jonathan Perkins, co-founder of the NFT platform SuperRare, is an indication of the NFT market’s developing pains.

“There’s been a lot of experimenting in the field,” Perkins added, referring to tweet tokenization and interest in NFT PFPs.He described the 2021 NFT market, specifically previous summer, as a high-risk environment.

Perkins stated, “This bubble has to explode.” “And it’s actually good for us; it makes it simpler for us to construct something that’s long-term, revolutionary, and accessible.”

According to the BBC, Estavi claimed on Thursday that he “may never sell” the tweet unless he receives a “high bid” of an undetermined amount.

“The time I set was over,” Estavi explained, “but if I get a nice offer, I might accept it, and I might never sell it.” He went on to say that my offer to sell was too good to be true, and that not everyone could afford it. Who wants to buy it is crucial to me; he will not sell this NFT to anyone since he does not believe everyone deserves it. The first tweet from Jack Dorsey The tweet is referred to as the “Mona Lisa of the digital world” by NFT’s owner.

“Maybe Elon Musk will purchase it,” Matt Navarra, a social media expert, said of Jack Dorsey’s first tweet NFT. “It’s not ideal if the owner of the entire Twitter does not own the first tweet,” Estavi reposted Elon Musk’s tweet.

NFTs are cryptographic tokens of digital content offered by artists, musicians, celebrities, sports entities, and others that may be traded or sold on a decentralized network of computers around the world using blockchain technology.

The lack of significant offers for such a high-profile NFT shows that the NFT market, which has skyrocketed in value over the last two years, is reaching its limits. According to a research by nonfungible token data business Nonfungible.com, trading in nonfungible tokens totaled $17.6 billion last year, up 21,000 percent from 2020.

The NFT market is still relatively new, having only taken off in the opening months of 2021 and fluctuating drastically since then. Dorsey had offers in the tens of thousands of dollars when he hit his first, and so far only, NFT in December 2020, which he finally turned down.

It was precisely at the start of this purple patch when Jack Dorsey minted his first tweet and placed it up for auction. The media was fueling the hype train as NFT interest skyrocketed, floor prices soared, and NFT interest skyrocketed. On second thought, the $2.9 million price tag made sense in that hyped-up climate, as absurd as it seems.

The boom went bankrupt just over a year after he made his original purchase. The search traffic has dropped by 60–70%. The starting price is really low. The market capitalization of NFT has plummeted from a peak of $23 billion to about $10 billion, shedding more than half of its worth.