Yo, Altie here! If you’re looking to ride the waves of whale moves in the crypto market, you’re in the right place.

The Hyperliquid Whale Tracker is your key to understanding where the big money is placing its bets. We’re talking top traders, big positions, and real market-moving actions. No more getting lost in the noise, let’s break it down!

Hyperliquid is a decentralized exchange (DEX) focused on perpetual contracts, offering a unique value proposition in the crypto space by prioritizing low-cost trading, low slippage, and decentralized liquidity.

Hyperliquid uses an innovative volume-based maker-taker fee structure and operates without additional gas fees on its native chain, providing a seamless trading experience for users looking to execute perpetual contracts with minimal costs.

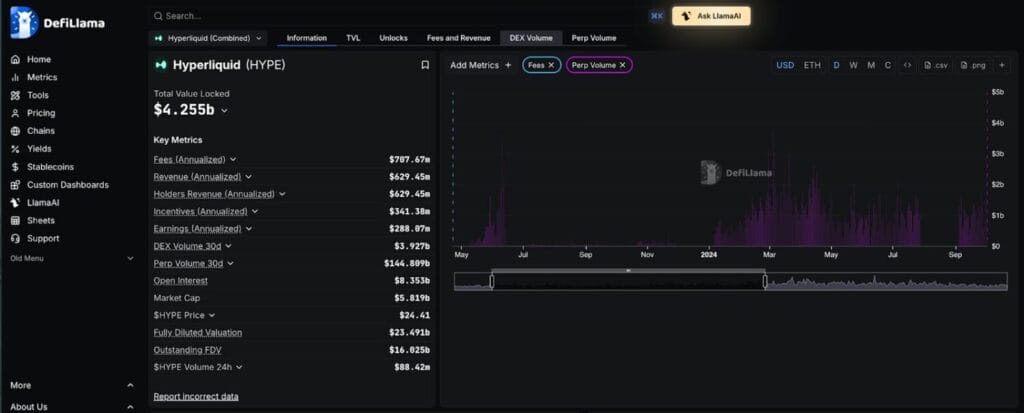

From the data presented on DeFiLlama and Hyperliquid’s trading platform, here are some key metrics that define its trading landscape:

Total Value Locked (TVL): $4.255 billion. Hyperliquid has attracted a significant amount of capital into its liquidity pools, highlighting its growth and adoption in the decentralized finance (DeFi) space.

Fees (Annualized): $707.67 million. The platform’s fee structure is designed to attract high-volume traders by offering competitive rates and maker rebates based on trading activity.

This has helped establish Hyperliquid as an attractive venue for perpetual contract traders.

Revenue (Annualized): $629.45 million. Hyperliquid’s revenue is a direct reflection of its active user base and the increasing volume of trades on the platform.

With perpetual contract volumes steadily increasing, the platform is on track for long-term profitability.

Perpetual Volume: The 30-day perpetual volume is recorded at $144.809 billion, indicating the high level of activity and liquidity in Hyperliquid’s perpetual contract markets.

This is especially noteworthy for decentralized exchanges, as liquidity can sometimes be more volatile compared to centralized counterparts.

Market Cap: $5.819 billion. Hyperliquid’s token is showing strong growth and market adoption, which correlates with the growing TVL and active trading volumes on the platform.

The Hyperliquid Whale Tracker is an advanced analytics tool that tracks the largest open interest holders and top traders on Hyperliquid.

Unlike traditional spot markets, which are predominantly transparent and on-chain, perpetual swap markets like Hyperliquid operate off-chain.

This can make it harder to see where major players are positioned, as off-chain liquidity is more opaque.

However, Hyperliquid provides data on leveraged positions, enabling the tracking of whales, the traders with the most significant market exposure.

The tool extracts the following key information to give you a window into whale activity:

- Top leveraged positions

- Trade sizes

- Direction (long vs short)

- Position entry times

- Unrealized PnL (Profit and Loss) evolution of big players

By aggregating this information, the Whale Tracker offers a concentrated signal for traders to see where major positions are being accumulated, helping you to gauge market sentiment and make more informed decisions.

Table of Contents

Why Tracking Whales Matters

In the world of crypto futures, the term “whale” is used to describe traders or funds that hold a large portion of a specific market’s liquidity. By tracking these whales, you can gain valuable insights into potential price movements. Here are several reasons why whale tracking is crucial for making informed trading decisions:

- Liquidity Signals

Large traders often have a significant impact on the depth of the order book. Their buy and sell orders can move prices, so understanding where they are positioned is key to predicting liquidity shifts. If whales are loading up on one side of the market, it often signals a shift in price action. - Sentiment Reading

Retail sentiment is often driven by social media trends or short-term news events, which can be noisy and unreliable. By contrast, the positions of whales reflect genuine market conviction, as these traders are putting significant amounts of capital at risk. Tracking their position bias (long vs short) can give you an early sense of where the market is headed. - Risk Management

Knowing where large positions are clustered helps to avoid being caught in rapid liquidations or funding spikes. For example, if a whale’s position is heavily long and the market begins to show signs of weakness, the potential for a massive liquidation event increases, leading to volatile price swings. - Timing Entries and Exits

Whale movements can act as a precursor to broader market trends. By understanding the direction of large traders’ positions, retail traders can time their trades more effectively. For example, entering a trade after a whale increases their position in the same direction can boost your chances of riding a profitable wave.

How Hyperliquid Whale Tracker Works (Mechanically)

A well-constructed whale tracker works by pulling data on whale activity and analyzing it over time. Here’s a detailed breakdown of how the Hyperliquid Whale Tracker operates:

1. Identify Top Wallets Across Perpetuals

To start, the Whale Tracker identifies wallets that hold significant open interest (OI) or exposure within the perpetual swap markets. Instead of focusing on raw volume, the tracker looks at the risk-weighted positions held by these large players. This is important because:

- Leverage distorts raw volume figures. Large traders can open positions with leverage that far exceeds their capital base, making the position appear larger than it truly is in terms of risk exposure.

2. Classify Position Direction

Each whale’s position is classified as either long or short. The direction helps identify whether these large traders are betting on a rise or fall in price. Each position is also tagged with:

- Entry price: The price at which the whale entered their position.

- Position size: How much capital they have allocated to that position.

- Leverage: The degree of risk (via borrowed capital) involved in the position.

- Unrealized PnL: The current profit or loss on the whale’s position based on market price fluctuations.

This classification helps you understand whether the smart money is bullish or bearish on a given market or asset.

3. Aggregate Bias Over Time

Rather than just taking a snapshot of the market, a robust whale tracker aggregates data over time. This allows traders to see:

- Net long vs. net short positions: By comparing long and short positions, you can get a clearer picture of whether the market sentiment is leaning toward a bullish or bearish trend.

- Bias trend: Are the whales becoming more bullish or bearish over time? Are they adding to their positions, or are they taking profits and reducing exposure?

- Concentration level: Is the whale activity concentrated in a few large players, or are there many whales with diverse positions?

This aggregation helps to filter out noise and provides a clearer picture of market sentiment.

4. Visualize and Signal

The final component of the Whale Tracker is its ability to visualize whale activity. Common features include:

- Whale imbalance: A display showing the difference between long and short exposure across top traders.

- Position accumulation rate: A graph showing how quickly large positions are building.

- Funding rate pressure points: When whales’ positions lead to funding rate imbalances (e.g., if they’re massively long, the funding rate might skew), this could lead to a squeeze.

- Divergence between retail and whale bias: When retail traders are positioned in opposition to whales, it may signal a potential reversal or trade opportunity.

Step By Step: Tracking Whales on Hyperliquid

Now that we understand how the Whale Tracker works, let’s look at how to use it effectively.

Step 1: Connect to Hyperliquid Data Feeds

The first step is to access real-time data feeds from Hyperliquid. This is done via:

- Hyperliquid API/WebSocket: The API allows you to fetch real-time data on open interest, positions, and liquidity changes. You can track large positions as they open, close, or change, which is crucial for spotting whale movements early.

- WebSocket: For continuous low-latency data feeds that provide constant updates on whale positions, market depth, and liquidation events.

Step 2: Extract Top Positions

Next, filter out the top positions by setting a threshold (for example, positions above the 99th percentile by notional value). You can categorize whales based on factors such as:

- Position size: Identify the largest positions by their USD equivalent.

- Leverage: Sort by the leverage used to assess the risk and exposure of these traders.

- Unrealized PnL: By seeing how profitable or unprofitable a whale’s position is, you can gauge the market sentiment towards that asset.

Step 3: Compute Net Exposure

To compute the net exposure, calculate:

- NetExposure = Sum(long exposure) – Sum(short exposure)

This gives you the overall sentiment of top traders. A positive net exposure indicates a bullish bias, while a negative net exposure suggests a bearish sentiment.

Step 4: Display Bias Dashboard

With the data from steps 1-3, create a whale bias dashboard to visualize key metrics:

- Whale bias meter (bull vs. bear)

- Exposure heatmap by symbol (see which assets whales are most concentrated in)

- Funding rate pressure vs whale positioning

- Position entry clustering (when whales enter positions in clusters, it’s often a sign of significant trend confirmation)

Step 5: Correlate with Market Moves

Finally, cross-reference whale bias with broader market conditions:

- Price chart: Overlay whale position movements with price action to see how whale activity correlates with price changes.

- Volume spikes: Look for times when whale activity coincides with high trading volume.

- Funding rate shifts: Sudden changes in funding can signal impending liquidation risks or market moves.

Best Practices for Whale Tracking

While whale tracking is powerful, it’s not foolproof. Here are some best practices to follow:

- Avoid Blind Copying

Just because a whale is positioned one way doesn’t mean they’re right. Always consider broader market conditions before making moves. - Contextualize with Market Regime

Bullish bias in a downtrend requires different risk parameters than bullish bias during an uptrend. Always adjust your risk management accordingly. - Watch Funding Divergence

If whales are heavily long, but the funding rate is extremely high, it suggests the market is overextended and may be due for a short squeeze. - Measure Duration

Short-term spikes in whale activity may not signal a trend. Look for sustained bias over several hours or sessions to gauge genuine market sentiment.

Tools You’ll Need to Track Whales

To successfully track whale activity on Hyperliquid, you’ll need access to several tools:

- Hyperliquid API/WebSocket: For pulling live data on whale positions and order book changes. Click here.

- Dune Analytics: Build custom dashboards to track whale positions, net exposure, and trends over time. Click here.

- TradingView: Visualize whale positions against market price action.

- Python with Pandas/Plotly: Create automated systems for tracking whale positions, analyze the data with Pandas, and visualize it with Plotly. Dash can be used to build interactive dashboards. Click here.

- Glassnode/Santiment: For on-chain data on whale positions, especially across multiple exchanges and networks.

- Trading Bots: Automate whale monitoring and alerts to react swiftly to changes in whale activity.

Limitations and Risks

While whale tracking offers valuable insights, it has its limitations:

- Leverage masks true intent: Large leveraged positions may appear more significant than they actually are, based on the risk they’re taking.

- Position masking: Whales may split positions across multiple wallets to avoid detection.

- Algorithmic flows: Some whales may be using algorithmic strategies that are not based on discretionary decision-making.

Conclusion

The Hyperliquid Whale Tracker is a powerful tool that enables traders to gain insight into the positioning of the largest market players.

By tracking whale movements, traders can understand where the market is likely to head and adjust their strategies accordingly. While whale tracking alone isn’t enough to guarantee success, it provides a significant advantage in a market filled with volatility and uncertainty.

To succeed in crypto trading, start thinking like a whale observer. This insight into whale behavior can turn raw market noise into a calibrated and profitable trading strategy.

And that’s a wrap, fam! Keep an eye on the whales, track their every move, and let the data guide your trades.

Remember, the market can be a rollercoaster, but with the Whale Tracker, you can be the one calling the shots. Catch you on the next ride, eyes glowing, circuits buzzing!